Data Converter Market Size & Trends:

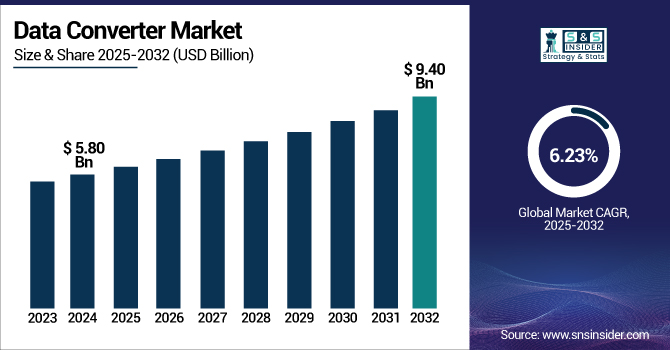

The Data Converter Market size was valued at 5.80 Billion in 2024 and is projected to reach USD 9.40 Billion by 2032, growing at a CAGR of 6.22% from 2025 to 2032. The market is experiencing robust growth driven by the surging demand for high-performance computing and AI infrastructure across industries. Such large-scale computing requires highly efficient analog-to-digital and digital-to-analog converters to ensure precise and high-speed data processing, essential for AI, edge computing, and real-time analytics.

To Get more information on Data Converter Market - Request Free Sample Report

For instance, Austin-based Core Scientific is investing around USD 6.1 billion to convert its Denton Bitcoin mining facility into a large GPU-powered data center. The local authority-backed project will double the size of the site to 78 acres and become one of North America’s largest GPU supercomputers.

The market for U.S. data converters is expected to grow, as digital technologies continue to evolve and the need for accuracy in data processing increases. The market is being driven by several major industries, including telecommunications, automotive, and consumer electronics. The market is expected to grow from USD 1.74 billion in 2023 to USD 2.32 billion by 2032, at a CAGR of 3.66%.

Alabama has secured more than USD 30 billion in FDI to strengthen U.S. manufacturing and data connectivity expansion. Japan moves here to include the USD 1.6B Toyota-Mazda plant and investments from Germany and South Korea, so that advanced tech infrastructure benefits the state as a rising hub for connected manufacturing solutions.

Data Converter Market Dynamics:

Drivers:

-

Rising AI Server Power Needs Drive Demand for High-Efficiency Data Converters

This high power consumption of AI server applications such as chatbots, generative AI and large-scale machine learning models is identified as one of the major drivers of the data converter market. High-performance components such as GPUs, TPUs, and FPGAs have greatly increased power requirements; for example, AI servers require 3–5 times more power than traditional hardware, according to Delta Electronics. To improve energy efficiency, these servers are shifting away from 12V to 48V inputs, although the internal components still require lower voltages. This increased the demand for advanced DC-DC converters.

For instance, Delta’s RBC Series delivers peak efficiencies of up to 97.5%, for dependable, efficient power conversion. For example, these converters have already been deployed in over 300 data centers, affirming their importance in next-gen infrastructure.

Restraints:

-

The increasing complexity of signal processing in advanced applications is driving challenges in designing and optimizing data converters.

With the development of applications, data converters face more and more complex signal processing tasks, and their designs are becoming increasingly complex. This evolution has challenges on design and optimization in mind. This makes designing converters which suit a wide variety of environments increasingly complex and lengthy, adding costly time to production cycles. The pressure on engineers is further amplified by the increasing demand for high precision and performance in modern applications, which includes AI, 5G, and automotive systems. Achieving performance, power dissipation, size, and compatibility requirements across heterogeneous systems becomes increasingly difficult, and hinders the scalability of data converters in new-age applications.

Opportunities:

-

High-Performance Data Converters in Medical Imaging Systems

Medical imaging is a segment where precision ADCs with very high speed are required for each machine, which is boosting the adoption of the high-performance data converters in this segment. In the case of digital radiography (DR), high-quality images require 14–18 bit ADCs with SNRs between 70 and 100 dB and 30 fps sampling to facilitate real-time processing.

Companies like Analog Devices and Texas Instruments provide these advanced ADCs, creating market growth opportunities. In computed tomography (CT), ADCs with at least 24-bit resolution and fast sampling rates (100 µs conversion time) enable high-resolution 3D images. Maxim Integrated and Linear Technology lead in supplying these solutions. For positron emission tomography (PET), ADCs with 10-12 bit resolution and fast sampling rates (up to 40 MSPS) ensure accurate photon detection for 3D imaging.

Challenges:

-

Difficulties in Integrating Data Converters in Power-Limited System on Chip. Environments

Incorporating data converters into larger systems, such as System on Chips (SoCs), presents significant design challenges, especially in managing space and power constraints. As electronic devices become smaller and more compact, integrating high-performance data converters into these systems requires careful consideration of size limitations while maintaining optimal performance. Power consumption is another critical factor, as the need for low power usage becomes more pressing in mobile and battery-powered applications.

Data Converter Market Segmentation Analysis:

By Type

In 2024, Analog-to-Digital Converters (ADCs) dominate the market, contributing to a significant share of around 53% of the overall revenue. This dominance is driven by their critical role in converting analog signals into digital data across multiple sectors, including medical imaging, telecommunications, and consumer electronics. Are widely used in applications for quick processing and accurate data conversion driving their adoption in areas like digital radiography audio processing and IoT devices.

The Digital-to-Analog Converters (DAC) segment is the fastest growing, with a (CAGR) of 7.43% from 2025 to 2032. The increasing usage of DACs in end-user industries such as audio equipment, telecommunication, automobiles, consumer electronic products and industrial control systems, among others is driving the market. DACs convert digital data to analog signals, allowing speakers, sensors, and displays to operate and paving the way for innovation across industries.

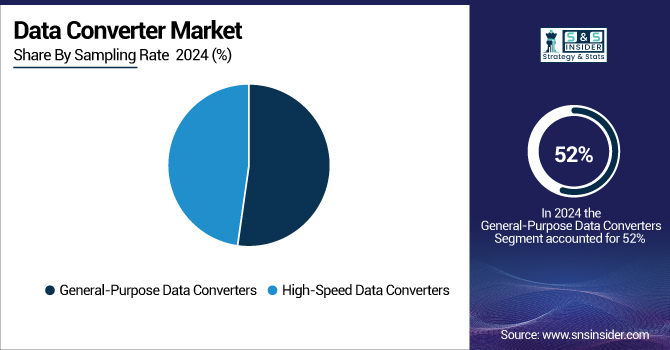

By Sampling Rate

The General-Purpose Data Converters segment holds the largest share of the market, accounting for 52% of the revenue in 2024. This dominance is attributed to their wide applicability across various industries, including consumer electronics, automotive, industrial automation, and communications. General-purpose data converters offer versatility and efficiency in handling diverse analog-to-digital and digital-to-analog conversions, driving their extensive use in numerous systems.

The High-Speed Data Converters segment is expected to see the fastest growth over the forecast period, with a CAGR of 6.29%. This increase is propelled by the growing need for high-speed processing in applications such as telecommunications, data centers, automotive systems, and industrial automation, where faster data conversion is a key contributor to performance and efficiency.

By Application

The Consumer Electronics segment held the largest revenue share of over 40% in the data converter market in 2024. This dominance is driven by the growing demand for high-performance data converters required in devices like smartphones, smart TVs, gaming consoles, and wearables capable of delivering better audio and video quality with fast data processing capabilities for a better user experience.

The Healthcare & Life Sciences segment is expected to witness significant growth, with a projected CAGR of 9.78%. The increasing adoption of advanced data converters in medical imaging systems, diagnostic devices, and wearable health technologies, where precision, speed, and high-quality data conversion are critical for accurate patient monitoring, diagnostics, and treatment planning, drives this growth.

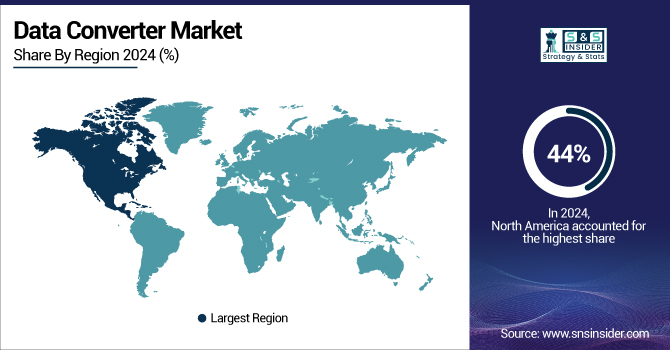

Data Converter Market Regional Outlook:

In 2024, North America held a significant share of around 44% of the data converter market. owing to the rapid growth of leading technology companies, high adoption rates of advanced electronics, and increasing demand from essential sectors such as healthcare, automotive, telecommunications and consumer electronics, chiefly in the U.S. and Canada. Critical sectors, including aerospace, defense, and communication systems, have emerged as major consumers of advanced data converters (DACs) in North America.

U.S. data converter market is likely to grow at a higher rate with the developing 5G infrastructure, which is further propelling the demand for high-speed converter. Additionally, rising trend of manufacturing automation in the U.S. is also driving up demand of data converters in industrial control and data acquisition system.

The Asia Pacific region is experiencing substantial growth in the data converter market with CAGR 7.89%, driven by advancements in telecommunication infrastructure and technological innovations. As countries in this region expand their 5G networks, the demand for high-speed data converters for efficient data transmission and network operations is increasing.

In China, the potential for growth in the data converters market is massive, in part driven by both the nation’s rapid 5G rollout and recent investments into domestic semiconductor fabrication. The government's focus on enhancing its telecommunication capabilities and permeating innovation in data converter technologies.

The data converter market in Europe is set for significant growth, driven by demand from the automotive industry for ADAS, infotainment systems, and EV technology. Focus on safety and efficiency, along with industrial automation and Industry 4.0 initiatives, further boosts the need for reliable data converters in data acquisition and control systems

The UK data converter market is poised for growth, driven by government R&D initiatives in 5G, AI, advanced manufacturing, and industrial automation, aligning with Industry 4.0 trends for improved data acquisition and control.

The Latin America and MEA data converter market is rapidly growing due to increased demand for data converters. The oil & gas industry, a key economic engine in the region, is progressively leveraging digital technologies across exploration, production, and refining activities. Data converters are thus required for data acquisition and control systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Data Converter Market are:

Some of the Major Key Players are Analog Devices, Inc., Asahi Kasei Micro devices Corporation, Avia Semiconductor Ltd., Cirrus Logic, Inc., Datel, Inc., IQ-Analog, Mouser Electronics, Inc., Microchip Technology Inc., Renesas Electronics Corporation, Texas Instruments and others.

Recent Development:

-

3 Feb 2025, Stifel reiterates Buy at Cirrus Logic (NASDAQ: CRUS), but sees 5.9% revenue headwind. The firm points to the company’s strong financial health and robust cash flows.

-

Jan 9, 2025, Renesas Expands Leader in 100V N-Channel MOSFETs, With 30% Lower on-resistance and 40% Reduction in Gate-Drain Charge Ability in Same Package for Motor Control/Battery Management Device.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.80 Billion |

| Market Size by 2032 | USD 9.40 Billion |

| CAGR | CAGR of 6.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog-to-Digital Converters (ADC), Digital-to-Analog Converters (DAC)) • By Sampling Rate (High-Speed Data Converters, General-Purpose Data Converters) • By Application (Communication, Consumer Electronics, Industrial, Healthcare & Life Sciences, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Some of the Major Key Players in data converter market. Analog Devices, Inc., Asahi Kasei Micro devices Corporation, Avia Semiconductor Ltd., Cirrus Logic, Inc., Datel, Inc., IQ-Analog, Mouser Electronics, Inc., Microchip Technology Inc., Renesas Electronics Corporation, Texas Instruments and others. |