Home Healthcare Devices Market Size:

Get More Information on Home Healthcare Devices Market - Request Sample Report

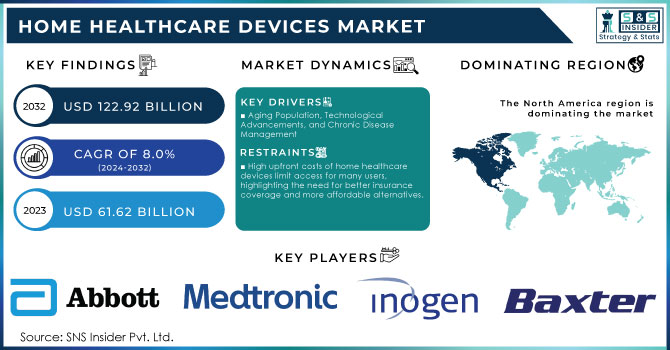

The Home Healthcare Devices Market size was valued at USD 61.62 billion in 2023 and is expected to reach USD 122.92 billion by 2032 and grow at a CAGR of 8.0% over the forecast period of 2024-2032.

The home healthcare devices market has shown significant growth, which is further attributed to an aging population and the increasing rate of chronic diseases. As stated by the World Health Organization, there were more than 3.8 million deaths in the year 2020 due to chronic respiratory diseases, and the demand for home healthcare equipment like oxygen delivery systems, ventilators, etc., rises. The International Diabetes Federation reported that in 2021, approximately 537 million people aged 20-79 were suffering from diabetes, a number expected to increase rapidly. This will further raise the demand for in-home glucose monitors and insulin delivery systems. In the United States, the CDC report indicates that cardiovascular diseases, including coronary heart disease, remain one of the leading causes of death, with approximately 697,000 deaths reported in 2021. Correspondingly, given the growing incidence of hypertension and heart failure, home monitoring devices pressure monitors, and portable ECG devices have also gained increasing popularity.

It also experienced the most critical acceleration in the growth of markets with increased demand for medical devices in home usage due to hospital backlogs. In 2020, CDC data reported a 154% increase in utilization of telehealth solutions for remote monitoring of patients. This trend has paved the way for better wearables integration providing more real-time health monitoring options.

At that time, people aged 65 years and above represented nearly 10% of the world population, a growing percentage calling for a more significant number of home healthcare services. The sales of wearable health devices, such as smartwatches with health-tracking features, have grown increasingly. There is a recent growth in sales of nearly 30% for wearable devices in 2023 compared to those sales in 2021. These developments have critically proved that home healthcare devices are the basis of modern medicine, stimulated by recent breakthroughs in technology and increased demand on the patient's part.

Most Commonly used home healthcare devices:

|

Home Healthcare Device |

Company |

|

Blood Pressure Monitor |

Omron Healthcare |

|

Philips Healthcare |

|

|

A&D Company |

|

|

Glucose Meter |

Abbott Laboratories (FreeStyle Libre) |

|

Roche Diagnostics (Accu-Chek) |

|

|

LifeScan, Inc. (OneTouch) |

|

|

Dexcom |

|

|

Portable Oxygen Concentrator |

Inogen |

|

Philips Respironics |

|

|

Invacare Corporation |

|

|

Nebulizer |

Omron Healthcare |

|

Philips Respironics |

|

|

PARI Respiratory Equipment |

|

|

Digital Thermometer |

Braun |

|

Vicks |

|

|

Omron Healthcare |

|

|

Pulse Oximeter |

Masimo |

|

Nonin Medical |

|

|

Medtronic |

|

|

Continuous Positive Airway Pressure (CPAP) Machine |

ResMed |

|

Philips Respironics |

|

|

Fisher & Paykel Healthcare |

|

|

Electric Wheelchair |

Pride Mobility |

|

Permobil |

|

|

Invacare Corporation |

|

|

Hearing Aids |

Sonova Group (Phonak) |

|

Starkey Hearing Technologies |

|

|

Widex |

|

|

Medical Alert System |

Life Alert |

|

Philips Lifeline |

|

|

Medical Guardian |

Market Dynamics

Drivers

-

Aging Population, Technological Advancements, and Chronic Disease Management

The elderly population, which has risen steadily, will be a dominant driver in the market for home healthcare devices. Manufacturers are, therefore, required to design more efficient, accurate, and user-friendly medical equipment. As aging adults, ever-increasingly in need of monitoring devices, mobility aids, and therapeutic apparatus, have given rise to the increasing demand for the same, it fuels the growth of the market.

Medical device development has also contributed a great deal to the growth of this market. The main growth strategy was innovation for "remotely monitored patient observation." The integration of IoT with medical devices for seamless communication between the patient and provider is complemented by telemedicine and mHealth technologies through mobile applications, cloud services, and machine-to-machine systems. Also, the rising cost of healthcare has further boosted the growth of the market. Home medical equipment is a more cost-effective alternative to in-clinic diagnostics and close observation, thus attracting it, particularly in economically depressed regions. The management of care at home is made easier and accessible to patients at a reduced cost through these devices.

The rising incidence of chronic diseases drives demand for home healthcare equipment. Chronic diseases such as diabetes, and cardiovascular and respiratory diseases are on the rise, thereby fueling an increased need for home-based devices that allow constant monitoring, medicines dispensation, and therapeutic interventions. It is also ascribed to the growing awareness and education about the benefits associated with home care, resulting in a rise in adoption of home healthcare equipment. The sector is witnessing tremendous growth as people grow aware of the benefits associated with home care, including convenience, cost savings, and personalization.

Restraints

-

High upfront costs of home healthcare devices limit access for many users, highlighting the need for better insurance coverage and more affordable alternatives.

-

The technical complexity of certain devices poses challenges for patients, especially seniors, necessitating user-friendly designs and sufficient training for confident and independent use.

Key Segmentation

By Product

Monitoring devices held the largest market share in 2023, with approximately 38.0% of the total market share. This category includes equipment that allows for the continual monitoring of patient's vital signs and health conditions. To name a few, it includes all types of blood pressure monitors, glucose meters, and heart rate monitors. The increasing cases of chronic diseases and a rapidly growing elderly population accelerate the demand for monitoring devices as patients need follow-up care and data in real-time to enable timely medical interventions. Increasing awareness about health monitoring among consumers and the increasing ease of home healthcare solutions are also enhancing the strong growth of this segment.

The testing devices segment is considered to be the fastest-growing category and is likely to expand at a CAGR of 10% over the next few years. Growth in this area can largely be attributed to the rising demand for at-home diagnostic solutions, which allow for easy and precise test performance in the convenience of one's home without actually requiring an in-clinical visit. Huge demand for home-based testing kits, including rapid antigen test kits and blood testing kits to be done from home, is triggered by growing awareness of the COVID-19 pandemic. This is a developing trend where self-diagnosis will increasingly be favored. Testing devices will be an important space for innovation and growth in the market for home healthcare.

By Service

Infusion therapy emerged as the dominant service segment, accounting for around 35.0% of the total market share in 2023. Infusion therapy delivers medicines and nutrients directly into the bloodstream, mostly needed for patients suffering from chronic conditions like cancer, diabetes, or infections. The increasing incidence of these diseases, combined with the development of portable infusion devices, is a factor that pushes the use of infusion therapy in the home environment. This segment is characterized by patient comfort improvement and quality of life, along with lowering the rates of hospital readmission, which allows it to be the leading shareholder in the market of home healthcare devices.

Skilled nursing is the most rapidly growing segment with an expected growth rate of 9% over the forecast period. This care includes holistic nursing by registered nurses, provided at home to all patients, and can be the basis for customized plans based on individual health requirements. The demand for skilled nursing care would rise with the intensity of care required, especially where patients have chronic conditions or require post-operative care. Emphasis on patient-centered care and the necessity for out-of-home individualized attention are the prime reasons behind the swift gain in demand for this section.

Regional Analysis

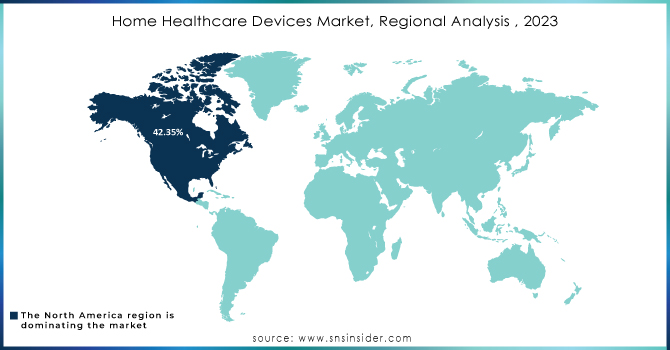

North America was the market leader for home healthcare devices, accounting for a substantial 42.35% of market revenue in 2023. The region boasts advanced healthcare infrastructure that lays a solid foundation for the proliferation of home care medical equipment. With a strong network of state-of-the-art medical infrastructure along with efficient delivery systems from well-trained healthcare professionals, North America provides an ideal setting for home care services to flourish. This existing infrastructure supports the smooth implementation and adoption of home healthcare devices, especially by providing efficient ways for distribution, utilization, and support services.

Furthermore, the sound economic condition prevailing in North America is also significantly increasing its dominance in the market. High income levels and disposable incomes empower individuals to make investments in home care medical equipment; thus adding more strength to the growth of the market. The financial ability of the population allows them to purchase advanced and, in many ways, costly home healthcare technologies, which further motivates consumers to adopt advanced innovations regarding home care.

An increasing awareness of the benefits accruing from receiving care at home contributes to the demand for home healthcare devices. North America is thus well-positioned at the top of the global market. A whole gamut of efforts in improving the delivery and outcomes of healthcare has driven the region. Economic empowerment is also another edge. The region is thus very well-placed to take into account the changes patients desire to adapt toward home management for their healthcare requirements. Infrastructures, economic conditions, and patient-centered care continue to seal the deal for North America's dominance in the home healthcare devices market.

Need Any Customization Research On Home Healthcare Devices Market - Inquiry Now

Key Players in the Home Healthcare Devices Market

Monitoring Devices

-

Abbott Laboratories

-

Medtronic plc

-

OMRON Healthcare Inc.

-

Philips Healthcare

Testing Devices

-

B. Braun Melsungen AG

-

Inogen, Inc.

-

AirSep Corporation

-

Caire, Inc.

Infusion Therapy

-

Baxter International Inc.

-

Convatec Group plc

-

Johnson & Johnson

Rehabilitation Services

-

Drive Medical

-

Sunrise Medical LLA

-

Meyra

Respiratory Therapy

-

ResMed Inc.

-

Invacare Corporation

-

Teijin Pharma Limited

Skilled Nursing Services

-

Hill-Rom Holdings Incorporated

-

Medline Industries LP

Miscellaneous Offerings

-

GE Healthcare

-

Stryker

-

Beckton Dickinson

Recent Developments

In May 2024, LG introduced Primefocus Health, a new initiative aimed at enabling healthcare providers to deliver enhanced home healthcare services. This venture focuses on utilizing innovative technologies and therapies for remote patient monitoring, helping to alleviate provider burnout and facilitating more personalized care for patients.

In April 2024, the FDA launched an initiative called Home as a Health Care Hub, aimed at advancing home healthcare models and devices. This initiative encourages technology developers and providers to explore innovative designs for at-home care solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 61.62 billion |

| Market Size by 2032 | US$ 122.92 billion |

| CAGR | CAGR of 8.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Testing, Screening, Monitoring) • By Service (Rehabilitation, Infusion Therapy, Unskilled Care, Respiratory Therapy, Pregnancy Care, Skilled Nursing, Hospice and Palliative Care) • By Software (Agency Software, Clinical Management Systems, Hospice Solutions) • By Application (cardiovascular diseases & Hypertension, Diabetes, Respiratory Diseases, Pregnancy, Mobility Disorders, Cancer, Wound Care, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Arkray Inc., AirSep Corporation, B. Braun Melsungen AG, Baxter International Inc., Beckton Dickinson, Caire Inc. (NGK Spark Plug Co. Ltd.), Convatec Group plc, Drive Medical, GE Healthcare, Hill-Rom Holdings Incorporated, Home Medical Products Inc., Inogen Inc., Invacare Corporation, Johnson & Johnson, Koninklijke Philips N.V., Medline Industries LP, Medtronic plc, Meyra, OMRON Healthcare Inc. (Omron Corporation), O2 Concepts, LLC, Philips Healthcare, Prime Medical, Resmed Inc., Rotech Healthcare Inc., Stryker, Sunrise Medical LLA., Smiths Group, Teijin Pharma Limited |

| Key Drivers | • Aging Population, Technological Advancements, and Chronic Disease Management |

| Restraints | • High upfront costs of home healthcare devices limit access for many users, highlighting the need for better insurance coverage and more affordable alternatives. • The technical complexity of certain devices poses challenges for patients, especially seniors, necessitating user-friendly designs and sufficient training for confident and independent use. |