Craft Beer Market Report Scope & Overview:

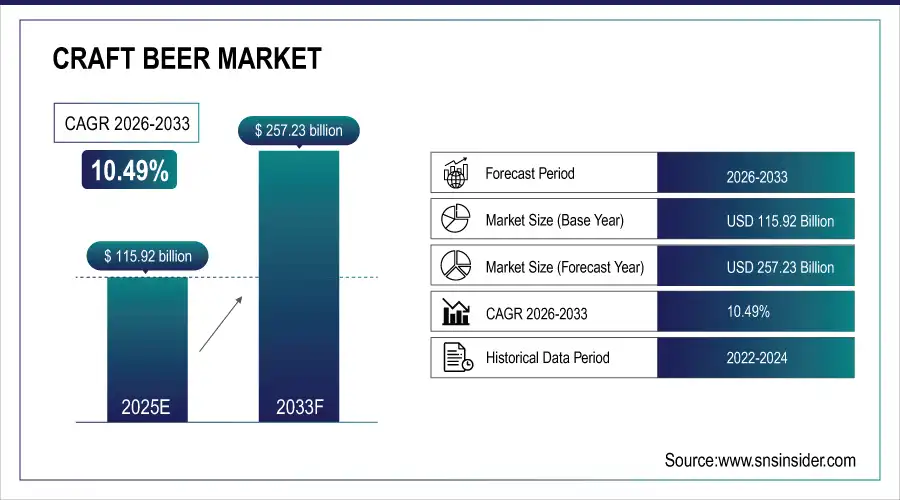

The Craft Beer Market Size was valued at USD 115.92 Billion in 2025E and is expected to reach USD 257.23 Billion by 2033 and grow at a CAGR of 10.49% over the forecast period 2026-2033.

The Craft Beer Market analysis, driven by rising consumer preference for premium, flavorful, and diverse beer options, coupled with an increasing awareness of artisanal and locally brewed beverages. Additionally, the expansion of craft breweries, innovative flavors, and seasonal brews, along with growth in on-trade and off-trade distribution channels, are boosting market adoption. According to analysis, Disposable Income Factor: Households with higher disposable income spend 15–20% more on craft beer than average households.

Market Size and Forecast:

-

Market Size in 2025: USD 115.92 Billion

-

Market Size by 2033: USD 257.23 Billion

-

CAGR: 10.49% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Craft Beer Market - Request Free Sample Report

Craft Beer Market Trends

-

Consumers increasingly prefer unique, artisanal craft beers over mass-produced alternatives globally.

-

Millennials and Gen Z drive demand for premium and flavorful beer experiences.

-

Small-batch and locally brewed beers gain popularity due to perceived authenticity and quality.

-

Expansion in Asia-Pacific and Latin America fuels craft beer market growth opportunities.

-

Tourism, beer festivals, and experiential taprooms enhance consumer engagement and brand visibility.

-

Digital marketing and social media adoption accelerate awareness and demand for craft beers.

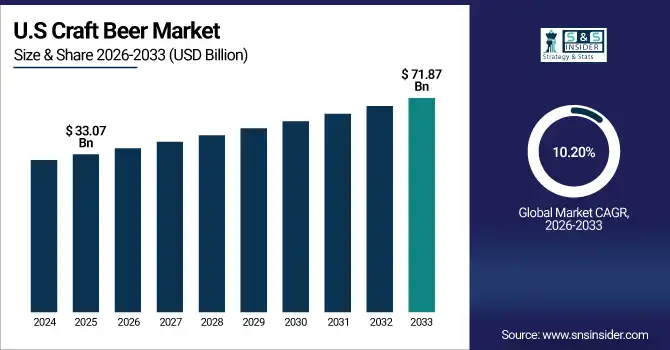

The U.S. Craft Beer Market size was USD 33.07 Billion in 2025E and is expected to reach USD 71.87 Billion by 2033, growing at a CAGR of 10.20% over the forecast period of 2026-2033, driven by high consumer awareness, a mature beer culture, and strong demand for premium and diverse brews. Expanding taprooms, craft breweries, and on-trade experiences drive growth, supported by urbanization and evolving millennial preferences.

Craft Beer Market Growth Drivers:

-

Premium Craft Beers Gain Popularity Among Millennials Seeking Unique Flavors

The Craft Beer Market growth, drivers by Consumers are increasingly seeking unique, flavorful, and premium alcoholic beverages rather than standard mass-produced beers. This trend is particularly strong among millennials and Gen Z, who value artisanal products and are willing to pay more for quality and taste. Craft beers, with their wide range of styles such as ales, lagers, sour beers, and barrel-aged varieties cater to these preferences. Additionally, local and small-batch breweries appeal to consumers’ desire for authenticity and a personalized experience, boosting market demand globally.

Flavor Innovation: Seasonal and experimental brews account for ~25–30% of new craft beer launches annually.

Craft Beer Market Restraints:

-

High Craft Beer Prices Limit Accessibility In Price-Sensitive Global Markets

Despite the long-term benefits, Craft beers generally have a higher price point due to small-scale production, premium ingredients, and labor-intensive brewing processes. This can limit accessibility in price-sensitive markets or regions where disposable incomes are lower. Mass-produced beers, which are cheaper and widely available, often dominate these markets, restricting craft beer adoption. Furthermore, taxes, import duties, and distribution costs can further increase retail prices, making it challenging for craft breweries to compete with mainstream beer brands.

Craft Beer Market Opportunities:

-

Emerging Markets Offer Growth Potential For Craft Beer Industry Expansion

Emerging markets, particularly in Asia-Pacific, Latin America, and parts of Africa, represent significant growth potential for craft beer. Rising urbanization, increasing disposable incomes, and evolving lifestyles are creating new consumer segments interested in premium alcoholic beverages. Additionally, tourism and the rising popularity of bars, pubs, and craft beer festivals provide platforms for brand exposure. Companies can capitalize on these trends by introducing locally adapted flavors, leveraging digital marketing, and expanding distribution networks in untapped regions.

Localization Trend: Locally adapted flavors account for ~20% of new product launches in Asia-Pacific and Latin America.

Craft Beer Market Segmentation Analysis:

-

By Product Type, in 2025, Lager led the market with a share of 42.30%, while Ale is the fastest-growing segment with a CAGR of 10.80%

-

By Packaging, in 2025, Bottles led the market with a share of 50.40%, while Cans is the fastest-growing segment with a CAGR of 11.50%

-

By Application, in 2025, Retail led the market with a share of 45.20%, while Food Service is the fastest-growing segment with a CAGR of 10.10%

-

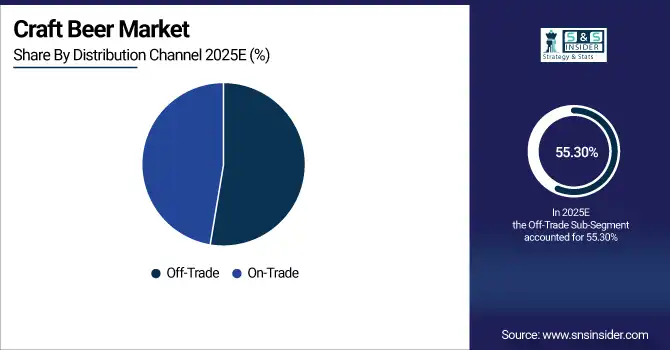

By Distribution Channel, in 2025, Off-Trade led the market with a share of 55.30%, while On-Trade is the fastest-growing segment with a CAGR of 10.30%

By Product Type, Lager led the market and Ale showed the fastest growth

The Lager lead the market in 2025, due to its smooth taste, wide availability, and mass appeal among consumers globally. Its popularity spans both on-trade and off-trade channels, making it a staple choice for casual and premium beer drinkers alike. Meanwhile, Ale emerged as the fastest-growing segment, driven by increasing consumer preference for bold flavors, experimental brews, and artisanal craft experiences. The growing interest in seasonal and specialty ales is further fueling adoption, particularly among millennials and urban consumers seeking unique, high-quality beer options.

By Packaging, Bottles led the market and Cans showed the fastest growth

The Bottles lead the market in 2025, due to their convenience, shelf life, and widespread availability in retail outlets and specialty stores. Bottled craft beers remain the preferred choice for both casual consumers and premium buyers seeking traditional packaging. Meanwhile, Cans segment the fastest growth, driven by portability, environmental benefits, and lower shipping costs. Increasing adoption of canned craft beers by breweries, coupled with rising consumer awareness of sustainable packaging, is fueling rapid expansion across on-trade and off-trade channels globally.

By Application, Retail led the market and Food Service showed the fastest growth

The Retail leads the market in 2025, due to the convenience and accessibility of supermarkets, liquor stores, and online platforms. Retail channels enable consumers to explore a wide variety of craft beers, driving consistent demand across urban and suburban areas. Meanwhile, Food Service showed the fastest growth, fueled by the increasing presence of craft beers in bars, restaurants, pubs, and cafes. Rising consumer preference for premium, on-premise drinking experiences, combined with brewery collaborations and curated menus, is accelerating adoption in the food service segment globally.

By Distribution Channel, Off-Trade led the market and On-Trade showed the fastest growth

The Off-Trade leads the market in 2025, due to the wide availability of craft beers through supermarkets, liquor stores, and online retail platforms. Off-trade channels provide consumers with convenience, variety, and competitive pricing, driving sustained demand across urban and suburban markets. Meanwhile, On-Trade showed the fastest growth, fueled by increasing craft beer offerings in bars, pubs, restaurants, and taprooms. Rising consumer interest in premium, on-premise experiences, beer festivals, and tasting events is boosting adoption and brand engagement within the on-trade segment globally.

Craft Beer Market Regional Analysis:

North America Craft Beer Market Insights:

The North America dominated the Craft Beer Market in 2025E, with over 39.60% revenue share, due to a mature beer culture, high consumer awareness, and strong demand for premium and diverse craft beers. The region benefits from a robust network of craft breweries, bars, and retail outlets, which facilitate widespread availability and adoption. Additionally, growing participation in beer festivals, taproom experiences, and brewery tours is enhancing consumer engagement. Strong distribution channels across on-trade and off-trade, combined with innovative flavor experimentation and seasonal brews, continue to drive significant growth in the North American craft beer market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. and Canada in Craft Beer Market Insights

The U.S. and Canada lead the Craft Beer Market due to a mature beer culture, high consumer awareness, strong disposable incomes, widespread brewery networks, and growing demand for premium, artisanal, and diverse craft beer experiences across on-trade and off-trade channels.

Asia Pacific Craft Beer Market Insights:

The Asia Pacific region is expected to have the fastest-growing CAGR 11.42%, driven by increasing urbanization, rising disposable incomes, and evolving consumer lifestyles. Growing interest in premium, flavorful, and artisanal beverages is creating new demand for craft beers across metropolitan areas. The expansion of bars, pubs, and on-trade experiences, along with participation in beer festivals and tasting events, is enhancing brand visibility and consumer engagement. Additionally, breweries are introducing locally adapted flavors and leveraging digital marketing channels, further accelerating craft beer adoption and market growth throughout the Asia-Pacific region

China and India Craft Beer Market Insights

China and India are growing in the Craft Beer Market due to rising urbanization, increasing disposable incomes, evolving lifestyles, and growing interest in premium, flavorful, and artisanal beers. Expanding bars, pubs, and brewery experiences further accelerate market adoption in these regions.

Europe Craft Beer Market Insights

Europe holds a significant share in the Craft Beer Market, driven by a well-established beer culture and strong consumer preference for premium and artisanal beverages. The region benefits from a mature network of craft breweries, bars, pubs, and retail outlets, ensuring widespread availability and adoption. Consumers are increasingly exploring experimental flavors, seasonal brews, and specialty beers, supporting market growth. Additionally, participation in craft beer festivals, brewery tours, and taproom experiences enhances brand engagement. Combined with on-trade and off-trade distribution expansion, these factors continue to sustain steady growth in Europe’s craft beer market

Germany and U.K. Craft Beer Market Insights

Germany and the U.K. hold significant Craft Beer Market shares due to their strong beer culture, established brewery networks, high consumer preference for premium and artisanal beers, and increasing demand for experimental flavors, seasonal brews, and craft beer experiences.

Latin America (LATAM) and Middle East & Africa (MEA) Craft Beer Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) regions are witnessing gradual growth in the Craft Beer Market, driven by rising urbanization, increasing disposable incomes, and evolving consumer lifestyles. Growing awareness of premium and artisanal beverages, coupled with the expansion of bars, pubs, and on-trade experiences, is fueling adoption. Breweries are introducing locally adapted flavors and leveraging digital marketing to engage consumers. Additionally, participation in beer festivals, tasting events, and taproom experiences, along with improving distribution channels, is accelerating the overall growth of craft beer in these regions.

Craft Beer Market Competitive Landscape

Molson Coors Beverage Company has been actively diversifying its portfolio to capture the growing craft beer and non-alcoholic beverage markets. Strategic partnerships, such as with Naked Life, and investments in energy drinks like Zoa, highlight its focus on innovation. The company leverages its global distribution network to expand craft beer availability, while targeting health-conscious and premium beverage consumers worldwide.

-

In September 2025, Molson Coors Beverage Company announced a strategic partnership with Naked Life for non-alcoholic canned cocktails and increased its stake in energy drink Zoa, diversifying its beverage portfolio. This move strengthens Molson Coors’ presence in the growing non-alcoholic and functional beverage segments, targeting health-conscious consumers globally.

Sierra Nevada Brewing Co. is a prominent player in the craft beer segment, known for its innovative brews and sustainable practices. Recent initiatives like the "CanDo" co-packing facility enhance production capacity and efficiency, supporting expanding demand. Seasonal and experimental beers continue to attract urban and millennial consumers, reinforcing Sierra Nevada’s reputation for high-quality, artisanal craft beer experiences.

-

In July 2025, Sierra Nevada Brewing Co. launched "CanDo," a co-packing operation in Chico, California, to support craft beer production. The facility aims to enhance production efficiency and meet rising demand for packaged craft beers across domestic and international markets.

Lagunitas Brewing Company focuses on creative, bold-flavored craft beers, catering to enthusiasts seeking unique and seasonal offerings. Launches like the "Hop Harvest" IPA showcase its commitment to innovation and limited-edition releases. By combining flavorful products with strong brand engagement through bars, festivals, and taproom experiences, Lagunitas effectively captures premium beer consumers and strengthens its presence in the competitive craft beer market.

-

In October 2025, Lagunitas Brewing Company introduced a new seasonal IPA, "Hop Harvest," featuring a blend of freshly harvested hops for a unique flavor profile. This seasonal launch expands Lagunitas’ portfolio, attracting craft beer enthusiasts seeking innovative and limited-edition brews.

Craft Beer Market Key Players:

Some of the Craft Beer Market Companies are:

-

Anheuser-Busch InBev

-

Heineken N.V.

-

The Boston Beer Company

-

Molson Coors Beverage Company

-

Constellation Brands

-

D.G. Yuengling & Son, Inc.

-

Sierra Nevada Brewing Co.

-

New Belgium Brewing Company

-

Deschutes Brewery

-

Lagunitas Brewing Company

-

Stone Brewing Co.

-

Dogfish Head Craft Brewery

-

Bell’s Brewery

-

The Gambrinus Company

-

Chimay Beers and Cheeses

-

Omer Vander Ghinste

-

Tenth and Blake Beer Company

-

Funky Buddha Brewery

-

Pabst Brewing Company

-

Kirin Holdings Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 115.92 Billion |

| Market Size by 2033 | USD 257.23 Billion |

| CAGR | CAGR of 10.49% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Ale, Lager, Pilsners, Others) • By Packaging (Bottles, Cans, Others) • By Application (Bar, Food Service, Retail) • By Distribution Channel (On-Trade, Off-Trade) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Anheuser-Busch InBev, Heineken N.V., The Boston Beer Company, Molson Coors Beverage Company, Constellation Brands, D.G. Yuengling & Son, Inc., Sierra Nevada Brewing Co., New Belgium Brewing Company, Deschutes Brewery, Lagunitas Brewing Company, Stone Brewing Co., Dogfish Head Craft Brewery, Bell’s Brewery, The Gambrinus Company, Chimay Beers and Cheeses, Omer Vander Ghinste, Tenth and Blake Beer Company, Funky Buddha Brewery, Pabst Brewing Company, Kirin Holdings Company, and Others. |