Cranes Market Report Scope & Overview:

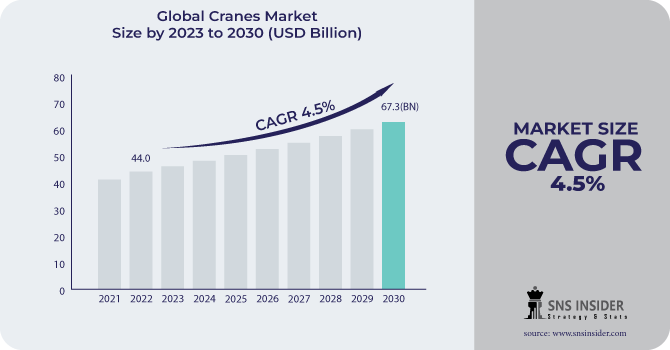

The Cranes Market Size was estimated at USD 46.59 billion in 2023 and is expected to arrive at USD 74.93 billion by 2032 with a growing CAGR of 5.42% over the forecast period 2024-2032.

To get more information on Cranes Market - Request Free Sample Report

This report offers a unique perspective on the crane market by analyzing global production trends, fleet utilization rates, and the impact of maintenance costs and downtime on operational efficiency. It further explores technological adoption, highlighting automation and IoT integration across regions, along with export/import dynamics, shedding light on global trade shifts. Additionally, insights into electrification trends, supply chain disruptions, and rental market expansion make this report a comprehensive industry outlook.

The U.S. cranes market is projected to grow steadily from USD 6.12 billion in 2023 to USD 10.13 billion by 2032, driven by increasing infrastructure development, industrial expansion, and advancements in crane technology. The market is expected to witness a CAGR of approximately 5.7%, with rising investments in construction and logistics sectors fueling demand

Market Dynamics

Drivers

-

The cranes market is driven by rapid urbanization, large-scale infrastructure projects, and technological advancements, fostering steady growth.

The growing construction and infrastructure development sector is a key driver for the cranes market, fueled by rapid urbanization, industrial expansion, and government-backed smart city initiatives. Growing investments in residential, commercial, as well as industrial projects globally is fuelling demand for advanced lifting solutions. Large-scale infrastructure projects in emerging economies, particularly in Asia-Pacific and the Middle East that include highways, bridges, metro rail and high-rise buildings are contributing to the boom in sales of cranes. Moreover, the construction industry is witnessing an increase in tower crane, mobile crane, and crawler crane adoption due to their capability to manage heavy loads in crowded urban areas. One of the key trends driving the market is the integration of automation and telematics in cranes to improve operational safety and efficiency. In addition, the shift to electric and hybrid cranes, following tight emission regulations, is encouraging innovation. The cranes market is anticipated to grow steadily over next few years, as global construction activities continue to grow.

Restraint

-

The high capital investment and ongoing maintenance costs of cranes make ownership challenging for SMEs, leading to a preference for rentals or leasing.

Cranes are essential for various industries, including construction, manufacturing, and logistics, but their high initial investment and maintenance costs pose a significant challenge, particularly for small and medium-sized enterprises (SMEs). The cost of buying a crane is significant expenditure the crane itself as well as transportation, installation, and operational setup. And you still have to do regular maintenance for safety, efficiency, and industry compliance. In addition, they incur ongoing costs such as inspections, spare parts, repairs and operator training, which contribute to total ownership cost. For SMEs, these financial responsibilities add up, and as a result, many feel they simply cannot justify purchasing a crane, and have therefore turned to rental or leasing solutions. Additionally, there are costs associated with unexpected breakdowns and repairs, which can lead to downtime and impact project schedules and profit margins. As a result, producers are working on creating economical, energy-efficient, and low-maintenance cranes for budget-conscious companies, and to increase availability in the marketplace.

Opportunities

-

The rise of modular construction is increasing demand for cranes to lift and assemble prefabricated components efficiently.

The rise of modular and prefabricated construction is driving significant demand for cranes, as these projects rely on heavy lifting for assembling pre-manufactured components. Modular buildings are designed and built off site before being assembled onto their final locations, and rely heavily on precision placement and installation by crane. The growth of structural components is particularly pronounced in urban locations, were land availability or construction crew shortages stress conventional construction. Various types of cranes, including tower cranes, mobile cranes, and crawler cranes, are widely utilized to lift precast steel structures, concrete panels, and modular units, minimizing on-site construction time and labor costs. Emerging crane technologies, including automatic lift and remote operation, also help in making this process more efficient as modular construction. As governments and private developers embrace modular techniques for residential, commercial, and infrastructure projects, the demand for cranes in this segment is projected to expand steadily, presenting lucrative opportunities for crane manufacturers and rental service providers.

Challenges

-

The growing preference for crane rentals over ownership is reducing new crane sales, pushing manufacturers to adapt with leasing models and advanced solutions.

The crane rental market is experiencing significant growth as businesses increasingly opt for renting over purchasing due to cost-effectiveness and operational flexibility. Owing a crane incurs high up-front costs, maintenance, insurance, and storage costs, so rentals often make more sense for prospective buyers especially for short-term projects. Crane rental services offer a full range of types of cranes and maximize crane access without the financial burden of ownership, enabling construction firms, logistics companies and industrial users to increase operations when required. Innovations in telematics and remote monitoring also allow rental companies to provide well-maintained, technologically advanced equipment, making them even more attractive. This move is affecting the crane manufacturers, since a drop in the demand for new crane sales leads them to seek other paths of revenues like leasing models, maintenance services and digital solutions. Manufacturers must offer technologically advanced cranes at a cost-competitive price, and also respond to the evolution towards flexibility through rental solutions.

Segmentation Analysis

By Product Type

The Mobile Cranes segment dominated with a market share of over 62% in 2023, due to its adaptability, ease of movement, and extensive applications across various industries. Truck-mounted, crawler, and rough-terrain cranes are among the most commonly used cranes in construction, infrastructure, and industrial projects, thanks to their ability to take on heavy lifting tasks. Their versatility allows them to work on different landscapes and atmospheres, proving to be crucial for city building, road working, and portico operations. Moreover, technological innovations like system automation and telematics integration have improved their operational efficiency and safety. Moreover, the rise in demand for fast project completion, as well as rising investments in smart city projects and renewable energy projects, further drives the expansion of the mobile cranes segment across the world.

By End-User

The construction segment dominated with a market share of over 38% in 2023, driven by the rising demand for advanced lifting equipment in large-scale infrastructure projects. There are significant investments being made by Governments across the globe in smart cities, bridge construction and urban development which fuels demand for cranes in order to increase the productivity and safety. The development of residential and commercial real estate, as well as the increasing industrialization, stimulate the market growth. Tower cranes, mobile cranes, and crawler cranes are widely utilized in high-rise buildings, roadways, and metro projects. Moreover, the increasing emphasis on sustainable and modular construction methodologies has further intensified the need for technologically sophisticated cranes. The construction sector remains the main driver of crane adoption and sustains its lead in the global market as urbanization continues to accelerate.

.png)

Need any customization research on Cranes Market - Enquiry Now

Key Regional Analysis

The Asia-Pacific region dominates with a market share of over 45% in 2023 and is also the fastest-growing region. Countries such as China, India, and Japan are responsible for this dominance due to rapid urbanization, industrialization, and infrastructure development. Demand for cranes in the region has accelerated due to government initiatives that promote smart cities, high-speed rail projects and the expansion of commercial construction. Presence of large construction and manufacturing facilities also propels market growth. As the world’s largest construction market, China holds a pivotal position in driving the industry, while India’s growing investment in metro, highways, and real estate is driving demand even further. Similarly, the increasing shipbuilding, energy and mining sectors in the Asia-Pacific are adding to the demand for heavy-lifting equipment. Furthermore, cranes industry in the world is surging towards Asia-Pacific due to availability of cheap labor, reduction in technology costs and increasing adoption rate of automated and electric cranes, which is driving the market growth.

Key players in the Cranes Market

-

SANY GROUP (China) – (Crawler Cranes, Truck Cranes, All-Terrain Cranes)

-

Konecranes (Finland) – (Overhead Cranes, Portal Cranes, Mobile Harbor Cranes)

-

Manitowoc Company, Inc. (U.S.) – (Crawler Cranes, Tower Cranes, Rough Terrain Cranes)

-

Tadano Ltd (Japan) – (Rough Terrain Cranes, Truck Cranes, All-Terrain Cranes)

-

Komatsu Ltd (Japan) – (Crawler Cranes, Hydraulic Cranes, Mobile Cranes)

-

Terex Corporation (U.S.) – (Tower Cranes, Rough Terrain Cranes, Boom Trucks)

-

Liebherr Group (Germany) – (Tower Cranes, Mobile Cranes, Crawler Cranes)

-

Hitachi Construction Machinery Europe NV (Netherlands) – (Hydraulic Cranes, Crawler Cranes)

-

Demag Cranes & Components GmbH (Germany) – (Overhead Cranes, Gantry Cranes, Mobile Cranes)

-

Zoomlion Heavy Industry Science and Technology Co., Ltd (China) – (Tower Cranes, Crawler Cranes, Truck Cranes)

-

XCMG Group (China) – (All-Terrain Cranes, Crawler Cranes, Tower Cranes)

-

Palfinger AG (Austria) – (Knuckle Boom Cranes, Loader Cranes, Marine Cranes)

-

Kobelco Construction Machinery Co., Ltd. (Japan) – (Crawler Cranes, Lattice Boom Cranes)

-

Sumitomo Heavy Industries (Japan) – (Crawler Cranes, Hydraulic Cranes)

-

Sennebogen Maschinenfabrik GmbH (Germany) – (Material Handling Cranes, Duty Cycle Cranes)

-

Favelle Favco Berhad (Malaysia) – (Tower Cranes, Offshore Cranes)

-

Manitex International, Inc. (U.S.) – (Boom Trucks, Articulating Cranes, Rough Terrain Cranes)

-

Broderson Manufacturing Corp. (U.S.) – (Carry Deck Cranes, Rough Terrain Cranes)

-

TIL Limited (India) – (Mobile Cranes, Rough Terrain Cranes, Truck Cranes)

-

Fassi Gru S.p.A. (Italy) – (Truck-Mounted Cranes, Articulating Cranes)

Suppliers for (Mobile cranes, rough terrain cranes, and innovative lifting solutions) Cranes Market

-

Liebherr

-

Terex Corporation

-

Manitowoc

-

Tadano Ltd.

-

Konecranes

-

Zoomlion Heavy Industry

-

SANY Group

-

XCMG Group

-

Palfinger AG

-

Kobelco Construction Machinery

Recent Development

November 12, 2024: Sany's SAC40000T, a 4,000-ton all-terrain crane, is poised to transform large-scale lifting, particularly in the wind energy sector, by accommodating next-generation 10-13 MW turbines.

June 27, 2024: Terex has introduced the TRT 80L, an 80-ton rough terrain crane equipped with a 47-meter telescopic boom, a compact 3-meter width, and superior maneuverability for tight job sites. Its self-mounting counterweight and four steering modes streamline transport and setup.

| Report Attributes | Details |

| Market Size in 2023 | USD 46.59 Billion |

| Market Size by 2032 | USD 74.93 Billion |

| CAGR | CAGR of 5.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Mobile, Fixed, Marine) • By End-User (Construction, Mining, Industrial, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SANY GROUP, Konecranes, Manitowoc Company, Inc., Tadano Ltd, Komatsu Ltd, Terex Corporation, Liebherr Group, Hitachi Construction Machinery Europe NV, Demag Cranes & Components GmbH, Zoomlion Heavy Industry Science and Technology Co., Ltd, XCMG Group, Palfinger AG, Kobelco Construction Machinery Co., Ltd., Sumitomo Heavy Industries, Sennebogen Maschinenfabrik GmbH, Favelle Favco Berhad, Manitex International, Inc., Broderson Manufacturing Corp., TIL Limited, Fassi Gru S.p.A. |