Mobile Wallet Market Size & Overview:

To Get More Information on Mobile Wallet Market - Request Sample Report

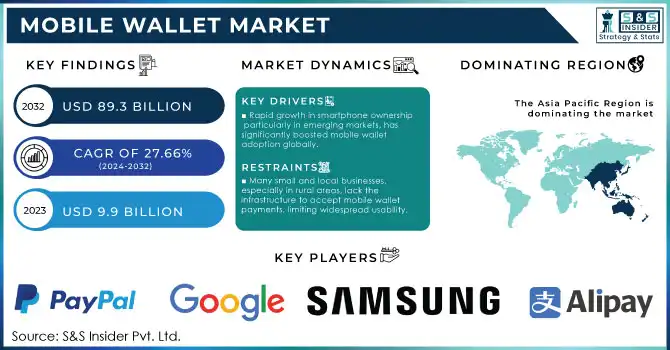

The Mobile Wallet Market was valued at USD 9.9 billion in 2023 and is expected to reach USD 89.3 Billion by 2032, growing at a CAGR of 27.66% over 2024-2032.

The mobile wallet market is witnessing remarkable expansion as digital payment systems increasingly integrate into commerce and daily transactions. Mobile wallets, enabling secure storage and swift payments via smartphones, are becoming indispensable due to their convenience, robust security, and adaptability to changing consumer demands. A key driver of this growth is the widespread adoption of smartphones and high-speed internet, especially in emerging markets. For instance, India recorded an extraordinary 13.4 billion mobile payment transactions in 2024, spearheaded by UPI platforms such as Google Pay and PhonePe. Likewise, in the U.S., apple pay reported a 25% surge in usage for in-store payments in 2024, emphasizing growing consumer trust. These trends align with global shifts towards cashless economies, as governments and enterprises promote digital transactions for enhanced efficiency and transparency.

Additionally, the integration of features like loyalty programs, bill payment options, ticketing, and financial management tools within wallet apps has further fueled adoption. PayPal, for instance, reported notable growth in its "Pay Later" feature in 2024, catering to users' demand for flexible payment options. Innovations in near-field communication (NFC) and biometric security, including fingerprint authentication, are also enhancing mobile wallet reliability and user experience. Collaborations between wallet providers and retailers are also reshaping consumer interactions. Starbucks, for example, facilitated 55% of its U.S. sales in 2024 through its mobile wallet app, which combines seamless payment processes with loyalty benefits. Such partnerships demonstrate how businesses use mobile wallets to enhance customer retention and satisfaction.

The growth of e-commerce has significantly bolstered mobile wallet usage, particularly in Asia-Pacific. In China, digital payment platforms like Alipay and WeChat Pay commanded over 90% of the country's digital transaction market share in 2024, reflecting regional dominance in mobile wallet adoption. In conclusion, the mobile wallet market is thriving due to rising smartphone penetration, changing user preferences, and multifunctional app integration. This trajectory suggests a future where mobile wallets are fundamental to global financial systems and consumer lifestyles.

Mobile Wallet Market Dynamics

Drivers

-

Rapid growth in smartphone ownership, particularly in emerging markets, has significantly boosted mobile wallet adoption globally.

-

The global shift towards cashless economies encourages mobile wallet usage as a secure, efficient alternative to cash and cards.

-

The surge in online shopping has amplified the need for seamless digital payment solutions, propelling mobile wallet growth.

The exponential growth of e-commerce has propelled mobile wallets into a central role in digital transactions, revolutionizing how payments are processed. With the steady expansion of online shopping platforms, consumers increasingly seek payment methods that are secure, efficient, and seamless. Mobile wallets fulfill these demands by offering frictionless checkouts, removing the need for manual card inputs, reducing transaction times, and strengthening security through advanced features like biometric authentication and tokenization.

In 2024, global e-commerce sales were estimated at USD 6.3 trillion, with a significant share attributed to mobile wallet-facilitated transactions. For instance, PayPal experienced a 19% year-on-year increase in mobile transactions during the first quarter of 2024. Likewise, leading platforms such as Amazon and Alibaba have implemented wallet features like one-click payments to align with the growing preference for effortless and efficient online shopping. Mobile wallets are versatile, accommodating multiple payment methods, loyalty programs, and promotional codes, making them attractive to both tech-savvy consumers and businesses. These capabilities not only streamline the payment process but also help businesses improve customer engagement and retention. For example, Amazon Pay and Google Pay offer seamless integration with online stores, ensuring quick transactions and enhancing customer satisfaction.

Furthermore, the rise of cross-border e-commerce has driven mobile wallet adoption due to its ability to support multi-currency transactions and diverse payment systems. In the Asia-Pacific region, platforms like Alipay and Paytm dominate the digital payment landscape, facilitating over 85% of retail transactions in countries like China, which leads the global e-commerce boom. As e-commerce continues to expand, especially in emerging markets with advancing internet infrastructure, mobile wallets are becoming an indispensable component of the digital economy. Enhanced user experiences, robust security measures, and growing consumer trust position mobile wallets as the preferred payment solution within the global e-commerce ecosystem.

| Metric | Data (2024) | Insights |

|---|---|---|

| Global e-commerce sales | USD 6.3 trillion | Mobile wallets contributed significantly to sales. |

| Increase in mobile wallet transactions | 23% YoY growth | Reflects growing reliance on wallets for online payments. |

| Mobile wallet adoption in APAC | >85% of e-commerce transactions | Dominated by platforms like Alipay and WeChat Pay. |

| Leading sector using wallets | Retail e-commerce | Fast and secure checkouts enhance consumer experience. |

Restraints

-

Many small and local businesses, especially in rural areas, lack the infrastructure to accept mobile wallet payments, limiting widespread usability.

-

Issues like app crashes, transaction delays, or network unavailability can lead to user dissatisfaction and reduced reliance on mobile wallets.

-

Users worry about the potential for cyberattacks, fraud, and unauthorized data access due to the sensitive financial information stored in mobile wallets.

Mobile wallets need to be reliable, any technical errors like app crashing, delays in transactions, or connectivity issues can majorly hamper the credibility of mobile wallets and take a toll on the user experience soon might lead to the fading away of the adoption of these wallets. Mobile wallet solutions rely on seamless, efficient operation to process secure transactions and any glitches can cause consumers to lose trust. If users face delays or crashes when making payments, they lose confidence in the reliability of the wallet and will be less inclined to use the service again.

In fast-paced industries like e-commerce and retail, even a brief delay in transaction processing can lead to frustrated users, increased transaction abandonment, and a negative impact on the reputation of mobile payment systems. According to J.D. Power, 44% of the total mobile wallet users have reported such issues which are directly related to user experience. These problems can keep consumers from using mobile wallets again because consumers expect the most seamless, efficient, and hassle-free payment experience possible. There are various issues also with connectivity that hampers the functionality of the mobile wallet. In an area with weak or unreliable internet, mobile wallets are subject to slow processing of transactions or even the failure of your transaction altogether. The issue is even more pronounced in developing markets where internet infrastructure is still maturing. According to the International Telecommunication Union (ITU), there are approximately 3.7 billion people across the globe who do not have reliable internet access, which has become a major hurdle for mobile wallet adoption in these regions.

Such technical disruptions not only erode consumer confidence but also hinder the growth trajectory of the mobile wallet market. The disruption to mobile wallets will impact transactions, sales, and customer loyalty for businesses that rely on them to process money. To avoid these potential risks, wallet providers are investing more in enterprise customer wallet infrastructure such as cloud-based and encryption technologies to offer better performance, reliability, and security. Yet, until these functionality problems are genuinely solved, they will continue to be a significant obstacle to the growth of the mobile wallet marketplace.

Mobile Wallet Market Segment Analysis

By Technology

The proximity technology segment dominated the market and represented a revenue share of 65.7% in 2023, due to its extensive application in in-store payments. NFC and other proximity-based technologies allow users to conduct instant in-store, contactless transactions via a simple tap of their smartphones over the POS. It has been popular in retail, transportation, and other consumer-facing sectors. This growth can be further attributed to the high penetration of NFC-enabled smart devices and consumers' ongoing need for speedy and secure payment methods. The growing integration of seamless proximity-based payment systems in mobile wallets is expected to drive the growth of mobile wallet deployment in brick-and-mortar stores, thereby dominating the segment in the market.

In the mobile wallet market, the remote technology segment is witnessing the highest compound annual growth rate (CAGR). This growth is a result of the increasing transition from traditional methods to transaction methods, where consumers can purchase goods and services remotely from their mobile devices without actually being near the merchant. With the continued growth of e-commerce and digital platforms across the world, especially as internet infrastructure improves in regions such as Africa, the appetite for remote payments only seems to increase. The emergence of new remote payment methods enables consumers to buy wherever and whenever they want — digital wallets, online payment systems, etc. Increasing convenience of remote payments and enhanced security measures like two-factor authentication are driving segment growth at an accelerating pace, and forecasts suggest that it will continue to grow in the coming years.

By Application

The retail and e-commerce segment held the largest revenue share of 35.2% in 2023 and is likely to retain its lead all through the forecast period. As retailers and online retailers start to see the possible benefits of accepting mobile wallet payments, the writing is on the wall. The intent of retail integration of cashless or contactless pay-tech with digital marketing is to gain consumer data, opportunities, and ultimately conversion and loyalty. Moreover, NFC technology is expected to improve operational efficiency by reducing processing costs and accelerating checkout. It helps e-commerce firms and brands deliver great offers and monitor loyalty points to serve mobile customers better.

The banking segment is anticipated to register the highest CAGR during the forecast period. In addition, many vending companies are switching to mobile payment systems for fast, convenient transactions at vending machines. Vending companies can accept mobile payments from QR code programs, electronic wallet applications, or vouchers.

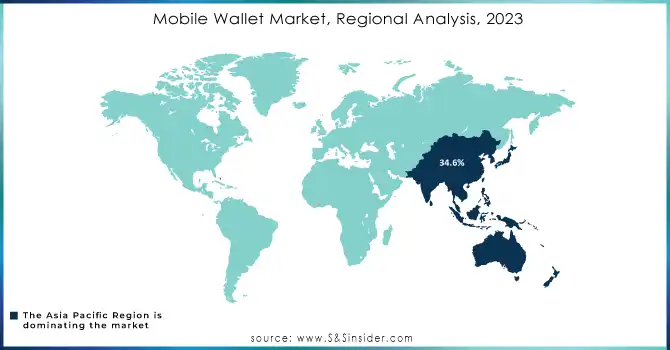

Mobile Wallet Market Regional Analysis

The market for mobile wallets was dominated by Asia-Pacific in 2023, accounting for 34.6% of the global share, and is expected to grow at the fastest CAGR over the forecast period. The main contributors to this growth are the young, smartphone-loving demographic and increasing number of internet users, particularly in markets like India and China. Besides, initiatives like Digital India and Make in India by the Government are to bolster smartphone penetration that drives mobile wallet demand in the region.

Latin America is expected to register the highest CAGR of 28.6% throughout the forecast period, on the back of burgeoning smartphone penetration, increasing e-commerce activity, and rising consumer need for convenience. The recent increase in the rate of adoption of mobile wallets across the region is also due to regional governments and financial institutions playing their parts through regulatory frameworks and support for infrastructure development.

Do You Need any Customization Research on Mobile Wallet Market - Enquire Now

Key Players

The major key players along with their products are

-

PayPal - PayPal Mobile Wallet

-

Apple Inc. - Apple Pay

-

Google - Google Pay

-

Samsung Electronics - Samsung Pay

-

Alipay (Ant Group) - Alipay Mobile Wallet

-

WeChat (Tencent) - WeChat Pay

-

Amazon - Amazon Pay

-

Visa Inc. - Visa Checkout

-

Mastercard - Mastercard PayPass

-

Square Inc. - Square Wallet

-

Paytm - Paytm Wallet

-

Venmo (owned by PayPal) - Venmo Mobile Wallet

-

MobiKwik - MobiKwik Wallet

-

Cash App (Square Inc.) - Cash App Wallet

-

Lazada (Alibaba Group) - Lazada Wallet

-

TrueMoney (Ascend Money) - TrueMoney Wallet

-

Samsung Electronics - Samsung Pay

-

Revolut - Revolut Mobile Wallet

-

Zelle (Early Warning Services) - Zelle Payment App

-

Razer - Razer Pay

Recent Developments in the Mobile Wallet Market

October 2024: Monzo introduced a new feature in its mobile wallet app, allowing users to store loyalty cards and make seamless contactless payments. This update enhances user convenience, offering greater control over financial management and fostering a more streamlined digital wallet experience.

September 2024: The Commonwealth Bank launched a digital wallet with cryptocurrency support and instant payment capabilities. This new offering enhances the customer experience by integrating various banking services, ensuring users can manage digital payments, including cryptocurrencies, in a unified platform.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.9 billion |

| Market Size by 2032 | US$ 89.3 billion |

| CAGR | CAGR of 27.66% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Remote, Proximity) • By Application (Retail & E-commerce, Hospitality & Transportation, Banking, Vending Machine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal, Apple Inc, Google, Samsung Electronics, Alipay, WeChat, Amazon, Visa Inc, Mastercard, Square Inc, Paytm, Venmo, MobiKwik, Cash App, Lazada, TrueMoney, Samsung Electronics, Revolut, Zelle, Razer |

| Key Drivers | • Rapid growth in smartphone ownership, particularly in emerging markets, has significantly boosted mobile wallet adoption globally. • The global shift towards cashless economies encourages mobile wallet usage as a secure, efficient alternative to cash and cards. • The surge in online shopping has amplified the need for seamless digital payment solutions, propelling mobile wallet growth. |

| Market Challenges | • Users worry about the potential for cyberattacks, fraud, and unauthorized data access due to the sensitive financial information stored in mobile wallets. • Many small and local businesses, especially in rural areas, lack the infrastructure to accept mobile wallet payments, limiting widespread usability. • Issues like app crashes, transaction delays, or network unavailability can lead to user dissatisfaction and reduced reliance on mobile wallets. |