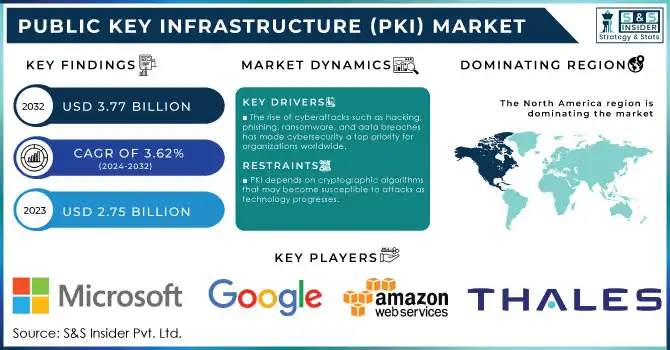

Public Key Infrastructure (PKI) Market Key Insights:

The Public Key Infrastructure (PKI) Market size was valued at USD 2.75 Billion in 2023 and is expected to reach USD 3.77 Billion by 2032, growing at a CAGR of 3.62% over the forecast period 2024-2032.

To Get More Information on Public Key Infrastructure (PKI) Market - Request Sample Report

The Public Key Infrastructure (PKI) market has experienced significant growth, driven by increasing concerns over cybersecurity threats, data breaches, and the widespread adoption of digital transformation strategies across industries. A major factor fueling the expansion of the PKI market is the surge in digital transactions, which has intensified the demand for secure online environments. The rapid growth of global digital payments market is projected to reach USD 525 billion by 2032 according to S&S Insider Research, which directly influences the PKI market. As digital payments continue to rise, with two-thirds of adults worldwide using them and digital wallets accounting for 49% of global e-commerce sales, the need for secure authentication systems, encryption solutions, and digital signature management becomes more critical. With central banks exploring central bank digital currencies (CBDCs), the demand for PKI solutions to secure these digital assets is growing. In the U.S., the dominance of digital wallets like PayPal, Apple Pay, and Venmo further amplifies the need for robust PKI solutions to protect user data and financial transactions. Additionally, with 76% of adults worldwide having access to a bank account or mobile money services, there is an increased reliance on secure digital identity systems, which are enabled by PKI. As more consumers embrace cashless transactions and e-commerce, the PKI market is poised for continued growth, as the need for advanced security infrastructure rises.

With the ongoing proliferation of online banking, mobile payments, and e-commerce platforms, the demand for secure digital identities and encrypted transactions has never been more pronounced. PKI is essential in securing email communications, protecting sensitive information exchanged between individuals or organizations, and ensuring that email content remains tamper-proof. The PKI market is crucial to meeting the growing need for cybersecurity solutions, ensuring the safe and seamless digital experiences that are now an integral part of daily life.

Market Dynamics

Drivers

- The rise of cyberattacks such as hacking, phishing, ransomware, and data breaches has made cybersecurity a top priority for organizations worldwide.

Public Key Infrastructure (PKI) offers a strong solution for encryption, digital signatures, and secure communication, aiding organizations in protecting their data. PKI guarantees the confidentiality, integrity, and authenticity of information shared online, serving as an essential safeguard against cyber threats. As cyber threats advance and become increasingly complex, the need for PKI solutions is anticipated to rise substantially. Organizations in sectors such as finance, healthcare, government, and e-commerce are increasingly implementing PKI to safeguard their confidential data. For example, financial entities must safeguard transactions and keep customer information safe, while healthcare organizations are required to adhere to stringent rules like HIPAA, guaranteeing that patient information stays protected. The increasing frequency of attacks aimed at sensitive personal and business information has prompted organizations to pursue more sophisticated security systems, aiding in the growth of the PKI market.

- The rapid growth of e-commerce and the increasing number of digital transactions are creating a greater need for secure communication and transactions.

E-commerce sites and online payment systems need to safeguard sensitive customer data, like credit card information, from fraudsters and hackers. PKI plays a crucial role in safeguarding online transactions by utilizing digital signatures and encryption techniques. This guarantees that customers' details are safeguarded during online transactions and that the authenticity and integrity of the payment are preserved. As an increasing number of shoppers turn to online purchases and companies enhance their online visibility, the dependence on secure payment systems escalates. PKI offers a reliable method for digital signatures, SSL/TLS certificates, and encryption, essential for protecting e-commerce platforms. The rising number of digital transactions and consumers' dependence on digital services will keep driving the expansion of the PKI market.

Restraints

- PKI depends on cryptographic algorithms that may become susceptible to attacks as technology progresses.

With the rise in computational power and the advancement of techniques for breaking encryption, algorithms that were once secure might become vulnerable to attacks. This has raised worries regarding the enduring safety of PKI systems, particularly with the emergence of quantum computing, which presents a possible risk to existing cryptographic techniques. The requirement to periodically update and substitute cryptographic algorithms introduces extra complexity and possible expenses for organizations employing PKI. Shifting to more secure algorithms demands careful planning and testing to confirm compatibility with current infrastructure and to prevent disruptions in business operations. This persistent issue restricts the long-term viability of PKI solutions, particularly if new vulnerabilities arise that necessitate regular updates or substitutions.

Key Segmentation Analysis

By Component

Hardware Security Modules (HSMs) led the public key infrastructure (PKI) market in 2023 with a 45% market share because of their essential function in delivering strong security for cryptographic processes. HSMs are tangible devices utilized to securely generate, store, and manage digital keys. Firms such as Thales, Gemalto, and SafeNet provide sophisticated HSM solutions for secure identity management, digital signatures, and encryption services. For instance, banks utilize Thales’ HSM solutions for secure transactions and in cloud settings to guarantee safe key management and authentication procedures. The significant market share of HSMs demonstrates their essential position in maintaining cybersecurity in PKI systems.

The services segment is projected to become the fastest-growing from 2024 to 2032 fueled by the rising demand for specialized security services that enhance PKI solutions, such as managed PKI, consulting, and system integration services. As organizations confront changing cyber threats and regulatory demands, the need for proficiency in deploying, overseeing, and enhancing PKI systems is growing. Businesses providing PKI services, including DigiCert, Entrust, and GlobalSign, are experiencing greater uptake of their managed services and cloud-oriented PKI solutions. For instance, DigiCert offers managed PKI solutions to secure digital certificates and bolster encryption features for corporations, online retail sites, and governmental bodies.

By Deployment mode

On-premises PKI deployment dominated the market with a 54% market share in 2023, driven by its ability to provide organizations with full control over their security infrastructure. On-premises PKI offers more customized solutions and direct oversight of key management, which can be crucial for organizations handling sensitive information. However, the upfront investment and maintenance costs are higher compared to cloud deployment. Companies like Entrust and Venafi offer on-premises PKI solutions, allowing enterprises to manage digital certificates and secure internal communication systems with a focus on compliance and privacy.

Cloud deployment is projected to have the fastest CAGR during 2024-2032, due to its flexibility, scalability, and cost-effectiveness. In cloud-based PKI solutions, the infrastructure is hosted on remote servers, making it accessible from anywhere and reducing the need for organizations to manage on-site hardware. The growing adoption of cloud computing and the rise of hybrid working models have significantly contributed to the expansion of this segment. Companies such as GlobalSign and DigiCert provide cloud-based PKI solutions, offering certificate management and secure digital identities for organizations across industries like healthcare, finance, and e-commerce.

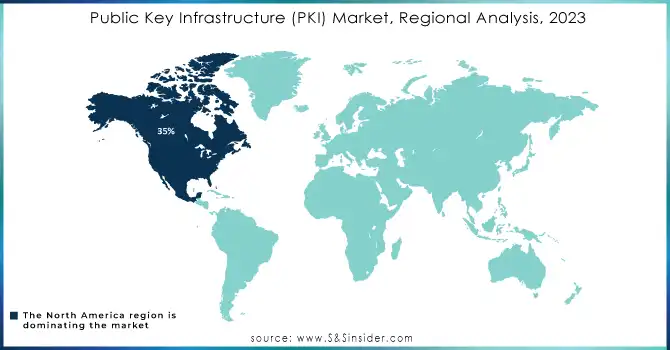

Regional Analysis

In 2023, North America dominated with a 35% market share in the public key infrastructure (PKI) market. The main factors behind this dominance consist of an established digital infrastructure, strong regulatory frameworks, and significant demand from crucial sectors like banking, financial services, healthcare, and telecommunications. Firms such as Verisign and Comodo have leveraged this need by providing extensive PKI services, which encompass secure online transaction systems and digital signatures. Verisign, for example, is a key provider of PKI solutions for SSL/TLS certificates, whereas Entrust Datacard delivers certificate authority services that cater to sectors such as BFSI and government.

Asia-Pacific is expected to see the fastest expansion from 2024 to 2032 fueled by elements like rising digitalization, the escalating incidence of cybersecurity risks, and the area's large population, which necessitates secure communication and data safeguarding. Nations such as China, India, and Australia are rising as significant contributors to PKI adoption, particularly in industries like telecommunications, IT, and government services. DigiCert and GlobalSign are broadening their presence in the area by providing scalable cloud-driven PKI solutions that serve both local and international companies. The growing adoption of IoT devices, along with changes in regulations such as GDPR compliance, also enhances the need for PKI solutions to protect digital identities and communications.

Do You Need any Customization Research on Public Key Infrastructure (PKI) Market - Inquire Now

Key Players

The major key players in the Public Key Infrastructure (PKI) Market are:

-

Google LLC (Google Cloud Identity Platform, Google Cloud Key Management)

-

Thales Group (Thales CipherTrust Cloud Key Manager, Thales SafeNet Data Protection)

-

DigiCert, Inc. (DigiCert SSL Certificates, DigiCert Identity & Trust Solutions)

-

Microsoft Corporation (Microsoft Azure Key Vault, Microsoft PKI)

-

Wisekey Incrypt (Wisekey Digital Identity, Wisekey PKI solutions)

-

HID Global (HID ActivID Authentication, HID DigitalPersona)

-

International Business Machines Corporation (IBM) (IBM Cloud Hyper Protect, IBM Security Key Lifecycle Manager)

-

Softlock (Softlock PKI, Softlock Digital Signing Service)

-

SSL.com (SSL Certificates, SSL Code Signing Certificates)

-

Enigma Systemy Ochrony Informacji Sp. Z O.O. (Enigma CA, Enigma PKI Service)

-

Amazon Web Services, Inc. (AWS Key Management Service, AWS CloudHSM)

-

HID Global Corporation (HID SafeNet, HID Identity Assurance)

-

Blue Ridge Networks (Blue Ridge VPN, Blue Ridge Identity Management)

-

LAWtrust (LAWtrust Digital Certificates, LAWtrust PKI Solutions)

-

Comodo Group (Comodo SSL Certificates, Comodo EV SSL)

-

GlobalSign (GlobalSign SSL, GlobalSign Identity & Access Management)

-

Sectigo (Sectigo SSL, Sectigo Code Signing Certificates)

-

Entrust (Entrust SSL, Entrust Certificate Services)

-

Trustwave (Trustwave SSL Certificates, Trustwave Digital Signature)

-

Venafi (Venafi Trust Protection Platform, Venafi Cloud Security)

Providers of software to these key players:

-

Red Hat (Red Hat Enterprise Linux, Red Hat OpenShift)

-

Symantec (Symantec Endpoint Protection, Symantec Web Security Service)

-

Amazon Web Services (AWS) (AWS Key Management Service, AWS CloudHSM)

-

VMware (VMware vSphere, VMware NSX)

-

Oracle Corporation (Oracle Cloud Infrastructure, Oracle Identity Management)

-

F5 Networks (F5 BIG-IP, F5 SSL Orchestrator)

-

Cisco Systems (Cisco Identity Services Engine, Cisco AnyConnect Secure Mobility)

-

Fortinet (FortiGate Firewalls, FortiAuthenticator)

-

A10 Networks (A10 Thunder SSLi, A10 Harmony Controller)

-

Micro Focus (Micro Focus NetIQ, Micro Focus SecureLogin)

Recent Developments

-

July 2024: Blue Ridge introduced solutions focused on securing IoT devices with advanced certificate management techniques, enabling enterprises to scale their digital security measures across connected devices.

-

August 2023: Digicert expanded its portfolio with new capabilities focused on automating the management of certificates across enterprises. This includes features for IoT device certificate lifecycle management and enhancing overall certificate security.

-

September 2023: AWS made several improvements to its Private Certificate Authority (CA) service, which now includes better integration with AWS services to streamline PKI setup, issuance, and management of digital certificates.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.09 Billion |

| Market Size by 2032 | USD 25.01 Billion |

| CAGR | CAGR of 19.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware Security Modules (HSM), Solutions, Services) • By Deployment Mode (Cloud, On-Premises) • By Services (Professional, Managed) • By Organization Size (Large Enterprises, SMEs) • By Application (Web Browsing Security, Email Security, Secure Communication, Authentication) • By Vertical (BFSI, Government and Defense, IT and Telecom, Retail, Healthcare, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google LLC, Thales Group, DigiCert, Inc., Microsoft Corporation, Wisekey Incrypt, HID Global, International Business Machines Corporation, Softlock, SSL.com, Enigma Systemy Ochrony Informacji Sp. Z O.O., Amazon Web Services, Inc., HID Global Corporation, Blue Ridge Networks, LAWtrust, Comodo Group, GlobalSign, Sectigo, Entrust, Trustwave, Venafi |

| Key Drivers | • The rise of cyberattacks such as hacking, phishing, ransomware, and data breaches has made cybersecurity a top priority for organizations worldwide. • The rapid growth of e-commerce and the increasing number of digital transactions are creating a greater need for secure communication and transactions. |

| RESTRAINTS | • PKI depends on cryptographic algorithms that may become susceptible to attacks as technology progresses. |