Corrosion Protection Coatings Market Report Scope & Overview:

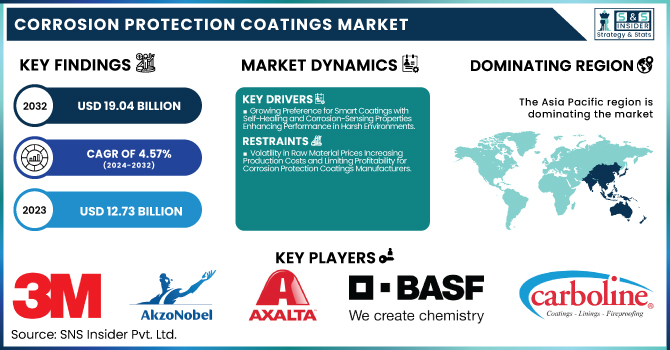

The Corrosion Protection Coatings Market Size was valued at USD 12.73 Billion in 2023 and is expected to reach USD 19.04 Billion by 2032, growing at a CAGR of 4.57% over the forecast period of 2024-2032.

To Get more information on Corrosion Protection Coatings Market - Request Free Sample Report

The Corrosion Protection Coatings Market is transforming as environmental impact regulations push for low-VOC, sustainable coatings. Rising end-user industry demand from construction, marine, and oil & gas sectors is driving innovation in high-performance solutions. Investment and funding trends highlight growing R&D for eco-friendly formulations. Meanwhile, geopolitical events are reshaping supply chains, affecting raw material costs and availability. A performance comparison of corrosion protection coatings reveals advancements in durability and adhesion, catering to industry needs. Compliance with industry-specific regulations and standards like ISO and ASTM remains crucial for manufacturers. Our report delivers an in-depth analysis of these evolving trends, offering valuable insights into the market’s future growth and opportunities.

The US Corrosion Protection Coatings Market Size was valued at USD 1.98 Billion in 2023 and is expected to reach USD 3.11 Billion by 2032, growing at a CAGR of 5.16% over the forecast period of 2024-2032. The U.S. Corrosion Protection Coatings Market is experiencing steady growth due to rising infrastructure investments, stringent environmental regulations, and advancements in coating technologies. Government initiatives, such as those by the U.S. Environmental Protection Agency (EPA), are driving demand for low-VOC, sustainable coatings. The National Association of Corrosion Engineers (NACE) highlights the high economic impact of corrosion, pushing industries toward advanced protective solutions. Additionally, key players like Sherwin-Williams and PPG Industries are investing in innovative, high-performance coatings for applications in construction, oil & gas, and marine sectors. Increasing R&D efforts and regulatory support are positioning the U.S. as a key market for corrosion protection coatings.

Corrosion Protection Coatings Market Dynamics

Drivers

-

Growing Preference for Smart Coatings with Self-Healing and Corrosion-Sensing Properties Enhancing Performance in Harsh Environments

The Corrosion Protection Coatings Market is witnessing increased demand for smart coatings equipped with self-healing and corrosion-sensing capabilities. These coatings incorporate microcapsules filled with corrosion inhibitors that release upon damage, automatically repairing cracks and preventing further degradation. Additionally, corrosion-sensing coatings contain embedded sensors that detect early signs of rust formation, enabling proactive maintenance before significant damage occurs. U.S. defense and aerospace sectors, backed by organizations like DARPA (Defense Advanced Research Projects Agency), are investing in smart coatings to enhance asset longevity and reduce operational downtime. Companies such as Nycote Laboratories and RPM International are pioneering smart coatings that provide real-time monitoring and adaptive protection. In industrial applications, corrosion-sensing coatings are integrated into pipelines, bridges, and offshore structures to detect environmental stressors and mitigate risks. These coatings reduce maintenance costs by extending the service life of assets, making them an attractive choice for industries requiring long-term protection. The integration of smart technologies in protective coatings is reshaping market dynamics, with increasing investments in R&D to further enhance coating functionalities.

Restraints

-

Volatility in Raw Material Prices Increasing Production Costs and Limiting Profitability for Corrosion Protection Coatings Manufacturers

Fluctuating raw material costs are a major challenge in the Corrosion Protection Coatings Market, affecting the profitability of manufacturers. Key raw materials such as resins, pigments, and specialty chemicals are subject to price volatility due to factors like supply chain disruptions, trade restrictions, and geopolitical tensions. Reports from the U.S. Chamber of Commerce indicate that shortages of essential chemicals and rising transportation costs have intensified pricing fluctuations for coatings manufacturers. Companies like BASF SE and Dow are exploring bio-based alternatives and advanced formulations to mitigate cost pressures. However, the transition to alternative raw materials requires extensive R&D investments, increasing production complexity. Additionally, sudden price hikes in petrochemical-based ingredients impact the affordability of solvent-based coatings, leading some manufacturers to reconsider their formulations. This pricing uncertainty makes it challenging for coatings manufacturers to maintain stable profit margins and compete in cost-sensitive markets. Unless supply chain stability improves and cost-effective sourcing strategies are implemented, price volatility will continue to be a restraint on the market’s growth.

Opportunities

-

Increasing Adoption of Corrosion Protection Coatings in Additive Manufacturing and 3D-Printed Metal Components

The rise of additive manufacturing (3D printing) is creating new opportunities in the Corrosion Protection Coatings Market, particularly for protecting metal components produced through this advanced technique. Industries such as aerospace, defense, and healthcare are increasingly utilizing 3D-printed metal parts that require specialized coatings to enhance durability and corrosion resistance. U.S. organizations such as America Makes (National Additive Manufacturing Innovation Institute) are investing in research to develop protective coatings for 3D-printed metal substrates. Companies like Carboline Company and Tnemec Company Inc. are exploring innovative coatings that improve the performance of lightweight, additively manufactured structures. Corrosion protection coatings tailored for 3D printing applications offer enhanced adhesion, flexibility, and thermal resistance, making them suitable for high-performance engineering applications. As 3D printing technology advances, the demand for coatings that provide long-term protection to printed metal parts is expected to increase, creating a promising growth avenue for coatings manufacturers.

Challenge

-

Complex Application Processes and High Skilled Labor Requirements Limiting Adoption of Advanced Corrosion Protection Coatings

The application of advanced corrosion protection coatings is highly technical, requiring precise surface preparation, correct mixing ratios, and specific environmental conditions for optimal adhesion and performance. Industries such as oil & gas, marine, and aerospace demand highly durable coatings, but the complexity of application often leads to inconsistencies in protection if not applied correctly. The U.S. Bureau of Labor Statistics reports a shortage of skilled coating applicators, making it challenging for industries to maintain high application standards. Improper application can lead to premature coating failure, increasing maintenance costs and asset downtime. Additionally, certain coatings require specialized equipment such as electrostatic spray systems or high-temperature curing processes, adding to operational expenses. Companies like Sherwin-Williams and Diamond Vogel are investing in training programs to bridge the skills gap, but workforce shortages remain a critical issue. Automated application technologies and robotics are emerging solutions, yet their high initial investment deters small and mid-sized businesses from adoption. Without widespread training initiatives and advancements in user-friendly coating technologies, the market’s growth may be constrained by the limited availability of skilled labor.

Corrosion Protection Coatings Market Segmental Analysis

By Resin Type

Epoxy coatings dominated the corrosion protection coatings market in 2023 with a market share of 38.5%. Their exceptional adhesion, chemical resistance, and mechanical durability make them a preferred choice across various industries, including oil & gas, marine, infrastructure, and power generation. Epoxy coatings provide long-term corrosion resistance, particularly in harsh environments where exposure to moisture, chemicals, and extreme temperatures is common. The U.S. Department of Transportation (DOT) mandates the use of epoxy-based coatings for steel bridges and highways, ensuring their structural integrity. Similarly, the National Association of Corrosion Engineers (NACE) recognizes epoxy coatings as a standard for protecting pipelines and industrial equipment. The increasing adoption of fusion-bonded epoxy (FBE) coatings in pipeline protection and marine applications has further driven demand. Companies like Sherwin-Williams and PPG Industries have developed high-performance epoxy coatings with enhanced flexibility and low volatile organic compound (VOC) emissions, aligning with evolving environmental regulations. Additionally, the U.S. Environmental Protection Agency (EPA) has set stricter limits on VOC emissions, prompting manufacturers to innovate epoxy-based solutions with improved sustainability and compliance. With rising infrastructure spending and stricter corrosion prevention requirements, epoxy coatings remain the dominant segment.

By Technology

Solvent-borne coatings dominated and held the largest share in the corrosion protection coatings market in 2023, accounting for 56.2%. These coatings are widely favored for their superior durability, high-performance characteristics, and strong adhesion, making them ideal for heavy-duty industrial applications. Their ability to provide uniform coverage and excellent resistance to chemicals, UV rays, and moisture makes them indispensable in industries such as marine, oil & gas, and aerospace. Despite growing concerns about VOC emissions, solvent-borne coatings continue to dominate due to their ability to perform in extreme weather conditions, including high humidity and fluctuating temperatures. The U.S. Environmental Protection Agency (EPA) has imposed regulations on solvent-borne coatings, leading manufacturers to develop low-VOC formulations that maintain performance while reducing environmental impact. Companies such as Axalta Coating Systems and AkzoNobel have introduced high-solids solvent-borne coatings that comply with strict regulatory standards while ensuring corrosion protection in demanding environments. Furthermore, industries such as offshore oil rigs and defense infrastructure continue to rely on solvent-borne coatings due to their quick drying times and high resistance to mechanical wear. The continued advancements in environmentally friendly solvent-based formulations have helped this segment retain its market leadership despite regulatory challenges.

By End-use Industry

The construction industry dominated the corrosion protection coatings market in 2023, holding a 35.6% share. The surge in infrastructure projects, commercial buildings, and residential developments has fueled demand for high-performance protective coatings that extend the lifespan of structures. Corrosion protection coatings play a critical role in safeguarding bridges, highways, pipelines, and high-rise buildings from environmental damage, oxidation, and moisture penetration. The U.S. Infrastructure Investment and Jobs Act, which allocated $1.2 trillion for upgrading roads, bridges, and public transit, has significantly boosted demand for durable coatings. Additionally, epoxy and polyurethane coatings are extensively used to protect steel structures, reinforced concrete, and metal reinforcements in construction projects. Organizations such as The American Institute of Steel Construction (AISC) emphasize the importance of corrosion-resistant coatings to enhance structural longevity and reduce maintenance costs. Leading manufacturers like BASF SE and Hempel A/S continue to innovate in this sector, introducing advanced coatings with self-healing properties, UV resistance, and extended durability. The growing focus on sustainable and energy-efficient buildings has further propelled demand for low-VOC and waterborne corrosion protection coatings in construction applications.

Corrosion Protection Coatings Market Regional Outlook

The Asia Pacific region dominated the corrosion protection coatings market in 2023, holding a market share of 41.2%, driven by rapid industrialization, expanding infrastructure projects, and a thriving manufacturing sector. Countries like China, India, and Japan are at the forefront due to massive investments in construction, automotive, and oil & gas industries. China, the largest consumer, has seen significant growth in its shipbuilding industry, with companies like China State Shipbuilding Corporation (CSSC) increasing production. Additionally, China’s Belt and Road Initiative (BRI) has spurred demand for corrosion protection coatings in infrastructure projects. India, with its ambitious Smart Cities Mission and Bharatmala Project, has also fueled market expansion, leading to rising consumption of epoxy and polyurethane-based coatings for roads, bridges, and commercial structures. According to the Indian Brand Equity Foundation (IBEF), India's construction sector is expected to reach $1.4 trillion by 2025, significantly driving coatings demand. Japan, known for its advanced coatings technology, continues to invest in marine and automotive sectors, with companies like Nippon Paint Holdings and Kansai Paint pioneering high-performance coatings. Additionally, Southeast Asian nations, including Indonesia and Vietnam, are witnessing substantial investments in petrochemical facilities, ports, and power plants, further fueling demand for corrosion protection coatings in the region.

Moreover, North America emerged as the fastest-growing region in the corrosion protection coatings market during the forecast period, with a significant CAGR. The growth is driven by stringent environmental regulations, increasing infrastructure investments, and advancements in sustainable coatings technology. The U.S. dominates the region due to its heavy investments in oil & gas, marine, and transportation sectors. The U.S. Department of Energy (DOE) has launched several initiatives to enhance pipeline durability, increasing demand for high-performance coatings. Moreover, the Bipartisan Infrastructure Law allocates $550 billion for roads, bridges, and public transit upgrades, driving coatings demand in construction applications. Canada, the fastest-growing country, is witnessing increased demand due to rising investments in offshore oil exploration and marine industries, supported by companies like Hempel and Sherwin-Williams. The Canadian government’s Net-Zero Emissions 2050 strategy is pushing industries to adopt low-VOC waterborne coatings. Mexico, with its expanding automotive and manufacturing industries, has attracted global players like BASF and Axalta Coating Systems, who are investing in localized production to meet growing demand. The increasing emphasis on eco-friendly coatings and smart corrosion prevention technologies is further propelling North America's market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

3M Company (Scotchkote Fusion-Bonded Epoxy, Scotchkote 323)

-

AkzoNobel N.V. (Interzone, Intergard)

-

Axalta Coating Systems Ltd. (Abcite, Alesta)

-

BASF SE (MasterProtect, CathoGuard)

-

Carboline Company (Carboguard, Carbozinc)

-

Chugoku Marine Paints Ltd. (Banmaru, Epofer)

-

Hempel A/S (Hempadur, AvantGuard)

-

Jotun A/S (Jotamastic, Barrier)

-

Kansai Paint Co., Ltd. (Zinc Rich Primer, Ecomarine)

-

Nippon Paint Holdings Co., Ltd. (Nippon Protect, Bodelac)

-

Nycote Laboratories Inc. (Nycote 7-11, Nycote 88)

-

PPG Industries Inc. (Amercoat, SigmaCover)

-

RPM International Inc. (Rust-Oleum High Performance, Tremco)

-

The Magni Group, Inc. (Magni 565, Magni 501)

-

The Sherwin-Williams Company (Macropoxy, Zinc Clad)

-

Tnemec Company Inc. (Series 66 Hi-Build Epoxoline, Series 27 Typoxy)

-

Wacker Chemie AG (SILRES BS, GENIOSIL)

-

Diamond Vogel (Peridium Powder Coatings, UltraGuard)

-

Ancatt Inc. (ZrGuard, Anti-Corrosion Nanocoatings)

-

Dow (Dowsil, DURATRON)

Recent Developments

-

December 2024: AkzoNobel partnered with Sinopec to support its global expansion by supplying high-performance coatings for overseas projects. The collaboration aimed to enhance corrosion resistance and sustainability in refining and chemical facilities.

-

November 2024: Carboline launched Carbothane DTM Mastic, a urethane-based coating for emergency maintenance. It offered superior corrosion protection and quick application for minimally prepared steel surfaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.73 Billion |

| Market Size by 2032 | USD 19.04 Billion |

| CAGR | CAGR of 4.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber, Others) •By Technology (Water borne, Solvent borne, Powder based) •By End-use Industry (Construction, Oil & Gas, Marine, Automotive & Transportation, Power Generation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Sherwin-Williams Company, PPG Industries Inc., AkzoNobel N.V., Jotun A/S, Kansai Paint Co., Ltd., Axalta Coating Systems Ltd., Hempel A/S, Nippon Paint Holdings Co., Ltd., BASF SE, RPM International Inc. and other key players |