Data Warehouse as a Service Market Analysis & Overview:

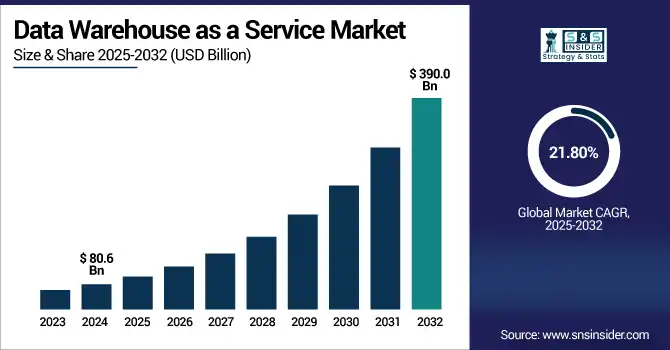

The data warehouse as a service market size was valued at USD 80.6 billion in 2024 and is expected to reach USD 390.0 billion by 2032, growing at a CAGR of 21.80% during 2025-2032.

To Get more information on Data Warehouse as a Service Market- Request Free Sample Report

Data Warehouse as a Service (DWaaS) Market growth is fueled by the rise in demand for scalable, flexible, and cost-effective cloud-based data management solutions promotes the market growth of Data Warehouse as a Service (DWaaS) Market. In this context, DWaaS solutions are advantageous in terms of real-time analytics, quicker deployment, and lower cost of maintenance compared to traditional on-premise infrastructure, thereby causing organizations to shift away from legacy systems. Then there is the ever-increasing amount of both unstructured and structured data that is being produced across sectors, fueling the requirement for agile data warehousing solutions. Mid-market enterprises are adopting DWaaS as it is available on a subscription basis, and there is no need for large upfront investments. Furthermore, the data stored in DWaaS is powered by AI, machine learning, and big data analytics customizations on top of the platform. Within the next decade, the market is likely to see increased growth largely due to demand stemming from sectors such as BFSI, healthcare, retail, and IT. Further adoption will be accelerated by hybrid cloud integration and security improvements.

Data Warehouse as a Service (DWaaS) Market trend in the U.S. is witnessing strong momentum due to early adoption of scalable cloud-based analytics platforms among BFSI, healthcare, and retail sectors. As organizations transition from legacy systems to modern cloud architectures, the need for support of real-time data integration, AI/ML integration, and cost-effectiveness is only continuing to increase. The U.S. market was valued at USD 1.87 billion in 2024 and is projected to reach approximately USD 10.54 billion by 2032, growing at a CAGR of around 18.9%.

Data Warehouse as a Service Market Dynamics:

Drivers:

-

Increased Cloud Analytics Adoption is Accelerating the Shift Toward DWaaS Platforms for Scalable, Real-Time Data Management

One of the key factors supporting the growth of the DWaaS market is the migration from traditional on-premise solutions to cloud infrastructure. As a result, organizations are finding cloud platforms as a useful tool for scalable & immediate analytics abilities that do not involve high capital costs. The deployment capability of cloud-based data warehouses, their flexibility, and integration with AI/ML tools are critical to the success of any data-driven organization these days. Further appealing to the large enterprises and the SMEs in search of cost efficiency is the pay-as-you-go pricing model. The pace of digital transformation across verticals like BFSI, healthcare, and retail has forced enterprises to demand highly available access to the huge incoming data-structured and unstructured, and DWaaS fits the bill. It continues to drive up market demand at an almost unsustainable rate.

In 2024, 43% of cloud customers currently utilize AI-based analytics, enabling predictive insights and automation, which significantly supports the real‑time analytics value proposition of DWaaS

Restraints:

-

Heightened Data Security and Compliance Risks Are Limiting DWaaS Adoption in Highly Regulated Industries

DWaaS has its upsides, but the DWaaS market is burdened by challenges regarding data security and compliance with regulations. The reality of recorded sensitive data being stored and processed in third-party cloud environments raises significant concerns of unauthorized access, data breaches, and loss of control over sensitive data. Industries like finance and healthcare, which deal with sensitive personal and financial information, are subject to extensive laws (HIPAA, GDPR, CCPA, etc.). Not meeting these compliance standards can earn you high penalties and damage to your reputation. Though security systems on the provider's end are strong, users need to simply pitch in a part of their responsibility as well, resulting in the complexity of a shared security model that is sometimes misinterpreted or poorly managed on the user end, causing the adoption rate to be slowed down by security-minded enterprises.

54% of respondents report difficulty maintaining consistent regulatory standards across hybrid or multi-cloud environments, directly complicating compliance efforts needed for DWaaS adoption in regulated industries

Opportunities:

-

Rising Integration of AI and ML Tools Is Enhancing DWaaS Value for Predictive Analytics and Intelligent Automation

The explosion penetrating wedged between the AI and Machine Learning (ML) and DWaaS approach. This means more and more organizations want to get predictive insights out of big, big datasets which needs things like automated data processing, integrated anomaly detection and real-time decision-making — exactly the kind of wisdom embedded in the modern class of DWaaS. Such capabilities empower organizations to drive novel efficiencies, elevate customer experiences and foster innovation. In addition, the ability of DWaaS platforms to connect big data tools, IoT data streams, and real-time dashboards makes them one of the indispensable infrastructures for digital transformation projects. Vendors that develop AI-laden DWaaS solutions will likely have a competitive advantage and see an increased share of enterprise customers over time.

92% of organizations planned to invest in AI tools such as chatbots and automation in 2024, indicating a strong enterprise commitment to AI-enhanced cloud analytics capabilities

Challenges:

-

Complexity in Legacy Data Migration Is Delaying DWaaS Implementation Across Large and Data-Intensive Enterprises

The complexity of integrating and migrating legacy data systems to new cloud-based environments is one of several key challenges in the DWaaS market. Most of the organizations run on legacy infrastructure and have data strewn across different sources and silos. All of these data must first be cleansed, mapped, and restructured before they can be moved to a cloud warehouse—resulting in costly and lengthy migrations. To make things even more complicated, migration should reach minimal interruption to ongoing business operations. Migration delays and failures dissuade adoption by enterprises, which lack standardized frameworks and skilled personnel. This complexity continues to hamper enterprises, especially for the large, data-hungry enterprises.

Data Warehouse as a Service Market Segmentation Analysis:

By Services:

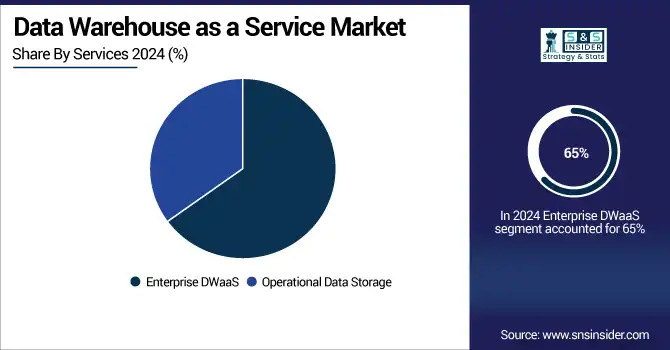

Enterprise DWaaS dominated the market in 2024 and accounted for 65% of data warehouse as a service market share, as they can manage the large volume of high-dimensional (complex) queries data, and facilitate AI/BI tools integration for rapid business decision making. Enterprise-grade scale, security, and compliance support is a must for large organizations—and they are looking for just such capabilities in the cloud. The prevalence of digital transformation across BFSI, healthcare, retail, and government in the previously mentioned verticals should keep this segment the market leader through 2032.

in June 2025, a USD 250M deal aimed at enhancing its enterprise data cloud and AI/ML capabilities—strengthening its position in enterprise DWaaS deployments across large organizations.

Operational Data Storage is expected to register the fastest CAGR owing to increasing demand for near real-time analytics, edge processing, and fast access to transactional data. Small and medium-sized enterprises(SMEs) and cloud-native businesses favor this segment for being cost-efficient and for quickly retrieving data. Adoption will be robust up to 2032 as businesses will want lightweight and responsive storage for fast-change operational surroundings.

By Application:

Business Intelligence (BI) dominated the data warehouse as a service market in 2024 and accounted for a significant revenue share, due to increasing importance to enterprises to gain real-time dashboards, performance tracking, and decision-support systems. In conjunction with DWaaS platforms, it allows for scalable visualization of data, automated reporting, and cross-functional insights. Widespread adoption of BI will continue through 2032, with implementation becoming essential to operationalizing a data-driven culture and strategic business planning regardless of your industry.

On April 17, 2025, a report highlighted how SaaS companies are blending strategy with real-time BI and AI-powered dashboards, signaling growing enterprise reliance on BI capabilities embedded in cloud data platforms.

Predictive Analytics is projected to register the fastest CAGR, due to the increasing adoption of AI/ML tools and techniques used for forecasting, anomaly detection, and customer behavior prediction. DWaaS facilitates such growth by providing rapid, cost-effective access to both historical and real-time data. With organizations moving more towards proactive decision-making, this segment will witness faster adoption within BFSI, healthcare, and retail verticals.

By Vertical:

BFSI dominated the DWaaS market in 2024 and accounted for a significant revenue share, the volume of data, and the need for secure real-time analytics. Institutions benefit from using DWaaS to detect and combat fraud, prepare compliance reports, and deliver customized financial services. BFSI will continue to dominate through 2032, propelled by digital banking, AI-driven customer insights/analytics, and the need for a secure and scalable data backbone critical within the sector.

Healthcare and Life Sciences are projected to register the fastest CAGR, the real-time nature of clinical, patient and operational data access made possible by DWaaS is crucial for diagnostics, trials and compliance. AI health analytics and telehealth adoption will reshape the data landscape through 2032 and facilitate accelerated growth.

By Deployment Mode:

Public Cloud dominated the data warehouse as a service market in 2024 and accounted for 69% of revenue share, providing high scalability, cost-efficiency, and quick deployment. It is preferred among enterprises from different verticals due to its on-demand storage and flexibility of integration with analytical tools. During this digital transformation, organizations will continue to put a premium on agility, remote accessibility, and less infrastructure governance, and this segment will continue to be the leader through 2032.

Private Cloud is expected to register the fastest CAGR attributed to high demand from regulated industries such as healthcare, BFSI and government. This ensures specific regulatory requirements for data control, security and compliance. Data privacy is becoming a increasingly important factor and private cloud segment will grow rapidly until 2032 with large enterprises requiring isolated and secure environments.

By Enterprise Size:

Large Enterprises dominated the data warehouse as a service market in 2024 and accounted for a significant revenue share, as organizations of this size often have complex data ecosystems, diverse business operations, and the need for advanced analytics and data governance. They spend a lot of money on DWaaS because it allows them to help make data integration, AI/ML adoption, and scaling decisions and decision-making easier. Through 2032, this segment will continue to lead every single category, due to increasing digital transformation, as well as expansion of multi-cloud infrastructure strategies.

SMEs are expected to register the fastest CAGR driven by an Increase in awareness for various benefits of cloud adoption, lowered IT expenditure, and demand for flexible, subscription-based analytics solutions are factors that poised SMEs to exhibit the highest CAGR. In terms of capabilities, DWaaS presents SMEs with the advantage of immediate operations as well as expansion without having to make significant capital expenditures. SMEs will witness an industry-wide adoption, and growth will skyrocket till 2032, driven by the movement towards data-oriented operations to improve customer engagement and competitiveness.

Data Warehouse as a Service Market Regional Outlook:

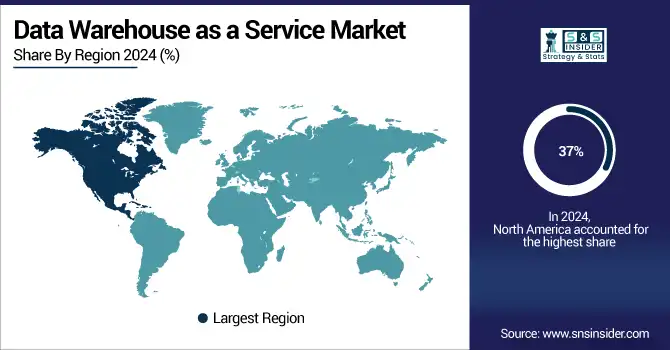

North America dominated the data warehouse as a service market in 2024 and accounted for a 37% of revenue share, due to well-established cloud infrastructure, which has led to early technology adoption and great demand from BFSI, healthcare, and IT sectors. The existence of top DWaaS companies and strong regulatory environments creates additional tailwinds_ The importance and adaptation of real-time decision-making in AI-driven analytics and hybrid cloud models will keep this type of dominance going through 2032 within enterprises.

According to data warehouse as a service market analysis, the Asia-Pacific is expected to register the fastest CAGR, owing to high digital transformation in emerging economies, increasing cloud adoption, and growing e-commerce and fintech sectors. Growth of DWaaS adoption among SMEs in growing markets such as India, China, and Southeast Asia as analytics needs become more scalable and cost-effective. The continued growth will be driven by cumulative digitalisation efforts of the government and rising penetration of smartphone data usage up to 2032.

Europe’s DWaaS market is growing steadily due to increasing adoption of cloud-based analytics in BFSI, manufacturing, and public sectors. The urge for secure help in-diocese, propelled by data sovereignty regulations and GDPR compliance. Investment-sensitive businesses across the continent will keep investing where the demand is for an AI-ready, scalable data infrastructure

Germany dominates the European data warehouse as a service market owing to having a strong industrial base, advanced IT infrastructure, and strict data compliance standards. Automotive, finance, and manufacturing enterprises are adopting cloud analytics at top speed. Investments in digital transformation and AI integration will continue to fuel momentum through 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major data warehouse as a service market companies are Amazon Web Services, Microsoft Corporation, Google LLC, Snowflake Inc., IBM Corporation, Oracle Corporation, SAP SE, Teradata Corporation, Cloudera Inc., Hewlett Packard Enterprise, Alibaba Cloud, Databricks Inc., Actian Corporation, Panoply, Yellowbrick Data, Exasol AG, Vertica, Firebolt Analytics Inc., Kyvos Insights, Informatica and others

Recent Developments:

-

In February 2025, Databricks Inc. partnered with SAP SE to launch the SAP Business Data Cloud, integrating Databricks' Lakehouse Platform. This enables zero-copy data sharing via Delta Sharing and supports enterprise-grade DWaaS deployments with enhanced AI and governance capabilities.

-

In February 2025, Informatica deepened its integration with Databricks, enabling advanced AI-powered data ingestion and ELT within Databricks SQL. This positioned Informatica’s IDMC as a leading platform for enterprise-scale, cloud-native data warehousing modernization.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 80.6 Billion |

| Market Size by 2032 | USD 390.0 Billion |

| CAGR | CAGR of 21.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Enterprise DWaaS, Operational Data Storage) • By Application (Customer Analytics, Operational Analytics, Business Intelligence, Predictive Analytics, Data Modernization) • By Vertical (BFSI, Energy and Utilities, IT and ITeS, Media and Entertainment, Retail and Consumer Goods, Healthcare and Life Sciences, Government and Public Sector, Manufacturing) • By Deployment Mode (Public Cloud, Private Cloud) • By Organization Size (Large Enterprises, SMEs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Microsoft Corporation, Google LLC, Snowflake Inc., IBM Corporation, Oracle Corporation, SAP SE, Teradata Corporation, Cloudera Inc., Hewlett Packard Enterprise, Alibaba Cloud, Databricks Inc., Actian Corporation, Panoply, Yellowbrick Data, Exasol AG, Vertica, Firebolt Analytics Inc., Kyvos Insights, Informatica and others in the report |