Data Exfiltration Market Report Scope & Overview:

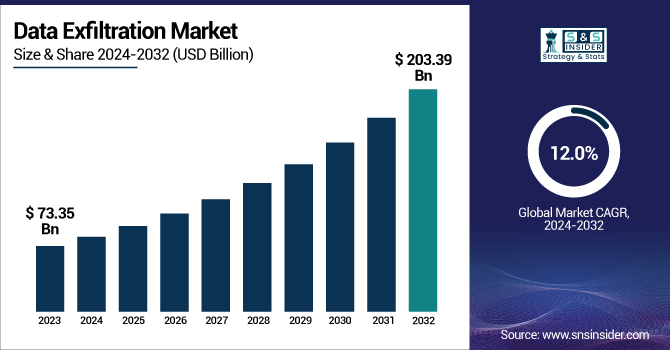

The Data Exfiltration Market Size was valued at USD 73.35 Billion in 2023 and is expected to reach USD 203.39 Billion by 2032 and grow at a CAGR of 12.0% over the forecast period 2024-2032.

To Get more information on Data Exfiltration Market - Request Free Sample Report

The Market is evolving rapidly due to increasing concerns around data security and the growing number of data breaches in both public and private sectors. This market encompasses the technologies and solutions used to prevent the unauthorized transfer of sensitive data outside organizational boundaries. With the increasing prevalence of cyber-attacks, regulatory demands for enhanced data protection, and the growing adoption of cloud computing, the need for robust data exfiltration solutions is at an all-time high.

The U.S. Data Exfiltration Market size was USD 19.16 billion in 2023 and is expected to reach USD 46.16 billion by 2032, growing at a CAGR of 10.27% over the forecast period of 2023-2032.

The U.S. Data Exfiltration Market is experiencing rapid growth as businesses increasingly prioritize data security in response to the rising threat of cyber-attacks. With the growing frequency and sophistication of data breaches, companies are investing heavily in advanced technologies to prevent unauthorized data transfers. This market is driven by the need for robust data protection solutions, including real-time monitoring, encryption, and cloud security. As regulations around data privacy become stricter, the demand for data exfiltration solutions is expected to continue expanding across industries.

Data Exfiltration Market Dynamics

Key Drivers:

-

Growing Cybersecurity Threats Accelerating the Data Exfiltration Market Growth

The continuous rise in cyber-attacks and security breaches remains the primary driver for the growth of the Data Exfiltration Market. As companies increasingly rely on digital infrastructure and cloud-based services, the risk of cybercriminals infiltrating networks and exfiltrating sensitive data grows. Attacks such as ransomware, phishing, and APTs (Advanced Persistent Threats) have become more sophisticated, and hackers are targeting sensitive information such as intellectual property, customer data, and financial records.

For Instance, In October 2024, Cisco Systems Inc. experienced a data breach when the hacker known as IntelBroker leaked 2.9GB of data allegedly stolen from Cisco's DevHub environment. The exposed information included source code, hardcoded credentials, confidential documents, and API tokens. Cisco acknowledged the incident, attributing it to a misconfigured DevHub platform and emphasized that their core systems remained uncompromised.

Consequently, businesses are investing heavily in data exfiltration solutions to protect critical assets and avoid legal and financial consequences from data leaks. The increasing need for real-time monitoring systems, intrusion detection systems (IDS), and encryption tools is expected to fuel market growth, providing ample opportunities for solution providers to offer comprehensive cybersecurity platforms.

Restrain:

-

High Costs of Implementing Data Exfiltration Solutions May Restrain Market Expansion

Despite the growing need for data exfiltration solutions, high implementation costs remain a significant restraint for many small to medium-sized enterprises (SMEs). Advanced cybersecurity systems, such as AI-based intrusion detection and advanced encryption solutions, come with substantial financial investments.

Moreover, ongoing maintenance and staff training to handle these technologies add to the cost burden. These costs may deter smaller businesses from implementing comprehensive security measures, leaving them vulnerable to cyber-attacks. While large organizations with more substantial budgets can absorb these expenses, the financial constraints of smaller firms pose a challenge to the widespread adoption of data exfiltration solutions. The market will need to address these cost challenges to ensure broader market penetration.

Opportunity:

-

Rising Need for Cloud Security Solutions as a Major Opportunity in the Data Exfiltration Market

The shift towards cloud computing presents a significant opportunity for the Data Exfiltration Market. With more businesses migrating their operations to the cloud, the risk of data exposure and exfiltration has intensified. However, this trend also creates a substantial demand for robust cloud security solutions, including tools to prevent unauthorized data transfer. Data exfiltration solutions that can effectively secure cloud environments, provide continuous monitoring, and protect multi-cloud infrastructures are poised to capture significant market share. Vendors offering cloud-native data protection solutions are well-positioned to cater to this growing need. The introduction of cloud-specific encryption and access management tools also opens up new avenues for market players to innovate and address these challenges.

Challenge:

-

Complexities in Detecting and Preventing Advanced Exfiltration Techniques Challenge the Market

The increasing sophistication of data exfiltration techniques poses a significant challenge for the market. Cybercriminals are employing more advanced methods to bypass security protocols, including data exfiltration via encrypted channels, insider threats, and evading detection by AI-driven systems. Traditional data loss prevention (DLP) methods are often inadequate against these sophisticated threats. The evolving nature of these attacks demands continuous innovation in detection and prevention mechanisms. As a result, organizations face difficulties in adapting their existing security infrastructure to counter such advanced threats. Additionally, the lack of skilled cybersecurity professionals further complicates the ability to deploy effective data exfiltration defenses, making this a critical challenge for the market.

Data Exfiltration Market Segment Analysis

By Component

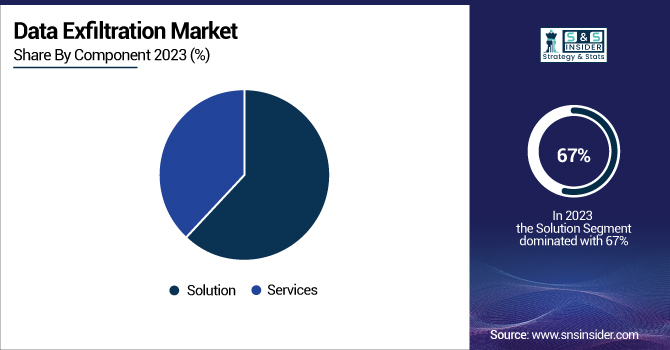

In 2023, the Solution segment of the Data Exfiltration Market held the largest share of the revenue, accounting for 67%. The growth of this segment can be attributed to the increasing demand for software-based solutions that prevent unauthorized data exfiltration. Companies are increasingly adopting real-time data monitoring, encryption software, and endpoint protection systems as part of their defense strategy.

Moreover, product development in the solution segment has focused on enhancing integration with cloud environments and improving ease of use for businesses. As businesses of all sizes seek to protect their sensitive data, the demand for comprehensive data exfiltration solutions will continue to rise, keeping this segment at the forefront of market growth.

The Services segment in the Data Exfiltration Market is expected to grow at the highest CAGR of 13.1% during the forecast period. This growth is driven by the increasing complexity of data security challenges that businesses face, requiring specialized services such as consulting, managed services, and incident response. Major companies like IBM, Accenture, and Deloitte are providing services that complement data exfiltration solutions, such as security audits, threat assessments, and recovery plans. These services help organizations create a robust data protection strategy, manage risk, and enhance the security posture of their IT infrastructures.

By Deployment

Active Data Exfiltration is the dominant segment in the Data Exfiltration Market, holding the largest share in 2023. Organizations are focusing on preventing active threats where data is being transmitted outside the network in real time. Companies such as Forcepoint and Digital Guardian have been at the forefront of developing active data exfiltration solutions, offering features such as network traffic monitoring, encryption, and automatic alerts for suspicious activities. These solutions provide robust protection against active threats like malware, ransomware, and insider threats. As businesses become more concerned about real-time attacks, the demand for active data exfiltration solutions is expected to grow steadily.

The Passive Data Exfiltration segment is anticipated to grow at the largest CAGR in the forecast period 2024-2032. Passive exfiltration involves unauthorized data transfers occurring without triggering alarms, often through covert channels or over extended periods. While it’s harder to detect, businesses are increasingly focusing on passive data exfiltration methods to uncover and prevent such threats. Companies like Varonis and Check Point have developed passive monitoring solutions that continuously track data movement across networks, detecting anomalies indicative of potential data exfiltration. The rapid adoption of these solutions, combined with rising concerns over data security and regulatory requirements, will further propel the growth of passive data exfiltration systems in the coming years.

By End-Use

The BFSI sector is the largest contributor to the Data Exfiltration Market, commanding 36% of the market share in 2023. The BFSI sector is a prime target for cybercriminals due to the highly sensitive nature of the data they handle, such as customer financial information and transaction records. Companies in this sector are investing heavily in data exfiltration solutions to prevent financial loss, regulatory fines, and damage to their reputation. Solutions such as real-time data monitoring, encryption, and multi-factor authentication (MFA) are commonly employed. Financial institutions like JPMorgan Chase and Bank of America have bolstered their data security protocols to protect sensitive customer data from unauthorized access.

The Healthcare sector is expected to grow at the highest CAGR of 13.3% during the forecast period. Healthcare organizations, which store sensitive patient data, are increasingly vulnerable to cyber-attacks and data breaches. The growing adoption of Electronic Health Records (EHR) and Health Information Systems (HIS) further amplifies the need for robust data exfiltration solutions. Companies like Cisco and Fortinet are offering specialized solutions tailored to the unique security needs of the healthcare industry, including HIPAA-compliant data protection tools and secure data transfer protocols.

Regional Analysis

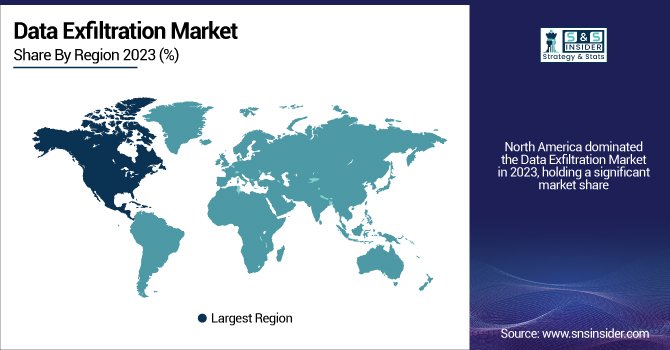

North America dominated the Data Exfiltration Market in 2023, holding a significant market share. The region benefits from the presence of major cybersecurity firms such as Symantec, McAfee, and Palo Alto Networks, which are continuously innovating and deploying advanced data protection solutions. Additionally, the stringent data protection regulations, such as the CCPA (California Consumer Privacy Act), and the growing number of cyber-attacks have created a strong demand for data exfiltration solutions.

Furthermore, the increasing adoption of cloud services, IoT, and AI technologies across industries has fueled the need for robust data security measures. North America's high levels of technological advancements and the presence of a large number of enterprises are key factors contributing to its dominance in the market.

The Asia Pacific region is witnessing the fastest growth in the Data Exfiltration Market in 2023, with an estimated CAGR of 13.6% during the forecast period. This rapid growth can be attributed to increasing digitization, the rise of e-commerce, and the growing adoption of cloud technologies in countries like China, India, and Japan. As more businesses embrace digital transformation, the need for data exfiltration solutions has intensified to protect sensitive business data.

Additionally, the increasing frequency of cyber-attacks in the region and the implementation of stronger data protection laws, such as the PDPA (Personal Data Protection Act) in Singapore, are fueling market growth. As a result, vendors are focusing on expanding their presence in the Asia Pacific region, addressing the demand for comprehensive data security solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Broadcom Inc. (Symantec Data Loss Prevention, Symantec CloudSOC CASB)

-

CrowdStrike Holdings, Inc. (CrowdStrike Falcon XDR, CrowdStrike Falcon Data Protection)

-

McAfee, LLC (McAfee Total Protection for Data Loss Prevention, McAfee MVISION Cloud)

-

Cisco Systems Inc. (Cisco Secure Endpoint, Cisco Umbrella)

-

Trend Micro Inc. (Trend Micro Cloud One, Trend Micro Apex One)

-

GTB Technologies (GTB Inspector, GTB Endpoint Protector)

-

Palo Alto Networks (Prisma Access, Cortex XSOAR)

-

Fortinet Inc. (FortiDLP, FortiGate Secure Web Gateway)

-

Zscaler Inc. (Zscaler Internet Access, Zscaler Cloud DLP)

-

Check Point Software Technologies (Check Point Harmony Email & Collaboration, Check Point CloudGuard DLP)

-

Juniper Networks (Juniper Secure Analytics, Juniper ATP Cloud)

-

Forcepoint (Forcepoint Data Loss Prevention, Forcepoint Cloud Security Gateway)

Recent Trends

-

In December 2023, CrowdStrike announced the general availability of CrowdStrike Falcon Data Protection, a solution designed to disrupt legacy data loss prevention (DLP) products. This offering aims to prevent adversary exfiltration and accidental data leakage by leveraging the AI-native Falcon XDR platform, allowing customers to consolidate outdated DLP point products and enhance data security.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 73.35 Billion |

| Market Size by 2032 | US$ 203.39 Billion |

| CAGR | CAGR of 12.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Solution, Services) •By Type (Active Data Exfiltration, Passive Data Exfiltration) •By End-Use (BFSI, Government & Defense, Retail & E-Commerce, IT & Telecommunication, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Broadcom Inc., CrowdStrike Holdings, Inc., McAfee, LLC, Cisco Systems Inc., Trend Micro Inc., GTB Technologies, Palo Alto Networks, Fortinet Inc., Zscaler Inc., Check Point Software Technologies, Juniper Networks, Forcepoint. |