Digital Radiology Market Report Scope & Overview:

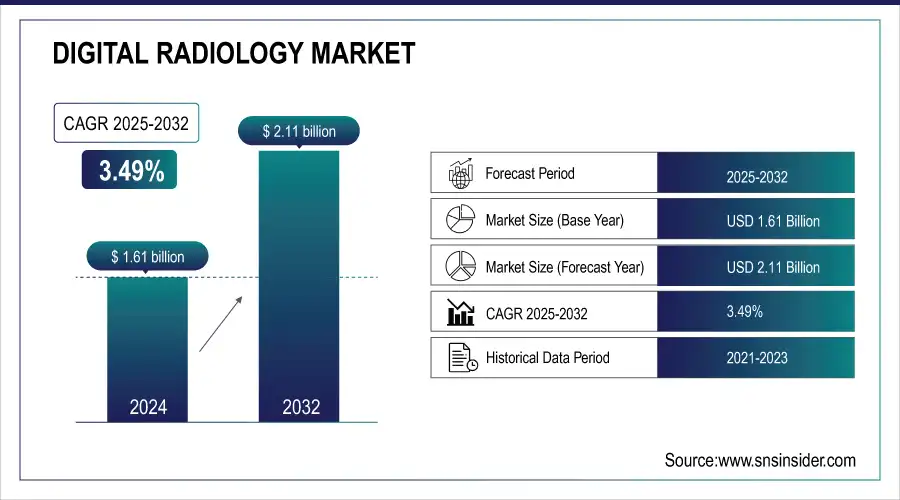

The Digital Radiology Market size was valued at USD 1.61 billion in 2024 and is expected to reach USD 2.11 billion by 2032, growing at a CAGR of 3.49% over the forecast period of 2025-2032.

The global digital radiology market is experiencing a strong growth in demand, as institutions demand faster, high-quality images for diagnostic purposes, and digital systems are replacing the analog equipment. Increasing utilization is being fueled by the development of AI-integrated imaging, greater workflow automation, and initiatives by governments for early disease detection on a global scale. Furthermore, increasing healthcare infrastructure in emerging countries and increasing investment in diagnostic technologies are anticipated to further propel the digital radiology market growth over the forecast period.

To Get more information on Digital Radiology Market - Request Free Sample Report

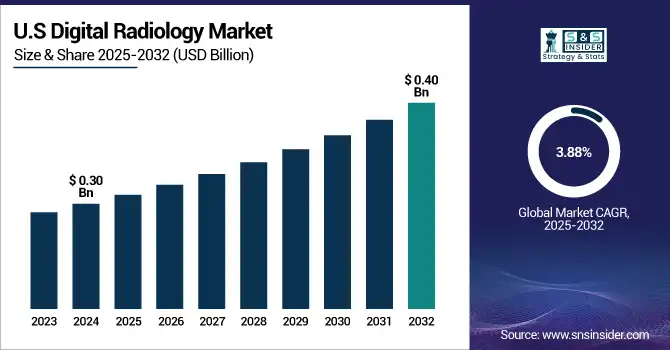

The U.S. digital radiology market size was valued at USD 0.30 billion in 2024 and is expected to reach USD 0.40 billion by 2032, growing at a CAGR of 3.88% over the forecast period of 2025-2032.

The U.S. is the highest North American digital radiology market owing to its developed health care infrastructure, higher utilization of AI-integrated imaging systems, and prominent players. Favorable reimbursement scenarios, ongoing investments for developing new diagnostics, and heavy procedural volumes additionally contribute to the country's dominance. Moreover, the growing emphasis on early diagnosis of diseases and workflow efficiency is further boosting the demand for digital radiology systems among hospitals and imaging centers in the U.S.

Market Dynamics:

Drivers

- Rise in Adoption of Imaging Systems and Hold of Technological Innovations is Boosting the Growth of the Market

The digital radiology market growth is largely propelled by constant advancements in imaging technologies. Further, these systems have AI-based image reading, automated positioning, and better detector sensitivity that help improve the diagnostic accuracy and reduce the scan timing. These developments are revolutionizing radiology processes and, in turn, early disease identification and personalized care provision. Interfacing with the hospital IT systems, such as PACS and EHR, provides access to their data and helps in making clinical decisions faster.

- Transformation from Analog to Digital Radiography is Driving the Market

The global move from conventional film-image radiography to digital radiography is one of the significant driving factors for the market. Digital radiography provides immediate postprocessing, less radiation dose, lower running costs, and simpler image storage and transmission than analogue. This move is appealing for healthcare facilities that need to upgrade imaging capabilities and improve patient productivity and diagnostic accuracy. The expedited transfer of high-grade digital images also facilitates telemedicine and multidisciplinary treatment planning.

Restraint

- High Initial Costs of Digital Radiology Systems are Hampering the Market Growth

The high initial cost involved for the purchase and installation of the digital imaging equipment is one of the significant limiting factors affecting the digital radiology market. Digital radiography systems, especially those of fixed installations with AI functionality, may be costly from the point of view of the expense of the detector, imaging software, PACS integration, and modification of infrastructure. To this, the additional expenses of upkeep, updates, and training staff, price tags. This is especially difficult for small clinics, rural health care facilities, and low- and middle-income country-based institutions with constrained capital budgets. Such requirements force most providers to defer or seek more affordable options to market and limit uptake.

Segmentation Analysis:

By Product

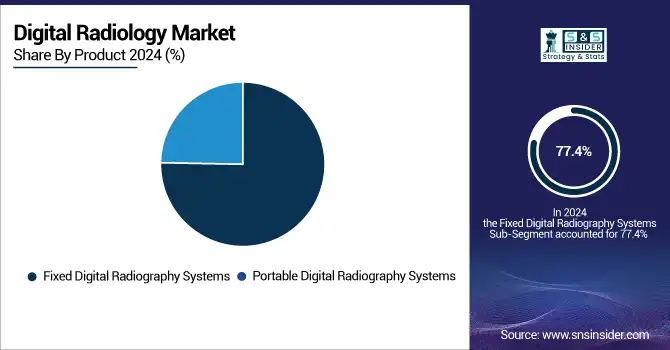

The fixed digital radiography systems segment held the largest share of the digital radiography market share in 2024 with a 77.4%, this segment is also projected to register the highest growth in the digital radiography market during the forecast period, the high growth of this segment is primarily attributed to the increasing demand for cost-effective imaging modalities in hospitals and diagnostic centers for high-volume, repeatable imaging procedures. These systems provide better image quality, increased throughput, and are easy to integrate with PACS, HIS, ideal for centralized radiology departments. Due to their reliability, high-quality imaging capabilities, and versatility for numerous clinical applications have become the gold standard in the institutional healthcare environment.

The portable digital radiography systems segment is projected to grow at a significant CAGR during the forecast period due to the rising demand for bedside imaging in ICUs, emergency rooms, and mobile health. Such systems allow bedside imaging, decrease patient transport, and increase imaging efficiency in urban and remote locales. Home health care services, disaster interventions, and technological development in lightweight, wireless systems are powerful drivers to promote the use of portable solutions.

By Type

In 2024, new digital systems led the digital radiology market share as a result of the rising installation of full-field digital radiology systems in new medical and radiology centers and departments. These systems are designed with state-of-the-art image quality, advanced workflow automation, and support for AI-based diagnostic tools, providing the perfect solution to institutions wishing to renew their imaging infrastructure. In addition, government and private investments in new hospital facilities in developed and developing regions have increased the demand for these advanced digital systems.

The retrofit digital system segment is anticipated to grow significantly during the forecast period, supporting healthcare providers to find more cost-effective solutions than replacing entire radiology units. Retrofitting provides the opportunity to upgrade new generation digital detectors (in the case of analog equipment) or state-of-the-art software onto older digital (or analog) equipment, effectively expanding the useful life of the system (and increasing image throughput). This type of strategy is particularly appealing in cost-sensitive segments and certain smaller health care environments, where budget allowances cannot enable full system replacements and the introduction of retrofit represents a pragmatic and scalable entry point.

By Application

The chest imaging segment dominated the digital radiology market in 2024 with a 51.20% market share, owing to the increasing global burden of respiratory diseases, such as COPD, tuberculosis, and pneumonia. Technical aspects of chest radiography are one of the most common radiologic procedures performed in the globe due to its rapid turn- over time, diagnostic capability, and daily use in the inpatient and outpatient settings. The COVID-19 pandemic also increased the need for digital chest imaging, further solidifying its role in patient care and screening applications.

The cardiovascular imaging segment is projected to witness the fastest growth rate during the forecast period due to the growing prevalence of heart diseases, stroke, and other heart conditions across the globe. Innovations in digital radiography—high-resolution detectors combined with AI-assisted image analysis—are improving our ability to detect cardiovascular abnormalities more accurately and earlier. Increasing awareness, action by the government, initiatives of preventive screening, and the addition of digital imaging in the cardiac care paths are also fuelling the growth, particularly among the elderly and high-risk population.

By End User

The hospitals segment held the largest share in the digital radiology market in 2024 and is characterized by established infrastructure, a high number of patient access, and investments made in advanced imaging technologies. The hospitals act as the epicenters of emergency rooms, surgery, and inpatient diagnostic requirements, which depend on fixed digital radiography systems for high-volume routine imaging applications. With their interoperability with EHRs, PACS, and multidisciplinary teams, these solutions also improve diagnostic productivity, which in turn fosters the broad adoption of digital radiology among hospitals.

The diagnostic imaging centers segment is anticipated to register the highest CAGR during the forecast period, driven by increasing demand for outpatient imaging services along with shorter waiting periods and cost-efficient diagnostics. These facilities have been turning to fully functional and high-end digital radiology systems due to the enhanced mobility they offer for specialized imaging services. The move to decentralized health care, combined with increasing insurance coverage for outpatient imaging studies, bodes well for the growth of imaging centers, especially in urban and suburban areas.

Regional Analysis:

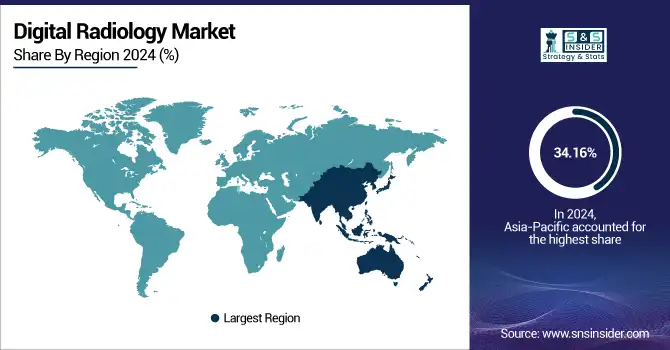

Asia Pacific leads the digital radiology market with around 34.16% market share in 2024, owing to the considerable and rapidly growing elderly population, rising incidence of chronic diseases, and the growing healthcare infrastructure and expenditure in the region. Increasing diagnostic imaging capabilities in countries such as China, India, and Japan through both public and private hospitals. Increasing Government-Backed Screening Program. The region is also gaining from a surging number of government-funded screening programs, growing consciousness about early diagnosis, and growing usage of advanced tech imaging systems. Strong market position due to local production facilities and low-cost radiology offerings.

Get Customized Report as per Your Business Requirement - Enquiry Now

The North American market is projected to register significant growth in the digital radiology market trends during the forecast period, mainly due to the high demand for AI-based diagnostic solutions, advanced imaging systems, and the need to execute medical procedures faster due to the workload. The U.S. ranks first in early technology adoption, and has a well-developed reimbursement ecosystem and huge R&D budget for key market participants. The region’s emphasis on precision diagnostics, adoption of cloud-based imaging platforms, and rising number of procedures in the ambulatory setting are driving growth and innovation.

The digital radiology market in Europe is growing on account of the growing geriatric population, along with increasing prevalence of chronic diseases and rising need for higher diagnostic solutions. A rapid uptake of AI-based imaging and tele-radiology services, backed by huge public and private investments, is also being observed across the region. Moreover, the introduction of digital radiology products and services in hospitals and diagnostics centers in Europe is driven by the healthcare development projects initiated by governments and the convergence of regulations among the countries.

The Latin American and MEA (Middle East & Africa) regions are showing moderate growth in the digital radiology market analysis. This expansion is driven by continued investments in healthcare infrastructure and diagnostic imaging facilities in the cities. In both regions, digital radiography systems are undergoing gradual uptake, which is further accelerating in the private hospitals and diagnostic centers where productivity and patient care are the top priorities. However, a combination of costs can prohibit widespread use, but piecemeal, choreographed implementation could be made possible as ‘seed’ funding from public–private partnerships and international health initiatives supports their deployment in limited portable and fixed digital systems. With an increasing level of awareness and changes in the reimbursement setup, these areas are gradually improving their level of diagnostic imaging in radiology.

Key Players

The digital radiology market analysis companies are Siemens Healthineers, Philips Healthcare, GE Healthcare, Canon Medical Systems, Fujifilm Holdings, Konica Minolta, Agfa-Gevaert Group, Carestream Health, Hitachi Medical Corporation, Shimadzu Corporation, and other players.

Recent Developments

- July 2024 – Siemens Healthineers, a global leader in medical technology, announced the start of local manufacturing of its Multix Impact E digital radiography X-ray system in India. The step reflects the company's strategy to increase accessibility to quality healthcare and diagnostic solutions for patients nationwide.

- December 2024 – Royal Philips, a health technology leader, unveiled its new range of AI-driven diagnostic and treatment imaging innovations to enhance precision, speed, and efficiency in radiology workflows. Philips leverages its prowess in cloud-based data management, advanced visualization, automation, and artificial intelligence to address critical operational challenges radiologists are facing globally.

Digital Radiology Market Report Scope:

Report Attributes Details Market Size in 2024 USD 1.61 Billion Market Size by 2032 USD 2.11 Billion CAGR CAGR of 3.49% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Fixed Digital Radiography Systems, Portable Digital Radiography Systems)

• By Type (Retrofit Digital System, New Digital System)

• By Application (Chest Imaging, Cardiovascular Imaging, Orthopedic Imaging, Pediatric Imaging, Other Applications)

• By End User (Hospitals, Diagnostic Imaging Centers, Orthopedic Clinics, Other End Users)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Siemens Healthineers, Philips Healthcare, GE Healthcare, Canon Medical Systems, Fujifilm Holdings, Konica Minolta, Agfa-Gevaert Group, Carestream Health, Hitachi Medical Corporation, Shimadzu Corporation, and other players.