Crawler Dozers Market Report Scope & Overview:

To get more information on Crawler Dozers Market - Request Free Sample Report

The Crawler Dozers Market size was estimated at USD 7.82 billion in 2023 and is expected to reach USD 13.89 billion By 2032 at a CAGR of 6.59% during the forecast period of 2024-2032. This report offers details about the latest trends in the crawler dozers market, changes in real-time pricing, the impact of raw material price trends, and supply trends in the production of crawler dozers as well. This study examines technological advances such as autonomous control systems, GPS-based precision guidance, and new hybrid and electric powertrains designed for increased fuel efficiency and lower environmental footprint. It also offers competitive benchmarking of key players regarding their technological patents, innovation pipeline, and strategic expansion for creating and sustaining a data-driven margin of competitive edge for business in this highly dynamic market.

MARKET DYNAMICS

DRIVERS

-

Rising investments across the mining sector, specifically in developing economies, will fuel crawler dozer adoption for excavation, grading, and material handling applications.

The demand for crawler dozers has been driven particularly in developing economies by the rapid growth in the mining industry. These machines are a must for mining operations for anything from excavation and grading to material handling. Demand for heavy-duty, rugged equipment that can withstand the rigors of harsh mining conditions will rise especially as mining expands into higher metal content areas in high-growth markets like the Asia-Pacific region, Africa, and South America. Because of their improved traction, stability, and capacity to work in harsh environments, crawler dozers are best suited to the rugged and uneven terrain routinely encountered in mining locations. Digger trucks play a vital role in land clearing, surface mining, and transloading throughout large mining areas. Mining companies are increasingly spending on advanced machinery such as crawler dozers to meet the growing global demand for minerals, metals, and energy resources while raising productivity, efficiency, and safety in mining sites. The continuing growth of the mining industry provides the crawler dozer market with a sizeable opportunity.

RESTRAINT

-

The accessibility of crawler dozers is highly constrained due to the very first cost involved in their purchase steering the market focus towards rentals along with flexible financing schemes.

Crawler dozers are expensive to procure and at the same time cost prohibitive for small and medium-sized enterprises (SMEs). Designed to be tough, efficient, and very high-performance, these heavy-duty machines are expensive, due to their advanced engineering and rugged construction. The costs of purchasing a new crawler dozer, plus associated costs like shipping and insurance as well as financing, can break the bank for smaller companies. This financial obligation restricts market entry, forcing some companies to either use rental services or buy second-hand equipment rather than procure new machines. Cost is further driven up by the need to invest in operator training, maintenance facilities, and spare parts. The risk is compounded further for businesses who operate in those regions where the economic climate is uncertain or construction and mining activity is intermittent because those high-value investments in equipment are now at risk.

OPPORTUNITY

-

The increase in demand for eco-friendly construction equipment is driving hybrid & electric crawler dozer adoption to minimize emissions & operational costs.

Technological advances such as hybrid and electric crawler dozers, are being powerfully propelled to meet the rising demand for eco-friendly and fuel-efficient construction equipment. As environmental regulations tighten at a global scale coupled with rising awareness of carbon emissions, manufacturers are investing in alternative power solutions on commercial vehicles to cut down fuel consumption and sustainable operational costs. Hybrid crawler dozers utilize a diesel engine to power the machine and an electric component to fuel the internal drivetrain, increasing efficiency and cutting emission rates, whereas fully electric models are less reliant on fuel and can run much quieter, saving on maintenance too. This trend of innovation furthers sustainability objectives in the construction and mining industries and is likely to be appealing to businesses aiming for greener solutions. Battery technology and charging infrastructure are also improving the ability to operate electric dozers. This trend is also reinforced by governments driving the clean energy initiative and providing incentives for consumers to embrace green machinery. With industries focusing on sustainability, the hybrid and electric crawler dozer has a big potential for manufacturers to broaden their product range and meet changing market needs.

CHALLENGES

-

The economic slowdowns depress construction further and reduce mining investment, more projects are delayed and demand for new crawler dozers is lower.

Sectors like construction, mining, and infrastructure have less troop movement, and project pauses or cancellations cross during economic slowdowns as projects are financed and capital is tighter. Demand for heavy machinery which commonly includes crawler dozers may be affected directly if governments and private investors curb spending on major projects. Reduced industrial operations and falling commodity values in the mining sector work against sales of equipment. Moreover, the preference of some companies to buy used or rent crawler dozers instead of purchasing new ones, owing to budget constraints further restricts the growth of the global crawler dozers market. Uncertainties from the economy are sending raw material prices up and down changing the cost of manufacturing and the following pricing strategies for the manufacturers. In addition, leading financing problems and increasing interest rates make it difficult for firms to purchase heavy equipment, limiting growth in the market. This has forced manufacturers and suppliers to think differently, such as making their rental services or new financing options more flexible to continue generating demand, even with looming economic recessions.

MARKET SEGMENTATION

By Horsepower

The 300 - 600 HP segment accounted for more than 42% of the total market share in 2023. This power range is very much favored by industries such as construction, mining, and forestry when high-performance and versatility are required to perform a wide array of heavy-duty tasks. Machines in this class features perfect mixture of power, efficiency and versatility and can be used to tackle wide variety of demanding terrains and operations. With infrastructure development expanding in emerging economies, the demand for robust construction machinery that can manage massive operations is on the rise. The growing mining and forestry sectors also drive the demand for Crawler Dozers falling in the 300 - 600 HP category which are further fuelling the growth of this market.

By Application

The Construction segment dominated with a market share of over 32%, as these machines perform critical tasks for earthmoving and grading applications in multiple infrastructure projects. From land clearing and excavation to preparing sites for residential, commercial, and roadwork, crawler dozers are a must-have. With rapid Urbanization, especially in developing countries, there is an increasing requirement for large scale construction equipment. Higher spending by governments for infrastructure development and the swift urban expansion is driving the crawler dozers demand in the construction industry. In addition, the advantages of dozer, such as productivity and fuel efficiency, are making them a more appealing construction equipment technology globally, further solidifying the dominance of this segment.

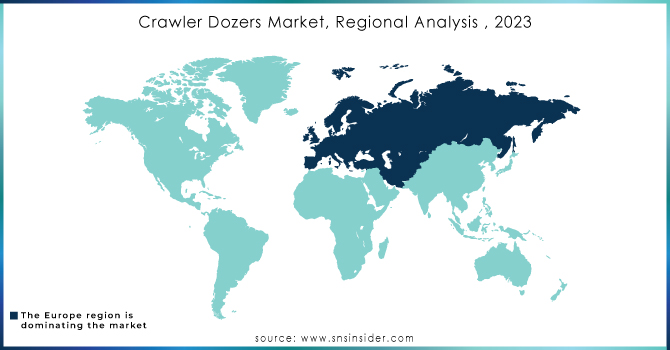

KEY REGIONAL ANALYSIS

North America region dominated with a market share of over 34% in 2023, primarily due to demand from construction, mining, and infrastructure markets in the U.S. and Canada. Crawler dozers are in demand as a result of requiring strong equipment for these construction projects, such as urbanization and roadbuilding project. The continuous market growth is also supported by the mining sector, with heavy equipment used for extraction and transport. One factor of urgency is also how advanced the region is adopting new technology with manufacturers streamlining automation, precision, and better fuel efficiency features into their products.

Asia-Pacific region which is projected to witness extensive growth. The nations including China, India, and the Southeast Asian regions are seeing an increase in demand for heavy tools due to the industrious increase of construction, mining, and industrial sectors. The rising demand of crawler dozers in the infrastructure sector for road construction, mining, and other big excavation tasks drives the market growth. Moreover, growing government expenditure on infrastructure, transport networks and industrialization is also propelling this demand. Given these aspects, APAC is anticipated to become the fastest growing global crawler dozer market, thus, an essential region for manufacturers and investors to focus on.

Need any customization research on Crawler Dozers Market - Enquiry Now

Some of the major key players of the Crawler Dozers Market

-

Caterpillar (CAT D10, CAT D6, CAT D8)

-

ChangZhou Joyous Machineries & Equipment Company Ltd. (JD-210, JD-160, JD-180)

-

China SINOMACH Heavy Industry Corporation (XCMG XE215, XCMG XE200)

-

CNH Industrial N.V. (Case 570N, New Holland C185)

-

Deere & Company (John Deere 850L, John Deere 950K)

-

Komatsu Ltd (Komatsu D65EX-18, Komatsu D155AX-8)

-

Liebherr-International Deutschland GmbH (PR 776, PR 734 Litronic)

-

LiuGong Dressta Machinery (Dressta TD-15M, Dressta TD-25)

-

Shandong Haitui Heavy Industry Machinery Co., Ltd (HT160, HT180)

-

Xuanhua Construction Machinery Co., Ltd (XH180, XH220)

-

JCB (JCB 457, JCB 540-170)

-

SANY (SANY SD22, SANY SD16)

-

Hitachi Construction Machinery (Hitachi ZW220, Hitachi ZW310)

-

Doosan Infracore (Doosan DX225, Doosan DX235)

-

Volvo Construction Equipment (Volvo EC950F, Volvo EC950F Crawler Dozer)

-

Hyundai Construction Equipment (Hyundai R220LC-9S, Hyundai R290LC-9S)

-

Terex Corporation (Terex TC175, Terex TXL220)

-

Fayat Group (Caterpillar 10M, Fayat BP 100)

-

Tata Hitachi (Tata Hitachi ZW100, Tata Hitachi ZW140)

-

Manitou Group (Manitou MLA 4, Manitou MI 10)

Suppliers for (Industry-leading technology, exceptional fuel efficiency, and long-lasting durability) on Crawler Dozers Market

-

Caterpillar Inc.

-

Komatsu Ltd.

-

Deere & Company

-

Liebherr-International Deutschland GmbH

-

CNH Industrial N.V.

-

Xuanhua Construction Machinery Co., Ltd.

-

Shandong Haitui Heavy Industry Machinery Co., Ltd.

-

LiuGong Dressta Machi006Eery

-

China SINOMACH Heavy Industry Corporation

-

ChangZhou Joyous Machineries & Equipment Company Ltd.

RECENT DEVELOPMENT

In September 2023: John Deere introduced its new QuikTrak mowers for 2024, establishing a new benchmark for commercial-grade stand-on mowers designed for professional landscape contractors.

In May 2023: Caterpillar announced that its D10 Crawler Dozer now delivers a 6% increase in efficiency. This is achieved through several advancements, including a 600-horsepower C27 diesel engine paired with a stator clutch torque divider. The D10’s operating weight is 154,700 pounds, and it features extended oil change intervals and integrated fuel lines for improved reliability. Key upgrades include a redesigned torque converter with a stator clutch, reducing fuel use by 4% and boosting productivity by 3% compared to the Cat D10T2.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 7.82 billion |

|

Market Size by 2032 |

USD 13.89 billion |

|

CAGR |

CAGR of 6.59% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Horsepower (Less than 300 HP, 300 - 600 HP, more than 600 HP) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Caterpillar, ChangZhou Joyous Machineries & Equipment Company Ltd, China SINOMACH Heavy Industry Corporation, CNH Industrial N.V., Deere & Company, Komatsu Ltd, Liebherr-International Deutschland GmbH, LiuGong Dressta Machinery, Shandong Haitui Heavy Industry Machinery Co., Ltd, Xuanhua Construction Machinery Co., Ltd, JCB, SANY, Hitachi Construction Machinery, Doosan Infracore, Volvo Construction Equipment, Hyundai Construction Equipment, Terex Corporation, Fayat Group, Tata Hitachi, Manitou Group. |