Digital Evidence Management Market Report Scope & Overview

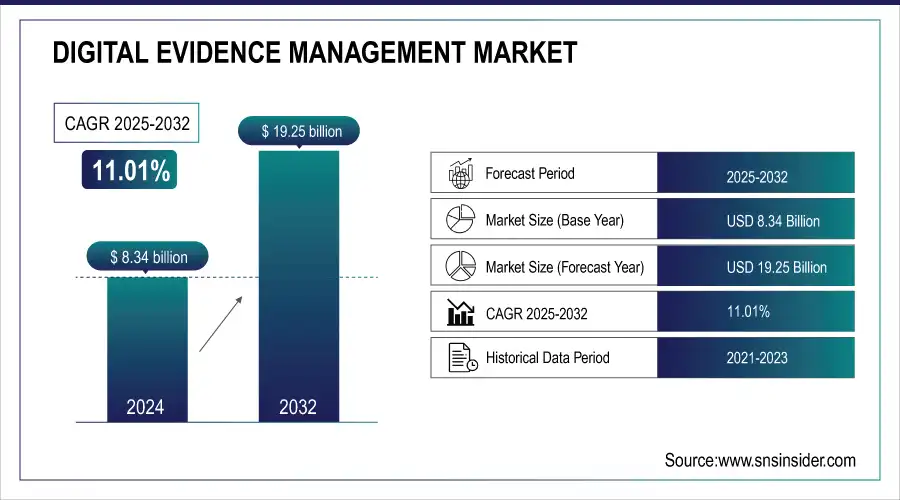

The Digital Evidence Management Market Size was valued at USD 8.34 Billion in 2024 and is expected to reach USD 19.25 Billion by 2032 and grow at a CAGR of 11.01% over the forecast period 2025-2032.

The Digital Evidence Management market is experiencing significant growth, driven by several key factors that are reshaping how digital evidence is collected, stored, and analyzed across various sectors. The proliferation of digital devices such as smartphones, tablets, and IoT devices has led to an exponential increase in digital data. Law enforcement agencies and legal entities are handling vast amounts of digital evidence, including emails, social media content, and surveillance footage.

Get more information on Digital Evidence Management Market - Request Free Sample Report

Rapid technological advancements, including artificial intelligence (AI), machine learning (ML), and blockchain, are enhancing the capabilities of digital evidence management systems. AI and ML enable the automated analysis of large datasets, identifying patterns and anomalies that human investigators might miss. Blockchain technology offers secure and immutable records of evidence handling, ensuring a transparent chain of custody. These technologies are transforming digital evidence management solutions, making them more efficient and reliable.

Key Digital Evidence Management Market Trends

-

Growing adoption of cloud-based DEM solutions for secure and scalable evidence storage.

-

Increasing use of body-worn cameras, CCTV, and IoT devices is generating large volumes of digital evidence.

-

Rising demand for AI and analytics-driven evidence management to automate tagging, redaction, and investigation workflows.

-

Focus on cybersecurity and data integrity, including encryption and blockchain-based evidence tracking.

-

Expansion of law enforcement and government digital transformation initiatives globally.

Digital Evidence Management Market Growth Drivers

-

Increasing Adoption of Advanced Technologies like AI and Blockchain Drives the Digital Evidence Management Market

The increasing integration of advanced technologies, particularly Artificial Intelligence (AI), Machine Learning (ML), and blockchain, is a significant driver for the growth of the Digital Evidence Management market. AI and ML enhance the capabilities of Digital Evidence Management systems by automating the analysis of large datasets and identifying patterns or anomalies that human investigators might miss. These technologies allow Digital Evidence Management systems to process and analyze data more efficiently, leading to faster, more accurate investigations. Furthermore, blockchain technology ensures the integrity and immutability of digital evidence through a secure and transparent chain of custody, which is crucial for maintaining legal and regulatory compliance. As law enforcement agencies and legal professionals handle increasingly complex digital evidence, such as video surveillance footage, emails, and social media activity, the demand for advanced Digital Evidence Management solutions that integrate these technologies is rising. Blockchain’s role in protecting evidence from tampering also adds an extra layer of trust and security to the management of sensitive data. These innovations not only improve operational efficiency but also enhance the ability to conduct thorough, secure investigations, making them crucial to the ongoing growth of the Digital Evidence Management market.

-

Rising Incidence of Cybercrime and Need for Efficient Digital Forensics Solutions Boost the Market Demand

The increasing prevalence of cybercrime is another primary driver of the Digital Evidence Management market. As cybercrimes such as hacking, data breaches, identity theft, and online fraud become more sophisticated and widespread, law enforcement agencies and organizations are increasingly turning to digital forensics to investigate and combat these crimes. Digital evidence plays a central role in these investigations, from tracing the origins of cyberattacks to identifying and securing sensitive information that can be used in legal proceedings.

There is a growing need for Digital Evidence Management solutions that can collect, preserve, and analyze large volumes of digital evidence in a way that adheres to legal standards and ensures its integrity. Cybercrime investigations often involve the examination of emails, social media activity, cloud data, and encrypted files, requiring advanced tools that can handle these complex and varied data types. With the growing threat of cybercrime and the need for more effective digital forensics solutions, the Digital Evidence Management market is expected to continue its expansion, driven by the demand for technologies that can efficiently handle, store, and secure digital evidence.

Digital Evidence Management Market Restraints

-

High Implementation Costs and Complexity of Digital Evidence Management Solutions Limit Market Growth Potential

One of the significant restraints on the Digital Evidence Management market’s growth is the high implementation cost and complexity associated with Digital Evidence Management solutions. While Digital Evidence Management systems offer substantial benefits in terms of efficiency, security, and regulatory compliance, the initial costs involved in procuring and setting up these advanced technologies can be prohibitive for smaller organizations or law enforcement agencies with limited budgets.

Additionally, the complexity of integrating new Digital Evidence Management solutions into existing workflows can present a significant barrier. Many agencies face challenges in terms of training staff, maintaining the systems, and ensuring that the solutions are scalable and adaptable to changing needs. Furthermore, the ongoing costs related to system upgrades, data storage, and cybersecurity also add to the financial burden, making it difficult for some organizations to justify the investment. The combination of high upfront costs and the need for continuous maintenance and expertise can slow down the adoption of Digital Evidence Management solutions, particularly in developing regions or smaller jurisdictions that may lack the resources to support such infrastructure.

Digital Evidence Management Market Segment Analysis

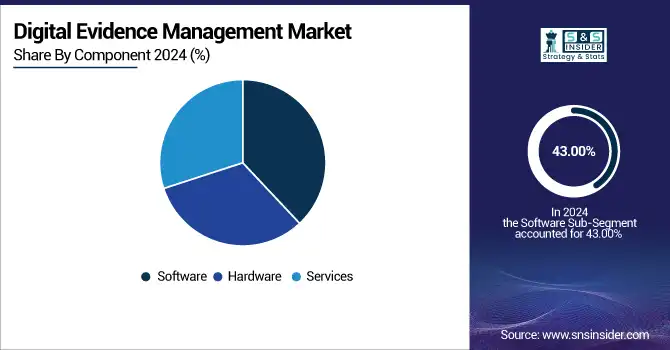

By Component

The Software segment in the Digital Evidence Management market is projected to dominate, holding a significant share of 43.00% in 2023, driven by its vital role in automating, organizing, and securely managing digital evidence across various industries, especially law enforcement and legal sectors. Software solutions facilitate the collection, storage, and analysis of digital data, enabling efficient evidence management, compliance with regulations, and maintaining chain of custody.

For instance, Axon’s Evidence.com platform provides cloud-based evidence storage, real-time evidence tracking, and AI-powered analysis, improving the efficiency and security of investigations. Similarly, Motorola’s CommandCentral Vault offers secure evidence management through an intuitive software interface, supporting video, audio, and document data.

The Services segment within the Digital Evidence Management market is experiencing rapid growth, with a projected CAGR of 12.50% during the forecast period. This growth is largely attributed to the increasing demand for customized, end-to-end services, such as consulting, implementation, integration, and support, which are essential for deploying and maintaining complex Digital Evidence Management solutions.

Furthermore, as cybercrime and regulatory requirements evolve, the demand for professional services that offer tailored solutions to meet the needs of specific organizations is accelerating. This shift towards comprehensive service-based offerings within the Digital Evidence Management market reflects a broader trend toward outsourcing expertise and ensuring proper implementation and management of advanced digital evidence solutions.

By End User

The Law Enforcement Agencies segment commands the largest share of 59.00% in the Digital Evidence Management market in 2023, driven by the critical need for managing and securing vast amounts of digital evidence involved in criminal investigations. Law enforcement agencies are increasingly relying on advanced DEM solutions to streamline the process of collecting, storing, and analyzing digital evidence such as surveillance footage, digital files, and mobile data.

For instance, Axon launched its cloud-based evidence management platform, Evidence.com, which enables secure storage, analysis, and sharing of evidence in real-time, improving operational efficiency. Similarly, Motorola Solutions’ CommandCentral Vault offers a centralized platform to manage multimedia evidence, ensuring data integrity and accessibility for law enforcement agencies.

The Criminal Justice Agencies segment is witnessing the largest CAGR of 11.61% within the Digital Evidence Management market during the forecast period. This growth is attributed to the increasing integration of DEM solutions within various stages of the criminal justice process, from investigation to prosecution and legal proceedings. Criminal justice agencies, including courts, prosecutors' offices, and correctional facilities, require advanced tools to manage the growing volume of digital evidence and ensure its proper handling in compliance with legal standards.

For example, Cellebrite’s Digital Intelligence (DI) Hub is expanding its capabilities to include services tailored to the specific needs of criminal justice agencies, such as digital evidence analysis and data visualization.

Digital Evidence Management Market Regional Analysis

North America Digital Evidence Management Market Insights

North America is the dominant region in the Digital Evidence Management (DEM) market in 2023, with a substantial market share. The region holds the largest share 43% due to its advanced technological infrastructure, strong law enforcement agencies, and stringent regulatory frameworks around data security and evidence management. The United States, in particular, has been a major driver, with government agencies like the FBI, Homeland Security, and local law enforcement investing heavily in DEM solutions to manage and analyze digital evidence.

Additionally, the U.S. government's emphasis on improving cybersecurity and digital evidence handling has created a favorable market environment for DEM providers. North America’s dominance is further supported by the region’s investment in cutting-edge technologies such as AI and blockchain, which enhance the effectiveness and security of evidence management.

Need any customization research on Digital Evidence Management Market - Enquire Now

Asia Pacific Digital Evidence Management Market Insights

Asia Pacific is the fastest-growing region in the Digital Evidence Management market, with an estimated CAGR of around 12.95% during the forecast period. This rapid growth can be attributed to the increasing adoption of digital technologies across emerging economies in the region, including China, India, and Japan. The rise in cybercrime and the growing importance of digital forensics in criminal investigations are driving the demand for advanced DEM solutions.

For example, in countries like India and China, law enforcement agencies are increasingly relying on digital evidence to combat cybercrimes, terrorism, and fraud. The introduction of cloud-based DEM solutions, such as those offered by companies like Veritone and i-Sight, is also contributing to the rapid expansion of the market in this region.

Europe Digital Evidence Management Market Insights

Europe holds a 28% share of the global DEM market in 2024, with Germany, the UK, and France driving regional growth. Adoption is fueled by AI-powered surveillance, analytics-driven platforms, cloud-based storage, and strict data privacy regulations such as GDPR. Smart city projects and increasing investments in public safety technology further accelerate market penetration, enabling law enforcement and judicial agencies to efficiently manage digital evidence and improve case processing.

Latin America Digital Evidence Management Market Insights

Latin America holds a 7% market share in 2024, with Brazil, Mexico, and Argentina leading adoption. Law enforcement agencies in the region are modernizing infrastructure and implementing cloud-based digital evidence management systems to address increasing crime and improve case management. However, budget constraints, uneven technological readiness, and limited technical expertise continue to challenge faster adoption across the region.

Middle East & Africa Digital Evidence Management Market Insights

The MEA region accounts for 5% of the global DEM market in 2024. Adoption is gradually increasing, led by smart city initiatives and advanced surveillance projects in the UAE, Saudi Arabia, and South Africa. DEM platforms are being deployed to enhance public safety and security, but regulatory barriers, limited technical expertise, and varying infrastructure maturity slow broader adoption. Ongoing investments in urban security and law enforcement modernization are expected to drive steady growth in the coming years.

Digital Evidence Management Market Competitive Landscape

IBM Corporation

IBM Corporation is a U.S.-based technology giant offering advanced security and analytics solutions, including digital evidence management platforms.

-

In April 2023, IBM launched the IBM Security QRadar Suite to streamline and enhance security analysts’ expertise across the incident lifecycle. The suite expands QRadar’s capabilities to include comprehensive threat detection, investigation, and response, supported by significant investments in portfolio innovation.

Axon Enterprise, Inc.

Axon Enterprise, headquartered in the U.S., is a leading provider of public safety technologies, including body-worn cameras and digital evidence management solutions.

-

In May 2023, Axon secured a 10-year agreement with the San Bernardino County District Attorney’s Office to manage digital evidence using Axon Justice Premier, reflecting the growing adoption of advanced DEM systems by law enforcement agencies.

Motorola Solutions

Motorola Solutions is a U.S.-based provider of communication and digital evidence solutions for public safety organizations.

- In March 2023, Motorola Solutions launched an enhanced CommandCentral Evidence platform integrating AI-driven video analytics and automated evidence tagging, aimed at improving case management efficiency for police departments.

Cellebrite

Cellebrite, an Israel-based digital intelligence company, specializes in mobile device forensics and digital evidence management.

- In February 2023, Cellebrite released the UFED Cloud Analyzer, enabling law enforcement to extract, analyze, and manage cloud-based digital evidence with enhanced speed and accuracy, supporting investigations across multiple jurisdictions.

VIDIZMO LLC

VIDIZMO is a U.S.-based provider of enterprise-grade digital evidence management and video content management solutions.

- In January 2023, VIDIZMO expanded its Digital Evidence Management System to integrate AI-based redaction and facial recognition tools, enhancing compliance and accelerating the investigative workflow for public safety agencies.

Key Players

Some of the major players in the Digital Evidence Management Market are:

-

Motorola Solutions (CommandCentral Records, CommandCentral Evidence)

-

NICE Ltd (NICE Investigate, NICE Inform)

-

Panasonic Corporation (Arbitrator 360° HD, Unified Digital Evidence)

-

IBM Corporation (IBM i2 Analyze, IBM Security QRadar)

-

Hitachi, Ltd. (Hitachi Video Management Platform, Hitachi Visualization Suite)

-

VIDIZMO LLC (VIDIZMO Digital Evidence Management System, VIDIZMO EnterpriseTube)

-

Coban Technologies, Inc. (FOCUS H1, EDGE HD)

-

Open Text (OpenText Axcelerate, OpenText EnCase)

-

Cellebrite (Cellebrite UFED, Cellebrite Physical Analyzer)

-

Axon Enterprise, Inc. (Evidence.com, Axon Body 3)

-

Oracle Corporation (Oracle Analytics Cloud, Oracle Autonomous Database)

-

Genetec Inc. (Genetec Clearance, Genetec Security Center)

-

Verint Systems Inc. (Verint Evidence Center, Verint Video Investigator)

-

Digital Ally, Inc. (FirstVu HD, VuLink)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.34 Billion |

| Market Size by 2032 | USD 19.25 Billion |

| CAGR | CAGR of 11.01 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Services (Digital Investigation and Consulting, System Integration, Support and Maintenance, Training and Education) • By Deployment Mode (On-Premise, Cloud) • By End Users (Law Enforcement Agencies, Criminal Justice Agencies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Motorola Solutions, NICE Ltd, Panasonic Corporation, IBM Corporation, Hitachi, Ltd., VIDIZMO LLC, Coban Technologies, Inc., OpenText Corporation, Cellebrite, Axon Enterprise, Inc., Oracle Corporation, Genetec Inc., Verint Systems Inc., Digital Ally, Inc. |