LIQUID HANDLING SYSTEM MARKET KEY INSIGHTS:

To Get More Information on Liquid Handling System Market - Request Sample Report

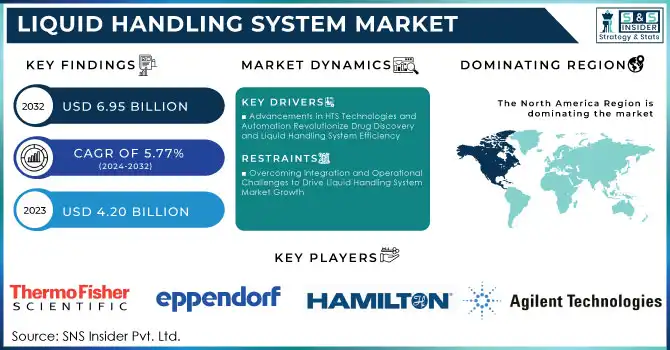

The Liquid Handling System Market size was valued at USD 4.20 billion in 2023 and is expected to reach USD 6.95 billion by 2032, growing at a CAGR of 5.77% over the forecast period 2024-2032.

The liquid handling system market is witnessing high growth due to rising automation in laboratories and R&D facilities. As the demands for accuracy, reproducibility, and efficiency increase across industries such as pharmaceuticals, biotechnology, and diagnostics, it has become a more crucial instrument in these fields. Such systems as pipettes, microplate washers, and robotic platforms provide efficient and accurate liquid handling methods needed in high-throughput settings minimizing errors introduced by operators and allowing for smooth workflows. In addition, the growing importance of genomic and proteomic research in tandem with the increased discovery of drugs and clinical diagnosis led to the demand for new liquid handling (LH) technologies. genomic plants showing a 15% rise in personnel cost reduction from the use of these systems. There are high-throughput systems, including an in-house developed PCR platform (Thermo Fisher), capable of generating around 6,000 samples/day. In early 2023, 36% of liquid handling systems were currently used in drug discovery and ADME-Tox research, and in 2020 biopharma invested USD 91 billion in drug discovery. This system is expected to be adopted by 40% of genomics labs by 2024, increasing from 28% in 2023.

One of the key reasons for that is the growing emphasis on personalized medicine and point-of-care testing, which necessitates accurate and scalable liquid handling solutions. Additionally, the integration of AI and ML in automated systems is contributing to the growth of the market as it helps in analyzing and optimizing the entire manufacturing process in real-time. High-throughput sample preparation and processing systems are a pressing necessity, especially with the onset of the COVID-19 pandemic, which has further fueled the demand for automated liquid handling devices. Also, rising investment in life sciences research and the increasing need for quality control in various industries continue to aid market growth. These trends are expected to still promote the market while prioritizing sustainable and consumer-friendly designs. in 2023, the pharma and biotech sectors funneled greater than USD 100 billion in life sciences R&D spend (and automation is growing annually by 9%.) As of 2023, around 40% of companies have their adapted energy-efficient liquid handling systems, due to sustainability demands. Finally, high-throughput automated systems are now employed by 45% of pharma and biotech labs, as compared to 30% in 2022.

MARKET DYNAMICS

KEY DRIVERS:

- Advancements in HTS Technologies and Automation Revolutionize Drug Discovery and Liquid Handling System Efficiency

The increasing use of HTS technologies for drug discovery and development is one of the major drivers for the growth of the liquid handling system market. With the timing of new therapies for pharmaceutical and biotechnology companies quickly on the line, the demand for systems to rapidly and accurately process thousands of samples has exploded. Liquid handling systems especially when integrated with a high degree of automation and advanced software are crucial components of HTS, allowing investigators to increase the efficiency of assay preparation, reagent dispensing, and sample management. Thanks to these technologies, traditional time and cost-consuming manual methods can be done more effectively ensuring reproducibility and accuracy making them integral in modern drug development pipelines. Automated systems have already increased throughputs to as many as 100,000 samples processed per day in 2023–2024 allowing pharmaceutical corporations to screen 1 million compounds in a fraction of the time that was needed beforehand. Integration of AI and machine learning is improving efficiency and decreasing the time required for sample preparation from 50% to twice while increasing accuracy. Robotic systems also have taken over, processing multiple assays at once (up to ~1,000 at the same time), increasing throughput.

- Rising Adoption of Liquid Handling Systems Drives Advancements in Synthetic Biology and Bioengineering Research

In addition, the rising use of liquid handling systems for synthetic biology and bioengineering is one of the major factors driving this market. These fields are growing out of their natural infancy and need better tools for DNA assembly, cell culture preparation, and enzyme optimization, among other things. Key for the accuracy of synthetic biology experiments, liquid handling systems aid in the mixing, transferring, and dispensing of biological samples at precise levels. In addition, the increasing use of lab-on-a-chip and microfluidic technologies, which typically rely on high-throughput liquid handling, is also supporting the growth of this market. It allows researchers to miniaturize, conserve resources, and maintain high precision across a wide range of applications, specifically academic research or industrial bioprocessing systems. The droplet microfluidics adoption in the synthetic biology domain has seen a jump of 40% in 2024 enabling screening of 10,000 – 100,000 cells/day (microfluidic chip) Microfluidic systems require a lower consumption of reagents, up to 90% lower than traditional methods, which increases their efficiency.

RESTRAIN:

- Overcoming Integration and Operational Challenges to Drive Liquid Handling System Market Growth

One of the main obstacles in the market for these systems is the difficulty of integrating these systems and the issues in their operation. A large proportion of automated systems demand integration into laboratory workflows, software, and instrumentation. Such complexity can result in incompatibilities and downtime, and the requirement for bespoke training poses an adoption challenge, especially to the smaller laboratory or if there is limited technical knowledge. Also, maintenance and calibration of these systems are crucial for accuracy which renders them difficult to operate. The more prominent challenges are contamination and cross-contamination, particularly in ultra-high accuracy applications like molecular diagnostics or NGS. The fidelity of liquid dispensing, handling, and thus experimental outcomes can be compromised by even small deviations from optimal conditions, which necessitates extensive quality control. These challenges need continuous innovation so that system reliability can be improved along with easy-to-use designs, which is immensely critical for sustaining liquid handling system market growth.

KEY SEGMENTATION ANALYSIS

BY PRODUCT

The drug discovery market held the largest share of 38% in 2023 due to the growing investments in R&D, especially within the biopharma segment. Growth was driven by the pharmaceutical sector's emphasis on novel therapeutics for chronic illnesses such as cancer, diabetes, and cardiovascular diseases. A rapidly growing trend for other personalized medicines, such as monoclonal antibodies and the complications of drug developments also are driving up its lucrative market share. The outsourcing of drug discovery processes has also emerged as a major trend as it aids companies in cutting costs and improving efficiencies, which is expected to continue to drive the market in the future.

The cancer and genomics research markets are expected to observe the most rapid growth with quite a high compound annual growth rate (CAGR) from the year 2024 to 2032. This acceleration is due to multiple factors. Firstly, the ongoing developments in genomics technologies, including gene sequencing as well as CRISPR, are making way for much more precise and targeted therapies, especially in the field of oncology. Global rise in the frequency of genetic disorders and cancers along with the growth of personalized medicine will further boost the genomics market in research, as personalized medicine approaches are becoming more viable and effective in the area of cancer. Innovation is expected to be stimulated in part by government funding from organizations like the National Institutes of Health (NIH) as well as increasing private sector investments in genomic startups. Moreover, the use of genomics in the early detection of disease and treatment will remain an important contributor to market growth.

REGIONAL ANALYSIS

North America accounted for the largest market share of 44% in 2023 owing to a well-established pharmaceutical and biotechnology industry, highly developed healthcare infrastructure, and increasing private, as well as public expenditure on R&D. In North America, pharmaceutical giants Pfizer, Johnson & Johnson and AbbVie continue pouring funds, both in terms of R&D (research & development) and capital, into drug discovery (including personalized medicine and sophisticated oncology treatments). Additionally, the presence of ongoing government support for advanced research and trials through funding sources such as the National Institutes of Health (NIH) which allocates billions of dollars on an annual basis for health-related research also benefits the region. Pfizer's experience with the COVID-19 vaccine and its late-phase oncology assets exemplify the strength of North America as a torchbearer of global health innovation.

Europe, which is in second place behind North America, is projected for the highest compound annual growth over the next decade (2024-2032). This expansion is propelled by a rising interest in personalized medicine, improvements in genomics, and high levels of public and private funding. One particularly noteworthy real-world example from Europe right now is the UK AstraZeneca which is focusing on a big push in oncology and respiratory disease, as well as the collaborations to make the COVID-19 vaccine. BioNTech of Germany, which had originally pursued cancer immunotherapies, was another major player in the development of the COVID-19 vaccine, highlighting an increasing European contribution to biotechnological innovation. European research collaborations, like the Horizon Europe program, also offer funding for innovative research and could accelerate the region's growth in genomics and drug discovery.

Do You Need any Customization Research on Liquid Handling System Market - Inquire Now

Key Players

Some of the major players in the Liquid Handling System Market are:

-

Thermo Fisher Scientific (E1-ClipTip Electronic Pipette, Multidrop Combi Reagent Dispenser)

-

Eppendorf AG (epMotion 5075, Reference 2 Pipette)

-

Hamilton Company (Microlab STAR, Nimbus)

-

Tecan Group (Fluent, Freedom EVO)

-

PerkinElmer (Janus G3, Sciclone G3)

-

Agilent Technologies (Bravo Automated Liquid Handling Platform, VWorks Automation Software)

-

Beckman Coulter (Biomek i5, Biomek 4000)

-

Gilson (PIPETMAN, TRACKMAN Connected)

-

Sartorius (Picus Pipette, Tacta Pipette)

-

Integra Biosciences (VOYAGER Adjustable Tip Spacing Pipette, VIAFLO Pipette)

-

Corning Incorporated (Lambda EliteTouch Pipettor, Corning LSET Liquid Handler)

-

Hudson Robotics (Micro10x, SOLO Automated Pipettor)

-

Labcyte (Echo 525, Echo 655)

-

Analytik Jena (CyBio FeliX, CyBio Well Vario)

-

BioTek Instruments (MultiFlo FX, EL406 Washer Dispenser)

-

Formulatrix (Mantis, Tempest)

-

Andrew Alliance (A Waters Company) (Andrew+, OneLab Software)

-

Aurora Biomed (VERSA 1100, VERSA 10)

-

Fluidigm Corporation (Juno System, Biomark HD)

-

Opentrons (OT-2, OT-3)

Some of the Raw Material Suppliers for Liquid Handling System Companies:

-

3M

-

DuPont

-

BASF SE

-

Evonik Industries

-

Sabic

-

Solvay

-

Dow Chemical Company

-

Toray Industries

-

Mitsubishi Chemical Corporation

-

Covestro AG

RECENT TRENDS

-

In January 2024, Eppendorf launched the revised Enhanced Feature Set GxP software extension for its epMotion automated liquid handlers. This update enhances compliance, efficiency, and data security in regulated laboratory settings.

-

In May 2024, Hamilton introduces the ZEUS X1, an automated pipette offering precision liquid handling and easy maintenance with replaceable heads and advanced monitoring. It's designed for seamless OEM integration.

-

In February 2024, FORMULATRIX launched Volume 4 of its MANTIS automated liquid dispenser, designed for accurate low-volume dispensing in scientific workflows. The system enhances reproducibility, quality, and laboratory efficiency at an affordable price.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.20 billion |

| Market Size by 2032 | USD 6.95 Billion |

| CAGR | CAGR of 5.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Manual, Electronic, Automated) • By Product (Pipettes, Manual Pipettes, Electronic Pipettes, Dispensers, Burettes, Automated Workstation, Microplate Readers, Consumables, Others) • By Application (Drug Discovery, Clinical Diagnostics, Cancer and Genomics Research, Others) • By End Use (Diagnostic Centers, Research and Academic Institutes, Pharmaceutical & Biotechnology Industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Eppendorf AG, Hamilton Company, Tecan Group, PerkinElmer, Agilent Technologies, Beckman Coulter, Gilson, Sartorius, Integra Biosciences, Corning Incorporated, Hudson Robotics, Labcyte, Analytik Jena, BioTek Instruments, Formulatrix, Andrew Alliance (A Waters Company), Aurora Biomed, Fluidigm Corporation, Opentrons. |

| Key Drivers | •The rising global incidents of vehicle theft are driving demand for advanced car alarm systems as consumers seek more reliable solutions to secure their vehicles. |

| RESTRAINTS | • Overcoming Integration and Operational Challenges to Drive Liquid Handling System Market Growth |