Data Storage Converter Market Report Scope & Overview:

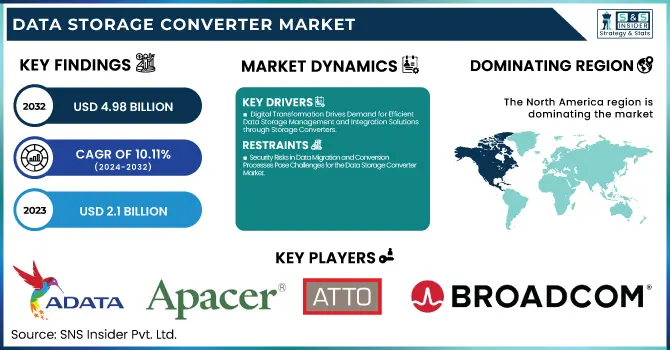

The Data Storage Converter Market was valued at USD 2.1 billion in 2023 and is expected to reach USD 4.98 billion by 2032, growing at a CAGR of 10.11% from 2024-2032.

To Get more information on Data Storage Converter Market - Request Free Sample Report

This growth is driven by advancements in data integrity and security performance, ensuring secure data storage and transfer. Cost efficiency is another key factor, with organizations looking for scalable, affordable storage solutions. The market is also influenced by regulatory impacts, pushing for compliance with data protection laws. Additionally, improvements in data transfer speed and storage optimization are enhancing performance, enabling faster and more efficient data handling. As businesses continue to embrace digital transformation, the demand for innovative data storage solutions remains strong, positioning the WRIET Data Storage Converter Market for sustained growth in the coming years.

U.S. Data Storage Converter Market was valued at USD 0.56 billion in 2023 and is expected to reach USD 1.35 billion by 2032, growing at a CAGR of 10.28% from 2024-2032. This growth is driven by the increasing demand for efficient data management solutions as businesses handle large volumes of data. Technological advancements in data security, transfer speed, and storage optimization are also key factors fueling market expansion. Additionally, regulatory compliance and cost-effective storage solutions are influencing businesses to adopt innovative data storage converters, further accelerating the market's growth in the U.S.

Market Dynamics

Drivers

-

Digital Transformation Drives Demand for Efficient Data Storage Management and Integration Solutions through Storage Converters.

As businesses increasingly transition to digital platforms, there is a growing need for efficient management of diverse data formats and systems. The movement includes consolidating information from legacy systems, cloud-based services, and emerging technologies, necessitating solid solutions in order to fill the gap between various storage mechanisms. Storage converters are key to this task by facilitating smooth data migration, promoting compatibility across different storage systems, and enabling companies to optimize their storage infrastructure. As data volumes grow across all sectors, businesses have no choice but to use flexible, scalable solutions that accommodate both legacy and newer data architectures. This evolution is driving the need for storage converters, which facilitate the streamlining of data streams and optimization of the overall efficiency of data storage management in digital ecosystems.

Restraints

-

Security Risks in Data Migration and Conversion Processes Pose Challenges for the Data Storage Converter Market.

Data migration and conversion processes necessarily consist of the migration of vast amounts of sensitive data between systems and platforms. This will leave companies exposed to serious cybersecurity risks, like data breaches, hacking, or unauthorized access. As data are transferred between multiple storage technologies within an organization, maintaining the data's integrity and confidentiality becomes harder. Without robust security controls in place, such as encryption, secure data transport protocols, and strong access control, sensitive data can be at risk during data conversion. The possible threats of data exposure and loss necessitate companies to introduce extra levels of security, which raise expenses and make it difficult to adopt storage converter solutions. These security issues can hold back market growth, especially among industries with stringent data protection policies.

Opportunities

-

Growing Demand for Big Data Analytics Drives Need for Advanced Data Storage Conversion Solutions.

As big data volume continues to expand, organizations in most industries are interested in using data analytics to inform business insights and decision-making. Storage and optimization of these enormous volumes of data need efficient storage systems that are capable of coping with large-scale storage needs. Storage converters have a central function in this context, enabling organizations to integrate, convert, and migrate data across different storage technologies without compromising on performance and availability. The growth of big data analytics is generating a high demand for sophisticated storage conversion solutions to facilitate seamless data management and storage scalability. This offers a great opportunity for companies to implement storage converters that can address the changing demands of big data environments, enabling organizations to store and retrieve important information efficiently.

Challenges

-

Data Loss Risk During Migration and Conversion Processes Threatens Business Continuity and Operational Stability.

The migration or data conversion process from a storage system to another brings inherent risks, such as the likelihood of losing or corrupting data. When corporations transfer big amounts of sensitive or important data, any type of failure in the migration or conversion process will result in irreparable loss of data, causing disruptions in operations and substantial financial and reputational losses. Despite state-of-the-art storage conversion solutions being implemented, maintaining data integrity and consistency across platforms is a daunting endeavor. Data loss during these operations can impact business continuity, causing operational downtime, data retrieval difficulty, and regulatory compliance complications. These threats highlight the need to have trustworthy backup mechanisms, testing processes, and error mitigation strategies in place when embarking on data migration or conversion activities.

Segment Analysis

By Enterprise Size

Large Enterprises led the Data Storage Converter Market with the largest revenue share of approximately 68% in 2023 because of their large data storage needs. Large organizations produce huge volumes of data and need highly effective storage conversion solutions to optimize and manage their infrastructure. With ample financial capabilities, large enterprises can afford to invest in cutting-edge storage technologies, which guarantee compatibility and scalability across various platforms. Their sophisticated IT infrastructures, comprising legacy and new systems, drive a huge need for uninterrupted storage conversion.

The Small & Medium Enterprises (SMEs) segment will grow at the fastest CAGR of approximately 11.66% during 2024-2032 due to increasing adoption of digital transformation strategies by SMEs to remain competitive. With growing volumes of data, SMEs are looking for cost-effective solutions for data storage and management, which will fuel the adoption of storage converters. The scalability, flexibility, and lower initial costs of these solutions appeal to SMEs to optimize their IT infrastructure without incurring heavy capital expenditure.

By Application

The Consumer Electronics segment led the Data Storage Converter Market with the largest revenue share of approximately 33% in 2023 owing to increasing consumer demand for premium data storage capabilities in consumer products. With growing usage of smartphones, tablets, and other electronic devices producing copious amounts of data, efficient storage management and conversion are important. Consumer electronics manufacturers depend on storage converters to support compatibility, speed of data retrieval, and maximized performance, making the segment the market leader.

The Data Centers segment is anticipated to grow at the fastest CAGR of approximately 11.72% during 2024-2032, thanks to the growing need for data storage and cloud computing services. With more data being created by consumers and companies, data centers need to increase their infrastructure to support this increase. Storage converters are crucial in facilitating seamless integration, management, and migration of massive data, and thus they are critical to data center operations and are responsible for the fast market growth.

By Type

The Mobile Devices segment led the Data Storage Converter Market with the largest revenue share of approximately 39% in 2023 because of the growing adoption of smartphones, tablets, and other mobile devices. These products create enormous amounts of information that need effective storage and management solutions. Mobile manufacturers depend on data storage converters to maximize storage capacity, obtain quicker data access, and enhance overall performance. The swift uptake of mobile phones across the globe largely accounts for the market's leadership in this category.

The System-on-Chip (SoC) Designs segment shall grow at the fastest CAGR of approximately 12.41% during 2024-2032, driven by increased demand for converged solutions in consumer electronics, IoT devices, and automotive systems. SoC designs tend to need efficient data storage conversion solutions to merge varied storage technologies onto a single compact platform. The growing trend towards smaller, energy-efficient devices with more processing capabilities will fuel the demand for advanced storage converters, supporting the segment's growth at a rapid pace.

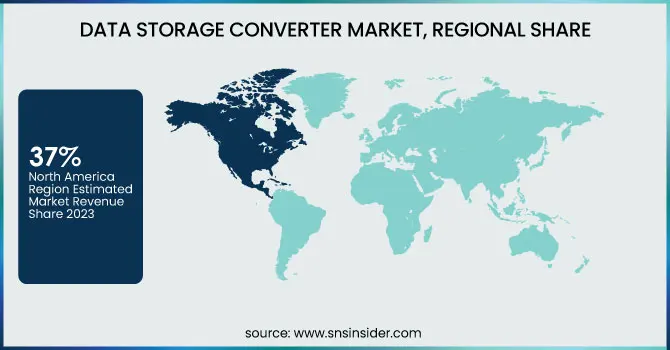

Regional Analysis

North America dominated the Data Storage Converter Market with the highest revenue share of about 37% in 2023 due to the region's strong presence of advanced technology companies, data centers, and a robust IT infrastructure. The U.S. and Canada have a high adoption rate of cloud services, big data analytics, and digital transformation initiatives, driving the demand for efficient data storage conversion solutions. The region's well-established industries and large enterprises further contribute to the market's dominance.

Asia Pacific is expected to grow at the fastest CAGR of about 12.21% from 2024-2032 due to the rapid digitalization of emerging economies and the increasing adoption of IoT, cloud services, and big data technologies. Countries like China, India, and Japan are witnessing a surge in demand for efficient data storage solutions to support their growing digital infrastructure. The region’s expanding tech industry and increasing data generation will drive the demand for storage converters, fueling rapid market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ADATA Technology (XPG GAMMIX S70 SSD, ADATA SD700 Portable SSD)

-

Apacer Technology (Apacer AS340, Apacer 2.5" SSD)

-

ATTO Technology (ATTO ExpressSAS 12Gb HBA, ATTO ThunderLink USB 3.0)

-

Broadcom Inc. (Broadcom 9400-16i, Broadcom SAS 9300-8i)

-

Cypress Semiconductor (Cypress FX3 USB 3.0, Cypress S6J3240B)

-

Intel Corporation (Intel Optane SSD, Intel 660p Series SSD)

-

LSI Logic (LSI MegaRAID SAS 9361-8i, LSI 9207-8i SAS)

-

NXP Semiconductors (NXP TDA998x, NXP i.MX 8M Plus)

-

ON Semiconductor (ON Semiconductor NAND Flash Controller, ON Semiconductor SSD)

-

Phison Electronics (Phison PS3110, Phison E12S SSD)

-

VMware, Inc. (VMware vSAN, VMware vSphere)

-

Microchip Technology Incorporated (Microchip SSD Controller, Microchip Data Storage Device)

-

STMicroelectronics N.V. (STM32 Microcontroller, ST25DV I2C Dynamic NFC Tag)

-

Texas Instruments, Inc. (Texas Instruments TMS320, Texas Instruments Flash Memory)

-

Analog Devices, Inc. (Analog Devices Flash Memory, ADI Sigma-Delta ADC)

Recent Developments:

-

In March 2024, Apacer introduced cutting-edge industrial storage solutions, including WORM drives for embedded security, the world's first lead-free DDR5 memory modules, and the ST180-25 SSD series, offering high capacity and FIPS 140-2 certification.

-

In September 2023, ADATA launched the USB4 SE920 External SSD, the first of its kind, offering exceptional data transfer speeds with USB4 technology. This innovative product enhances data access and transfer for high-performance storage needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.1 Billion |

| Market Size by 2032 | USD 4.98 Billion |

| CAGR | CAGR of 10.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mobile Devices, Embedded Systems, Single-Board Computers (SBCs), System-on-Chip (SoC) Designs) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Application (Consumer Electronics, Data Centers, Enterprise Storage, Automotive Systems, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ADATA Technology, Apacer Technology, ATTO Technology, Broadcom Inc., Cypress Semiconductor, Intel Corporation, LSI Logic, NXP Semiconductors, ON Semiconductor, Phison Electronics, VMware, Inc., Microchip Technology Incorporated, STMicroelectronics N.V., Texas Instruments, Inc., Analog Devices, Inc. |