Dental Digital X-ray Market Report Scope & Overview:

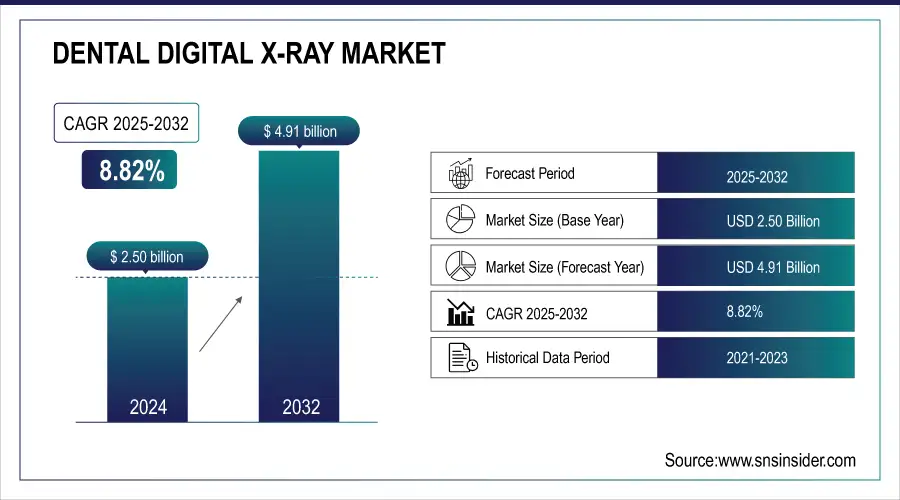

The Dental Digital X-ray Market size was valued at USD 2.50 billion in 2024 and is expected to reach USD 4.91 billion by 2032, growing at a CAGR of 8.82% over the forecast period of 2025-2032.

The Global Dental Digital X-Ray Market is being driven by the increasing incidence of dental disorders, including caries, periodontal diseases, and oral infections. These diseases need precise and timely diagnosis, and so increasing demand for effective imaging instruments, such as digital X-rays. Digital systems provide faster findings, less radiation, and the convenience of storing images digitally as opposed to on traditional film. Diagnostic demand is rising due to an aging population who are more susceptible to dental problems. Furthermore, are rise in cosmetic dentistry and preventive care is driving the demand for advanced imaging. Governmental programs for oral health and improved access to dental care also promote the transition of clinics to digital systems and overall foster market growth globally.

For instance, in March 2025, Dentsply Sirona unveiled its DS Imaging 4.0 Suite, featuring AI tools for detecting caries and bone loss in X-rays, aiming to improve diagnostic speed and accuracy in high-volume practices.

To Get more information on Dental Digital X-ray Market - Request Free Sample Report

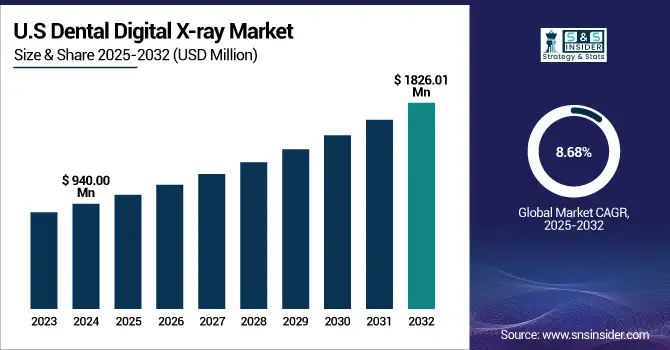

The U.S. Dental Digital X-ray Market was valued at USD 940.00 million in 2024 and is expected to reach USD 1826.01 million by 2032, growing at a CAGR of 8.68% over 2025-2032.

The dental digital X-ray market in the U.S. is highly consolidated, owing to the high adoption of integrated AI and predictive diagnostic imaging technology. These systems help improve accuracy in identifying defects, including caries and periodontal disease, thus both diagnosis and treatment are more effective. Enhancements, from ultra-low radiation and HIPAA-compliant cloud platforms for patient safety and workflow efficiency, to tele-dentistry in underserved regions. Clinics in the U.S. are using the latest imaging technology to stay ahead, gain patient confidence, and grow their income. Demand is also fueled by modular CBCT systems and integration with orthodontic tools such as Invisalign. Expensive, certainly, but industry demand and reasonable ROI, and the increased expectations of today's patients wanting high-tech, efficient, and comfortable care, make advanced imaging a necessary component in the U.S. dental arena.

For instance, in March 2025, Carestream Dental launched CS Cloud Imaging Suite 2.0 in the U.S., enabling HIPAA-compliant, cloud-based image access and sharing, enhancing workflow efficiency, and supporting multi-location teledentistry practices.

Market Dynamics:

Drivers:

-

Patient Comfort is Driving the Dental Digital X-Ray Market Growth

The oral digital X-ray market is driven by the patient’s comfort. Digital sensors feature a simple ergonomic design with smooth, rounded corners to maximize patient comfort while minimizing physical discomfort associated with traditional film X-rays. They also expose patients to up to 90% less radiation, so this examination is safer, particularly for children and pregnant women. Real-time images eliminate the wait times for patients to keep sensors in their mouths, which can be both uncomfortable and anxiety-inducing. Moreover, the high-quality imaging and real-time feedback can reduce the number of retakes, possibly in turn increasing overall efficiency and patient satisfaction. Digital X-rays do not require chemical processing, and therefore, have a reduced risk of contamination to the environment. Combined, these attributes contribute to improved patient acceptance and preference, driving faster market acceptance in dental practices.

For instance, in July 2024, Carestream Dental enhanced its CS 7200 system with faster image acquisition and quieter operation, reducing patient anxiety and discomfort while improving workflow efficiency in high-volume dental practices.

Restraints:

-

Radiation Exposure Concerns Are a Significant Restraint on the Dental Digital X-Ray Market

Concerns related to radiation exposure are key factors inhibiting the growth of the dental digital X-ray market. Even though the doses are lower than with conventional systems, both patients and providers are concerned about potential long-term health effects, including cancer, genetic mutations, and developmental problems, particularly in children and pregnant women. Patients are often skeptical about the need for X-rays at recall visits, and providers are concerned about compliance, liability, and health risks to themselves. Moreover, adopting and maintaining rigorous radiation safety regulations can be a costly affair. Patient under-education about the safety and benefits of digital X-rays very often results in fear or refusal. Collectively, these factors outpace broad adoption, and effective radiation protection and transparent communication are the key to enhancing market acceptance.

For instance, in May 2025, the ADA updated its guidelines to recommend reduced frequency of dental X-rays for asymptomatic patients, addressing growing concerns over cumulative radiation exposure, especially in children and pregnant women.

Segmentation Analysis:

By Product

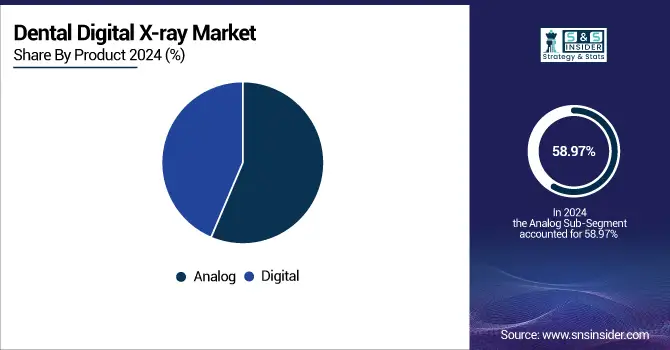

Analog is the dominant segment in the global Dental Digital X-Ray Market, with a 58.97% market share in 2024. Owing to its low cost and global applicability, particularly in underdeveloped areas. Many small clinics and rural practices continue to use analog systems due to the lower cost of purchase, experience, and the low level of personnel training necessary. In these areas, the lack of availability of digital infrastructure and the lack of access to technical support are barriers to digital adoption. These parameters account for the continued utilization of analog X-ray systems, which ensures their significant share in the dental imaging market.

The Digital segment is emerging as the fastest growing with a CAGR of 9.05% in the Dental Digital X-ray Market trend, owing to its many logistical and clinical benefits. It has the advantage of shortening the exposure time of the image, reducing the radiation dose, and increasing the diagnostic accuracy, compared with the analog method. Functionality such as AI integration, cloud storage, and real-time image processing increases the speed of workflow and patient experience. Moreover, burgeoning knowledge of radiation protection, increasing cosmetic dentistry needs, and favoring digital health setups are propelling the market growth of digital X-rays globally. With the digitization of dental offices and the adoption of patient-focused care being in vogue, digital systems are now being preferred by a large number of healthcare providers, resulting in exponential growth in the digital X-ray market share globally.

By Type

In 2024, the Intraoral segment dominated the Dental Digital X-ray Market trend with a 58.80% market share as play a key role in standard dental diagnostics. These applications are used in the diagnosis of tooth decay, cavities, periodontal disease, and other common dental conditions. Due to narrow space requirements, low price, great diagnostic value, and wide range of use, they have become a necessity in the general dental practices. An increase in preventive dental care and regular check-ups also supports the demand for them. Intraoral X-rays are faster to perform and produce less radiation, which is less painful for the patient. These benefits have largely fueled their acceptance and have made them an integral part of the overall digital X-ray market share.

The extraoral segment is the fastest growing aspect of the Dental Digital X-ray Market Analysis, which is being fueled by the incorporation of more advanced technology and increased use in niche dental applications, such as implants and orthodontics. These machines, such as panoramic and Cone Beam Computed Tomography (CBCT), generate full 2D and 3D images of the jaw, sinuses, and surrounding areas, which are important in orthodontics, implant planning, oral surgery, and TMJ analysis. Since more and more dental offices are incorporating advanced and cosmetic procedures, they are utilizing more extensive diagnostic imagery. Extraoral systems have been rising in popularity in the dental digital X-ray market as they enable high-quality imaging combined with minimal patient discomfort and compatibility with digital workflows, making them the fastest-growing category in both developed and emerging markets.

By Application

Medical held a dominant Dental Digital X-ray Market share of 72.22% of the Dental Digital X-ray industry in 2024, as it is an integral part of dental diagnosis and treatment for various common oral diseases, including cavities, infections, and periodontal diseases. The global burden of dental diseases is increasing, and with this comes a need for accurate, efficient diagnostic tools, particularly within general dentistry. Digital X-ray images are commonly used for routine checkups, preventive treatments, and treatment planning. Its application in routine medical practice at hospitals and dental clinics is the major driving factor for the sustained dominance of the medical application segment in the market.

Cosmetic Dentistry is emerging as the fastest growing segment in the Dental Digital X-ray Market with the highest CAGR of 9.33%. because of skyrocketing requests for cosmetic dental treatments, including veneers, whitening, smile makeovers, and orthodontics. Digital x-rays, particularly CBCT and panoramic machines, are essential in accurate treatment planning, allowing these practitioners to view bone density and volume, tooth orientation, and facial forms. Increasing dental tourism, rising disposable incomes, and a growing focus on appearance are some of the factors driving the demand for such products. Moreover, real-time imaging is now possible using digital cameras, which helps doctors communicate with patients and gain trust. All these factors contribute toward a faster acceptance of digital imaging in cosmetic dentistry, leading to the growth of the market.

By End-User

Dental hospitals & clinics are the largest segment of end users for the dental digital X-rays industry, given their high patient churn and diversified dental service offering. These clinics perform diagnostics for common cavities, gum diseases, and root infections, which makes it routinely necessary to take intraoral and extraoral X-rays. Rising focus on preventative care, routine check-ups, and early diagnosis has also escalated the adoption of digital imaging in clinical applications. Hospitals and clinics are more likely to have resources to dedicate to expensive imaging tools and advanced infrastructure and funding. As efficient workflow and accurate diagnoses are important for them, they are significant contributors to the growth of the dental digital X-ray market.

The Dental Diagnostic Centers segment is witnessing the highest growth in the dental digital X-ray market as these centers specialize in high-end imaging services with increasing demand from independent and specialist clinics. Such centers are frequently equipped with high-end CBCT and panoramic systems to provide a full range of diagnostics for implantology, orthodontics, or oral surgery. High-resolution imaging, added to the fact that you can refer stream with any unnecessary overhead of a full dental surgery, means these services are cost-effective, efficient options to utilize. Growing multidisciplinary dental collaboration, rise in outsourcing of imaging, and surge in dental tourism continue to fuel their demand. Transducer to control unit interfaces (TCUI) are the key drivers for the adoption of digital X-ray technology in this space.

Regional Analysis:

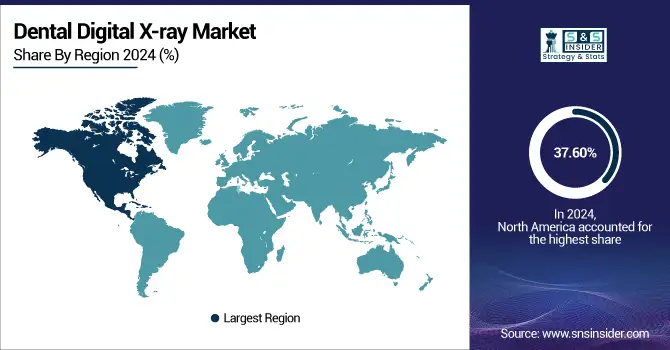

In 2024, the North American region holds the largest market share of the Dental Digital X-ray Industry and dominates the market with a 37.60% market share. The growth is driven by the beneficial demographic situation and the high level of development of the medical care system. Rising geriatric population, which is highly susceptible to dental disorders such as dental cavities and gum diseases, further accelerates the rise in demand for precise diagnosis. The rate of routine visits to the dentist when stratified by age group (children, adults, and seniors) also helps justify the need for periodic imaging. Growing concern for preventative oral care and the growing trend of cosmetic dentistry, particularly among the youth, are driving the need for high-resolution digital X Ray. In the high-tech age, patients and providers prefer modalities with lower radiation and instant imaging. Urbanization and improved access to well-equipped clinics will further accentuate adoption, driving the dental digital X-ray market in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe is the second leading market for the dental digital X-ray industry due to the high demand for minimally invasive procedures (MIS). Such treatments need accurate and high-resolution imaging to provide accurate planning and performance, so the need of advanced digital X-ray system is necessary. This trend is driven by Europe’s robust acceptance of 3D imaging and AI-based diagnostics, notably Cone Beam CT (CBCT). Due to the benefits of minimally invasive surgery (MIS) as reduced pain, accelerated recovery, patients are more inclined to MIS, which has prompted clinics to incorporate digital imaging techniques. In addition, adoption is expedited when the government supports mHealth deployment through financing, awareness, and favorable reimbursement policies. Moreover, Europe holds a leading position in robotics and computer-assisted dental procedures, which require accurate imaging, driving its market growth. This convergence of MIS and digital innovation powers ongoing market expansion.

Asia-Pacific emerges as the fastest-growing region with the highest CAGR of 9.29%. Driven by a complicated mixture of demographic, economic, and technological pressures. The countries, such as China, India, South Korea, and Japan are investing heavily in the healthcare infrastructure and digital dentistry technologies. The trend is supported by an increasing incidence of dental disorders, such as cavities and periodontal diseases, which necessitate early and precise diagnosis, further surging the demand for technologically advanced imaging systems. Population ageing in the region is also contributing to growth, as older people are more likely to need their teeth X-rayed due to oral health problems. Meanwhile, growth in both disposable incomes and oral health knowledge is driving demand for premium dental care in emerging markets.

From the ability to provide CBCT, diagnosis using AI, and availability of small, portable X-ray systems, technology has rapidly made accurate, easily accessible diagnostic aids available even in rural or underserved areas. Furthermore, increasing preference for dental checkups in the Asia Pacific as a dental tourism spot is also propelling demand for advanced diagnostic machines. Lastly, in a less regulated marketplace with less market access lag, faster uptake of novel imaging technologies can occur. These factors are collectively driving its market, which is projected to almost double by 2030, solidifying its position as the fastest-growing market for dental digital X-rays.

The Middle East & Africa have the least market share in the dental digital X-ray industry due to a lack of required healthcare infrastructure and technology. Despite the region suffering from a high prevalence of dental and non-communicable diseases, there is low uptake of digital radiography imaging systems in the rural and underserved areas as a result of a lack of infrastructure, poor digital literacy, and poor internet access. The availability of expensive technology and trained staff also acts as a barrier. Yet, efforts of the government to continue developing the healthcare infrastructure and increase investments in portable and cloud-based X-ray technologies are expected to offer some respite in terms of access. However, the adoption level is slow, at least as regards new technologies, in comparison with other territories, which is reflected in the market share being relatively low in comparison with the clinical necessity and disease burden growth.

The dental digital X-ray market in Latin America is expected to grow at a stable rate on account of growing awareness about oral health, the rising number of private dental clinics, and the upsurge in dental tourism. Brazil has one of the highest numbers of dentists on the planet, having more dentists than Mexico or Argentina. The use of digital X-ray systems is on the ascendant as clinics and hospitals seek to enhance diagnostic accuracy and patient care. But economic uncertainty, unequal access to health care, and relatively low investment by the government in rural regions are hampering widespread uptake. Yet, the desire for low-cost, high-quality dental care, particularly from international patients, is compelling clinics to invest in state-of-the-art imaging gear. This indicates that the area has a good market for metallic dental digital X-rays.

Key Players:

Dental Digital X-ray companies Dentsply Sirona Inc., Planmeca Oy, Carestream Dental LLC, Vatech Co., Ltd., KaVo Kerr, Acteon Group, Midmark Corporation, Owandy Radiology, FONA Dental, Asahi Roentgen Ind. Co., Ltd., and other players.

Recent Developments:

-

In April 2025, KaVo Kerr launched the OP 3D Vision AI Suite, integrating CBCT imaging with AI to automate pathology detection and implant planning, enhancing diagnostic accuracy and clinical efficiency.Top of Form

-

In November 2024, Owandy Radiology introduced the I-Max Pro 3D, a compact CBCT and panoramic system with a touchscreen interface and remote access, enhancing portability, usability, and diagnostic flexibility for dental clinics.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.50 billion |

| Market Size by 2032 | USD 4.91 billion |

| CAGR | CAGR of 8.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Digital, Analog) • By Type (Intraoral, Extraoral) • By Application (Medical, Cosmetic Dentistry, Forensic) •By End User(Dental Hospitals & Clinics, Dental Diagnostic Centers, Dental Academic & Research Institutes)" |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Dentsply Sirona Inc., Planmeca Oy, Carestream Dental LLC, Vatech Co., Ltd., KaVo Kerr, Acteon Group, Midmark Corporation, Owandy Radiology, FONA Dental, Asahi Roentgen Ind. Co., Ltd. |