Enterprise Search Market Report Scope & Overview:

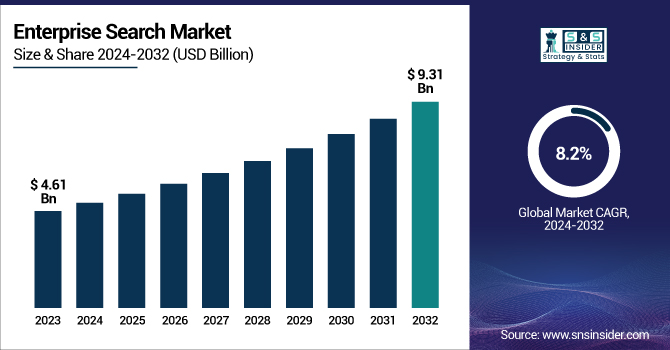

The Enterprise Search Market Size was valued at USD 4.61 Billion in 2023 and is expected to reach USD 9.31 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period 2024-2032.

To Get more information on Enterprise Search Market - Request Free Sample Report

The market is expanding due to the increasing need for businesses to efficiently manage vast amounts of unstructured data. As organizations embrace digital transformation, AI, machine learning, and cloud computing, the demand for real-time, precise data retrieval grows. Advancements in Natural Language Processing (NLP) and AI-driven search tools are accelerating this growth. Furthermore, the rise of remote work and the focus on improving internal processes and customer service are driving the adoption of enterprise search platforms, with key players innovating to integrate these systems with cloud storage for more personalized search experiences.

The U.S. enterprise search market size was USD 1.13 billion in 2023 and is projected to reach USD 1.98 billion by 2032, growing at a CAGR of 6.47% during the forecast period from 2024 to 2032.

The U.S. enterprise search market is experiencing significant growth as organizations increasingly rely on efficient data management solutions. With the proliferation of unstructured data, businesses are adopting advanced search technologies to enhance decision-making and operational efficiency. The rise of AI, machine learning, and cloud integration is further shaping the demand for these solutions. As companies prioritize real-time data retrieval and seamless access across platforms, enterprise search systems are becoming crucial for improving productivity and customer service. This shift is driving innovation among key market players and fueling further adoption across industries.

Enterprise Search Market Dynamics

Key Drivers:

-

Growing Demand for Real-Time Data Retrieval and Efficient Knowledge Management Drives Enterprise Search Market Growth

The increasing need for real-time data access and enhanced knowledge management systems is a significant driver for the enterprise search market. With businesses handling large data volumes, the ability to search and access relevant information quickly is vital for operational efficiency. Enterprises are adopting advanced search technologies to enhance decision-making, improve collaboration, and boost productivity. Moreover, real-time insights provided by AI-enhanced search tools are driving the demand for these solutions across various industries, including healthcare, finance, and manufacturing. This trend is expected to sustain the market’s growth as more businesses realize the value of optimizing their data retrieval processes.

Restrain:

-

Data Security and Privacy Concerns Restrict Adoption of Enterprise Search Solutions

Despite the growing adoption of enterprise search systems, data security and privacy concerns remain a significant restraint. Businesses dealing with sensitive information may hesitate to adopt cloud-based search systems due to fears about unauthorized access and data breaches. Regulatory compliance, such as GDPR and HIPAA, adds another layer of complexity for companies integrating enterprise search tools. Organizations need to ensure that their enterprise search solutions comply with stringent privacy laws while maintaining data security and slowing the widespread implementation of such systems, especially in highly regulated industries.

Opportunity:

-

AI and Machine Learning Integration Presents Significant Opportunity for Growth in Enterprise Search Market

The integration of AI and machine learning into enterprise search tools presents a major opportunity for market growth. AI-powered search systems enhance user experience by enabling more accurate, context-aware results. These systems also improve over time through machine learning, allowing organizations to continually refine their search capabilities. By automating data categorization and retrieval processes, businesses can increase efficiency and reduce manual intervention. Companies are increasingly investing in AI-driven search solutions to automate workflows, improve decision-making processes, and enhance customer satisfaction. This technological advancement is expected to expand the scope of enterprise search applications across industries.

Challenges:

-

Lack of Standardization in Enterprise Search Technologies Hinders Market Growth

A significant challenge in the enterprise search market is the lack of standardization across search technologies. The market is fragmented, with various providers offering different features, capabilities, and integration options. This lack of uniformity makes it difficult for organizations to evaluate and select the best enterprise search solutions for their needs. As businesses require highly tailored solutions to meet specific industry demands, the absence of common standards leads to compatibility issues and higher implementation costs. To fully realize the potential of enterprise search systems, the industry must develop standard frameworks that allow for smoother integration and better scalability.

Enterprise Search Market Segment Analysis

By Type

The local search segment in the enterprise search market holds the largest revenue share, representing 49% of the market in 2023. This dominance can be attributed to the rising demand for geographically localized data retrieval in sectors such as retail, logistics, and customer support. Companies are increasingly investing in localized search solutions to improve the relevance of search results based on location, providing customers and employees with more precise and timely information. These innovations are driving growth in the local search segment as organizations aim to offer more tailored search experiences. The growing trend toward location-based search tools, especially in retail and supply chain management, is expected to sustain this segment’s growth trajectory.

The Hosted Search segment is witnessing the fastest growth, with a projected CAGR of 9.36% during the forecast period. Hosted search solutions are particularly appealing for businesses looking to offload infrastructure management to third-party providers, allowing them to focus on core operations.

In 2023, Google Cloud and Amazon Web Services (AWS) introduced enhanced search offerings in their cloud platforms, which integrate advanced machine learning models to deliver superior search functionalities.

Hosted search solutions are gaining traction due to their scalability, cost-effectiveness, and ease of integration with existing business systems. As businesses increasingly shift to cloud-based infrastructures, the hosted search segment is positioned for significant growth, with companies across various industries embracing these solutions for efficient data retrieval and improved user experience.

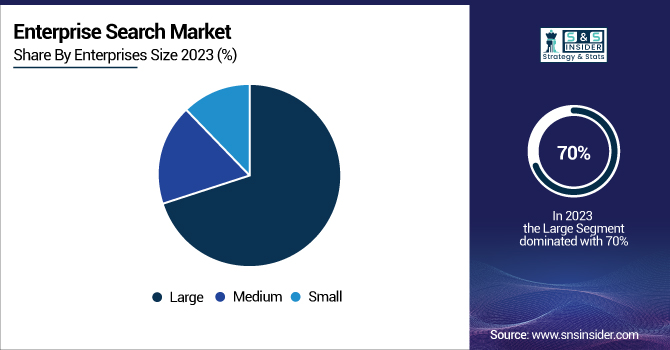

By Enterprises Size

In 2023, Large Enterprises accounted for the largest share of the enterprise search market, with a revenue share of 70%. This is primarily due to the need for robust, scalable search solutions that can handle vast volumes of data and support complex organizational structures. Large businesses in sectors such as finance, healthcare, and manufacturing require enterprise search systems that can index and retrieve data across multiple departments, locations, and databases. As these enterprises continue to digitize and scale their operations, the demand for comprehensive enterprise search systems is expected to remain high, contributing to the continued dominance of the large enterprise segment.

The Small Enterprise segment is experiencing the highest growth rate, with a projected CAGR of 9.21% during the forecast period. Small and medium-sized businesses (SMBs) are increasingly adopting enterprise search tools to enhance their operational efficiency and streamline information retrieval. These solutions offer enhanced flexibility, scalability, and integration capabilities, allowing small businesses to adopt enterprise-level search functionality without significant investment in infrastructure. As SMBs continue to digitalize and compete in data-driven markets, the demand for enterprise search solutions is expected to increase, fueling growth in this segment.

By End-Use

In 2023, the Healthcare segment represented the largest share of the enterprise search market by end-use, with a revenue share of 20%. Healthcare organizations rely on enterprise search solutions to manage vast amounts of medical records, research data, and patient information. Search tools help medical professionals quickly access critical data, improving patient care and operational efficiency. With the growing need for fast and accurate access to medical data, the healthcare segment continues to drive demand for advanced enterprise search solutions tailored to the sector’s specific needs.

The Banking and Financial Services segment is expected to exhibit the highest CAGR of 9.7% during the forecast period. Financial institutions require efficient search systems to handle vast amounts of transactional data, customer records, and compliance documents. In 2023, major financial institutions have adopted AI-enhanced search solutions for fraud detection, regulatory compliance, and customer service optimization. As financial institutions increasingly embrace digital transformation, the demand for secure and efficient enterprise search solutions in banking and financial services is expected to rise significantly.

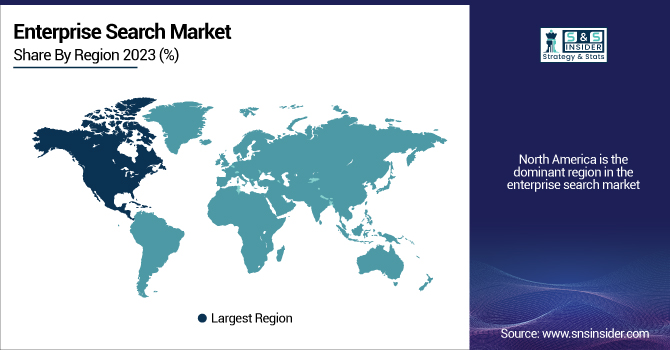

Regional Analysis

North America is the dominant region in the enterprise search market, holding the largest market share in 2023. The region’s dominance is driven by the rapid adoption of advanced technologies such as AI, cloud computing, and machine learning, which are integrated into enterprise search solutions. The presence of major technology companies like Google, Microsoft, and Amazon Web Services in the region has further contributed to its market leadership. Additionally, North American companies are at the forefront of digital transformation, pushing the demand for innovative enterprise search solutions. The region’s strong regulatory framework and high focus on data security also make it a preferred market for enterprise search vendors.

Asia Pacific is the fastest-growing region in the enterprise search market, with a projected CAGR surpassing other regions during the forecast period. The rapid digitalization of businesses in countries like China, India, and Japan is driving the demand for enterprise search solutions. Additionally, the growing number of small and medium-sized enterprises in the region is contributing to market growth. With increased adoption of cloud-based solutions and AI-powered search tools, companies across various sectors, including healthcare, finance, and retail, are embracing these technologies. The Asia Pacific region’s rapidly expanding IT infrastructure and growing investments in smart technologies make it a key area for enterprise search market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Attivio (Attivio AI, Attivio Search Platform)

-

Coveo Solutions Inc. (Coveo for Salesforce, Coveo for ServiceNow)

-

Dassault Systemes Inc. (3DEXPERIENCE, CATIA)

-

Dieselpoint Inc. (Dieselpoint Search, Dieselpoint Search Engine)

-

EMC Corporation (Documentum, EMC Elastic Cloud Storage)

-

Expert System Inc. (Cogito, Expert System's AI Solutions)

-

Alphabet Inc. (Google Cloud Search, Google Search Appliance)

-

HP (HP Autonomy, HP IDOL)

-

Autonomy (IDOL, Autonomy Structured Data)

-

IBM Corporation (IBM Watson Discovery, IBM Content Manager)

-

Lucidworks Inc. (Fusion, Fusion AI)

-

MarkLogic Corporation (MarkLogic Database, MarkLogic Search)

-

Oracle (Oracle Endeca, Oracle Cloud Search)

-

Perceptive Software Inc. (Perceptive Content, Perceptive Intelligent Capture)

-

PolySpot (PolySpot Search, PolySpot Enterprise Search)

Recent Trends

-

In February 2025, Dassault Systèmes announced a long-term partnership with Volkswagen to accelerate the automaker's transition toward software-defined vehicles. Volkswagen selected Dassault's 3DEXPERIENCE platform as its main engineering and manufacturing solution, aiming to standardize processes and reduce time-to-market.

-

In December 2023, Coveo Solutions Inc. was recognized as a Leader in The Forrester Wave: Cognitive Search Platforms, Q4 2023 report. This acknowledgment highlights Coveo's strengths in automated relevancy tuning and robust analytics, reinforcing its position in the enterprise search market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.61 Billion |

| Market Size by 2032 | US$ 9.31 Billion |

| CAGR | CAGR of 8.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Local Search, Hosted Search, Search Appliance) • By End-use (Government & Commercial, Banking & Financial, Healthcare, Retail, Media, Manufacturing, Others) • By Enterprise Size (Small, Medium, Large) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Attivio, Coveo Solutions Inc., Dassault Systemes Inc., Dieselpoint Inc., EMC Corporation, Expert System Inc., Alphabet Inc., HP Autonomy, IBM Corporation, Lucidworks Inc., MarkLogic Corporation, Oracle, Perceptive Software Inc., PolySpot. |