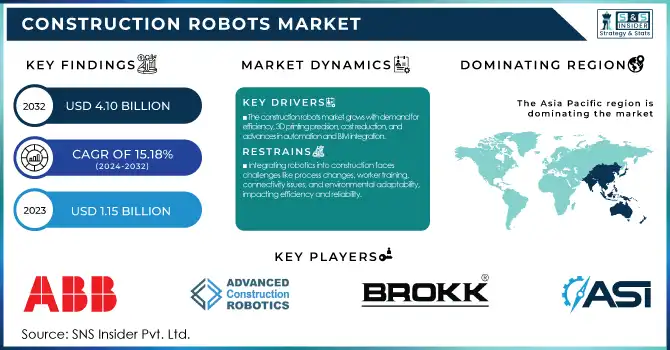

Construction Robots Market Size:

The Construction Robots Market size was valued at USD 1.15 billion in 2023. It is expected to grow to USD 4.10 billion by 2032 and grow at a CAGR of 15.18% over the forecast period of 2024-2032.

To get more information on Construction Robots Market - Request Free Sample Report

The construction robots market is experiencing rapid growth as the industry embraces automation to address challenges such as labor shortages, rising costs, and the demand for faster project completion. These robots are transforming traditional construction processes by enhancing precision, efficiency, and safety. They include a range of robotic solutions, such as bricklaying robots, demolition robots, 3D printing robots, and drones for surveying and inspection. The integration of advanced technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT) further elevates their functionality, enabling real-time monitoring and predictive maintenance. Key trends shaping the market include the increasing adoption of autonomous and semi-autonomous robots, driven by advancements in AI and robotics. Demolition robots are gaining traction for their ability to safely perform hazardous tasks, while 3D printing robots are revolutionizing the way buildings and infrastructure are constructed, offering reduced material waste and quicker build times. Moreover, the use of drones for aerial mapping and site inspections is becoming standard practice, improving project accuracy and efficiency.

The industry is also witnessing significant investments in research and development to improve robot capabilities and expand their application scope. For example, robots are now being designed to handle complex tasks such as tunnelling and large-scale modular construction. According to research, the adoption of robotics in construction has the potential to reduce construction costs by up to 20%, while increasing productivity by approximately 30%.

Construction Robots Market Dynamics

DRIVERS

-

The construction robots market is driven by the need for enhanced efficiency, with robots offering continuous operation, precision in tasks like 3D printing, and reduced costs, supported by advancements in automation, BIM integration, and sustainability-focused trends.

The demand for enhanced efficiency and productivity is a significant driver in the construction robot’s market. Unlike human workers, construction robots can operate continuously without fatigue, ensuring consistent performance, higher productivity, and faster project completion. These robots excel in precision-intensive tasks such as bricklaying, demolition, and 3D printing, minimizing material waste and significantly reducing overall project costs.

The market is witnessing robust growth due to advancements in automation technologies and the rising adoption of robotics to address labor shortages and cost pressures. Trends such as integrating robots with Building Information Modeling (BIM) systems and deploying autonomous equipment for hazardous tasks are gaining traction. Additionally, the increasing focus on sustainable construction practices and smart infrastructure projects further accelerates the adoption of these technologies. With continuous innovation, construction robots are set to redefine traditional construction workflows, ensuring efficiency, safety, and sustainability.

RESTRAINT

-

Integrating robotics into construction faces challenges like process changes, worker training, connectivity issues, and environmental adaptability, impacting efficiency and reliability.

Integrating robotics into traditional construction workflows poses significant technical challenges and complexities. These technologies often require reengineering established processes, demanding substantial adjustments in planning, execution, and coordination. Additionally, workers need specialized training to operate, maintain, and troubleshoot robotic systems, which can lead to initial inefficiencies and increased costs.

Connectivity and calibration issues further hinder seamless operations, especially in large-scale or remote projects where stable networks are unavailable. Environmental adaptability is another critical concern, as construction sites often feature uneven terrains, dust, and extreme weather conditions that can impair robot performance. Such challenges can result in downtime, increased maintenance needs, and reduced productivity, limiting the full potential of robotic systems in construction. Overcoming these barriers requires robust engineering, innovative design, and the integration of advanced technologies like AI and IoT to ensure reliability and efficiency in diverse operational environments.

Construction Robots Market Segmentation

By Function

The material handling segment dominated with the market share over 34% in 2023, driven by the increasing need to automate tasks like transporting materials and equipment. Automation plays a crucial role in enhancing operational efficiency by reducing human intervention, which in turn accelerates project timelines and optimizes resource allocation. By incorporating automated systems like cranes, conveyors, and robotic machines, the handling of heavy or bulky materials becomes more precise and streamlined. This not only improves productivity but also reduces the likelihood of errors and delays caused by manual labor. Additionally, automation significantly boosts safety by minimizing worker exposure to hazardous tasks, such as lifting heavy objects or working in risky environments.

By Type

The Robotic Arm segment dominated with the market share over 68% in 2023, due to its exceptional versatility and efficiency in executing a wide range of construction tasks. Robotic arms are highly adaptable, capable of performing repetitive, precise, and labor-intensive activities such as material handling, welding, painting, and assembly, making them invaluable in modern construction processes. Their ability to work in hazardous or challenging environments, where human workers might be at risk, further boosts their demand. Additionally, robotic arms reduce the need for manual labor, leading to improved productivity and cost-effectiveness. The growing trend toward automation in construction, driven by the need for faster project completion and reduced labor costs, has solidified the robotic arm's role as a key player.

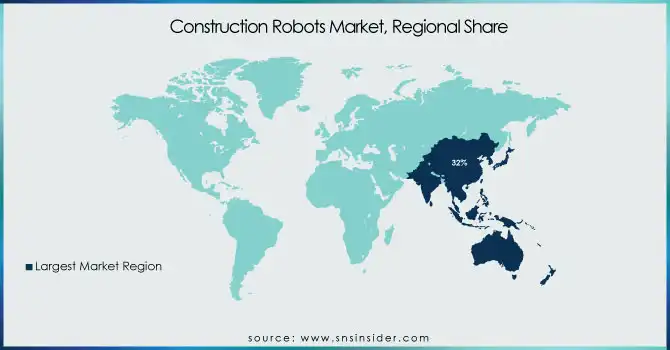

Construction Robots Market Regional Analysis

Asia-Pacific region dominated with the market share over 32% in 2023, driven by the rapid adoption of advanced construction technologies in countries such as Japan, China, and South Korea. These nations have been at the forefront of integrating robotics and automation into the construction industry to improve efficiency, reduce costs, and address growing labor shortages. Japan, for instance, has long been a leader in robotics, with its emphasis on innovation and smart technology. China and South Korea have also heavily invested in construction automation, seeing it as a solution to increasing urbanization and the need for high-speed infrastructure development. Governments and private sectors in the region have supported research and development in construction robotics, enabling the widespread use of robots for tasks such as bricklaying, painting, and inspection.

North America is witnessing rapid growth in the construction robots’ market, driven by several key factors. Technological advancements, including the development of sophisticated robotics, are enhancing the capabilities of construction robots, making them more efficient and reliable. There is a rising demand for labor-saving solutions as the construction industry faces labor shortages and increased pressure to complete projects faster. Construction robots help address these challenges by automating repetitive and hazardous tasks, such as bricklaying, welding, and site inspection. The focus on improving safety and productivity is also a major driver, as robots reduce human exposure to dangerous conditions and improve the overall efficiency of construction processes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Construction Robots Market

-

Construction Robotics LLC (robotic solutions for construction tasks)

-

ABB Ltd. (industrial robots and robotic arms)

-

Advanced Construction Robotics, Inc. (autonomous robotic equipment for productivity improvement)

-

Brokk AB (remote-controlled demolition robots)

-

Ekso Bionics Holdings, Inc. (wearable exoskeletons for construction workers)

-

Autonomous Solutions Inc. (autonomous vehicle technology for construction machinery)

-

MX3D (robotic 3D printing for metal structures)

-

Husqvarna AB (demolition and drilling robots)

-

FBR Ltd. (Hadrian X bricklaying robot)

-

Conjet AB (hydrodemolition robots for concrete removal)

-

Fanuc Corporation (industrial robots for construction applications)

-

KUKA AG (automation and industrial robots)

-

Yaskawa Electric Corporation (industrial robots for automation)

-

Caterpillar Inc. (autonomous construction equipment)

-

Komatsu Ltd. (autonomous vehicles and robotic arms)

-

Boston Dynamics (robots for site inspection and material transportation)

-

Built Robotics Inc. (autonomous construction equipment conversions)

-

CyBe Construction (3D concrete printing robots)

-

Blueprint Robotics Inc. (robotic systems for prefabricated building construction)

-

Shimizu Corporation (construction robots for welding and assembly).

Suppliers for (creating versatile robots like Atlas and Spot, which assist in tasks such as site inspection, demolition, and material handling) on Construction Robots Market

-

Construction Robotics

-

Boston Dynamics

-

Fastbrick Robotics

-

Advanced Construction Robotics

-

Ekso Bionics

-

nLink

-

Apis Cor

-

FBR Ltd.

-

Dusty Robotics

-

Komatsu

RECENT DEVELOPMENT

In March 2023: FBR Ltd. entered into a strategic agreement with M&G Investment Management, a UK-based shareholder, to finance the production and deployment of three additional next-generation Hadrian X robots in the United States. These robots will be built on truck bases in the U.S. and deployed through the Perth firm's FastbrickAmericas joint venture, offering 'Wall as a Service' bricklaying solutions.

In January 2023: Husqvarna Construction teamed up with AABTools, a prominent industrial tools and equipment supplier in the region. AABTools was entrusted with distributing a variety of Husqvarna Construction's products, including high-frequency concrete coring machines, wall saws for brick and reinforced concrete, remote-controlled demolition robots, and more than twenty models of handheld power cutters, dust extractors, and floor saws.

In July 2023: Ekso Bionics, a leader in exoskeleton technology for both medical and commercial applications, acquired Parker Hannifin's Human Motion and Control Business Unit. This acquisition includes the Indego lower limb exoskeleton line and aims to develop orthotic and prosthetic devices with robotic assistance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.15 billion |

| Market Size by 2032 | USD 4.10 billion |

| CAGR | CAGR of 15.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (Demolition, Bricklaying, Material Handling, Others) • By Type (Traditional Robot, Robotic Arm, Exoskeleton) • By End-use (Industrial, Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Construction Robotics LLC, ABB Ltd., Advanced Construction Robotics, Inc., Brokk AB, Ekso Bionics Holdings, Inc., Autonomous Solutions Inc., MX3D, Husqvarna AB, FBR Ltd., Conjet AB, Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Caterpillar Inc., Komatsu Ltd., Boston Dynamics, Built Robotics Inc., CyBe Construction, Blueprint Robotics Inc., Shimizu Corporation. |

| Key Drivers | • The construction robots’ market is driven by the need for enhanced efficiency, with robots offering continuous operation, precision in tasks like 3D printing, and reduced costs, supported by advancements in automation, BIM integration, and sustainability-focused trends. |

| Restraints | • Integrating robotics into construction faces challenges like process changes, worker training, connectivity issues, and environmental adaptability, impacting efficiency and reliability. |