Influencer Marketing Platform Market Report Scope & Overview:

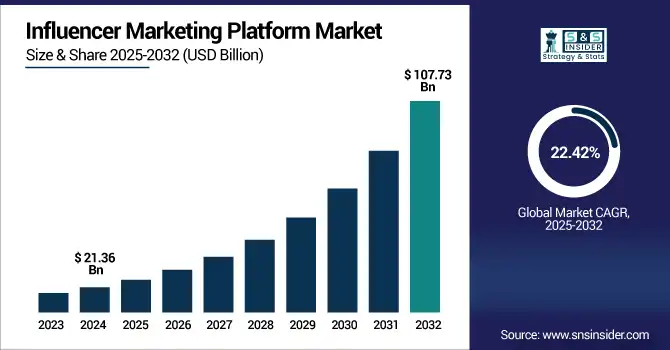

The influencer marketing platform market size was valued at USD 21.36 billion in 2024 and is expected to reach USD 107.73 billion by 2032, expanding at a CAGR of 22.42% over the forecast period of 2025-2032.

To Get more information on Influencer Marketing Platform Market - Request Free Sample Report

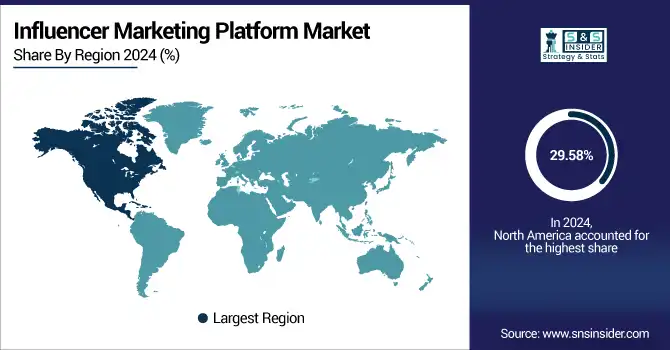

The Influencer Marketing Platform Market is growing rapidly as brands adopt influencer-led campaigns for authentic, targeted engagement. These platforms provide campaign management, influencer discovery tools, analytics, and ROI measurement tools. Growth is buoyed by an increase in digital ad budgets and the influence of social media platforms, including Instagram, TikTok, and YouTube. Usage is generally dominated by large enterprises, while small and medium-sized enterprises (SMEs) are in the developing phase of using micro-influencer strategies. Fashion & lifestyle, food, travel, and fitness are frontrunners in the adaptation. North America dominates due to a more developed digital ecology, and Asia Pacific is the fastest growing, with mobile-first consumers and surging influencer action.

According to research, influencer-led campaigns generate twice the conversion rates of traditional ads, with analytics-enabled platforms boosting purchase intent by 23%. In 2024, nano-influencers delivered 4x engagement at 78% lower costs, while micro-influencers captured 35% of total campaign budgets.

The U.S. influencer marketing platform market size reached USD 4.69 billion in 2024 and is expected to reach USD 21.78 billion in 2032 at a CAGR of 21.17% over 2025-2032.

The U.S. dominates the Influencer Marketing Platform Market due to its developed digital infrastructure, high social media penetration, and global brands having their presence in the US with significant digital ad spend. The U.S. is where some of the major platforms, including Instagram, TikTok, and YouTube, are based and are critical to influencer campaigns. Meanwhile, there is Influencer marketing agencies and tech startups making the direction of the platform evolution. Some factors driving the market are growing demand for genuine brand storytelling, growing usage of data-driven influencer analytics, and preference for micro and nano influencers for laser-focused targeting.

Market Dynamics:

Drivers:

-

Increasing Shift Toward Data-Driven Influencer Campaigns Enhances Platform Integration and Adoption Across Enterprises

The explosion of being able to prove ROI and demonstrate performance transparency has driven brands to leverage influencer marketing technologies, which offer instant analytics, engagement data, and audience intelligence. Businesses are using AI-powered tools to find the right influencers, measure KPIs, and analyze the effectiveness of campaigns. Three years later, through 2024, new technology companies, such as GRIN and CreatorIQ, launched advanced reporting dashboards to drive predictive analytics to maximize campaign value.

According to research, in 2024, 72% of marketers reported improved ROI attribution and campaign visibility through influencer marketing platforms, while platforms integrated with CRM and first-party data achieved 35% higher engagement rates due to enhanced audience targeting and personalized outreach.

Restraints:

-

Growing Concerns Over Fake Followers and Engagement Fraud Restrict Platform Trust Among Brand Marketers

One of the main barriers to platform growth is the continued challenge of influencer fraud, specifically fake followers, fraudulent engagement figures and bot activity. This erodes brand confidence, marketers are skeptical of whether their campaigns are authentic and return on investment. There are technical advances, but there are still many platforms that cannot accurately screen out malicious users or maintain ethical standards. In recent years, brands have been asking for more stringent vetting processes. There is still a clear need for more sophisticated fraud detection technology and public influencer databases.

Opportunities:

-

Rising Adoption of Micro and Nano Influencers Opens Scalable Opportunities for Niche and Localized Campaign Strategies

As brands shift toward authenticity and personalized engagement, micro and nano influencers are gaining prominence for their strong community connections and cost-effectiveness. Platforms are now supporting expanded databases and tailored campaign tools for smaller influencers. In 2025, Upfluence and Tagger Media will release the ability to better dig into the audience's demographics and local-market insights. This change allows SMBs to conduct hyper-targeted campaigns that can convert at increased rates. It also widens the pool of potential users for influencer platforms, which can deliver scalable campaigns that do not rely on celebrity-led endorsements.

Challenges:

-

Difficulty in Measuring Long-Term Brand Impact from Influencer Collaborations, Challenges Platform ROI Justification

The tools of the influencer platforms are made for immediate metrics including impressions and click tracking. Most companies have a hard time determining the return of influencer-generated brand equity, customer retention, or lifetime value. This is especially challenging for awareness-targeted campaigns. While some platforms have started to integrate with CRM and eCommerce programs, full attribution models are still relatively undeveloped. Without this visibility, marketing teams may also underinvest in influencer strategies or overindex in channels with clearer ROI tracking, stifling the market’s long-term growth.

Segment Analysis

By Application

Search & Discovery held a 34.57% share in 2024 in the applications segment. This is largely due to the rise of demand for brands in search of influencers who are relevant to their target audience with good engagement rates. influencer marketing platform market companies including Aspire and Heepsy are enhancing AI-driven search features to help marketers more easily find niche influencers to work with. The explosion of influencer variety (micro, macro, and nano, alike) is also driving the market demand of strong discovery tools that help better influencer-fit and stronger ROI from campaigns.

The Influencer Management market is projected to grow at the fastest CAGR of 23.84%. The brands and agencies are looking for platforms with strong CRM-like features to handle influencer relationships, tracking, and performance insights. CreatorIQ and Influencity are some of the companies that brought automated workflow and contract management tools to facilitate campaigns. Increasing complexity in multi-platform influencer campaigns, coupled with demand for long-term influencer relationships, is also contributing to the rise in the sector.

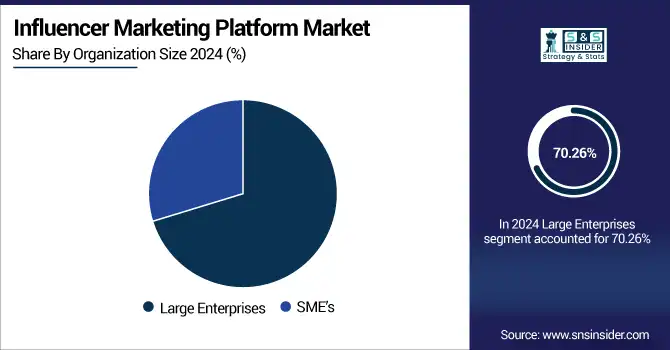

By Organization Size

Large Enterprises held the largest influencer marketing platform market share at 70.26% in 2024 due to their higher marketing budgets and global campaign requirements. These enterprises prioritize data-driven influencer partnerships and use platforms including Traackr and Tagger to conduct granular performance analyses and cross-platform reporting. The shift toward brand authenticity and reputation management also drives the adoption of comprehensive influencer solutions by established brands.

SMEs are the fastest-growing segment, registering a CAGR of 23.38% during the projection period. With the rise of digitalisation, even smaller players now understand the value of money and engagement offered by influencer marketing. Companies are now even offering scalable subscription models designed specifically for SME’s via platforms, such as Upfluence and Shoutcart. With the advent of affordable, easy-to-use platforms becoming more and more accessible to the business owner, along with the whole nano-influencing trend, the smallest of companies can now have a campaign that has performance indicators in place.

By End-Use

Fashion & Lifestyle accounted for the largest revenue share at 27.18% in 2024, driven by its visually appealing content and influencer dominance across platforms including Instagram, TikTok, and Pinterest. Platforms including LTK and RewardStyle are catering specifically to fashion brands by offering influencer marketplaces, affiliate integrations, and real-time analytics. This segment thrives on trend-driven consumer engagement, making influencer partnerships critical for seasonal campaigns and product launches.

Sports & Fitness is projected to expand at the fastest CAGR of 24.40% through the forecast period. Fitness influencers and athletes are leveraging platforms including Fitfluence and Gymfluencers to promote activewear, supplements, and wellness products. The global rise of health consciousness and the surge in home workouts post-pandemic have increased engagement with fitness content. Brands are prioritizing partnerships with performance-driven influencers who embody authenticity, further propelling growth in this segment.

Regional Analysis

North America dominated the Influencer Marketing Platform Market in 2024, accounting for 29.58% of the total revenue share. The leadership in the region is driven by the consumption of digital media, which is the highest, a well-matured ecosystem of influencers, and usage of platforms including CreatorIQ and Tagger. Largely robust demand through fashion, tech, and beauty verticals; the presence of global social media titans is a constant driver of influencer marketing platform market growth. Influencer infrastructure in North America is uniquely powerful, and the U.S. is the strongest country with significant engagement rates on content and vibrant partnerships with top-level influencers especially on Instagram and TikTok.

Europe continues to establish itself with influencer marketing platforms as increasing numbers of content creators enter the space and brands are looking to ensure transparency in their digital partnerships. Leading this influencer marketing platform trend are the U.K., Germany, and France, where brands are combining influencer campaigns primarily in fashion, travel, and sustainable goods. The U.K. is leading the charge in Europe, with its wide pool of influencers, established digital marketing and influencer marketing platform industry, and early adoption of data analytics to drive influencer outreach strategies.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR of 25.37%. Fueling the surge is the widespread adoption of smartphones, the appetite for short video clips, and high engagement among younger users. In China, India, South Korea, and elsewhere, demand is strong among the fashion, gaming & personal care industries, where SMEs have particularly leveraged influencers and driven the growth of social commerce. China dominates the region with huge engagement on platforms such as WeChat and Xiaohongshu, heavy government support for its e-commerce industry, and strong influencer-brand integration across lifestyle and tech campaigns.

The Middle East & Africa and Latin America are growing with higher intensity driven by increasing social media usage, mobile commerce, and brands’ interest in youth-targeted promotion campaigns. The UAE and Brazil are forerunners in the region due to a developed digital environment, numerous influencers, and fast-growing platform adoption rates for fashion, beauty, food, and lifestyle marketing.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key players of the Influencer Marketing Platform Market are Dentsu Group, Grin Technologies Inc., Upfluence, AspireIQ, Inc., Later (Powered by Mavrck), Traackr, Inc., Klear (Meltwater), SocialEdge Inc. (CreatorIQ), Brandwatch, Neoreach, and others.

Key Developments

-

In November 2024, GRIN partnered with CreatorCommerce to launch co-branded “creator shops” on its platform, enabling brands to deliver personalized shopping experiences. This integration boosted affiliate conversion rates by 2–3×, aligning influencer content with e-commerce functionality.

-

In April 2025, Upfluence introduced an AI-powered Influencer Marketplace driven by Jace AI, giving brands access to over 12 million creators and enabling campaign launches within hours based on real-time performance metrics.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.36 Billion |

| Market Size by 2032 | USD 107.73 Billion |

| CAGR | CAGR of 22.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Campaign Management, Search & Discovery, Analytics & Reporting, Influencer Management) •By Organization Size (Large Enterprises, SME’s) •By End Use Food & Entertainment, Sports & Fitness, Travel & Holiday, Fashion & Lifestyle, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Dentsu Group, Grin Technologies Inc., Upfluence, AspireIQ, Inc., Later (Powered by Mavrck), Traackr, Inc., Klear (Meltwater), SocialEdge Inc. (CreatorIQ), Brandwatch, Neoreach |