Specialty Chemical Packaging Market Report Scope & Overview:

Get More Information on Specialty Chemical Packaging Market - Request Sample Report

The Specialty Chemical Packaging Market Size was valued at USD 14 billion in 2023 and is expected to reach USD 19.97 billion by 2032 and grow at a CAGR of 4.03% over the forecast period 2024-2032.

The specialty chemical packaging market has witnessed consistent growth in recent years, primarily fuelled by the escalating demand for specialty chemicals across diverse sectors like automotive, healthcare, electronics, and agriculture. This surge in demand can be attributed to the unique properties and applications of specialty chemicals. Simultaneously, stringent regulations governing the proper packaging and labelling of chemicals, particularly specialty chemicals, have prompted the widespread adoption of specialized packaging solutions. These solutions aim to ensure compliance with safety and environmental standards, reflecting the industry's commitment to responsible practices.

In terms of packaging types, the market features a variety of options catering to different needs. Drums and Intermediate Bulk Containers (IBCs) are prevalent for transporting and storing larger quantities of specialty chemicals, while bottles and cans are favoured for smaller volumes and retail distribution. Moreover, there is a growing trend towards the adoption of flexible packaging, such as pouches and bags, offering a lightweight and cost-effective alternative.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Demand for Specialty Chemicals

The increasing demand for specialty chemicals with unique properties and applications across various industries, including automotive, healthcare, electronics, and agriculture, serves as a primary driver. As industries continue to innovate and develop specialized products, the need for appropriate packaging solutions has grown proportionally.

-

Globalization of supply chains in the specialty chemical industry.

RESTRAIN:

-

Packaging Waste and Recycling Challenges

Despite efforts to adopt sustainable packaging, challenges persist in managing packaging waste and ensuring effective recycling, especially for materials that are not easily recyclable. Developing efficient recycling processes for specialty chemical packaging materials remains a concern.

-

Rising price of oil can significantly affect the Speciality Chemical Packaging market.

OPPORTUNITY:

-

Focus on Health and Safe packaging solutions.

The heightened awareness of health and safety concerns provides an opportunity for packaging companies to develop solutions that prioritize the secure containment and transportation of specialty chemicals. This includes packaging designs that minimize the risk of spills, leaks, or exposure during handling.

-

Increasing Demand for Sustainable Packaging

CHALLENGES:

-

Efficiently managing packaging waste, especially for materials that are not easily recyclable, poses challenges.

Impact Of Russia Ukraine War

The Specialty Chemical Packaging market faces substantial challenges amidst the Russia-Ukraine crisis, impacting crucial aspects such as raw material availability, energy prices, and global supply chains. Disruptions in the availability and cost of raw materials, particularly from Russia, a major global supplier of oil and gas, create fluctuations that may elevate production costs for specialty chemicals and their packaging. Rising global energy prices, influenced by the crisis, affect energy-intensive industries like chemical manufacturing and packaging, potentially leading to reduced profit margins and necessitating revaluations of production strategies.

Supply chain disruptions, stemming from the conflict, introduce challenges in the transportation and availability of specialty chemicals and packaging materials, contributing to logistical inefficiencies and potential market shortages. Geopolitical tensions and sanctions imposed on Russia create regulatory complexities, compelling companies to navigate new landscapes and seek alternative suppliers, incurring additional time and costs. The resulting market uncertainty prompts cautious decision-making, potentially impacting investment, technological advancements, and expansion plans in the Specialty Chemical Packaging sector. In response, industry players may adopt strategic measures such as diversifying supply chains, investing in energy efficiency, and exploring alternative raw materials, with an increased emphasis on innovative, sustainable packaging solutions.

Impact of Economic Slowdown

The ongoing economic slowdown is anticipated to impact the Specialty Chemical Packaging market across several dimensions. Reduced industrial activity, a common outcome during economic downturns, is expected to directly affect the demand for specialty chemicals and, consequently, their packaging. Industries such as automotive and manufacturing, major users of specialty chemicals, may scale back production, impacting the need for specialized packaging solutions. Supply chain disruptions, heightened by economic challenges and geopolitical tensions like the Russia-Ukraine crisis, could lead to delays and increased costs in accessing critical raw materials for packaging. Changes in consumer demand driven by cost-cutting measures might prompt a shift towards more affordable packaging alternatives, intensifying market competition.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Metal

-

Glass

-

Others

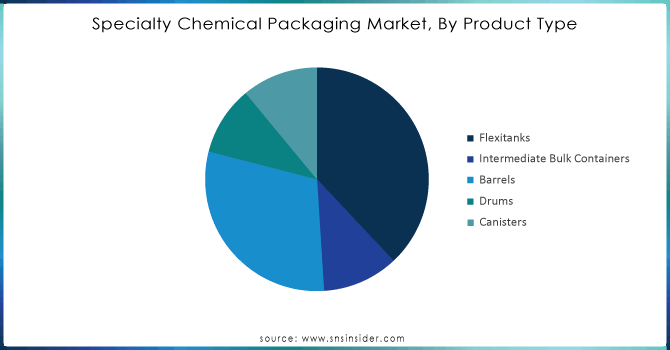

By Product Type

-

Barrels

-

Drums

-

Canisters

-

Intermediate Bulk Containers

-

Flexitanks

Flexitanks holds the largest market share by 35%. It is used to exports oil, food-grade liquids, non-hazardous chemicals and wines over the world. As demand for construction materials, speciality polymers, detergents and powdered non-hazardous chemicals increases, thereby rise the business of specialty chemical packaging products.

Need any customization research on Specialty Chemical Packaging Market - Enquiry Now

By Packaging Type

-

Flexible Packaging

-

Rigid Packaging

By Chemical Type

-

Agrochemicals

-

Speciality Polymers

-

Electronic Chemicals

-

Other

By Capacity Type

-

100-250 Liters

-

250-500 Liters

-

Over 500 Liters

By End Use

-

Automotive

-

Construction

-

Electronics

-

Agriculture

-

Healthcare & Pharmaceuticals

REGIONAL ANALYSIS

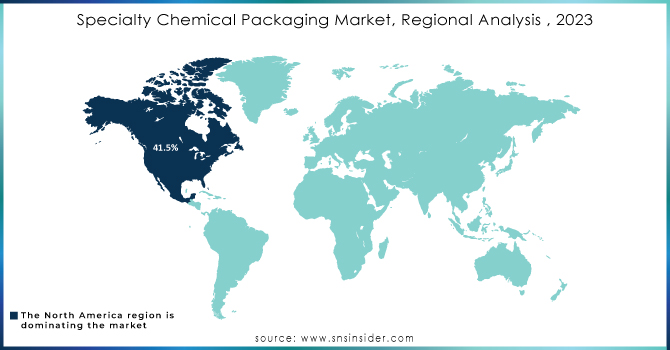

North America commands a substantial market share approximately 41.5% in the specialty chemical packaging industry, primarily driven by the advanced industrial and manufacturing sectors within the region. The well-established infrastructure and stringent regulatory standards contribute to the region's market dominance.

On the other hand, Asia Pacific emerges as the fastest-growing market, propelled by escalating industrialization and heightened demand for specialty chemicals in emerging economies. The region's dynamic economic growth, particularly in countries like China and India, fuels increased manufacturing activities, thereby driving the demand for specialized packaging solutions.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the Specialty Chemical Packaging Market are Amcor Plc, Bemis Company Inc., Berry Global Inc., Sealed Air Corporation, Mondi Plc, Sonoco Products Company, Aptar Group, WestRock Company, Scholle IPN, Graham Packaging Company and other players.

RECENT DEVELOPMENTS

-

In 2020, Greif, Inc. acquired a minority interest in Centurion Container LLC and expanded its network for reconditioning intermediate bulk container in North America. This investment aims to strengthen the company’s business in IBCs and intermediate bulk container reconditioning.

-

In 2021, Mauser Packaging solutions disclosed their acquisition with Global Tank Srl. This will further enhance the offering of packaging products in the Italian market and empowering the position in global market for reconditioning.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14 Billion |

| Market Size by 2032 | US$ 19.97 Billion |

| CAGR | CAGR of 4.03 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Glass, Others) • By Product Type (Barrels, Drums, Canisters, Intermediate Bulk Containers, Flexitanks) • By Packaging Type (Flexible Packaging, Rigid Packaging) • By Chemical Type (Agrochemicals, Speciality Polymers, Electronic Chemicals, Others) • By Capacity Type (100-250 Liters, 250-500 Liters, Over 500 Liters) • By End Use (Automotive, Construction, Electronics, Agriculture, Healthcare & Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor Plc, Bemis Company Inc., Berry Global Inc., Sealed Air Corporation, Mondi Plc, Sonoco Products Company, Aptar Group, WestRock Company, Scholle IPN, Graham Packaging Company |

| Key Drivers | • Rising Demand for Specialty Chemicals • Globalization of supply chains in the specialty chemical industry. |

| Restraints | • Packaging Waste and Recycling Challenges • Rising price of oil can significantly affect the Speciality Chemical Packaging market. |