Digital Filter Market Size & Trends:

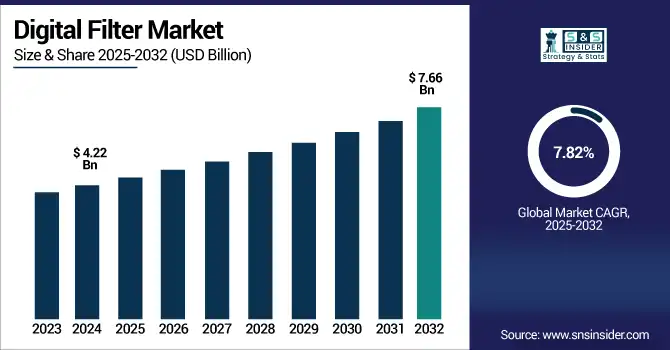

The Digital Filter Market Size was valued at USD 4.22 billion in 2024 and is expected to reach USD 7.66 billion by 2032 and grow at a CAGR of 7.82 % over the forecast period 2025-2032.

To Get more information on Digital Filter Market - Request Free Sample Report

Global Digital Filter Market will expand significantly owing to rising technological developments and increasing requirement for advanced signal processing solutions. The integration of digital filters is becoming stronger in the most important areas such as telecommunications, consumer, automotive or medical electronics, and power and efficiency. Furthermore, the developing economies are also witnessing strong adoption on account of increasing industrialisation and expansion of digital infrastructure.

The U.S. Digital Filter Market size was USD 0.91 billion in 2024 and is expected to reach USD 1.44 billion by 2032, growing at a CAGR of 5.98 % over the forecast period of 2025–2032.

The U.S. digital filter market growth is attributed to the growing use of the advanced communication technologies, rising consumer electronics, and the incorporation of digital filters in automotive and healthcare applications. Rise in focus to improve signal processing features and to overcome interference in electronic devices also drive the growth in the region.

Digital Filter Market Dynamics

Key Drivers:

-

Increasing Integration of Digital Filters in Consumer Electronics Devices

Consumers electronic is an exponentially increasing industry with every product such as smart phone, top let and smart home system at their disposal. These equipments need high-performance digital filters to sustain signal integrity and improve user experience. Ongoing advancements in consumer electronics such as digital filters that are compact and efficient is one of the major factors boosting the growth of the market. Moreover, the advent of 5G technology, AI-enabled devices and IoT applications has also intensified the requirement for high-level digital filtering solutions in consumer electronics.

According to research, recent advancements have resulted in a 20% reduction in the size of digital filter components and an improvement in energy efficiency by up to 15%, enhancing their suitability for use in compact smart devices.

Restrain:

-

Technical Challenges in Designing and Integrating Digital Filters

Efficient designs of digital filters suitable for multiple applications and targeted at different working environment face tough technical issues. Design considerations that must be accounted for include retaining signal fidelity, reducing latency, and compatibility with existing systems - these all demand sophisticated engineering solutions. Such intricacies can cause long development times and possible integration problems that may delay the adoption of digital filters in some industries. Not only must this performance be balanced with cost, power consumption must be managed and shrinkage be implemented without sacrificing quality, the latter also presenting an extra layer of complexity, as far as filter design and implementation are concerned.

Opportunities:

-

Growing Demand for Energy-Efficient Electronic Systems

Due to the worldwide concern on energy savings, there is an increasing demand for electronic systems that operate with lower energy and achieve higher performance. Digital filters play an important role for saving energy by aective ltering operations which enhanced the signal processing and minimize a superuous power consumption. This line of development paves the way to low-power digital filter designs for supporting sustainable initiatives, as well as for gaining market visibility. Additionally, policies that favour energy efficient technologies and the growing consumer demand toward green devices are also accelerating the deployment of power efficient filtering solutions in various industrial and consumer applications.

According to research, in the automotive sector, over 40% of new infotainment systems integrated low-power digital filters in 2023 to meet stringent energy efficiency requirements.

Challenges:

-

Rapid Technological Advancements Leading to Short Product Lifecycles

The digital filter industry is a fast growing, technically loaded market were seldom the same product remains the same for more than a few months. Innovation powers growth but also shortens product lifecycles and prompts the need for continuous R&D investment by manufacturers. This situation creates resource pressures and requires enterprises to be nimble to adapt to changing market needs. Rapid obsolescence also means a higher inventory risk, longer-term planning difficulties and the need to rush to market whilst delivering exceptional product quality and cost competitiveness in a volatile marketplace.

Digital Filter Market Segment Analysis:

By Application

The Consumer Electronics segment dominated the Digital Filter Market in 2024 with a revenue share of approximately 32.98%, because filters are now used in even more pervasive devices such as smart phones, tablets, and wearable electronics. Companies such as the Texas Instruments are important suppliers of advanced digital filter ICs that have advanced the quality of signal processing in consumer products. The global preference for compact, multi-functional and high efficiency consumer electronics has contributed and shaped the growth of noise reduction and better audio-visual quality to remain as an insurmountable force within this sector.

The Healthcare Equipment segment is expected to grow at the fastest CAGR of about 9.33% from 2025 to 2032, owing to increasing acceptance of advanced diagnostic and monitoring devices. Digital filter companies like Medtronic, moves digital filtering in products like ECG machines and wearable monitors for accurate signal processing. With the development of healthcare technology trends towards real-time, noninvasive monitoring and telemedicine, the requirements of the high quality filtering components are likely to rise sharply.

By Component

The Capacitors segment dominated the Digital Filter Market in 2024 with a revenue share of approximately 35.31%, because of their key role in frequency selection and noise filtration in analog and digital systems. Murata Manufacturing is a major player in capacitors, which are used extensively in consumer electronics and telecommunications, and industrial systems. Their low price, small physical size and low noise make them eminently suitable for voltage regulation and signal conditioning duties in digital filtering applications.

The Inductors segment is anticipated to expand at the fastest CAGR of about 9.25% from 2025 to 2032, driven on momentum of power electronics and RF communication applications. Firms such as TDK Corporation are also bringing high performing inductors to the market to address 5G infrastructure, electric cars, and sophisticated electronics. With the development of new technologies as well as the trend of miniaturization, small and high performance inductance components play a critical role in EMI suppression and signal quality enhancement, and enjoy a broad & fast growth.

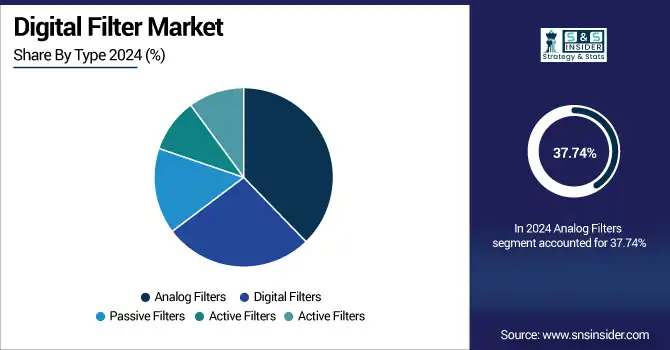

By Type

The Analog Filters segment dominated the highest digital filter market share of 37.74% in 2024, due to its prevalent employment in audio electronics, industrial instrumentation and in the telecommunications industry. Analog Devices, Inc. is a well-known manufacturer of such analog filter products, that permit real-time processing of signals with minimum delay. Simple and reliable as they are, analog filters remain indispensable in legacy and mission-critical signal-processing systems, and preclude a costly market withdrawal.

The Digital Filters segment is expected to grow at the fastest CAGR of 8.63% from 2025 to 2032, due to the higher requirement for precision filtering in modern electronics. Xilinx offers programmable digital filter designs commonly employed in AI, IoT, and communication systems. Because digital filters are flexible, accurate and directly manage the integrity of the data, a new generation of digital filters are increasingly being adopted in a wide variety of applications.

By Technology

The Infinite Impulse Response (IIR) Filters segment dominated revenue share of approximately 41.23% in 2024, due to its computational simplicity and lower number of filter coefficients required. Real-time processing in embedded and portable audio devices is heavily based on IIR filter implementations Monreal et al. They are able to have great market share in the consumer, industrial and communication applications for the compact size and low power consumption.

The Finite Impulse Response (FIR) Filters segment is forecasted to register the fastest CAGR of about 9.24% from 2025 to 2032, due primarily to the inherent stability and linear phase response. Firms such as NXP Semiconductors concentrate on implementations of FIR filters in biomedical devices and radar systems, which demand high-precision. Advanced DSP technology and requirements for high fidelity filtering are also pushing FFIR filters to rapidly generate in major industries.

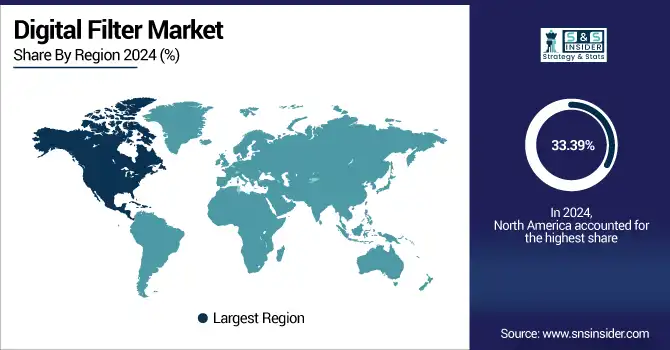

Digital Filter Market Regional Overview:

North America dominated the Digital Filter Market in 2024 with a revenue share of approximately 33.39%, due to its concentration of major technology firms and leading-edge chip manufacturing plants. High R&D investments, RGB giants consumer electronics, automotive and healthcare devices with advanced digital filtering are used so much because of the worldwide adoption There are a number of strong trends in the region. Furthermore, strong infrastructure and early acceptance of future technologies, including 5G and IOT, also help in ensuring stable development of the market in North America making it an established leader in the market.

-

The US is one of the leading markets for digital filter in North America as it has a strong semiconductor industry and also has leading technology companies. The leading position is additionally strengthened by advanced infrastructure and early introduction of consumer electronics as well as telecommunication innovations.

The Asia Pacific segment is expected to grow at the fastest CAGR of about 9.04% from 2025 to 2032, driven by a boom in industrialization, growing electronics manufacturing and rising consumer demand in China, India and South Korea. The increasing smart cities, the increasing production of automotive electronics,as well as increased healthcare infrastructure will continue to promote the market development. Favorable government initiatives and ample skilled workers also help in accelerating the uptake of digital filter technologies in the end use industries in the region.

-

China leads the Asia Pacific digital filter market due to the presence of a large electronics industry, significant government support, and rapid technology development. Its leading market position is owing to consumer demand, automotive and healthcare applications growth and 5G and IoT investments gains.

Digital Filter market in Europe is also estimated to see a steady growth throughout the forecast period due to the presence of automotive, industrial, and telecommunications industries. Countries, such as Germany and the UK, are at the forefront of the utilization of sophisticated filters in applications like automation and smart infrastructure. The region's reliance o technological advancements in addition to its high-quality oriented and innovative approach to livestock disease management support the moderate growth of the market.

-

Germany has the largest share of the European Digital Filter Market, driven by its flourishing industry and automotive sector, electronics manufacturing, and substantial R&D expenditure. Its emphasis on innovation and good engineering has contributed to the penetration of digital filtering into many fields and applications.

The Middle East & Africa region is dominated by the UAE, owing to fast growth in infrastructure sector, telecom expansion and smart city projects. Saudi Arabia and Qatar also invest in industrial developments. In Latin America, Brazil leads courtesy of growing consumer electronics sales, growing telecoms infrastructure and expansion in the automotive industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Digital Filter Companies are:

Major Key Players in Digital Filter Market are Analog Devices, Inc., Texas Instruments Inc., Broadcom Inc., Murata Manufacturing Co., Ltd., STMicroelectronics, Qorvo, Inc., Skyworks Solutions, Inc., Infineon Technologies AG, Maxim Integrated, NXP Semiconductors N.V.

Recent Development:

-

In December 2024, Analog Devices continues to support the ADSP-21489 SHARC audio processor, which features integrated FIR, IIR, and FFT accelerators for advanced digital filtering applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.22 Billion |

| Market Size by 2032 | USD 7.66 Billion |

| CAGR | CAGR of 7.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog Filters, Digital Filters, Passive Filters, Active Filters, Adaptive Filters) • By Application (Consumer Electronics, Telecommunication, Automotive, Healthcare Equipment, Industrial Applications) • By Component (Resistors, Capacitors, Inductors, Integrated Circuits, Other Passive Components) • By Technology (Finite Impulse Response (FIR) Filters, Infinite Impulse Response (IIR) Filters, Software-defined Filters, Hardware-based Filters) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Analog Devices, Inc., Texas Instruments Inc., Broadcom Inc., Murata Manufacturing Co., Ltd., STMicroelectronics, Qorvo, Inc., Skyworks Solutions, Inc., Infineon Technologies AG, Maxim Integrated, NXP Semiconductors N.V. |