Diabetic Neuropathy Market Report Scope & Overview:

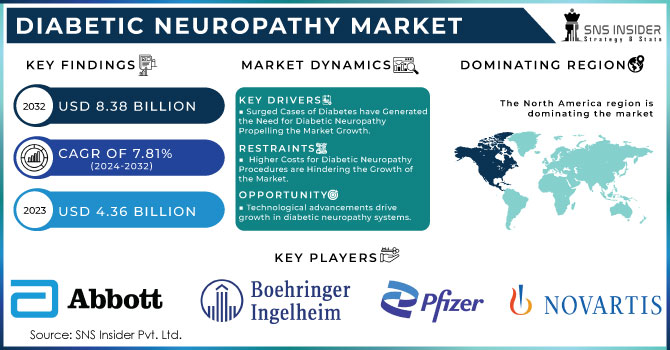

The Diabetic Neuropathy market size was USD 4.28 billion in 2023 and is expected to reach USD 8.18 billion by 2032 and grow at a CAGR of 7.48% over the forecast period of 2024-2032. This report offers comprehensive insights into key trends shaping the prescription drugs market, including drug pricing trends that reflect the evolving strategies in cost management and market accessibility. It also delves into the regulatory approvals and market authorization process, highlighting how stringent regulations influence drug launches and market dynamics. The report examines the R&D investment in pharmaceuticals, focusing on innovation and the prioritization of high-value therapeutic areas. Additionally, it covers emerging pharmaceutical marketing and distribution trends, exploring how companies are adapting to digital platforms and global distribution strategies. Furthermore, the report provides insights into clinical trials and drug development, emphasizing the latest advancements and strategies for accelerating drug development. These insights combined help stakeholders understand the evolving landscape and make informed decisions in the rapidly changing prescription drugs market

Get more information on Diabetic Neuropathy Market - Request Free Sample Report

The U.S. held the largest market share in the prescription drugs market, accounting for 75% of the global share, driven by its well-established healthcare infrastructure, advanced pharmaceutical research, and high demand for innovative treatments. With a market size of USD 1.346 billion, the U.S. has become a global leader in pharmaceutical spending, supported by significant government investment in healthcare through programs like Medicare and Medicaid, as well as private insurance coverage. The country is home to some of the world’s largest pharmaceutical companies, which continuously drive drug innovation and development, contributing to the dominance of the U.S. market. Additionally, the aging population, combined with the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions, has fueled the demand for prescription medications. As a result, the U.S. continues to dominate the global prescription drug market, both in size and share.

Market Dynamics

Drivers

-

Increasing prevalence of diabetes and growing awareness of diabetic neuropathy fuel market growth.

The rising global prevalence of diabetes is one of the main drivers for the diabetic neuropathy market's growth. As more people are diagnosed with type 1 and type 2 diabetes, the likelihood of developing diabetic neuropathy increases. Diabetic neuropathy is a common complication of diabetes, causing significant discomfort and pain. This growing disease burden has heightened awareness about the condition among healthcare providers and patients, leading to an increased demand for treatments and therapies. Additionally, ongoing research into innovative treatment options, such as neuroprotective drugs and advanced medical devices, has spurred the growth of the market. The increased diagnosis rate of diabetes and improved healthcare access worldwide are driving the need for better management solutions, fueling market expansion.

Restrain

-

The high cost of treatment and limited access to advanced therapies pose challenges to market growth.

A key restraint for the diabetic neuropathy market is the high cost of treatment and limited access to advanced therapies, which hinders widespread adoption, particularly in developing regions. Diabetic neuropathy treatments, including pain relief medications, neuroprotective drugs, and medical devices, can be prohibitively expensive, especially for patients without comprehensive healthcare coverage. In addition, while some advanced therapies have shown promise, they may not be readily available in low-income areas due to limited healthcare infrastructure and economic constraints. These barriers to access can delay diagnosis and appropriate treatment, negatively impacting market growth, especially in regions where diabetes is prevalent but healthcare access remains constrained.

Opportunity

-

Growing research and development activities in diabetic neuropathy treatments provide market expansion potential.

The growing research and development (R&D) efforts in diabetic neuropathy treatments present a significant opportunity for the market. With increasing recognition of the disease burden, pharmaceutical companies are investing heavily in developing more effective and affordable treatments for diabetic neuropathy. Research into novel drug formulations, stem cell therapies, and gene therapies offers the potential for breakthroughs that can significantly improve patient outcomes and quality of life. Additionally, government support and private sector investments aimed at accelerating R&D in neuropathic pain management and neuroprotection are helping bring innovative treatments to market. These advancements could help address unmet medical needs, opening up new avenues for growth in the diabetic neuropathy market.

Challenge

-

Lack of early diagnosis and standardized treatment guidelines limits effective management of diabetic neuropathy.

One of the main challenges facing the diabetic neuropathy market is the lack of early diagnosis and standardized treatment guidelines, which can delay the initiation of proper care and hinder effective management. Diabetic neuropathy often develops gradually and can be difficult to diagnose in its early stages due to overlapping symptoms with other conditions. Additionally, there is no universally accepted treatment protocol, leading to variability in clinical practices and difficulties in determining the most appropriate therapy for individual patients. This challenge limits the timely intervention needed to prevent further progression of the disease, resulting in greater complications and higher healthcare costs. Improved diagnostic tools and standardized treatment guidelines would help address this issue, enhancing patient outcomes and market growth.

Segmentation Analysis

By Disorder Type

Peripheral Neuropathy dominated the market in 2023, with 62%. It is due to a very prominent number of diabetic patients have this type of diabetic neuropathy. Peripheral neuropathy primarily targets the peripheral nerves, one of the largest nervous systems in the human body, that supply the distal parts of our body, such as the hands, feet, and legs leading to pain, numbness and tingling that greatly affect the quality of life of the people with these disabilities. The rising global prevalence of diabetes is leading to an increased incidence of peripheral neuropathy, thereby increasing the demand for the treatment. Furthermore, diabetes is frequently associated with peripheral neuropathy as one of its first complications, causing early diagnosis and potential therapeutic demands.

By Drug Class

Non-steroidal anti-inflammatory Drugs (NSAIDs) held the largest market share, around 32% in 2023. It is owing to their widespread use and effectiveness against pain and inflammation associated with diabetic neuropathy. In conditions like peripheral neuropathy, where patients suffer pain, swelling, and discomfort, NSAIDs like ibuprofen and naproxen are often prescribed to relieve symptoms. They are usually very well-established in terms of efficacy in managing pain, which has subsequently made them a go to option for both doctors and patients without prescription standards given their over-the-counter nature. Furthermore, compared to other therapeutic options, NSAIDs are frequently regarded as a low-cost alternative, which adds to their popularity. Although potential side effects such as gastrointestinal problems due to long-term use are known, the low cost and rapid symptom relief of NSAIDs make them a first-line treatment, thus dominating the market.

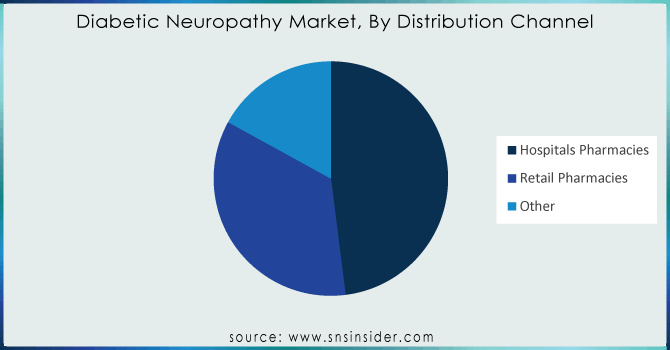

By Distribution Channel

Hospital pharmacies held the largest market share at around 52% in 2023. As hospital pharmacies play an integral role in the provision of specialized treatment and a major role in the management of complex cases of neuropathic pain. For patients suffering from hyperalgesic diabetic neuropathy, prescription medications such as opioid medications, antidepressants, and anticonvulsants are normally dispensed through hospital pharmacies; as opposed to retail or online pharmacies. Hospitals are also often primary sites for the diagnosis, initiation of treatment, and ongoing management of neuropathy, so they are filling a lot of those prescriptions.[38] Hospital pharmacies also get rapid access to these specialized drugs, including those with very narrow therapeutic windows and an emphasis on medical oversight, and such hospitals become the go-to site for physicians taking care of severe cases. Additionally, the rising number of diabetes-related complications leading to hospital visits and admissions has also boosted the upsurge in demand for hospital pharmacies, thus maintaining their market dominance.

Need any customization research on Diabetic Neuropathy Market - Enquiry Now

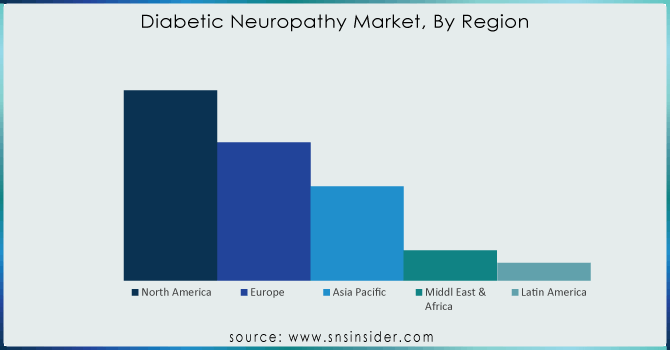

Regional Analysis

North America held the largest market share, around 42%, in 2023. It is owing to the increased prevalence of diabetes, advanced health care infrastructure, and strong research and development activities in the region. The epidemic of diabetes in the United States and Canada, in part due to non-exercise, obesity, and aging with its association of diabetic neuropathy, has grown quite rapidly. North America also has a mature health care system and very good access to sophisticated treatment options like prescription drugs, pain management systems, and drug innovation. In addition to this, the region hosts excellent government programs and reimbursement policies, which further the accessibility of treatment for patients. In addition, major pharma players are contributing major investments towards drug research and clinical trials in neuropathy-oriented drugs, thus boosting market growth. North America holds the top rank among all geographic markets for diabetic neuropathy owing to higher healthcare expenditure and greater awareness for diabetic complications.

Europe held the significant market share. This is owing to the increasing incidence of diabetes, geriatric population, and presence of well-established healthcare infrastructure. A rise in new diabetic neuropathy cases has been observed in Germany, the U.K., France, and Italy due to increased volumes of diabetes patients. Moreover, the government healthcare policies in Europe, compliments by the government hospitals and clinics, offer universal access to treatment, which introduces neuropathy medications in the reimbursement programs. Moreover, the presence of key pharmaceutical companies and ongoing research and development in the arena of neuropathic pain treatment has also boosted the overall market. In addition, the rising awareness campaigns and preventive healthcare initiatives in Europe have resulted in early diagnosis and treatment, which in turn is anticipated to fuel the demand for diabetic neuropathy drugs.

Key Players

-

Abbott (Lyrica, Prodigy)

-

Novartis (Tegretol, Voltaren)

-

Pfizer Inc. (Neurontin, Lyrica)

-

Boehringer Ingelheim GmbH (Duloxetine, Pragiola)

-

Lupin Pharmaceuticals (Gabapentin, Amitriptyline)

-

Janssen Pharmaceuticals, Inc. (Topamax, Ultram)

-

Glenmark Pharmaceuticals Ltd. (Carbamazepine, Pregalin)

-

Eli Lilly and Company (Cymbalta, Trulicity)

-

Astellas Pharma Inc. (Amaryl, Tarceva)

-

Medtronic PLC (Intellis, SynchroMed II)

-

Sanofi (Lantus, Soliqua)

-

Merck & Co., Inc. (Januvia, Steglatro)

-

AstraZeneca (Forxiga, Onglyza)

-

GlaxoSmithKline plc (Lamictal, Paxil)

-

Teva Pharmaceutical Industries Ltd. (Gabapentin, Copaxone)

-

Bayer AG (Aspirin, Glucobay)

-

Takeda Pharmaceutical Company Limited (Actos, Edarbi)

-

Sun Pharmaceutical Industries Ltd. (Gabapin, Dulane)

-

Novo Nordisk A/S (Ozempic, Victoza)

-

UCB Pharma (Keppra, Vimpat)

Recent Development:

-

In January 2024, Neuralace Medical, Inc. secured FDA approval for the Axon Therapy device, developed to treat chronic painful diabetic neuropathy (CPDN). This neuromodulation therapy provides a non-invasive treatment alternative for patients experiencing diabetic nerve pain.

-

In October 2023, Boston Scientific received FDA approval for the WaveWriter Alpha Spinal Cord Stimulator (SCS), designed to treat painful diabetic peripheral neuropathy (PDN). This approval strengthens the company’s position in the competitive PDN market, alongside key players like Abbott, Medtronic, and Nevro.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD4.28 Billion |

| Market Size by 2032 | USD 8.18 Billion |

| CAGR | CAGR of7.48 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Disorder Type (Peripheral Neuropathy, Autonomic Neuropathy, Proximal Neuropathy, Focal Neuropathy) • By Drug Class (Antidepressants, NSAIDs, Capsaicin, Opioid, Others) • By Distribution Channel (Hospitals Pharmacies, Retail Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, Novartis, Pfizer Inc., Boehringer Ingelheim GmbH, Lupin Pharmaceuticals, Janssen Pharmaceuticals Inc., Glenmark Pharmaceuticals Ltd., Eli Lilly and Company, Astellas Pharma Inc., Medtronic PLC, Sanofi, Merck & Co. Inc., AstraZeneca, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Bayer AG, Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., Novo Nordisk A/S, UCB Pharma |