ERP Software Market Report Scope & Overview:

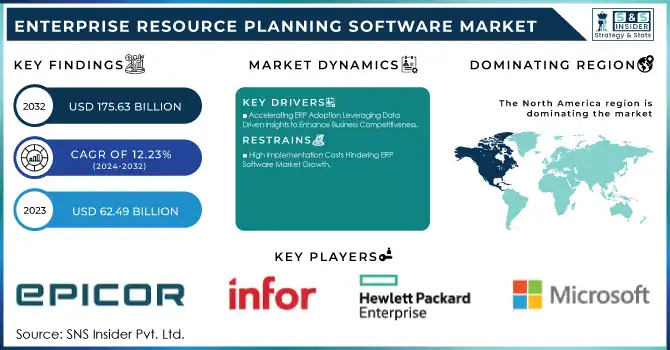

The Enterprise Resource Planning Software Market was valued at USD 62.49 billion in 2023 and is expected to reach USD 175.63 billion by 2032, growing at a CAGR of 12.23% from 2024-2032.

Get more information on ERP Software Market - Request Free Sample Report

The enterprise resource planning software market has seen substantial growth as businesses seek to streamline operations and improve efficiency across key functions such as finance, supply chain, human resources, and customer relationship management. This surge in demand is largely driven by the need for organizations to integrate core processes into a unified platform. Cloud technology plays a pivotal role, allowing small and medium-sized enterprises to access scalable and affordable ERP solutions once reserved for larger organizations. According to research, More than 55% of retail companies are expected to implement hybrid ERP deployments, reflecting a shift towards flexible systems. Additionally, 69% of private organizations say the pandemic accelerated their digital transformation, including ERP adoption. This trend is underscored by ECI Software Solutions' acquisition of Khameleon Software in 2024 to expand its ERP capabilities for project-based dealers in the commercial furniture industry.

This growth trend is further reinforced by the increasing demand for real-time data analytics, as businesses require actionable insights to stay competitive. The integration of artificial intelligence, machine learning, and the Internet of Things into ERP systems has enabled predictive analytics, automation, and improved decision-making, enhancing business operations. Industries such as manufacturing, retail, and healthcare are increasingly relying on ERP solutions to tackle challenges like supply chain disruptions, regulatory compliance, and shifting consumer demands. According to research, 58% of healthcare ERP developers have integrated AI into their products. The rise of AI is also seen in Microsoft's USD 13 billion partnership with OpenAI, which resulted in AI-assisted ERP software in Microsoft Dynamics 365, while SAP launched its generative AI assistant, "Joulie," in 2023. Additionally, the growth of hybrid and remote work models has accelerated cloud-based ERP adoption, offering businesses the flexibility needed for seamless collaboration.

The ERP software market is set to capitalize on new opportunities, especially in emerging markets and specialized industries. The growing emphasis on sustainability and the rise of Industry 4.0 technologies are expected to drive the development of ERP systems focused on green supply chain management and sustainability efforts. Furthermore, the integration of blockchain technology within ERP systems is anticipated to enhance data security and transparency, creating more trust in digital transactions. As enterprises continue to prioritize agility and innovation, vendors that focus on customizable, modular ERP solutions with advanced analytics capabilities are well-positioned to capture a larger share of the market.

Market Dynamics

Drivers

-

Accelerating ERP Adoption Leveraging Data Driven Insights to Enhance Business Competitiveness

Data-driven decision-making is essential for businesses seeking to maintain a competitive edge. Enterprise Resource Planning software enables organizations to harness the power of real-time data analytics, providing actionable insights into operations, financials, and overall performance. By consolidating data across various business functions, ERP systems allow companies to make informed decisions that optimize resource allocation, streamline processes, and enhance efficiency. This capability is particularly valuable as businesses need to respond rapidly to market shifts and consumer behavior changes. With an increasing reliance on data to guide business strategies, ERP solutions that integrate advanced business intelligence and analytics tools are becoming more critical, driving strong demand in the market and accelerating ERP software adoption.

-

Integration with Emerging Technologies Fueling ERP Software Market Growth

Integrating emerging technologies such as Artificial Intelligence, machine learning, the Internet of Things, and blockchain with ERP systems significantly enhances operational efficiency and fosters innovation. AI and machine learning can automate processes, predict trends, and improve decision-making, while IoT enables real-time data collection from connected devices, providing deeper insights into operations. Blockchain enhances security and transparency in transactions, which is crucial for businesses handling sensitive data. These advanced technologies transform traditional ERP systems, making them more powerful and adaptive to the dynamic needs of modern enterprises. As businesses look for ways to optimize their operations, increase automation, and stay ahead of technological advancements, ERP solutions that incorporate these cutting-edge technologies become increasingly attractive, leading to a growing adoption of ERP systems across industries.

Restraints

-

High Implementation Costs Hindering ERP Software Market Growth

The initial investment required for implementing ERP software can be a significant barrier, particularly for small and medium-sized businesses. ERP systems often involve substantial costs, including licensing fees, customization, integration with existing systems, and comprehensive employee training. For many organizations, these upfront expenses can be overwhelming, leading to hesitation in adopting ERP solutions. The cost of ERP systems typically ranges between USD 1,740 and USD 9,330 per month, depending on the size of the business and its specific requirements. Small businesses can expect annual costs between USD 20,880 and USD 55,440, while enterprise-level companies may pay up to USD 111,960 annually. Additionally, the complexity of tailoring ERP systems to specific business processes drives up costs, and the need for skilled IT professionals for integration and ongoing maintenance adds to the financial burden, limiting market growth potential.

-

Data Security Concerns Impacting ERP Software Adoption

ERP systems handle vast amounts of sensitive business data, including financial records, employee information, and customer details. This makes data security a major concern for organizations considering ERP adoption. Companies worry about the risk of cyberattacks, data breaches, and unauthorized access, which could lead to significant financial and reputational damage. These concerns are exacerbated in industries with strict data privacy regulations, such as healthcare and finance, where compliance is crucial. As cyber threats evolve and become more sophisticated, businesses must ensure that their ERP systems are equipped with robust security features, such as encryption and multi-factor authentication. This need for strong cybersecurity measures can lead to hesitation in adopting or fully integrating ERP solutions, especially for businesses lacking the resources to invest in secure, advanced systems.

Segment Analysis

By Deployment

In 2023, the on-premise segment led the enterprise resource planning software market with the highest revenue share of approximately 58%, driven by businesses' preference for full control over their data and infrastructure. On-premise solutions provide enhanced security, customization options, and compliance, making them particularly attractive to large organizations with stringent regulatory requirements. Additionally, the substantial upfront investment and long-term stability offered by on-premise systems appeal to industries where data privacy and control are paramount.

The cloud segment is expected to grow at the fastest CAGR of 13.39% from 2024 to 2032. Cloud-based ERP systems offer scalability, lower upfront costs, and quicker implementation, making them ideal for businesses seeking agility and operational efficiency. The increasing adoption of remote work, the need for real-time collaboration, and the reduced IT burden are key factors contributing to the rapid growth of the cloud ERP segment. This shift towards cloud solutions reflects a broader trend of digital transformation, where flexibility and cost-effectiveness are prioritized.

By Enterprise Size

In 2023, the large enterprises segment dominated the enterprise resource planning software market, capturing about 67% of the revenue share. This is primarily due to their extensive need for integrated systems to manage complex operations, vast data sets, and large-scale resources. Large organizations benefit from the robust capabilities of ERP systems, which offer high customization, advanced security, and scalability. Their substantial budgets also enable them to invest in on-premise ERP solutions, ensuring greater control and compliance with industry regulations.

The small and medium enterprises segment is expected to grow at the fastest CAGR of 14.14% from 2024 to 2032. This growth is driven by the increasing availability of affordable cloud-based ERP solutions, which offer SMEs scalability, faster deployment, and reduced upfront costs. Additionally, the growing need for SMEs to streamline operations, improve efficiency, and remain competitive in a digital-first world is further fueling the demand for ERP systems. With cloud-based options, SMEs can now access enterprise-grade capabilities that were previously out of reach.

By Function

In 2023, the finance segment dominated the enterprise resource planning software market, capturing around 33% of the revenue share. This is largely attributed to the critical role financial management plays in businesses of all sizes. ERP systems provide comprehensive solutions for budgeting, accounting, reporting, and compliance, helping organizations streamline financial processes and ensure accuracy. Additionally, the growing complexity of regulatory requirements and the need for real-time financial insights are driving demand for robust financial management capabilities offered by ERP solutions.

The HR segment is projected to grow at the fastest CAGR of 14.51% from 2024 to 2032. This growth is fueled by the increasing need for businesses to optimize workforce management, enhance employee engagement, and manage talent effectively. ERP systems integrated with advanced HR functionalities allow organizations to streamline recruitment, performance management, and payroll processing. As organizations prioritize employee experience and productivity, the demand for HR-specific ERP solutions is rising rapidly, positioning it as the fastest-growing segment in the market.

Regional Analysis

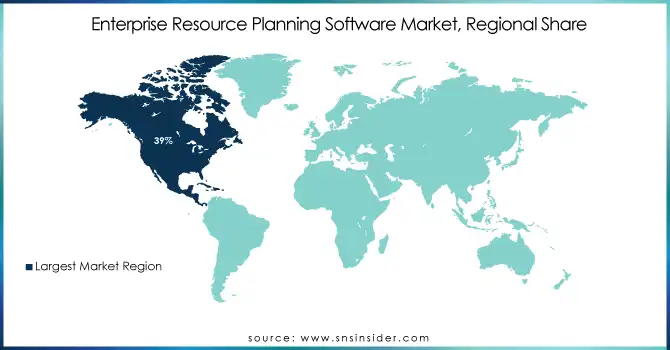

In 2023, North America led the enterprise resource planning software market, holding the highest revenue share of approximately 39%. The region's dominance can be attributed to the presence of many established enterprises across various industries, such as manufacturing, finance, and retail, which rely heavily on ERP systems for operational efficiency and scalability. Additionally, North America's advanced technological infrastructure, high adoption of cloud computing, and a strong focus on digital transformation further fueled the demand for ERP solutions, reinforcing its leadership in the market.

The Asia Pacific region is expected to grow the fastest CAGR of 14.85% from 2024 to 2032. The rapid industrialization and digitalization efforts across key economies such as China, India, and Japan drive this growth. As businesses in the region seek to enhance operational efficiency, streamline supply chains, and manage resources effectively, the demand for ERP systems is soaring. The increasing number of small and medium enterprises (SMEs) adopting ERP solutions, along with significant investments in digital infrastructure, will contribute to Asia Pacific's rapid market expansion.

Need any customization research on ERP Software Market - Enquiry Now

Key Players

-

Epicor Software Corporation (Epicor ERP, Prophet 21)

-

Hewlett-Packard Development Company, L.P (HP Adaptive Management, HP Project Portfolio Management)

-

Infor Inc. (Infor CloudSuite, Infor M3)

-

IBM Corporation (IBM Cognos Analytics, IBM Maximo)

-

Microsoft Corporation (Microsoft Dynamics 365, Microsoft Power BI)

-

NetSuite Inc. (NetSuite ERP, NetSuite CRM+)

-

Oracle Corporation (Oracle NetSuite, Oracle Fusion Cloud ERP)

-

Sage Group plc (Sage Intacct, Sage 300cloud)

-

SAP SE (SAP S/4HANA, SAP Business ByDesign)

-

Unit4 (Unit4 ERP, Unit4 Financial Planning & Analysis)

-

Workday Inc. (Workday Financial Management, Workday Human Capital Management)

-

Deltek (Deltek Costpoint, Deltek Vantagepoint)

-

QAD Inc. (QAD Adaptive ERP, QAD Cloud ERP)

-

IFS AB (IFS Cloud, IFS Applications)

-

Acumatica (Acumatica Cloud ERP, Acumatica Construction Edition)

-

Syspro (SYSPRO ERP, SYSPRO Avanti)

-

Tally Solutions Pvt Ltd (TallyPrime, Tally ERP 9)

-

Odoo SA (Odoo ERP, Odoo CRM)

-

Priority Software (Priority ERP, Priority Zoom)

-

Ramco Systems (Ramco ERP Suite, Ramco Global Payroll)

-

abas Software GmbH (abas ERP, abas Distribution)

-

Plex Systems Inc. (Plex Smart Manufacturing Platform, Plex ERP)

Recent Developments:

-

In 2024, Epicor announced its acquisition of Smart Software, aiming to enhance its supply chain management offerings with Smart's advanced demand forecasting and inventory optimization capabilities. This move expands Epicor’s analytics and AI-driven solutions for businesses.

-

In October 2023, IBM and KPMG expanded their partnership to enhance SAP S/4HANA adoption in the energy and utilities sector, leveraging IBM's technical expertise and KPMG's industry knowledge to ensure successful Cloud ERP implementations and improved operational efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 62.49 Billion |

| Market Size by 2032 | USD 175.63 Billion |

| CAGR | CAGR of 12.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premise, Cloud) • By Function (Finance, HR, Supply Chain, Others) • By Enterprise Size (Small & Medium Enterprises, Large Enterprises) • By Vertical (Manufacturing & Services, BFSI, Healthcare, Retail, Government, Aerospace & Defense, Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Epicor Software Corporation, Hewlett-Packard Development Company, L.P., Infor Inc., IBM Corporation, Microsoft Corporation, NetSuite Inc., Oracle Corporation, Sage Group plc, SAP SE, Unit4, Workday Inc., Deltek Inc., QAD Inc., IFS AB, Acumatica, Syspro, Tally Solutions Pvt Ltd, Odoo SA, Priority Software, Ramco Systems, abas Software GmbH, Plex Systems Inc. |

| Key Drivers | • The Rise of Data-Driven Decision Making as a Key Driver for ERP Software Market Growth • Integration with Emerging Technologies Fueling ERP Software Market Growth |

| RESTRAINTS | • High Implementation Costs Hindering ERP Software Market Growth • Data Security Concerns Impacting ERP Software Adoption |