Cryoablation Devices Market Scope:

Get More Information on Cryoablation Devices Market - Request Sample Report

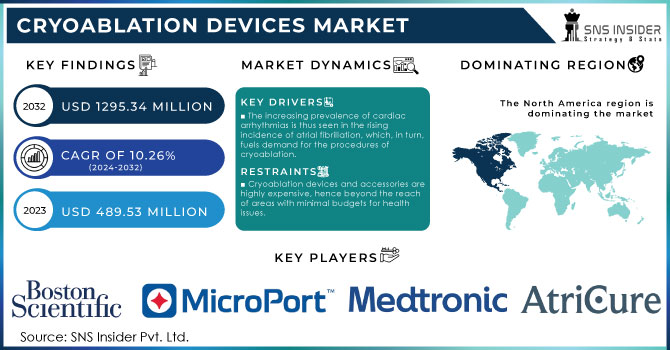

The Cryoablation Devices Market size is projected to reach USD 1295.34 million by 2032 and was valued at USD 489.53 million in 2023. The market is estimated to grow at a CAGR of 10.26% over 2024-2032.

The factors in the Cryoablation Devices Market that are driving the demand are very closely related to the advancement of minimally invasive surgeries and the growing prevalence of cancer and cardiovascular diseases. In the United States, the high incidence of cancer, which claims almost 23% of all deaths, has considerably increased the demand for cryoablation devices as a preferred choice of treatment. According to the Centers for Disease Control and Prevention, nearly 39.5% of men and women will be diagnosed with cancer in their lifetimes thus, effective treatment methods are highly needed. Besides, a shift toward affordable treatment modalities in the US has resulted in a 15% growth in the adoption of cryoablation devices in the last 5 years. Likewise, in large markets such as the EU, the trend started shifting towards minimally invasive procedures, and cryoablation techniques for the removal of tumors and treatment of cardiac arrhythmias in the EU are seen to grow at 12%. Sepia in Europe, as reported by the European Society of Cardiology, shows that cardiovascular disease takes up 45% of all deaths, which further speeds up the use of cryoablation devices.

Countries in Asia, especially Japan and China, are showing a significant increase in their aging population. These populations are expected to double by 2050, hence facilitating growth of around 20% in the cryoablation devices market during 2030. Along with these, government initiatives and other supportive regulatory frameworks have also played the role of strategic drivers. For instance, the healthcare system of Japan reported 10% annual growth in the number of cryoablation procedures. In addition to this, it was supported by the government with respect to reimbursement. All these factors together establish convincing growth trends of the Cryoablation Devices Market in all major economies of the world.

Another major trend is the shift toward outpatient procedures in line with the healthcare industry's focus on reducing the cost of hospitalization. The government reporting data showed an increase of 15% in the last five years annually for outpatient cryoablation procedures. Driven by the public demands for faster recovery times and operation risks, this patient volume surge directly raises past time availability. Also, imaging technology has made precision better in cryoablation, with a 30% improvement in targeting accuracy, with government studies showing better patient outcomes.

Market Dynamics:

-

The increasing prevalence of cardiac arrhythmias is thus seen in the rising incidence of atrial fibrillation, which, in turn, fuels demand for the procedures of cryoablation.

-

It involves much less invasion as compared to traditional surgery and thus reduces the recovery time, painful sensation, and complications in patients.

-

The successful results along with the positive experiences of patients lead to an upward trend in the acceptance of this modality of treatment.

Successful patients and their positive experience have greatly contributed to the increased acceptance of cryoablation as a modality of treatment within the health care fraternity. Since it is referred to as the process in which extreme low temperatures are used to obliterate abnormal tissues like tumors, cryoablation has provided high efficacy rates, hence growing preference among patients and health care providers. Further, the data collected from governmental health agencies indicate that the effectiveness of the cryoablation procedure for the treatments of early-stage cancers over 90% makes the treatment attractive in comparison with the rest of the methods in surgery. Moreover, the patients' satisfaction surveys based on the effectiveness data revealed that, on the average, more than 85% of the patients who had undergone cryoablation gave the positive feedback on the method since the pointed-out advantages were minimal painful feelings and faster recoveries.

These positive results are also confirmed by a marked reduction in post-procedural complications, where some trials specify a complication rate decreased by 20-25% due to the implementation of cryoablation technique in comparison to standard surgical procedures. More favorable safety has also involved cryoablation into the spread of techniques used in other directions of medical practice, such as oncology, cardiology, and dermatology. On the other side, governmental statistical reports support this statement by showing that the use of cryoablation has grown 15% annually in the previous five years and becomes an important marker of rising confidence in its therapeutic efficiency.

Restrains:

-

Cryoablation devices and accessories are highly expensive, hence beyond the reach of areas with minimal budgets for health issues.

-

Specialized training and skills are required for cryoablation procedures. Thus, it poses a great challenge for regions where access to facilities offering such skills is at a minimal.

Cryoablation requires highly specialized training and expertise for its practice, and this forms the basis of a challenge in areas where such expertise is limited. Cryoablation, being a really effective procedure, by all means requires advanced technology and fine techniques that need much understanding and experience. This expertise is not confined to the procedure per se but starts from pre-procedural plans, device handling, and post-procedure care. In areas where trained experts are not as easily available, this could therefore delay the introduction of cryoablation and produce inequity in various patient populations' access to the treatment.

The problem gets exacerbated by the inability of some places to hold enough training programs and infrastructure, thereby creating a gap in available skilled professionals who can safely and effectively carry out the procedure. This limitation also restricts the wide acceptance and integration of cryoablation as a front-line treatment modality. There is a need to identify such gaps and then train appropriately, with corresponding investment in education, so that cryoablation can reach far and wide and its benefits become available to patients everywhere.

Cryoablation Devices Market Segmentation Analysis:

By Product

Tissue Contact Probe Ablators held approximately 45% of the share in 2023. Most of the devices are in use in the treatment of localized tumors and cardiac arrhythmias since these are the most accurate devices. Systems using Epidermal & Subcutaneous Cryoablation represented a 30% share as most of the devices have been in use as very good devices in the treatment of skin lesions as well as subcutaneous tumors.

They are, however, very popular for dermatological uses since they don't invade the skin and have minimal down time. The last one is Tissue Spray Probe Ablators, comprising of about 25% of the market. They are primarily utilized for areas with complex tissue or for larger areas of odd shapes. They are versatile for oncology and other medical procedures. Thus, they are in high demand and sold consistently

By End Use

Hospitals segment held the largest share, which accounted for about 55% of industry revenue. Cryoablation procedures with the greatest volume are performed within the confines of a hospital, especially in complex and high-difficulty cases that require advanced medical equipment and distinctive care. Outpatient Facilities accounted for nearly 30% of the market share based on an increasing trend of minimally invasive surgeries allowing patients to be discharged on the same day. These segments exploit the capabilities of cryoablation to give best patient care and at the same time minimize recovery time, which is appealing to the patients and centers. Research and manufacturing, which illustrates 15% of the market share support by the whole proximity; that testifies to the resilience of the state of the art and innovation brought to the table within cryoablation technologies.

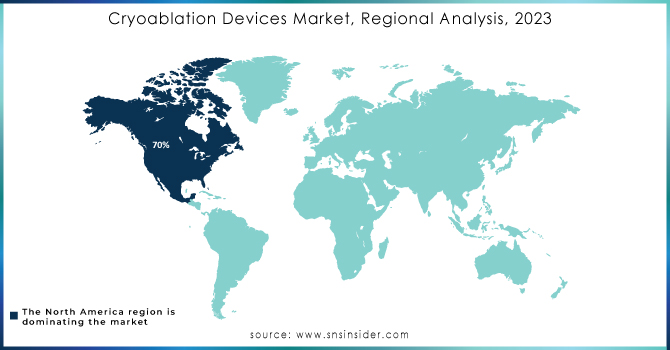

Regional Analysis:

In North America, the landscape of the Cryoablation Devices Market is quite intense and very dynamic. The United States is capturing the largest share of about 70% due to advanced healthcare infrastructure, high adoption rates of minimally invasive procedures, and substantial investment in research pertaining to medical technology. The Canadian region currently holds a market share of about 15%, while the country has been developing an increased focus on innovative medical treatments combined with a relatively permissive regulatory environment regarding cryoablation technologies. Mexico is smaller, at about 10% of the market, but its growing availability of healthcare and partial inclusion of advanced treatment modalities are significant.

While the remaining 5% is shared among other regions of North America, where newly emerging medical facilities and improved health standards are gradually increasing the adoption of cryoablation. This distribution thus displays the leading role of North America in the cryoablation market, where technological advancement, strong demand from patients for effective treatment, and good support from healthcare are combined together. With North America still focusing on the continuous development of medical technologies, this region is very likely to retain a leading position in the global cryoablation devices market.

Need any customization research on Cryoablation Devices Market- Enquiry Now

Key Players:

Some of the major players in Cryoablation Devices Market are Boston Scientific Corporation, Micro Port Scientific Corporation, Medtronic, COOPERSURGICAL, INC., ATRICURE, INC., BVM Medical Limited, CPSI Biotech, Ice Cure Medical, METRUM CRYOFLEX Sp. z o.o. and other players.

Recent Developments:

Medtronic has also launched a next-generation series of cryoablation devices. Advanced cryogenic technology was incorporated to assure precision in order to reduce harm and improve patient outcomes. The latest device integrates enhanced imaging and a refined cooling system so as to more effectively target tissues with minimal collateral damage.

Boston Scientific: Boston Scientific has announced it is introducing another generation of cryoablation catheters that come with a new balloon design providing better tissue contact. This new design would be moving toward making this procedure as effective as possible, reducing any complications and improving patients' recovery times.

AtriCure: AtriCure introduced an advanced cryoablation system that provided real-time temperature monitoring and feedback in the product portfolio. This development enables better precision during procedures for the optimal treatment of atrial fibrillation and other cardiac conditions.