Small Cell Networks Market Report Scope & Overview:

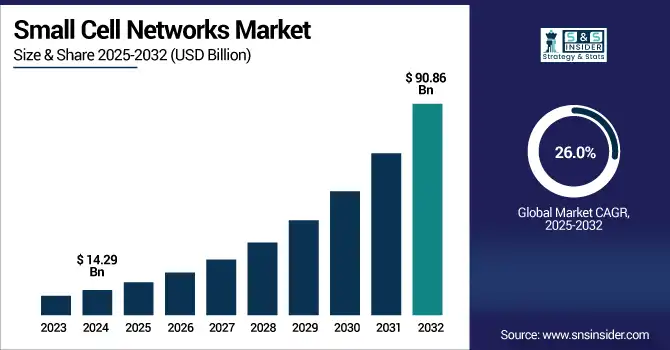

The Small Cell Networks Market Size was valued at USD 14.29 billion in 2024 and is expected to reach USD 90.86 billion by 2032 and grow at a CAGR of 26.0% over the forecast period of 2025-2032.

The market is growing strongly, fuelled by growing demand for better mobile coverage and high-capacity mobile data. Such small cell base stations are crucial for 5G roll-outs, as network operators strive to enhance coverage and capacity, especially indoors. Small cell base stations are vital to 5G deployments as network operators strive to improve coverage and capacity, often indoors. Small cells can be used to assist licensed and unlicensed spectrum, and they are the required equipment to solve the issue of the dramatic traffic growth in mobile data. Small cell solutions are extensible across the globe in applications such as telecom, medical/healthcare, retail, and smart cities that require high capacity, low-latency performance. 5G devices, market scaling, and technology will also get a big boost as mobile operators focus on 5G infrastructure deployment.

To Get more information on Small Cell Networks Market - Request Free Sample Report

According to a study, only 4% will be consumed “on the go,” according to Cisco’s VNI. Small Cell Networks are positioned to meet this indoor demand, especially as DAS is projected to grow at only a low single-digit CAGR over the next five years. Additionally, new shared spectrum regimes including CBRS in the 3550–3700 MHz band are enabling scalable small cell deployments through tiered frequency sharing.

The U.S. Small Cell Networks Market size was USD 3.10 billion in 2024 and is expected to reach USD 16.99 billion by 2032, growing at a CAGR of 23.68% over the forecast period of 2025–2032. The U.S. Small Cell Networks Market growth in the country can be primarily attributed to a sustained proliferation of 5G infrastructure to cater to the intense bandwidth demand requirements for urban areas. The North American market is being led by the U.S. with a surge in 5G adoption, high investment by telecom operators, and favorable regulatory initiatives such as the allocation of CBRS spectrum by the FCC. Also, the exploding demand for better indoor coverage in enterprise, retail, and public venues is driving continued small cell deployment across the country.

Small Cell Networks Market Dynamics:

Key Drivers:

-

Rapid 5G Infrastructure Rollouts Across Urban Areas Drive the Small Cell Networks Market Growth

The growth of 5G networks in the densely populated urban areas is the key for the U.S. Market. As demand for mobile data continues to skyrocket and low-latency applications such as autonomous cars, intelligent infrastructure, and real-time communications expand, macrocell towers cannot provide the full coverage and capacity that's needed. Small cells provide high-speed and low-latency connectivity with a small form factor and are crucial to the densification of networks and to closing the connectivity gap indoors and outdoors, in urban and enterprise settings.

In July 2023, AT&T announced that it would deploy over 70000 small cells nationwide through 2025 for the enhancement of its 5G coverage in areas with heavy traffic. At the same time, the FCC has taken action to promote spectrum access, including with new initiatives such as CBRS, that support lower-cost and shared small cell deployment. These advancements mark significant institutional backing and telecom industry investment in network densification, driving the expansion of the U.S. Small Cell Networks Market.

Restraints:

-

High Initial Deployment Costs and Power Requirements Restrict Growth Potential of the Small Cell Networks Market

Despite strong market demand, high initial deployment costs, and infrastructure complexities serve as a significant restraint for the Small Cell Networks Market. The installation of a dense network of small cells requires substantial capital investment, especially in urban areas where space, access to utility poles, and backhaul integration come with logistical and financial challenges. Power supply and thermal management also add complexity, especially for outdoor units exposed to environmental stressors. Small cell deployments are often cost-prohibitive for smaller carriers and enterprises due to the combined expense of equipment, site acquisition, and professional installation.

Additionally, allowing delays and nonuniform municipality regulations slows the overall time-to-deployment, thus delaying returns on investments. Some constraints are easing, with federal backing and more liberal use of the spectrum, but steep costs stand in the way of full-scale deployment. The desire for lower cost is endemic for end-users, particularly those in the public and education sectors, causing even slower adoption. Therefore, despite the attraction of enhanced connectivity and the potential output of 5G, high initial investment and power requirements are slowing the pace of deployed equipment, especially to suburban and rural areas, for which ROI models are difficult to justify.

Opportunities:

-

Emerging Demand for Private 5G Networks Creates Lucrative Opportunities in the Small Cell Networks Market Growth

The growing use of private 5G networks in various industries, including manufacturing, healthcare, logistics, and smart cities, is providing a major impetus in the U.S. small cell networks market. To ensure quality of service, security, and scalability, enterprises are looking for their on-premises private dedicated small cells networks assisting mission-critical operations and IoT wide area campus-style networks. Small cells provide localized high-capacity coverage and are well-suited for facilities-based deployments, especially where macro-cellular solutions are impractical or uneconomic.

In March 2024, Qualcomm and Siemens implemented a private 5G network based on small cells at Siemens’ Amberg Electronics Plant to provide real-time automation and data-driven manufacturing. In the U.S., the CBRS spectrum is fast-tracking the same roll-outs, allowing enterprises to build their high-performance networks. These developments underscore how shared spectrum and plug-and-play small cell offerings are transforming enterprise connectivity and fuelling new demand beyond established telecom use cases.

Challenges:

-

Inter-Operator Infrastructure Sharing and Multi-Vendor Integration Pose Major Challenges for Small Cell Network Market Scalability

One of the major challenges facing the Market is the complexity of implementing multi-operator infrastructure sharing and achieving seamless multi-vendor interoperability. As indoor environments such as airports, malls, and hospitals seek to provide universal connectivity, the need for small cells that support multiple carriers has become critical.

However, achieving this is technically and operationally challenging. Current infrastructure solutions including DAS are often expensive and difficult to scale. While standardized approaches, such as 3GPP’s MOCN (Multi-Operator Core Network) and new open RAN architectures aim to facilitate sharing, full multi-vendor interoperability remains a hurdle due to fragmented standards and reluctance among vendors to open proprietary interfaces. These technical gaps complicate network optimization and increase deployment time and cost.

Small Cell Networks Market Segmentation Analysis:

By Cell Type

Femtocells dominate the Small Cell Networks Market by revenue in 2024, accounting for 33%, due to their widespread adoption in residential and small office spaces. These compact, cost-effective units enhance indoor connectivity and reduce network load on macro towers. In February 2024, Samsung Electronics expanded its femtocell portfolio for enterprise use, integrating advanced 5G support. Such innovations, coupled with increasing mobile data demands indoors, are solidifying femtocells’ leading role in small cell deployments across the U.S.

The Microcell segment is projected to grow at the fastest CAGR of 31.98% over 2025-2032, driven by rising demand in urban and suburban zones for mid-range coverage. In 2023, Ericsson launched a new 5G microcell solution optimized for dense environments, supporting multi-operator access. This trend aligns with carriers focusing on scalable, energy-efficient nodes to expand capacity. Microcells serve as a bridge between femtocells and macrocells, accelerating the densification crucial for next-gen network evolution.

By End-user Vertical

The IT and Telecom sector leads the U.S. Small Cell Networks Market by end-user vertical with a 28% revenue share in 2024. This dominance stems from telcos and cloud providers rapidly deploying small cells to expand 5G and edge network infrastructure. In 2024, AT&T and CommScope collaborated on a new small cell platform tailored for telecom edge computing. With high-speed data demands and latency-sensitive services, the IT and Telecom industry is central to driving small cell adoption.

The Smart City and Government segment is anticipated to grow at the highest CAGR of 32.04% during 2025–2032, propelled by public infrastructure upgrades and smart mobility initiatives. In early 2024, American Tower partnered with New York City to roll out outdoor small cell nodes across public transit and street furniture. These projects aim to improve public Wi-Fi, traffic monitoring, and emergency communications, demonstrating the role of small cells in transforming cities into connected, data-driven ecosystems.

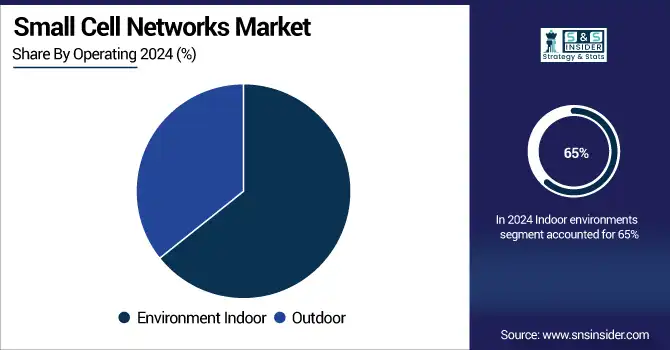

By Operating Environment

Indoor environments account for 65% of revenue in 2024 due to the massive indoor data consumption by enterprises, retail, and public facilities. Cisco’s small cell systems for indoor enterprises, launched in late 2023, offer seamless multi-operator access and integration with private 5G networks. With over 80% of mobile traffic occurring indoors, demand for scalable indoor coverage is soaring, positioning indoor small cells as vital infrastructure for reliable and secure wireless communication in enterprise and commercial spaces.

The Outdoor segment is forecasted to grow at a CAGR of 30.05%, fueled by 5G rollouts in high-density areas including stadiums, campuses, and city centers. In 2023, ZTE introduced weatherproof outdoor small cell solutions that enable rapid deployment in challenging terrains. These cells improve network capacity and coverage where macro towers are insufficient. As urban connectivity becomes a public priority, outdoor small cells are increasingly deployed on lamp posts, traffic lights, and transit hubs to ensure ubiquitous access.

Small Cell Networks Market Regional Outook:

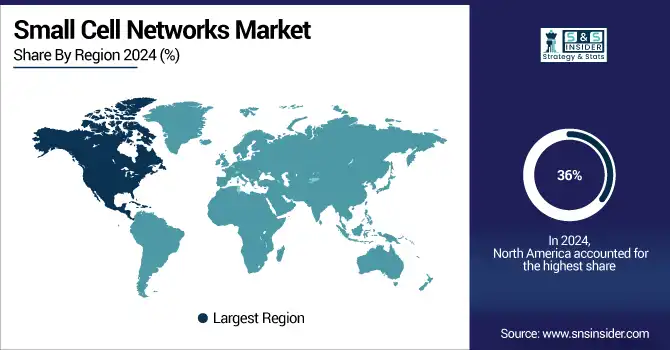

North America holds a dominant 36% share of the Small Cell Networks Market in 2024 owing to its advanced 5G infrastructure, dense urban environments, and growing mobile data consumption. This increasing network load has led to expanded small cell deployments to enhance coverage and capacity in congested areas. The U.S. dominates the region due to proactive spectrum allocation by the FCC, rising enterprise connectivity demands, and early adoption of private 5G networks. Major telecom providers such as Verizon and AT&T are investing in small cell densification to meet performance standards, boosting the market’s regional momentum and long-term growth outlook.

Asia Pacific is the fastest-growing region in the Small Cell Networks Market in 2024, with a projected CAGR of 31.54% over 2025-2032. The cause lies in rapid urbanization, mobile data surge, and substantial 5G investments by both governments and private players. As a result, countries across the region are accelerating small cell deployments to address capacity needs and connectivity gaps. China dominates this growth, backed by state-supported infrastructure projects and strong contributions from domestic vendors, including Huawei and ZTE. These companies are facilitating fast and large-scale deployments, making China a leader in small cell-enabled 5G transformation.

Europe remains a key contributor to the Small Cell Networks Market in 2024 due to EU-driven policies promoting digital infrastructure and spectrum liberalization. This supportive regulatory framework has led to an increase in public and private investments for small cell deployments, especially for indoor and enterprise connectivity. Germany stands out as the regional leader, driven by robust industrial applications, private 5G licensing for enterprises, and initiatives from operators, such as Deutsche Telekom. As a result, Germany’s telecom sector is leveraging small cell networks to boost productivity, enhance automation, and support the country’s broader goals of digital innovation and industrial modernization.

Middle East & Africa and Latin America are emerging markets in the Small Cell Networks Market in 2024 due to the rising smart city investments and expanding mobile network demands. These efforts are encouraging governments and telecom companies to adopt small cells for better coverage in urban zones. In the Middle East, countries including the UAE and Saudi Arabia are deploying 5G-ready small cells to power smart city initiatives such as NEOM. In Latin America, Brazil leads with recent 5G spectrum auctions, evolving telecom regulations, and growing fintech and digital services, driving the deployment of small cells to enhance service reach and quality.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Small Cell Networks Market companies include Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, ZTE Corporation, Samsung Electronics Co., Ltd., Cisco Systems Inc., CommScope Inc., American Tower Corporation, Qualcomm Technologies Inc., AT&T Inc., and others.

Recent Developments:

-

June 2025: At MWC Shanghai 2025, Huawei and China Telecom unveiled a breakthrough 5G‑A Intelligent Ultra Pooling Uplink technology, designed for small-cell and distributed RAN deployments. This new solution enhances uplink coverage through dynamic resource pooling, combining AI-based control across time, frequency, RAT, space, and power layers, tailored for 5G‑small-cell densification.

-

March 2025: Ericsson launched a machine‑learning powered deployment solution specifically for 5G small-cell densification. Published via GSMA Foundry, the tech helps operators rapidly detect optimal street‑pole sites and automate KPI-driven traffic balancing, accelerating urban small-cell rollouts.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.29 Billion |

| Market Size by 2032 | USD 90.86 Billion |

| CAGR | CAGR of 26.0% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Cell Type (Femtocell, Picocell, Microcell, Metrocell, Radio Dot Systems) • By Operating Environment (Indoor, Outdoor) • By End-user Vertical (BFSI, IT and Telecom, Healthcare, Retail, Power and Energy, Smart City and Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Nokia Corporation, ZTE Corporation, Samsung Electronics Co., Ltd., Cisco Systems Inc., CommScope Inc., American Tower Corporation, Qualcomm Technologies Inc., AT&T Inc., and Others. |