Development To Operations Market Report Scope & Overview:

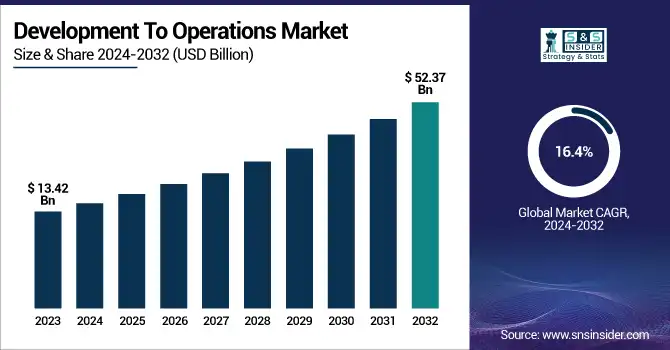

The Development To Operations Market Size was valued at USD 13.42 billion in 2023 and is expected to reach USD 52.37 billion by 2032 and grow at a CAGR of 16.4% over the forecast period 2024-2032.

To Get more information on Development To Operations Market - Request Free Sample Report

The Development to Operations Market is growing rapidly due to the increasing need for agile development, automation, and continuous integration. Businesses are adopting DevOps to enhance collaboration, accelerate deployments, and improve system reliability. Cloud computing, AI-driven automation, and containerization further fuel market expansion. Key players like AWS, Microsoft, GitLab, and Atlassian are advancing DevOps platforms with AI and cybersecurity features. The demand for Infrastructure as Code (IaC), microservices, and serverless computing is reshaping industries such as BFSI, healthcare, retail, and manufacturing. With rising digital transformation and IT investments, the DevOps market is set for significant future growth.

The U.S Development to Operations Market was USD 3.34 billion in 2023 and is expected to reach USD 11.48 billion by 2032, growing at a CAGR of 14.76% over the forecast period of 2024-2032.

The U.S. Development to Operations Market is witnessing significant growth, driven by the increasing adoption of agile development, automation, and cloud-based DevOps solutions. Organizations are investing in AI-driven automation, containerization, and Infrastructure as Code (IaC) to enhance software delivery speed and operational efficiency. Major players like Amazon Web Services, Microsoft, and GitLab are expanding their DevOps offerings to meet the rising demand across industries such as BFSI, healthcare, and retail. With continuous digital transformation initiatives, the U.S. DevOps market is expected to experience substantial expansion in the coming years.

Market Dynamics

Key Drivers:

-

Rising Adoption of Cloud-Based DevOps Solutions Accelerates the Growth of the Development to market

The increasing adoption of cloud-based DevOps solutions is a key driver fueling market growth. Organizations are leveraging DevOps-as-a-Service (DaaS) to enhance software development speed, reduce operational costs, and improve scalability. The integration of AI, automation, and Infrastructure as Code (IaC) in cloud platforms is streamlining software deployment and monitoring processes. Companies like Amazon Web Services, Microsoft Azure, and Google Cloud are expanding their DevOps tools, offering enhanced CI/CD pipelines, security features, and container orchestration to facilitate seamless development operations.

Additionally, businesses are embracing hybrid and multi-cloud environments, driving the demand for cloud-native DevOps solutions. The shift toward microservices and serverless computing further supports DevOps adoption, enabling organizations to achieve agility and efficiency in software delivery. With continuous advancements in cloud computing, security automation, and AI-driven DevOps tools, the market is poised for sustained growth in the coming years.

Restraint:

-

High Implementation Costs and Complexity Limit the Adoption of DevOps in Small and Medium Enterprises

The high initial investment and complexity of DevOps implementation pose significant restraints, particularly for small and medium enterprises (SMEs). The adoption of DevOps requires businesses to invest in cloud infrastructure, automation tools, security frameworks, and skilled DevOps professionals, which can be financially burdensome. Additionally, integration challenges arise when transitioning from traditional IT operations to DevOps methodologies, requiring extensive training and restructuring of development teams.

Furthermore, ensuring security compliance, data privacy, and regulatory adherence adds to the complexity of DevOps adoption. Although open-source DevOps tools and low-code platforms are helping mitigate some cost barriers, the overall expense and complexity of deployment remain major challenges, slowing down adoption among smaller enterprises.

Opportunity:

-

Growing Adoption of AI and Machine Learning in DevOps to Enhance Automation and Predictive Analytics

The integration of AI and machine learning (ML) in DevOps presents a significant growth opportunity, enabling businesses to automate testing, optimize workflows, and enhance predictive analytics. AI-powered DevOps tools help organizations identify potential system failures, optimize resource allocation, and enhance security by analyzing vast amounts of data in real time. Companies like GitLab, IBM, and Broadcom are investing in AI-driven DevOps platforms, offering intelligent automation for continuous integration, anomaly detection, and real-time performance monitoring.

Additionally, AI-driven predictive analytics help businesses proactively manage system vulnerabilities, reduce downtime, and improve deployment accuracy. As organizations focus on enhancing software quality and security through AI-driven DevOps, this presents a lucrative opportunity for market expansion.

Challenge:

-

Increasing Cybersecurity Risks and Compliance Issues Hamper the Widespread Adoption of DevOps

The Development to Operations market is cybersecurity threats and compliance issues. As organizations adopt cloud-native DevOps frameworks, containerized applications, and Infrastructure as Code (IaC), the risk of data breaches, misconfigurations, and security vulnerabilities increases. Continuous deployment pipelines can expose applications to unauthorized access, insider threats, and malware attacks, making security integration a critical challenge.

Moreover, businesses operating in highly regulated industries like BFSI, healthcare, and government must adhere to strict compliance standards such as GDPR, HIPAA, and PCI DSS, complicating DevOps implementation. Ensuring secure coding practices, automated security testing, and compliance monitoring requires advanced tools and expertise, increasing the complexity of DevOps adoption. Companies like Docker, Oracle, and Cisco Systems are investing in DevSecOps solutions to mitigate these risks, but the challenge of balancing agility and security continues to hinder seamless DevOps adoption.

Segment Analysis

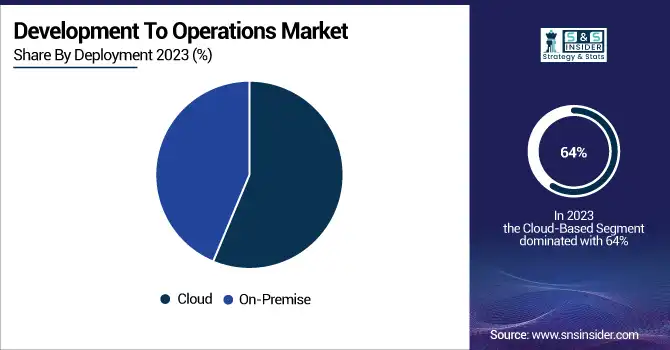

By Deployment

The cloud-based deployment segment dominated the Development to Operations market in 2023, accounting for 64% of total revenue. Organizations are increasingly adopting cloud-native DevOps solutions due to their scalability, cost-efficiency, and automation capabilities. Cloud platforms enable continuous integration and continuous delivery (CI/CD), microservices architecture, and container orchestration, enhancing agility in software development and deployment.

For example, AWS launched its CodeCatalyst platform in 2023, an end-to-end development service that accelerates DevOps automation. Similarly, Google Cloud’s Cloud Build provides secure CI/CD pipelines, enhancing deployment efficiency.

The rise of hybrid and multi-cloud environments is further driving cloud-based DevOps adoption, enabling organizations to seamlessly deploy, monitor, and scale applications. As businesses focus on digital transformation and cloud security, the demand for cloud-driven DevOps solutions is expected to continue its upward trajectory.

The on-premise segment in the Development to Operations market is experiencing the highest CAGR of 17.51% during the forecast period. Despite the dominance of cloud solutions, large enterprises, financial institutions, and government agencies continue to invest in on-premise DevOps deployments due to data security, compliance, and infrastructure control concerns. Industries such as BFSI, healthcare, and defense prioritize on-premise DevOps to maintain strict regulatory compliance and minimize cybersecurity risks. Companies such as IBM, Dell Technologies, and Broadcom are expanding their on-premise DevOps offerings to meet the growing demand.

By Enterprise Size

The large enterprise segment dominated the Development to Operations market, accounting for 58% of total revenue in 2023. Large enterprises across BFSI, healthcare, retail, and manufacturing are heavily investing in DevOps automation, AI-driven analytics, and hybrid cloud integration to enhance software delivery, security, and operational efficiency. These enterprises require scalable, high-performance DevOps solutions to manage complex IT infrastructures and ensure continuous software development and deployment. Leading companies such as Microsoft, IBM, and GitLab have launched enterprise-grade DevOps solutions tailored for large organizations. The increasing demand for microservices architecture, Infrastructure as Code (IaC), and DevSecOps further strengthens the large enterprise segment, driving continuous innovation and adoption of enterprise-focused DevOps solutions.

The SMEs segment in the Development to Operations market is projected to grow at the highest CAGR of 17.24% over the forecast period. Small and medium-sized enterprises (SMEs) are rapidly adopting DevOps-as-a-Service, low-code automation, and cloud-based DevOps platforms to accelerate software development and deployment with minimal IT infrastructure costs. The rise of SaaS-based DevOps solutions allows SMEs to leverage cost-effective, scalable, and user-friendly tools without requiring extensive in-house expertise. Companies such as GitLab, Atlassian, and Docker are actively introducing SME-focused DevOps solutions. The increasing adoption of cloud-native DevOps, serverless computing, and automation tools is enabling SMEs to streamline operations, enhance agility, and compete in the digital economy, driving substantial market growth in the segment.

By End-use

The IT segment held the largest revenue share of 39% in the Development to Operations market in 2023, driven by the increasing adoption of automation, cloud-native development, and AI-driven DevOps tools. IT organizations are implementing DevOps practices to streamline software development, enhance system reliability, and improve collaboration between development and operations teams. The demand for continuous integration/continuous deployment (CI/CD), Infrastructure as Code (IaC), and security automation has led major IT firms to invest heavily in advanced DevOps solutions.

In 2023, Microsoft launched an AI-enhanced DevOps suite on Azure, integrating machine learning-powered monitoring and automated troubleshooting. Similarly, IBM expanded its hybrid cloud DevOps solutions, focusing on multi-cloud orchestration and AI-powered automation.

The manufacturing segment in the Development to Operations market is expected to grow at a CAGR of 17.28%, fueled by the adoption of Industrial IoT (IIoT), smart factories, and AI-driven automation. Manufacturers are implementing DevOps strategies to optimize production workflows, reduce downtime, and enhance supply chain management. The rise of cloud-based DevOps platforms, predictive maintenance, and real-time monitoring solutions is driving market expansion in the manufacturing sector.

Additionally, Siemens launched an AI-powered DevOps tool for factory automation, enabling real-time system monitoring and automated troubleshooting. The increasing demand for cybersecurity, digital twins, and automated software updates in industrial environments is further accelerating DevOps adoption in the manufacturing industry.

Regional Analysis

North America held the largest market share of 41% in 2023 in the Development to Operations market, driven by the strong presence of leading cloud service providers, advanced IT infrastructure, and high adoption of automation technologies. The U.S. and Canada are leading markets, with companies such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM Cloud investing heavily in AI-powered DevOps tools, containerization, and Infrastructure as Code (IaC). In 2023, AWS launched new DevOps automation tools, integrating serverless computing and Kubernetes orchestration, which further strengthened its dominance in the region. Similarly, Microsoft expanded its Azure DevOps services, enhancing machine learning-based workflow automation. The high adoption of DevOps in BFSI, IT, and healthcare sectors, along with the rise in hybrid and multi-cloud deployments, continues to drive market growth in North America.

The Asia-Pacific region is experiencing the highest growth in the Development to Operations market, with a CAGR of 17.92% during the forecast period. The rapid digital transformation, expansion of cloud computing, and increasing adoption of DevOps practices in emerging economies such as China, India, Japan, and South Korea are key drivers of growth. The surge in startups, fintech innovations, and government-backed IT initiatives has fueled DevOps adoption across industries. In 2023, Alibaba Cloud launched a new DevOps automation suite, enabling faster software development and deployment for enterprises in China. Additionally, Tata Consultancy Services (TCS) introduced an AI-driven DevOps solution, helping businesses enhance operational efficiency and streamline software delivery. The increasing demand for agile methodologies, container orchestration (Kubernetes, Docker), and hybrid cloud solutions is further accelerating DevOps adoption in APAC, making it the fastest-growing region in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amazon Web Services (AWS) [AWS CodePipeline, AWS CodeDeploy]

-

Atlassian Corporation Plc. [Jira Software, Bitbucket]

-

Dell Technologies [Boomi, DevOps Ready Solutions]

-

Microfocus [ALM Octane, LoadRunner]

-

Broadcom Inc. [CA Automic, CA Release Automation]

-

Cisco Systems, Inc. [AppDynamics, Intersight]

-

Docker, Inc. [Docker Desktop, Docker Hub]

-

Rackspace Technology [Rackspace DevOps Automation, Rackspace Managed Kubernetes]

-

Oracle Corporation [Oracle Cloud Infrastructure DevOps, Oracle Developer Cloud Service]

-

Hewlett Packard Enterprise (HPE) [HPE ALM Quality Center, HPE LoadRunner]

-

IBM Corporation [IBM UrbanCode Deploy, IBM Instana]

-

GitLab [GitLab CI/CD, GitLab Runner]

-

Parasoft [Parasoft SOAtest, Parasoft Virtualize]

-

Progress Software Corporation [Chef, OpenEdge]

-

Puppet Inc. [Puppet Enterprise, Bolt]

Recent Trends

-

In December 2024, AWS introduced Amazon Q Developer, an AI tool designed to automate routine tasks and free up developers' time for coding. AWS CEO Matt Garman highlighted that developers typically spend only about one hour per day on actual coding, with the rest consumed by tasks like learning codebases and fixing issues. Amazon Q Developer aims to alleviate this by automating such tasks, potentially enhancing productivity.

-

In November 2024, Atlassian's head of AI, Sherif Mansour, emphasized that AI tools like Microsoft's Copilot and Atlassian's Rovo are designed to create more focused effort rather than reduce work hours. Employees have reported saving around 20 hours a month using these tools, which help prioritize important tasks and enhance productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.42 Billion |

| Market Size by 2032 | US$ 52.37 Billion |

| CAGR | CAGR of 16.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premise, Cloud) • By Enterprise Size (SMEs, Large Enterprise) • By End-use (IT, BFSI, Retail, Manufacturing, Healthcare, Energy & Utilities, Others [Food & Beverages, Education, Aerospace & Defense, Government]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Atlassian Corporation Plc., Dell Technologies, Microfocus, Broadcom Inc., Cisco Systems, Inc., Docker, Inc., Rackspace Technologies, Oracle Corporation, Hewlett Packard Enterprise, IBM Corporation, GitLab, Parasoft, Progress Software Corporation, Puppet Inc |