Pressure Pumping Market Key Insights:

To Get More Information on Pressure Pumping Market - Request Sample Report

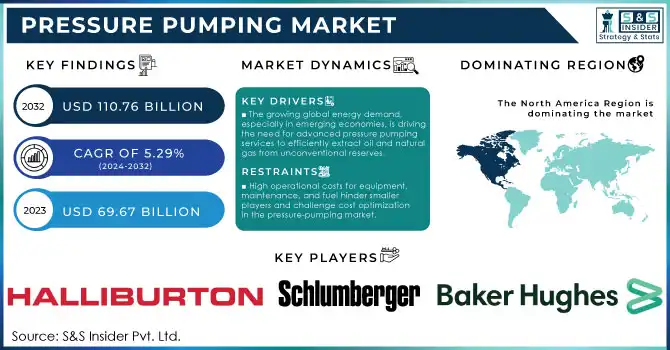

The Pressure Pumping Market Size was valued at USD 69.67 billion in 2023 and is projected to reach USD 110.76 billion by 2032 and develop at a CAGR of 5.29% over the forecast period 2024-2032.

The pressure pumping market plays a crucial role in the oil and gas industry, providing essential services for the extraction of hydrocarbons from wells. Pressure pumping refers to the use of high-pressure equipment to inject fluids into oil or gas wells to stimulate production. The primary techniques involved in pressure pumping include hydraulic fracturing (fracking) and cementing, both of which are pivotal for enhancing well productivity. Hydraulic fracturing is the most common method, wherein high-pressure fluid is pumped into underground rock formations to create fractures, allowing the oil or gas to flow more freely to the surface. This process has become particularly important with the rise of unconventional oil and gas production from shale deposits. The market has experienced significant growth, driven by the increasing demand for oil and gas, particularly from emerging economies. As exploration and production activities continue to expand, the need for efficient and cost-effective pressure pumping services has grown.

Pressure pumping is not limited to conventional oil and gas wells; it is also vital for the production of shale gas and tight oil, both of which require advanced fracking techniques. The rise of hydraulic fracturing in the past decade has transformed the energy landscape, particularly in North America, where the boom in shale oil production has significantly increased the demand for pressure-pumping services. The U.S. alone saw more than 1,000 rigs active in shale oil production during peak years. Additionally, the market is impacted by regulatory changes and environmental concerns, with a growing emphasis on sustainability and minimizing the environmental footprint of pressure-pumping activities. The development of greener technologies, such as waterless fracking, is expected to influence the future trajectory of the market.

| Feature | Description | Commercial Products |

|---|---|---|

| Security | Ensures data security with immutable transaction records and encryption methods. | IBM Blockchain for Aerospace, VeChain Aerospace Blockchain |

| Traceability | Provides detailed tracking of materials, components, and parts throughout the supply chain. | Blockchain in Aerospace Traceability System, Aeron Blockchain |

| Smart Contracts | Automates agreements and processes without intermediaries, ensuring efficiency and compliance. | Accenture Aerospace Smart Contracts, AEROSPACECHAIN |

| Cost Efficiency | Reduces costs by eliminating middlemen and automating processes such as payments and record-keeping. | LedgerX Blockchain Solutions, FULCRUM Blockchain |

| Supply Chain Optimization | Enhances transparency and efficiency in tracking and verifying components in the aerospace supply chain. | Boeing’s Blockchain Pilot, Honeywell Blockchain System |

| Data Integrity | Provides consistent and verified data in a decentralized ledger that prevents fraud or tampering. | AWS Blockchain for Aerospace, Lockheed Martin Blockchain |

| Operational Efficiency | Streamlines operational processes with blockchain-enabled systems to reduce downtime and improve response time. | T-Systems Aerospace Blockchain, Airbus Blockchain Integration |

| Regulatory Compliance | Facilitates adherence to industry regulations by recording every transaction and change in real-time. | Arianespace Blockchain System, Siemens Aerospace Blockchain |

| Interoperability | Ensures smooth integration between various platforms and technologies used in aerospace operations. | SAP Blockchain Integration, IBM Aerospace Blockchain |

| Transparency | Provides a transparent system for all stakeholders to view records and transactions in real time. | ConsenSys Blockchain for Aerospace, CloudSigma Aerospace Blockchain |

MARKET DYNAMICS

DRIVERS

- The growing global energy demand, especially in emerging economies, is driving the need for advanced pressure pumping services to efficiently extract oil and natural gas from unconventional reserves.

The rising demand for oil and gas, driven by increasing global energy consumption, is a key factor fueling the growth of the Pressure Pumping Market. As emerging economies like China, India, and others continue to industrialize, their energy needs are expanding rapidly, creating a significant demand for oil and gas. This demand is pushing exploration activities deeper into more complex and unconventional reserves, such as shale oil, tight oil, and deepwater fields. To extract these resources efficiently, advanced pressure pumping techniques, including hydraulic fracturing, are required. Pressure pumping services are essential in enhancing well productivity by injecting fluids at high pressure to fracture rock formations and stimulate production. This need for efficient extraction methods is more pronounced as conventional oil reserves deplete, pushing operators to seek innovative solutions for tapping into harder-to-reach resources. The International Energy Agency (IEA) has projected that global oil and gas consumption will continue to rise, especially in non-OECD countries, reinforcing the need for pressure pumping services. This ongoing shift towards more challenging extraction sites, coupled with the growing energy demand, directly correlates with the increasing use of pressure pumping technologies to maximize resource recovery and meet global energy needs.

- Technological advancements in hydraulic fracturing and horizontal drilling have boosted the demand for pressure pumping services by enabling efficient extraction from previously inaccessible oil and gas reserves.

Technological advancements in hydraulic fracturing (fracking) and horizontal drilling have played a pivotal role in the growth of the pressure pumping market. The development of these technologies has revolutionized the oil and gas industry by unlocking previously inaccessible reserves, especially in shale formations and deepwater fields. Hydraulic fracturing, combined with horizontal drilling, allows for more efficient extraction of oil and gas from unconventional resources, which requires high-pressure pumping systems to inject fluids into wells. This has significantly increased the demand for pressure pumping services, as they are essential for optimizing well productivity and ensuring efficient resource recovery. Fracking technology enables the extraction of natural gas and oil from tight rock formations, which was once considered economically unfeasible. In the U.S. the production of shale oil has surged, leading to an increase in pressure pumping activities. With improvements in fracking techniques such as multi-stage hydraulic fracturing, the efficiency of resource extraction has dramatically improved, thereby propelling the demand for specialized pressure pumping equipment. Furthermore, these advancements have allowed for the extension of well life and higher recovery rates, ensuring sustained production from mature fields, thus strengthening the need for ongoing pressure pumping services. The trend is expected to continue as exploration in unconventional fields expands.

RESTRAIN

- High operational costs, including significant investments in equipment, maintenance, and fuel, pose a barrier for smaller players and challenge operators in optimizing their cost structure in the pressure-pumping market.

High operational costs are a major factor influencing the growth of the pressure pumping market. Pressure pumping operations require substantial investments in specialized equipment, such as high-pressure pumps, blenders, and fluid mixing systems, along with ongoing maintenance to ensure reliability and efficiency. This initial capital expenditure, along with the ongoing costs of fuel, labor, and transportation, can be particularly challenging for smaller companies with limited financial resources. In fact, maintaining a fleet of pressure-pumping equipment can account for a significant portion of an operator’s budget, with costs for maintenance, repairs, and parts often reaching millions of dollars annually. These high costs can limit market entry for smaller players and create a competitive advantage for larger companies that can better absorb these financial burdens. Moreover, operational costs related to the handling and disposal of fracturing fluids and water management further add to the overall expense, particularly in environmentally sensitive areas where regulations are strict. As pressure pumping is critical for unconventional oil and gas extraction, managing these costs becomes crucial for profitability. Operators are thus under constant pressure to innovate and find more cost-effective solutions to improve efficiency, reduce downtime, and lower the total cost per well to remain competitive in the market.

KEY SEGMENTATION

By Service Type

The Hydraulic Fracturing segment dominated with the market share over 48% in 2023, driven by its critical role in oil and gas extraction from unconventional sources, particularly shale formations. Hydraulic fracturing, or fracking, involves injecting pressurized fluid into deep rock formations to create fractures, allowing oil and natural gas to flow more freely from the reservoir to the wellbore. This technique has revolutionized the energy industry, particularly in regions like North America, where shale gas and oil production has surged. As a result, hydraulic fracturing requires specialized pressure pumping equipment and services to manage the high-pressure fluid injection necessary for effective extraction. The growth of hydraulic fracturing is supported by increasing global energy demand and technological advancements that have improved the efficiency and safety of fracking operations.

By Well Type

Horizontal wells segment dominated with the market share of over 52% in 2023, particularly in shale gas and oil exploration. These wells are designed to access larger portions of the reservoir compared to vertical wells, significantly enhancing production rates. The ability to drill horizontally allows operators to tap into reservoirs that are otherwise difficult to reach with traditional methods. Horizontal wells offer a more efficient recovery method, maximizing output from a single wellbore. Although the initial drilling costs for horizontal wells can be higher, they are often more cost-effective over time due to their higher production capabilities. This combination of enhanced recovery and cost efficiency makes horizontal wells the preferred choice in modern exploration and production activities.

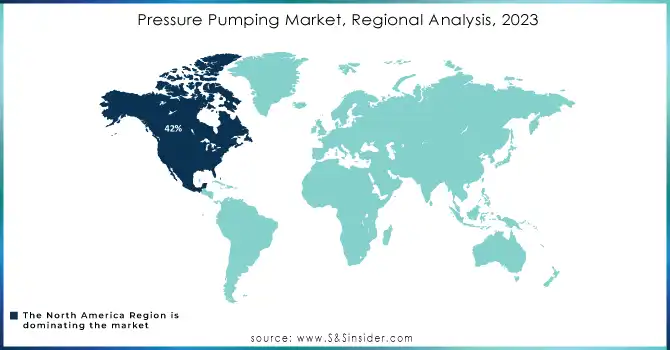

KEY REGIONAL ANALYSIS

In 2023, North America region dominated with the market share over 42% in 2023, primarily driven by abundant shale formations and significant reserves of oil and natural gas, especially in the United States. Hydraulic fracturing (fracking) has become a crucial method for extracting resources from major shale basins, fueling ongoing demand for pressure pumping services to improve extraction efficiency. Furthermore, partnerships and collaborations within the industry have played a key role in improving operational effectiveness, facilitating the sharing of resources, and driving technological advancements. These factors have contributed to North America's strong market presence and sustained growth in the pressure pumping sector.

Asia-Pacific has become the fastest-growing region in the pressure pumping market, driven by rapid industrialization and urbanization, particularly in China, India, and Southeast Asia. As energy consumption in these countries increases, there has been a surge in investments aimed at expanding oil and gas infrastructure. These investments often come with technology transfers, improving local capabilities and increasing the demand for pressure pumping services. The growing energy sector, coupled with continued infrastructure development, is creating a robust market for pressure pumping services in the region. As Asia-Pacific transitions to greater energy security and seeks to explore unconventional oil and gas reserves, demand for advanced extraction technologies, including pressure pumping, is expected to rise significantly in the forecast period.

Do You Need any Customization Research on Pressure Pumping Market - Inquire Now

Key Players

-

Baker Hughes (Hydraulic fracturing pumps, cementing pumps, coiled tubing pumps)

-

Schlumberger Limited (Frac pump units, Well stimulation equipment)

-

Halliburton (Frac pumps, cementing systems, acidizing equipment)

-

C&J Energy Services, Inc. (Pressure pumping services, hydraulic fracturing, cementing solutions)

-

Calfrac Energy Services Ltd. (Hydraulic fracturing, acidizing pumps)

-

Trican Well Service Ltd. (Pressure pumping, cementing equipment, acidizing systems)

-

Superior Energy Services, Inc. (Frac equipment, cementing services)

-

Liberty Oilfield Services (Hydraulic fracturing fleets, pressure pumping)

-

Nabors Industries Ltd. (Well services, pressure pumping)

-

ProPetro Holding Corp. (Frac services, cementing services)

-

Weatherford International (Cementing and stimulation services)

-

Nextier Oilfield Solutions (Hydraulic fracturing, wireline services)

-

National Oilwell Varco (NOV) (Frac pumps, pressure pumping units)

-

FTSI (Frac Tech Services International) (Hydraulic fracturing services)

-

Step Energy Services (Pressure pumping, coil tubing solutions)

-

RPC, Inc. (Acidizing, cementing, and hydraulic fracturing)

-

Weir Group (High-pressure frac pumps, flow control equipment)

-

BJ Energy Solutions (Frac fleets, natural gas-powered frac equipment)

-

GOES GmbH (Cementing and frac equipment)

-

Keane Group (Hydraulic fracturing, cementing services)

Suppliers for Renowned for high-pressure pumps and fluid management systems of Pressure Pumping Market

-

Gardner Denver Holdings, Inc.

-

Weir Group PLC

-

National Oilwell Varco (NOV)

-

GE Oil & Gas

-

Caterpillar Inc.

-

Flowserve Corporation

-

Aker Solutions

-

TechnipFMC

-

Forum Energy Technologies

-

SPX FLOW, Inc.

RECENT DEVELOPMENTS

-

In November 2024: Roto Pumps Ltd. unveiled its latest innovation, the Roto Cake Pumps, at IFAT 2024, held from October 16-18 at the Bombay Exhibition Centre, Mumbai. This launch highlights the company's commitment to high-efficiency solutions for the wastewater industry.

-

In April 2024: Xylem launched the Jabsco PureFlo 21 single-use pump, a revolutionary solution for the biotechnology and pharmaceutical industries. This pump introduces an adjustable, integrated pressure release valve—marking a first in single-use pumping technology enhancing operator safety and minimizing the risk of fluid contamination.

-

In October 2023: Watson-Marlow Fluid Technology Solutions (WMFTS) unveiled the versatile Bredel NR Transfer hose, expanding its range of hoses for Bredel hose pumps. Designed for general fluid transfer applications at pressures up to 12 bar (174 psi), the hose efficiently handles food and beverage waste, abrasive slurries, and high-solid-content sludge. This addition complements the existing Bredel NR Metering hose, which is engineered for more demanding tasks with a pressure capacity of up to 16 bar (232 psi).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 69.67 billion |

| Market Size by 2032 | USD 110.76 billion |

| CAGR | CAGR of 5.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Hydraulic Fracturing, Cementing, Others) • By Resource Type (Conventional, Unconventional) • By Well Type (Horizontal, Vertical, Directional) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Baker Hughes, Schlumberger Limited, Halliburton, C&J Energy Services, Inc., Calfrac Energy Services Ltd., Trican Well Service Ltd., Superior Energy Services, Inc., Liberty Oilfield Services, Nabors Industries Ltd., ProPetro Holding Corp., Weatherford International, Nextier Oilfield Solutions, National Oilwell Varco (NOV), FTSI (Frac Tech Services International), Step Energy Services, RPC, Inc., Weir Group, BJ Energy Solutions, GOES GmbH, Keane Group. |

| Key Drivers | • The growing global energy demand, especially in emerging economies, is driving the need for advanced pressure pumping services to efficiently extract oil and natural gas from unconventional reserves. • Technological advancements in hydraulic fracturing and horizontal drilling have boosted the demand for pressure pumping services by enabling efficient extraction from previously inaccessible oil and gas reserves. |

| RESTRAINTS | • High operational costs, including significant investments in equipment, maintenance, and fuel, pose a barrier for smaller players and challenge operators in optimizing their cost structure in the pressure pumping market. |