Contract Lifecycle Management (CLM) Software Market Report Scope & Overview:

Get More Information on Contract Lifecycle Management (CLM) Software Market - Request Sample Report

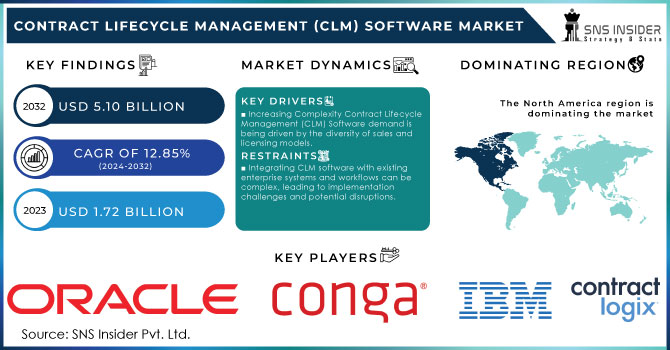

The Contract Lifecycle Management (CLM) Software Market Size was recorded at USD 1.72 Billion in 2023 and is expected to surpass USD 5.10 Billion by 2032, growing at a CAGR of 12.85 % over the forecast period 2024-2032

The contract lifecycle management software market has recorded tremendous growth over the past years. With businesses troubled over growing numbers of contracts, demand has similarly surged for proficient and customized software that will help organize the creation, negotiation, execution, and management of contracts. For instance, it halves the time for the contract lifecycle and reduces administrative overhead by 25-30%. In addition, compliance improves by more than 50%. Moreover, cloud-based CLM software will now propagate adoption through industries by employing easy-to-use UI and seamless integration into already existing CLM systems. For instance, based on a study by various companies, it is observed that using the CLM can save about 2-5% of the loss incurred over inaccuracies and non-compliance, and also speed up the negotiation cycle by 50%.

This market is characterized by several factors, including tighter laws, expensive compliance measures, and a further need for risks to be reduced concerning operational efficiency and contract violations. There are several alternatives of contract lifecycle management software in the market that any firm, from a startup to an enterprise, can use. To assist businesses optimize their return on investment from contractual agreements, innovators in this field have introduced improved features including AI contract analysis, workflow automation, and enriched analytics, among others. For Instance, Various software are booming the LCM software market such as Agiloft contract management suite, DocuSign, SpringCM, ContractPodAI, SportDraft, etc. Their significant performance in reducing the management risk reduces the time involved in legal actions and helps to close the contracts in less time. Targeting the needs of general counsel and C-level executives, CLM software facilitates contract creation, management, and analysis, supporting complex business operations and benefiting from government investments in legal technologies. For Instance, the U.S. Federal court has heavily invested in Electronic case filing, AI, and ML. Along with that, to regulate the proper functioning of Contract lifecycle Management software; the U.S. govt. has also enacted laws such as Arbanes-Oxley (SOX), Dodd-Frank, and Federal Acquisition Regulations (FAR).

Merger & Acquisition activities have increased within the industry, with giants expanding their market share and product offerings. For instance, Icertis, a leading CLM platform provider, announced acquiring Evisort, a contract intelligence company known for its AI drive, on September 27. This strategic move is poised to widen Icertis' capability to deliver scalable AI solutions to CLM while reinforcing its market leadership. Furthermore, the integration of new technologies, like blockchain and natural language processing, is altering the dynamics of the industry. Though the contract lifecycle management software market presents an immense opportunity to grow, data security, integration complexities, and updating of software at frequent intervals are some of the challenges. Because businesses realize the strategic importance of contract management, this will continue to fuel the growth of the contract lifecycle management software market for many years to come.

Market Dynamics

Drivers:

-

Increasing Complexity Contract Lifecycle Management (CLM) Software demand is being driven by the diversity of sales and licensing models.

-

Organizations seek CLM solutions to streamline contract processes, reduce manual errors, and achieve cost savings through better contract management.

-

The shift towards digitalization and automation in business processes fuels the demand for CLM software to improve operational efficiency and collaboration.

-

With the complexity of contracts increasing, including multi-party agreements and global operations, CLM software helps manage diverse contract types effectively.

The rising complexity of business characterized by increasing job pressure, challenges of digital transformation, information management, compliance pressures, and hybrid work environments is dramatically driving up demand for Contract Lifecycle Management software. More and more organizations recognize the need for such tools to help an organization efficiently and effectively manage its contracts, as they aid in process streamlining, collaboration, and compliance in the setting of a complicated and complex business environment. For Instance, software such as DocuSign, Conga, Icertis, SAP Ariba, etc. is some that help organizations with price management, writing contracts, and reducing the risk associated with compliance and regulation-related contracts.

Restraints:

-

Integrating CLM software with existing enterprise systems and workflows can be complex, leading to implementation challenges and potential disruptions.

-

Data security and privacy issues related to storing sensitive contract information in cloud-based CLM platforms may raise concerns among enterprises, especially in highly regulated sectors.

-

Choosing the right CLM vendor that aligns with specific business requirements and offers scalable solutions can be challenging, affecting adoption rates.

Market segmentation

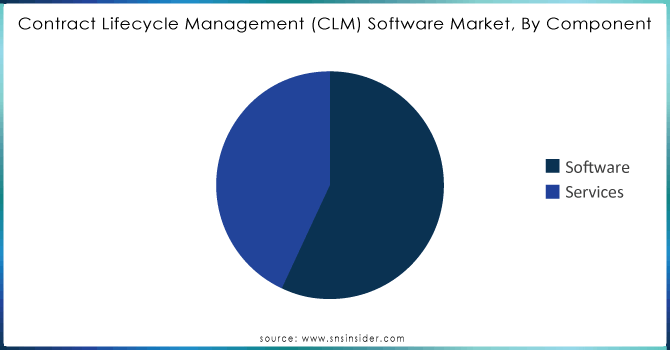

By Component

The contract management software market is anticipated to be largely dominated by the software segment with a holding share of more than 57% of the market share in 2023. This segment facilitates the efficient execution of contracts and specific tasks through configurable instructions, data, and programs. These software applications come equipped with diverse templates and clauses, enabling the assembly of contracts based on various criteria such as products, regions, and services. For Instance, poor contracts lead to a loss of around 9% of their annual revenue, and around 40% of their contract’s value is lost due to close governance. So, for all that specific software designed such as Icertis, Agiloft, SportDraft, etc that can help to reduce the contract lifecycle time by 25-30% and improve compliance by more than 52%. Advanced contract management software allows end users to automatically generate contracts based on specific business needs and perform bulk data uploads, contributing significantly to the widespread adoption of software in contract management solutions.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Organization Size

Based on organization size, small and medium-sized enterprises (SMEs) held the dominant position with more than 56% of the market share in 2023. These companies prioritize cost-effective solutions to optimize their limited contract management budgets. SMEs manage fewer contracts, allowing for manual supervision and cost savings on software, although they may lack aggressive contract management strategies due to the lower impact of postponing contracts. Large enterprises are increasingly adopting contract lifecycle management to automate structured processes, especially given their higher volume of collaborations and transactions compared to SMEs, aiming to enhance efficiency and reduce administrative costs.

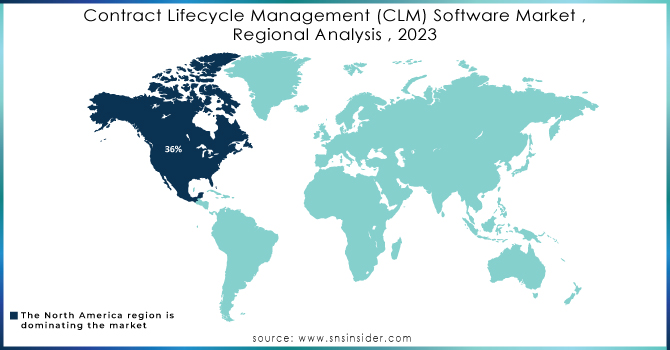

Regional Analysis

Regional Analysis

The North American region held the dominant position with more than 36% of the revenue share in 2023 and is poised to maintain its dominance during the forecast period due to the presence of key industry players in the region. The well-established BFSI, IT, and healthcare sectors in North America offer substantial opportunities for contract management solution providers, with organizations emphasizing systematic contract management for transparency.

In Addition, another major driving factor came from the growth of key regional players. Some of the major players in the region include Icertis, Coupa, Apttus, Zycus, and SAP SE, etc. Key players deploy high expenditure in research and development to integrate innovative technological characteristics into their solutions to give an improved customer experience. Fortunately, these customers have also grown their CLM solution purchases. He pointed out one addition of further momentum and innovation in the flagship solutions of Conga, which includes the release of its AI-infused platform, Conga Contract Intelligence, in April 2022 helmed by former DocuSign executive Peter Li, which are enabled with the latest technologies like Artificial Intelligence, ML, and its likes.

The Asia Pacific contract management software market is anticipated to grow with a significant growth rate driven by increasing demand for automated contract modifications, a shift towards cloud services, and the integration of advanced technologies to enhance operational efficiency.

Key Players

The major key players are Conga, Contract Logix LLC, Coupa Software Inc., Icertis, Oracle Corporation, SAP SE, IBM Corporation, Determine Inc., DocuSign Inc., GEP Worldwide, Corridor Company Inc., and other players mentioned in the final report

| Report Attributes | Details |

| Market Size in 2023 |

US$ 1.72 Bn |

| Market Size by 2032 |

US$ 5.10 Bn |

| CAGR |

CAGR of 12.85 % From 2024 to 2032 |

| Base Year |

2022 |

| Forecast Period |

2024-2032 |

| Historical Data |

2020-2022 |

| Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Software, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Conga, CLM Matrix, Contract Logix, LLC, Coupa Software Inc., Gatekeeper, Icertis, Integreon, Inc., Newgen Software Technologies Limited, Oracle Corporation, Zycus Inc. |

| Key Drivers |

• Contract Lifecycle Management Software Adoption Driven by Changing Legal Compliances. • Increasing Complexity Contract Lifecycle Management (CLM) Software demand is being driven by the diversity of sales and licensing models. • Organizations seek CLM solutions to streamline contract processes, reduce manual errors, and achieve cost savings through better contract management. |

| Market Challenges |

• Integrating CLM software with existing enterprise systems and workflows can be complex, leading to implementation challenges and potential disruptions. |