Digital Remittance Market Report Scope & Overview:

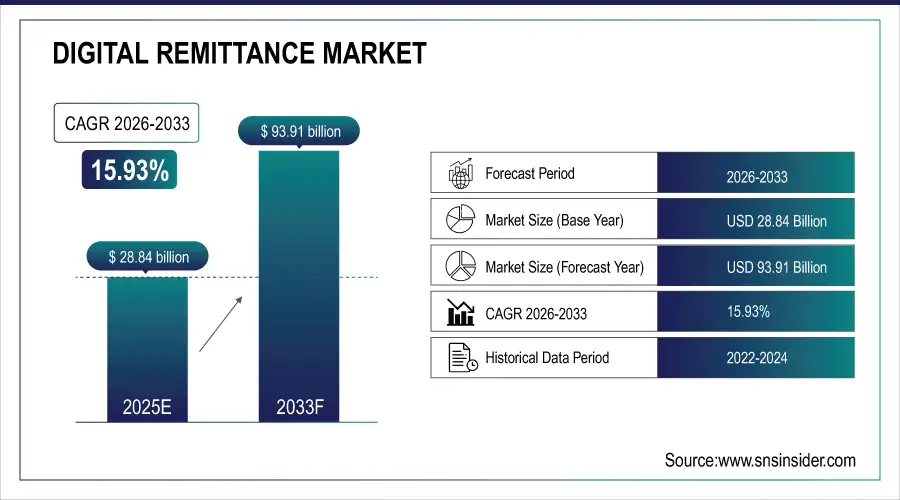

The Digital Remittance Market Size is valued at USD 28.84 Billion in 2025E and is projected to reach USD 93.91 Billion by 2033, growing at a CAGR of 15.93% during the forecast period 2026–2033.

The Digital Remittance Market analysis report provides an in-depth understanding of remittance trends. Rising cross-border migration, rapid fintech adoption, and increasing smartphone penetration are driving faster, cost-effective digital money transfers, expected to significantly boost market growth over the coming years.

Digital remittance transactions reached 1.3 billion in 2025, driven by rising migrant transfers and rapid fintech adoption enabling faster, low-cost cross-border payments.

Market Size and Forecast:

-

Market Size in 2025: USD 28.84 Billion

-

Market Size by 2033: USD 93.91 Billion

-

CAGR: 15.93% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Digital Remittance Market - Request Free Sample Report

Digital Remittance Market Trends:

-

Rising adoption of mobile wallets and digital payment apps is redefining how consumers transfer money globally.

-

Cross-border remittances are increasingly shifting from cash-based to online platforms driven by fintech innovation.

-

Growing partnerships between remittance providers and banks are expanding accessibility and lowering transfer fees.

-

Blockchain and AI integration are enhancing transaction transparency, security, and speed.

-

Increasing migrant workforce and globalization are fueling the demand for instant, low-cost digital transfers.

-

Expansion of super-app ecosystems is merging remittance, payments, and financial services into unified digital experiences.

U.S. Digital Remittance Market Insights:

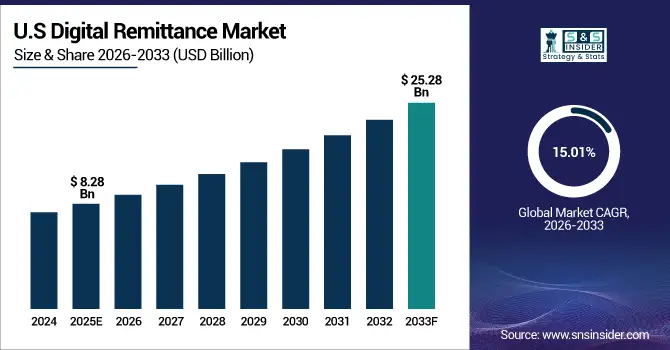

The U.S. Digital Remittance Market is projected to grow from USD 8.28 Billion in 2025E to USD 25.28 Billion by 2033, at a CAGR of 15.01%. Growth is driven by increasing migrant remittances, fintech adoption, smartphone-based transfers, and expanding cross-border payment innovations across major metropolitan and immigrant-dense regions.

Digital Remittance Market Growth Drivers:

-

Rising migration and smartphone penetration are accelerating adoption of fast, affordable, and secure digital money transfers.

Rising migration and increasing smartphone penetration are key drivers of Digital Remittance Market growth. Millions of migrant workers are turning to mobile-based platforms for faster, low-cost cross-border money transfers. Growing fintech innovation, better internet connectivity, and secure digital ecosystems are further encouraging users to shift from traditional cash-based remittances. As accessibility and affordability improve, digital channels are becoming the preferred choice for remittance transactions, fueling market expansion.

Digital remittance volumes grew 18.5% in 2025, driven by rising migration, fintech expansion, and smartphone-based payment adoption.

Digital Remittance Market Restraints:

-

Stringent regulatory compliance, high transfer fees, and cybersecurity risks are limiting seamless adoption of digital remittance services.

Stringent regulatory compliance, high transfer fees, and cybersecurity risks are major restraints for the Digital Remittance Market. Complex and varying regulations across countries make cross-border transfers cumbersome and costly for service providers. High transaction fees discourage small-value remittances, especially among low-income migrant workers. Additionally, rising concerns over data breaches, fraud, and digital identity theft reduce consumer trust in online money transfers. These challenges collectively hinder market scalability and slow the transition from traditional to fully digital remittance systems.

Digital Remittance Market Opportunities:

-

Expanding fintech ecosystems and rising blockchain adoption present opportunities for secure, low-cost and real-time remittance solutions.

Expanding fintech ecosystems and rising blockchain adoption present major opportunities for the Digital Remittance Market. Fintech innovation is driving faster, cheaper, and more transparent cross-border payments, addressing long-standing inefficiencies in traditional remittance channels. Blockchain integration enhances transaction security and traceability, building user trust. Meanwhile, the growth of mobile-based financial services and partnerships between fintech startups and banks are expanding financial inclusion, positioning digital remittance as a cornerstone of the digital payments’ revolution.

Blockchain-based remittance platforms grew 22% in 2025, driven by rising demand for transparent and low-cost cross-border transfers.

Digital Remittance Market Segmentation Analysis:

-

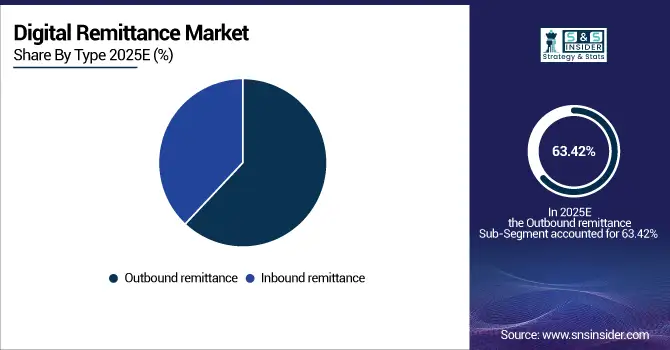

By Type, Outbound remittance held the largest market share of 63.42% in 2025, while Inbound remittance is expected to grow at the fastest CAGR of 16.27% during 2026–2033.

-

By Channel, Online segment dominated with a 71.56% share in 2025, and projected to expand at the fastest CAGR of 17.48% during the forecast period.

-

By Application, Personal remittance accounted for the highest market share of 68.39% in 2025, while Business remittance is anticipated to record the fastest CAGR of 16.91% through 2026–2033.

-

By Mode of Transfer, Bank transfer held the largest share of 54.83% in 2025, while Mobile banking is expected to grow at the fastest CAGR of 18.36% during 2026–2033.

By Type, Outbound Remittance Dominates While Inbound Remittance Expands Rapidly:

Outbound Remittance segment dominated the market in 2025 as millions of migrant workers continued sending money to their home countries through digital channels. Increasing smartphone use, lower transfer fees, and wider accessibility of online platforms strengthened outbound transaction volumes. Inbound Remittance is the fastest growing segment, benefiting from rising digital wallet adoption and faster processing times. In 2025, over 850 million outbound digital transactions were recorded globally, highlighting its dominance.

By Channel, Online Dominates and Expands Rapidly:

Online segment dominated the market in 2025 as consumers increasingly preferred mobile apps and web-based services over traditional cash transfers. Enhanced user convenience, lower transaction costs, and fintech innovation fueled this shift. Online is also the fastest growing segment, supported by AI-driven verification and blockchain integration improving speed and security. In 2025, 1.1 billion remittance transactions were conducted through online platforms, underscoring their expanding importance.

By Application, Personal Dominates While Business Expand Rapidly:

Personal segment dominated the market in 2025, driven by growing cross-border worker migration and family-based financial support. Ease of use, instant transfers and reach made personal payments the primary driver of volume. Business is the fastest growing segment, aided by the rise of e-commerce and SME cross-border trade. In 2025, personal digital transfers accounted for over 70% of total remittance volume, affirming their leading position.

By Mode of Transfer, Bank Transfer Dominates While Mobile Banking Expands Rapidly:

Bank Transfers segment dominated the market in 2025 due to their reliability, security, and strong integration with payment systems. Users continued to trust established banking channels for high-value international transfers. Mobile Banking is the fastest growing segment, accelerated by fintech expansion, smartphone penetration, and ease of app-based transfers. In 2025, mobile banking transactions surpassed 400 million globally, reflecting its rapid rise as a preferred remittance channel.

Digital Remittance Market Regional Analysis:

North America Digital Remittance Market Insights:

The North America Digital Remittance Market dominated with a 38.42% share in 2025, driven by robust fintech adoption and high digital literacy. The region’s strong banking infrastructure, coupled with growing demand for fast, low-cost cross-border transfers, is propelling digital remittance use. Expanding collaborations between financial institutions and fintech companies in the U.S. and Canada are enhancing transaction efficiency, reinforcing North America’s dominance in the evolving digital remittance landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Digital Remittance Market Insights:

The U.S. Digital Remittance Market is driven by growing fintech innovation, high smartphone penetration, and widespread digital payment adoption. Increasing migrant inflows, app-based transfer convenience, and integration of blockchain for transparency are reshaping remittance flows. Strategic partnerships between banks and fintech firms continue to enhance speed, security, and affordability in cross-border transactions.

Asia-Pacific Digital Remittance Market Insights:

The Asia-Pacific Digital Remittance Market is the fastest-growing region, projected to expand at a CAGR of 17.74% during 2026–2033. Growth is fueled by rising migrant worker populations, increasing smartphone penetration, and expanding fintech ecosystems in countries including India, China, the Philippines, and Indonesia. The surge in mobile wallet adoption, government digitalization initiatives, and competitive transfer costs is further accelerating digital remittance adoption, positioning Asia-Pacific as the hub for remittance innovation.

India Digital Remittance Market Insights:

India’s Digital Remittance Market is driven by rapid fintech adoption, strong smartphone penetration, and increasing inbound remittances from migrant workers. Government initiatives promoting digital payments, expanding mobile wallet usage, and lower transaction costs are accelerating growth. India remains a key player in Asia-Pacific’s digital remittance ecosystem, driving financial inclusion and innovation.

Europe Digital Remittance Market Insights:

The Europe Digital Remittance Market is expanding steadily, supported by advanced financial infrastructure, strong regulatory frameworks, and widespread digital banking adoption. Countries including the UK, Germany, France, and Italy are driving market growth through increased cross-border transactions and migrant remittances. Growing use of fintech platforms, integration of blockchain for transparency, and strategic partnerships between banks and payment providers are enhancing transaction efficiency, reinforcing Europe’s position as a mature digital remittance hub.

U.K. Digital Remittance Market Insights:

The U.K. Digital Remittance Market is growing rapidly, supported by strong fintech innovation, widespread smartphone use, and expanding migrant remittances. London’s position as a financial hub, coupled with regulatory support for digital payments, drives adoption. Increasing fintech–bank collaborations and mobile app-based transfers are reinforcing the U.K.’s leadership in Europe’s remittance landscape.

Latin America Digital Remittance Market Insights:

The Latin America Digital Remittance Market is rising steadily, driven by increasing migrant remittances, expanding fintech access, and rapid smartphone adoption. Countries including Brazil, Mexico, and Argentina are leading growth through mobile payment innovations and cross-border transfer apps. Strengthening digital infrastructure and financial inclusion efforts are boosting regional adoption of digital remittance services.

Middle East and Africa Digital Remittance Market Insights:

The Middle East & Africa Digital Remittance Market is growing rapidly, driven by rising migrant worker populations, expanding fintech ecosystems, and increased smartphone penetration. Powerhouse markets including Saudi Arabia, the UAE, and South Africa are leading digital payment modernization. Government support for financial inclusion and low-cost transfer solutions is boosting adoption across the region.

Digital Remittance Market Competitive Landscape:

Western Union Holdings, Inc., headquartered in Denver, Colorado, is a leader in cross-border, cross-currency money movement and payment services. Operating in over 200 countries and territories, Western Union dominates the digital remittance market through its unmatched agent network and reputation for reliability. Its success stems from blending legacy infrastructure with digital innovation, offering customers mobile and online transfer options. The company’s continuous investment in technology, compliance, and partnerships enhances accessibility, security, and real-time transfer capabilities, reinforcing its industry leadership.

-

In May 2025, Western Union launched WU Digital Connect, a next-generation remittance platform integrating blockchain-based tracking and instant payout options, enhancing transaction transparency, speed, and customer experience across major remittance corridors.

PayPal Holdings, Inc., based in San Jose, California, is a pioneering fintech leader revolutionizing payments through secure, fast, and transparent digital solutions. Its remittance service, Xoom, enables seamless money transfers across more than 160 countries, ensuring user convenience and trust. PayPal’s dominance in digital remittance is driven by its massive customer base, innovative AI-driven fraud detection, and strong ecosystem integration. By promoting financial inclusion and mobile-first experiences, PayPal continues to strengthen its influence as a digital payments’ powerhouse.

-

In August 2025, PayPal introduced PayPal Global Remit, a new digital remittance app offering low-cost international money transfers with real-time exchange rate visibility and AI-driven fraud protection for users in over 80 countries, strengthening its footprint in the cross-border payment ecosystem.

Ria Financial Services Ltd., headquartered in Buena Park, California, and owned by Euronet, is a top-tier remittance provider known for affordability and reliability. Operating in over 160 countries, Ria bridges traditional and digital remittance systems with a vast agent network and digital-first strategy. Its dominance stems from offering competitive exchange rates, flexible transfer methods, and strong financial partnerships. By focusing on user accessibility, transparency, and real-time money movement, Ria continues expanding its digital footprint and reinforcing its leadership in remittance services.

-

In June 2025, Ria Financial Services launched Ria SmartSend, a mobile-first remittance solution allowing instant cross-border payments, biometric authentication, and multi-currency wallet integration, improving accessibility and security for migrant and unbanked customers.

Digital Remittance Market Key Players:

Some of the Digital Remittance Market Companies are:

-

Western Union Holdings, Inc.

-

PayPal Holdings, Inc.

-

Ria Financial Services Ltd.

-

MoneyGram International, Inc.

-

Wise plc (formerly TransferWise)

-

Zepz (incorporating WorldRemit, Sendwave)

-

Remitly Global, Inc.

-

Azimo Limited

-

TransferGo Ltd.

-

NIUM, Inc. (Instarem)

-

TNG FinTech Group

-

Digital Wallet Corporation

-

Coins.ph

-

OrbitRemit

-

Smiles

-

Flywire Corporation

-

SingX

-

FlyRemit

-

Intermex Group, Inc.

-

Small World Financial Services

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 28.84 Billion |

| Market Size by 2033 | USD 93.91 Billion |

| CAGR | CAGR of 15.93% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Inbound Remittance, Outbound Remittance) • By Channel (Online, Offline) • By Application (Personal, Business) • By Mode of Transfer (Bank Transfer, Money Transfer Operators, Mobile Banking, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Western Union Holdings, Inc., PayPal Holdings, Inc., Ria Financial Services Ltd., MoneyGram International, Inc., Wise plc (formerly TransferWise), Zepz (WorldRemit, Sendwave), Remitly Global, Inc., Azimo Limited, TransferGo Ltd., NIUM, Inc. (Instarem), TNG FinTech Group, Digital Wallet Corporation, Coins.ph, OrbitRemit, Smiles, Flywire Corporation, SingX, FlyRemit, Intermex Group, Inc., Small World Financial Services. |