Data Center Rack Market Report Scope & Overview:

Get more information on Data Center Rack Market - Request Free Sample Report

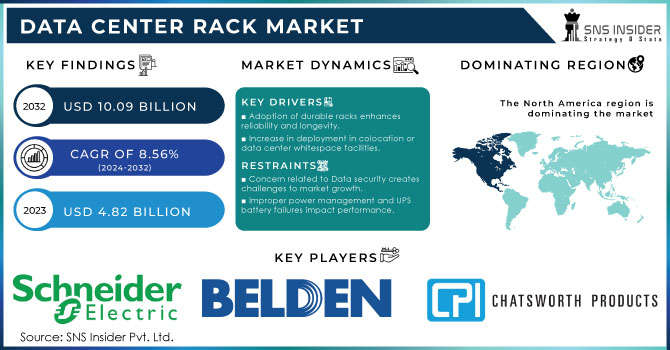

The Data Center Rack Market Size was valued at USD 4.46 Billion in 2023 and is expected to reach USD 9.17 Billion by 2032 and grow at a CAGR of 8.34% over the forecast period 2024-2032.

With the rapid growth of digital technologies and solutions, the requirement for efficient IT infrastructure is also on the rise, which is largely driving the data center rack market. The growth of Cloud Computing, Big Data, & IoT has resulted in several users opting for cloud computing and big data analytics is driving the global data center chassis market, as cloud computing, big data analytics, and IoT need scalable & high-performance data centers. Whether it is table staking or servicing a gaming machine digital transformation has stepped into organizations across industries and businesses of all scales which demands digital infrastructures with advanced data center facilities and reliable racks that assemble servers, routing equipment, and IT components. Additionally, the rising proliferation of edge computing to reduce latency and enhance real-time data processing is a key element propelling the product investment trend towards compact, modular racks, especially for edge data centers. The North America data center supply under construction increased 70% quarterly with a total of 3.9 gigawatts. In North America, vacancy rates for data centers plunged to an unprecedented 2.8%, and the rents soared by 15-20%. Edge data center demand grew 30% fueled by edge computing and 40-50% of new racks were intended for higher density servers to improve space and power efficiency.

Additional growth factors include the increase in 5G network deployment and the increasing expansion of hyperscale data centers by technology and cloud service giants. With more businesses turning to AI, ML, and HPC, high-density racks that support advanced hardware are in demand. Moreover, the increased emphasis on energy efficiency and sustainability within data centers has resulted in new rack designs that utilize power and cooling more efficiently. Together with the rising IT spending and the growing demand for colocation services, these trends are fuelling the data center rack market. As of mid-2024, there were 316 commercial 5G networks in service worldwide, and in North America, the number of 5G networks is approaching that of 4G LTE at this current point in technology cycles. AI-ready data center capacity demand is expected to increase 33% per annum between 2023 and 2030, with 70% of data center capacity supporting complex AI workloads by 2030.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Data Localization Regulations and Cybersecurity Threats Fuel Demand for Advanced Scalable Data Center Racks

The global rise in data localization regulations is one of the most crucial aspects driving the data center rack market. To guarantee businesses keep information close to home, stricter laws are being passed in nations around the globe. This trend has forced organizations to create or scale local data centers that in turn are further creating the requirement for data center racks. These regulations are especially impacted by certain industries that handle sensitive data such as BFSI, healthcare, and government. Businesses are investing in racks to scale up and have scalable IT infrastructure rack that meets data privacy requirements and improves data security. Moreover, the rising data localization mandates are paired with the rising trend of cyber-attacks due to which organizations are adopting advanced racks which can be integrated with monitoring systems and access control and are expected to propel the market growth over the forecast period. In 2024, 75% of the population of the world will be reached by privacy laws and new 100 data localization laws in 40 countries. Average attacks per organization were up 75% in Q3, 2024 (1,876 attacks per organization). These regulations heavily impact industries such as BFSI, healthcare, and government, thereby fuelling the need for advanced and scalable data center racks to meet data privacy and security mandates.

-

Modular and Prefabricated Data Centers Drive Rapid Deployment Scalability and Efficiency for SMEs and Industries

One of the most pivotal trends is the expanding popularity of modular and prefabricated data centers, which has fundamentally changed the IT infrastructure deployment game. Such modular solutions are inexpensive, scalable, and quicker to deploy than traditional data centers and are therefore very appealing to small and mid-sized enterprises (SMEs). Many prefabricated data centers include racks that are already optimized for space and cooling. This also highlights the growth of demand for these solutions across industries, such as retail, energy, and utilities, where businesses require a quick set-up to adapt to the changing data requirements. Moreover, with enterprises beefing up on initiatives for lowering operational costs, modular racks that support hot-swappable components along with flexible configurations are also witnessing a sale. The rising demand for edge computing is also compounding this trend, as a new, smaller generation of modular data centers and racks is necessary to fulfill local processing requirements. These aforementioned factors when combined help modular racks to be a key driver for the growth of the market. Modular data centers can be set up in 6 to 8 weeks, much quicker compared to traditional data centers deployed in more than a few months in 2024. Due to their ability to scale and be deployed quickly, SMEs now represent 45% of the demand for these solutions. 60% of prefabricated modular data centers come equipped with rack optimization, by ensuring racks are suitable for energy-efficient usage with support for space and cooling. The increasing demand for adaptive IT infrastructure is reflected in the 40% growth over the last year in the adoption of its services in sectors including retail, energy and utilities.

RESTRAIN:

-

Overcoming Challenges of Thermal Efficiency Scalability and Customization in the Evolving Data Center Rack Market

In the data center rack market, a major challenge is the increasing complexity of thermal & energy efficiency. Fitting more into a space is a developmental aim of data centers but with this high density, controlling heat dissipation is difficult. This is because poor cooling may cause equipment failures, shorten their lifespan, and lead to excessive powering down. As a result, organizations have been forced to procure high-end cooling technologies that do not always perfectly blend in with the existing racks resulting in operational hardships. The most important challenge is the requirement for effortless scalability and personalization. As IT infrastructure and technology are evolving at a fast pace, organizations are looking for racks that provide for future requirements like support of higher densities or hardware types such as GPUs to support AI-related applications. However, the need to balance scalability and legacy system compatibility can be a challenging technical exercise. Additionally, rolling out racks is such a customized task that it can take a long time to roll out, which leaves a lot of bottlenecks when expanding hours, and is thus a hindrance to businesses.

SEGMENTS ANALYSIS

BY RACK TYPE

In 2023, cabinets captured 57.5% of the market share, primarily due to their popular application in both small and large data centers for versatility and high security. In contrast, cabinets keep servers and networking equipment enclosed, safe from dust and physical damage, as well as restrict unauthorized access, making cabinets the choice provider in compliance-driven industries like BFSI, Healthcare, & Government. Cabinets also include integrated cable management and cooling solutions, which help make higher-density deployments more efficient in operation. Their compatibility with nearly all equipment settings makes them ideal for both traditional and hybrid data centers, which serves to further promote their popularity.

The open frame racks segment is projected to record the highest compound annual growth rate (CAGR) over the 2024 to 2032 timeframe due to their lower cost and efficient architecture for edge computing and modular data center deployments. Open frame racks allow easy access to equipment and are suited for environments where frequent maintenance or upgrades are necessary. They allow more airflow, which also minimizes the need for sophisticated cooling systems and makes for an easier operating experience. As applications such as IoT, 5G, and AI drive the need for low latency for processing, edge data centers are becoming mainstream where lightweight and compact open-frame racks can be a feasible option for consideration. In addition, the rise of greater sustainability and energy efficiency focus pairs with open frame racks which utilize less material and provide efficient cooling, rendering them a popular selection for upcoming data center innovation.

BY RACK HEIGHT

The 42U and below segment accounted for the largest market share of 58.7% in 2023 because of its extensive applications in small and medium-sized data centers, colocation facilities, and enterprises. These racks are the industry standard and provide a good combination of price, adaptability, and performance features Due to their small form factor, they are perfect for organizations that have space constraints or need to perform moderate data processing, for example, retail, BFSI, and healthcare verticals. Also, 42U racks are extremely versatile and compatible with servers, switches, storage units, etc. Because of having such traits that offer compatibility with existing infrastructure and ease of deployment, they are dominating the market as of now.

43U up to 52U segment is anticipated to witness the highest CAGR during 2024-2032, due to growing demand for high-density computing in large data centers. With reduced vertical space, these racks allow for more servers and other equipment to be installed in the same footprint of the data center, which is essential for optimizing the effectiveness of operations. Demand for higher-capacity racks is also driven by expansion in IT & telecom, cloud service providers that require high capacity of rack scale for efficient use of AI, IoT, and Big Data applications in industrial processes. In addition, the migration to hyperscale and modular data centers has led to a demand for larger racks with features designed to accommodate high-performance computing solutions and more sophisticated cooling technologies. With a business focus on scalability and ensuring future readiness of IT infrastructure, the 43U to 52U segment has become the hot tub choice of next-generation data centers.

BY RACK WIDTH

The 19-inch racks have the highest market share 67.5% in 2023, because this type of rack is standard in most data center environments and IT infrastructure, These racks are very common because most IT equipment like servers, switches, and routers are designed to fit the 19in width specification. They are suitable across industries such as BFSI, healthcare, retail, and government organizations where standardized and scalable solutions for data storage and processing are required. 19-inch racks are also economical, and widely supported for various cable management and cooling solutions allowing them to operate efficiently in high-density situations. The widespread adoption also ensured their dominance in the market.

The 23-inch racks are expected to have the highest CAGR during the forecast period (2024 — 2032). The extra horizontal space in the racks is great for running IT hardware like AI accelerators, High-performance computing systems, and custom-designed IT hardware. Evolving trends like 23-inch racks filtering down to common usage in several industries including IT & telecom, cloud computing, and energy are allowing for wider adoption due to increasing demand for performance-intensive applications and edge computing. This extra width also paves the way for more airflow and easier cable management, both of which are typically very important in high-density setups. Furthermore, with the growth of data centers and infrastructure upgrades required to support new technologies such as 5G and IoT (Internet of Things), the size and capability of 23-inch racks make them ideal for those looking to futureproof their infrastructure. The 23-inch rack, with its superior scalability, support for advanced functionalities like IP, and the promise of future system advancements all but guarantees the rapid acceptance of 23-inch racks.

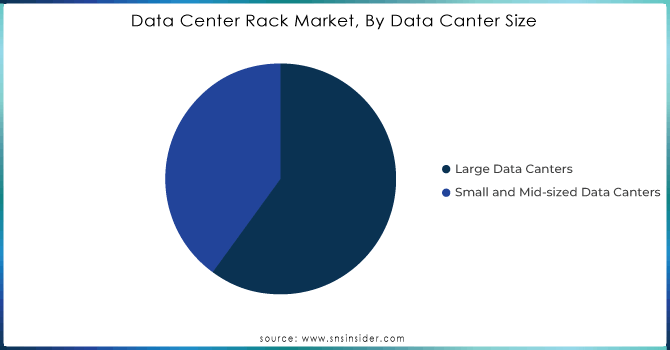

BY DATA CENTER SIZE

In 2023, large data centers captured a whopping 57.3% of the overall market share on account of the rising requirement for higher capacity plants that provide support for upcoming technologies such as cloud computing, artificial intelligence (AI), and big data analytics. Hyperscale providers and enterprises, particularly in IT & telecom, BFSI, and government, set up large data centers to manage a huge amount of data and keep their operations running smoothly. These centers often use very high-density racks to maximize space and power efficiency, accommodating thousands of servers and networking devices. Large data centers, powered with their features to centralize IT resources, enhance operational efficiency, and sustain global data traffic, constitute an essential part of modern IT infrastructure, hence taking market ownership.

Small and mid-sized data centers will register the fastest growth during the forecast period from 2024 to 2032 after the surge in edge computing and intense local data processing activities. As the demand for low-latency infrastructure increases with applications like IoT, self-driving cars, and 5G networks, organizations tend to bring online smaller, distributed data centers closer to end users. Such facilities offer cheaper alternatives to companies wanting to migrate some of their infrastructure without building large, high-cost facilities. Both of these aspects are also galvanizing this segment due to an increase in the adoption of modular and prefabricated data centers which usually serve primarily small and mid-sized data center environments. Various industries are propelling this growth most notably retail, retail, and manufacturing need scalable, on-demand IT solutions that are, for example, responsive to specific operational requirements. The rapid growth of small and mid-sized data centers as a cornerstone of the next-generation data center landscape is fueled by the trend towards distributed, scalable infrastructure.

BY INDUSTRIES

The retail sector accounted for the largest market share in 2023 with a market share of 25.7% of the global in terms of data center rack owing to the rapid expansion of e-commerce, digital payments, and customized customer experience. Data-driven approaches are being used more greatly by retailers, especially in inventory management, consumer behavior tracking, and supply chain process management. Hence, there is increasing demand for data centers to have reliable racks that play host to servers and storage systems. The growing need for omnichannel retail strategies to integrate online and offline sales channels will also drive an increase in investment into data center solutions for the sector, as a modern IT infrastructure is required for successful omnichannel deployment. Those new-age cabinets and related racks are important for housing the critical IT systems and other infrastructure over there as security & compliance are another top priority for retailers due to the nature of sensitive customer data processed over there.

IT & telecom sector to grow at the fastest CAGR during the period 2024-2032. The rapid growth of data traffic generated by connected devices, IoT applications, and real-time communication systems is driving telecom companies to invest heavily in upgrading their infrastructure. This sector is experiencing an increasing need for racks that can accommodate high-density equipment, including servers for AI and machine learning. In addition, IT companies are increasingly adopting hyperscale and colocation data centers to provide scalable and efficient cloud services, which in turn drives the demand for new rack solutions. The IT telecom sector is the fastest-growing segment in the data center rack market as it can host future-ready, high-capacity data centers.

REGIONAL ANALYSIS

In 2023, North America led the data center rack market with a 43.6% share of the overall market due to the technology infrastructure developments, a large number of hyperscale data centers, and the existence of innovative cloud and AI technologies Tech powerhouses, such as Amazon Web Services (AWS), Microsoft (Azure), Google Cloud, and Meta, are located here, with each rapidly expanding its data center footprints in response to surging data consumption. Furthermore, the presence of established IT markets in the USA and Canada and stringent regulations for data security in North America is increasing the adoption of dependable and secure rack solutions. As reflected by Meta continuing to expand its hyperscale data center footprint in Iowa and Google opening a data center in Nebraska, the region is a major hub for hyperscale data centers.

The Asia-Pacific region will exhibit the highest CAGR over the forecast period of 2024 to 2032, this can be attributed to the fast pace of digital transformation in emerging economies, rising smartphone penetration, and deployment of 5G networks. Nations including China, India, Japan, and Singapore are ramping up data middle creation to aid rising demand for cloud offerings, area computing, and digital ecosystems. China’s Alibaba Cloud, AdaniConneX’s planned data center projects in India, and Google’s new data center in the city of Tokyo, Japan are several current concrete instances. Major cloud providers and telecom companies to react to data sovereignty policies and lower latency requirements have invested strongly in creating local capacity across the Asia-Pacific region–this has also contributed positively to cloud availability in the region. Thus, these factors are making the Asia Pacific one of the key growth enablers for the global data center rack market.

Need any customization research on Data Center Rack Market - Enquiry Now

Key players

Some of the major players in the Data Center Rack Market are:

-

Schneider Electric (NexGen, EcoStruxure IT)

-

Huawei Technologies (FusionModule, NetEngine)

-

Rittal (TS IT Rack, LCP)

-

Vertiv (Liebert DSE, NetSure)

-

Eaton (Energy Saver, PDU)

-

Delta Electronics (Rack PDU, InRow AC)

-

Hewlett Packard Enterprise (ProLiant DL380, Aruba Networks)

-

IBM (IBM PureFlex, IBM Power Systems)

-

Intel (Intel Rack Optimized Servers, Intel Xeon Scalable Processors)

-

American Power Conversion (APC) (Smart-UPS, Rack Power Distribution Unit)

-

Apc by Schneider Electric (Smart-UPS, Rack PDU)

-

Legrand (Rackmount PDU, Server Racks)

-

Cisco Systems (Catalyst Switch, Unified Computing System)

-

Siemens (Siemens PDU, Sitop PSU)

-

Tripp Lite (SmartPro UPS, Rackmount Surge Protector)

-

NetApp (FAS Series, AFF Series)

-

Samsung Electronics (Smart DCI, SSD Rack Storage)

-

Zyxel Communications (XGS-PON ONU, Network Switches)

-

Panduit (NetShelter SX, Rack PDU)

-

Conteg (C-Rack, CoolCube)

Some of the Raw Material Suppliers for Data Center Rack Companies:

-

ArcelorMittal

-

POSCO

-

ThyssenKrupp

-

Nippon Steel Corporation

-

AK Steel (Now part of Cleveland-Cliffs)

-

Baosteel

-

SSAB

-

Alcoa Corporation

-

Novelis Inc.

-

Rusal

RECENT TRENDS

-

In March 2024, Rittal launched its TS IT Colo rack initiative to meet the growing demand in the colocation market, offering pre-configured, in-stock solutions for quick delivery and flexible deployment.

-

In September 2024, Vertiv unveiled its AI-ready modular data center featuring advanced liquid cooling technology, designed to accelerate AI infrastructure deployment by up to 50%.

-

In March 2024, Eaton launched its SmartRack modular data center solution, designed for rapid deployment and scalable IT infrastructure with integrated cooling and power management.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 4.46 Billion |

|

Market Size by 2032 |

USD 9.17 Billion |

|

CAGR |

CAGR of 8.34% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Rack Type (Open Frame, Cabinets) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Schneider Electric, Huawei Technologies, Rittal, Vertiv, Eaton, Delta Electronics, Hewlett Packard Enterprise, IBM, Intel, American Power Conversion, Apc by Schneider Electric, Legrand, Cisco Systems, Siemens, Tripp Lite, NetApp, Samsung Electronics, Zyxel Communications, Panduit, Conteg |

|

Key Drivers |

• Rising Data Localization Regulations and Cybersecurity Threats Fuel Demand for Advanced Scalable Data Center Racks |

|

RESTRAINTS |

• Overcoming Challenges of Thermal Efficiency Scalability and Customization in the Evolving Data Center Rack Market |