DC-DC Converter Market Size

To get more information on DC-DC Converter Market - Request Sample Report

The DC-DC Converter Market Size was valued at USD 5.16 Billion in 2023 and is expected to reach USD 8.21 Billion by 2032, and grow at a CAGR of 5.3% over the forecast period 2024-2032.

The importance of efficient DC-DC converters for effective power management and grid integration is highlighted by the rapid expansion of renewable energy sources, such as solar and wind power. These converters make it easier to convert and regulate electricity from renewable sources, ensuring stability and reliability in the power grid. Additionally, the increasing popularity of electric vehicles (EVs) and hybrid electric vehicles (HEVs) plays a major role in driving the growth of the DC-DC converter market. Dependable DC-DC converters are crucial for overseeing battery systems, electricity distribution, and enhancing performance in such vehicles, improving their effectiveness and distance. As per the U.S. Department of Energy, the amount of EVs in the U.S. is expected to hit 18.7 million by 2030, increasing the need for advanced power management solutions like DC-DC converters. Furthermore, the International Energy Agency (IEA) predicts that there will be a 50% growth in global renewable energy capacity from 2020 to 2025, increasing the demand for effective energy conversion technologies. As the DC-DC converter market is projected to expand substantially, it will reflect its crucial position in backing renewable energy and electric mobility efforts.

The DC-DC converter market is experiencing significant growth due to the rapid development of telecommunications, especially the rising need for wireless connections. An illustration of this is the recent unveiling of a specialized 1,300 W DC-DC converter module for telecom base stations, demonstrating the market's reaction to the demand for efficient power management options. This converter, in a small half-brick size, provides a 28 V output and reaches almost 96% efficiency at maximum load, resulting in a notable decrease in energy usage. Incorporating remote digital control features via a PMBus connection enables improved setup, surveillance, and management, resulting in decreased maintenance expenses and enhanced operational productivity. Efficient DC-DC converters are crucial to guarantee continuous network coverage and reduce operating expenses, as RF power amplifiers in base stations consume the most energy. Also, the converters' capacity to offer flexibility in voltage changes and integrate protective measures against over-voltage and over-current issues demonstrates their crucial importance in supporting the changing telecommunications industry. Aligning advanced DC-DC converter technologies with the requirements of the telecommunications industry is crucial in ensuring the future viability of RF power amplifier applications and boosting market expansion.

DC-DC Converter Market Dynamics

Drivers

-

Innovative technologies are pushing the growth of the DC-DC Converter Market.

The growth of the DC-DC converter market is being majorly propelled by the introduction of advanced technologies like piezoelectric resonators. Recent advancements by scientists have shown that piezoelectric resonators can effectively substitute traditional inductors, resulting in significant enhancements in efficiency and a decrease in the size of power converters. The DB-IPRC demonstrates innovation by achieving a high efficiency of 96.2% while converting voltage from 200 V to 120 V with the help of inductive circuits. This improvement not just upholds the key separation of the converter, but also expands its usefulness to a wider range of gadgets such as TVs, smartphones, tablets, and power tools. Piezoelectric converters can handle power levels in the hundreds of watts due to their capability to operate at high frequencies greater than 100 kHz, allowing them to be used in both low and high-power scenarios. The rise in demand for small, efficient power solutions in industries is expected to drive the DC-DC converter market with the use of piezoelectric technologies, in line with the growth of consumer electronics and renewable energy systems.

-

Increasing need for advanced power solutions in commercial and off-highway vehicles is on the rise.

The growing use of dual-voltage electrical systems in commercial and off-highway vehicles is a major factor driving the DC-DC converter market. Advanced 48-volt DC/DC converters are specifically engineered to function effectively in difficult conditions and offer strong power management solutions. These converters reduce the voltage from 48 volts to 12 volts to support important systems like antilock brakes and power steering, guaranteeing operational dependability even when there is a power outage. These converters are crucial for modern vehicles as they can endure harsh conditions like shock and vibration with an output current capacity of up to 40 amps. The shift towards higher voltage systems not only improves power efficiency but also lessens wire size and weight, tackling important packaging issues in vehicle design. Additionally, incorporating functionalities such as a Controller Area Network (CAN) bus for diagnostic communication is in line with the automotive industry's movement towards smarter and more interconnected vehicle systems. With manufacturers focusing on efficient, durable, and compact power solutions to keep up with the increasing demands of electrification and digitalization in the automotive industry, the DC-DC converter market is expected to experience substantial growth, facilitating the shift towards advanced vehicle technologies.

Restraints

-

Improving Effectiveness with Low-Power Mode Features in DC-DC Converters

DC-DC converters are essential for maximizing energy efficiency, especially in scenarios where power usage needs to be minimized. These converters effectively control voltage levels, enabling devices to function with lower power consumption while still maintaining performance. During periods of reduced power usage, DC-DC converters have the ability to adapt their output to align with the decreased energy demands of devices like portable electronics, IoT gadgets, and battery-operated systems. This feature not only increases the lifespan of the battery but also reduces heat production, which helps in extending the overall durability of the device. Advanced capabilities, like pulse width modulation (PWM) and adaptive voltage scaling, allow these converters to switch smoothly between active and low-power modes, improving operational efficiency. The need for DC-DC converters with low-power capabilities is anticipated to grow as industries place more emphasis on energy efficiency and sustainability. The increase in smart devices and renewable energy applications is driving this trend, as they rely on accurate power management. As a result, the DC-DC converter industry is ready for substantial growth as companies strive to fulfill the changing demands of environmentally conscious customers and sectors, highlighting the crucial role of effective power solutions in today's technological environment.

Segment Outlook of DC-DC Converter Market

by Product

In 2023, the isolated DC-DC converter sector dominated the DC-DC converter market, securing 54.44% of revenue due to its vital function of providing electrical isolation between input and output, improving safety and efficiency across multiple uses. Businesses are actively working on creating innovative isolated DC-DC converters to keep up with the increasing demand in industries like telecommunications, automotive, and renewable energy. A top power management company recently introduced a new high-efficiency isolated DC-DC converter with a 1,500 W output power, including an advanced thermal management system that greatly improves operational reliability in harsh conditions. Another company unveiled a small, standalone converter with PMBus communication features, allowing for remote supervision and control, ultimately cutting down on maintenance expenses in industrial settings. Furthermore, progress in semiconductor technology has enabled manufacturers to create converters with enhanced power density and efficiency, thereby broadening the use cases of isolated DC-DC converters in electric vehicle (EV) charging systems and energy storage solutions. These advancements in products help drive the growth of the segment and highlight the importance of isolated DC-DC converters in the shift towards more intelligent and sustainable systems.

by Input Voltage

The 9-36V input voltage segment dominated the DC-DC converter market in 2023, with 34.22% revenue share, due to its wide usage in telecommunications, automotive, and industrial automation sectors. This variety of products is widely used because it can power a diverse range of devices, from communication tools to electric cars. In 2023, a number of major companies introduced important product releases specifically designed for this range of voltage. For example, a top manufacturer released a new line of small, high-performance DC-DC converters made specifically for use in cars, providing improved thermal control and a strong design able to endure tough operating environments. A different company introduced a 25W converter that functions between 9-36V, with an efficiency of up to 95%, making it appropriate for use in battery-powered devices. Furthermore, a key player in the renewable energy industry launched a 12V to 24V DC-DC converter specifically designed for solar power systems, improving energy conversion efficiency. These advancements not only strengthen the leadership of the 9-36V input voltage range, but also highlight the increasing need for effective power options in various uses.

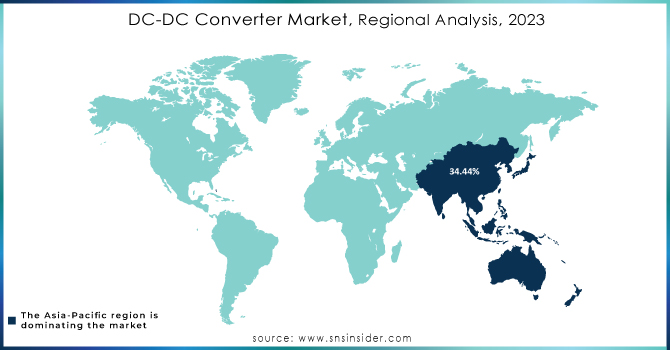

DC-DC Converter Market Regional Analysis

The DC-DC converter market in 2023 saw the Asia-Pacific region leading with a substantial revenue share of 34.44%, fueled by increasing need for energy-efficient electronics in consumer and industrial industries. The area has seen significant investments in renewable energy projects and electric vehicle (EV) initiatives, leading to a strong demand for effective power conversion solutions. An illustration of this is when a top manufacturer in Japan introduced a fresh line of small, high-performing DC-DC converter made specifically for electric cars, including upgraded thermal regulation and increased dependability in tough situations. In the same way, a well-known Chinese company launched a 48V DC-DC converter designed for renewable energy uses, improving energy conversion efficiency for solar and wind installations. Nations such as India are also becoming significant participants, as their government actions support the use of clean energy technologies and boost domestic production of DC-DC converter . The increasing need for advanced power management solutions to support expanding infrastructure is driven by the growing telecommunications and IT sectors, especially in countries such as South Korea and Australia. These advancements demonstrate the Asia-Pacific region's important impact on shaping the worldwide DC-DC converter market, known for its innovation, efficient production methods, and dedication to sustainable energy practices.

In the global market for DC-DC converter , North America stood out as the region with the highest growth rate in 2023. The region's strong embrace of advanced technologies like IoT and digital power management systems is fueling this growth in different industries. The rise in the need for DC-DC converter has been driven by the growing demand for energy-efficient solutions in sectors such as automotive, aerospace, healthcare, and consumer electronics. For example, a leading American company released a state-of-the-art DC-DC converter for electric vehicles, equipped with advanced thermal control to enhance performance in rough environments. Moreover, advancements in surgical instruments which rely on accurate digital power control have also contributed to the rapid expansion of the market. The increasing utilization of DC-DC converter in common electronic devices such as laptops, smartphones, and data centers, along with specific uses in spacecraft power systems and public transportation, is driving the need for these devices. The area's advanced infrastructure, along with investments in renewable energy initiatives and 5G network installations, is also helping to drive market growth. The United States and Canada are leading the way in these advancements, with government backing for clean energy and cutting-edge technology production being essential.

To Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The key players in the Global DC-DC Converter Market include several leading companies offering innovative products to meet the growing demand for efficient power conversion solutions. These players are focusing on advanced technologies and expanding their product portfolios. Some of the major companies include:

-

Flex Ltd (DC-DC Power Module Series)

-

Delta Electronics (Digital Isolated DC-DC Converters)

-

Synqor Inc (Military-Grade DC-DC Converters)

-

Texas Instruments Incorporated (Simple Switcher DC-DC Converters)

-

TDK Lambda Corporation (POL DC-DC Converters)

-

Infineon Technologies AG (High-Efficiency DC-DC Controllers)

-

Thales Group (Aerospace DC-DC Converters)

-

Asp Equipment GmbH (High Power DC-DC Converters)

-

Steel S.P.A (Industrial DC-DC Converters)

-

Microsemi Corporation (US) (Radiation-Hardened DC-DC Converters)

-

Crane Aerospace and Electronics (DC-DC Converters for Aircraft Systems)

-

UTC Aerospace Systems (US) (Space-Grade DC-DC Converters)

-

Vicor Corporation (Modular DC-DC Converters)

-

Artesyn Embedded Power (Open Frame DC-DC Converters)

-

Murata Manufacturing Co., Ltd (Miniature DC-DC Converters)

-

XP Power (High Voltage DC-DC Converters)

-

RECOM Power GmbH (Compact DC-DC Converters)

-

Mean Well Enterprises Co., Ltd (Encapsulated DC-DC Converters)

-

Others

Recent Development

-

In June 2024, Renesas Electronics Corporation completed its acquisition of Transphorm, Inc., enabling Renesas to offer GaN-based power products and reference designs to meet the growing need for wide bandgap (WBG) semiconductor products. WBG materials such as GaN and SiC are seen as crucial technologies for advanced power semiconductors because they offer superior power efficiency, higher switching frequencies, and smaller sizes than traditional silicon devices.

-

In January 2023, Micross Components, Inc., a well-known provider of reliable microelectronic products and services for various industries like space, defense, aerospace, medical, and industrial sectors, revealed the completion of a definitive deal to purchase the DC-DC converter division of Infineon Technologies AG, a leading company in semiconductor power systems and IoT.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.16 Billion |

| Market Size by 2032 | USD 8.21 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Isolated DC-DC Converter, Non-Isolated DC-DC Converter) • By Form Factor (DIP, Box, Discrete, SIP, DIN Rail, Chassis Mount, Brick) • By Input Voltage (<12v>200v) • By Output Power (0.5-9W, 10-29W, 30-99W, 100-250W, 250-500W, 500-1000W, >1000W) • By Output Voltage (<2v>24v) • By Industry (Automotive, Service Robots, Medical, Server, Storage And Network, Energy And Power, Telecommunication, Industrial Robots, Aerospace And Defense, Railway, Consumer Electronics, Marine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Flex Ltd, Delta Electronics, Synqor Inc, Texas Instruments Incorporated, TDK Lambda Corporation, Infineon Technologies AG, Thales Group, Asp Equipment GmbH, Steel S.P.A, Microsemi Corporation (US), Crane Aerospace and Electronics, UTC Aerospace Systems (US), Vicor Corporation, Artesyn Embedded Power, Murata Manufacturing Co., Ltd, XP Power, RECOM Power GmbH, and Mean Well Enterprises Co., Ltd. & Others |

| Key Drivers | • Innovative technologies are pushing the growth of the DC-DC Converter Market. • Increasing need for advanced power solutions in commercial and off-highway vehicles is on the rise. |

| RESTRAINTS | • Improving Effectiveness with Low-Power Mode Features in DC-DC Converters |