Data Center Containment Market Report Scope & Overview:

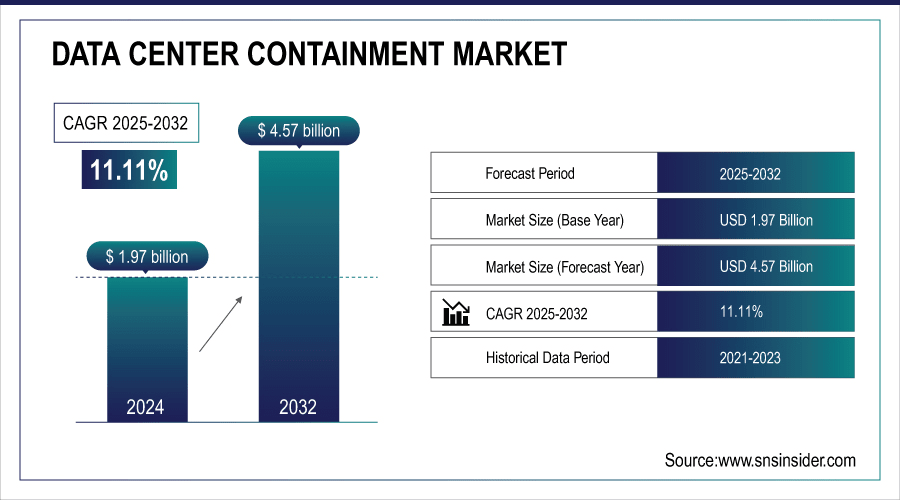

The Data Center Containment Market Size was valued at USD 1.97 billion in 2024 and is expected to reach USD 4.57 billion by 2032 and grow at a CAGR of 11.11% over the forecast period 2025-2032.

The Global market report provides an in-depth Data Center Containment Market analysis of deployment model, application segments, containment type, end-user industry and regional trends globally. Indicators of increased demand then are upsurging energy prices, cloud footprint expansion and increasing focus on operational efficiency. Various regions globally are optimizing data centers to be more environment friendly, thus, organizations are spending more money on spending more on containment systems where cooling performance is improved and power usage effectiveness (PUE) is reduced to meet sustainability targets.

For instance, containment solutions allow for up to 60% increase in rack density, making better use of white space.

To Get More Information On Data Center Containment Market - Request Free Sample Report

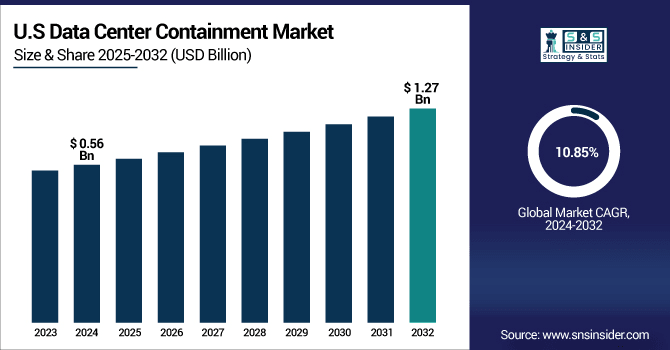

The U.S. Data Center Containment Market size was USD 0.56 billion in 2024 and is expected to reach USD 1.27 billion by 2032, growing at a CAGR of 10.85% over the forecast period of 2025–2032.

The U.S. market reflects strong growth as a result of increasing investments in hyperscale and colocation data centers, coupled with strict energy efficiency regulations. The uptick only continues with rapid digital transformation across industries, specifically cloud computing, finance and healthcare. In addition, U.S. datacenter industries have also started implementing heat containment and advanced thermal management systems due to growing number of major cloud providers and adoption of large number of AI and high- performance workloads.

For instance, cooling systems account for nearly 40% of energy consumption in U.S. data centers, making containment essential for cost control.

Data Center Containments Market Key Drivers:

-

Efficient Cooling Needs in Hyperscale and Colocation Data Centers Fuel Containment System Deployments

Increasing heat loads in hyperscale and colocation facilities are driving the need for more energy efficient cooling and containment solutions. Data centers face pressure to trim OPEX while extracting the maximum performance. By facilitating proper temperatures in hot and cold aisle containment systems, these enclosure systems lower the requirement for traditional cooling machines and subsequently increase air flow efficiency. As global data traffic grows — driven by the demands of artificial intelligence (AI), the Internet of Things (IoT), and higher-density cloud services — operators are investing in more sophisticated containment solutions to improve thermal performance and rack level cooling efficiency, helping to achieve less energy utilization and enhanced sustainability metrics.

For instance, global IP data traffic is expected to exceed 396 exabytes per month by 2025, intensifying thermal and containment challenges.

Data Center Containments Market Restraints:

-

Lack of Awareness and Skilled Workforce Restricts Market Growth in Emerging Economies

Caught in the mire of energy-saving advantages are containment systems that pioneered operational advantages in energy savings, but remain among the least-known systems outside the developed countries globally. Another factor is the absence of industry specialists, which makes it difficult to manage and deploy adoption efficiently. The majority of data centers are still using traditional cooling techniques due to they are inexpensive to install and relatively simple to operate. Emerging nations do not have strict efficiency standards and financial incentives; therefore, they are less compelled to adopt advanced containment solutions which is another factor restraining the Data Center Containment Market growth globally.

Data Center Containments Market Opportunities:

-

AI and IoT Growth Drive Demand for High-Density Cooling and Containment Systems

Modern data centers experience higher rack densities with the advent of AI and IoT workloads that produce greater processing and heat output. It necessitates the development of advanced containment architectures to handle thermal loads. The need grows even more as data centers and accelerators such as GPU and TPU are being developed specifically for AI. Real-time adjustments to airflow and cooling for optimized thermal efficiency and overall performance can be achieved with containment solutions that are integrated with smart monitoring tools. Such opportunities are lucrative for the vendors, which provide intelligent and high-performance containment products.

For instance, over 50% of new hyperscale data centers are now deploying GPU- or TPU-based systems to support AI/ML workloads.

Data Center Containments Market Challenges:

-

Retrofitting Legacy Data Centers with Containment Systems Involves Structural and Operational Barriers

Technical and operational challenges surround containment systems in older or legacy data centers. Furthermore, these facilities typically do not have containment that is compatible with the structural integrity to manage air flow. Changes may need to be done with finding racks and getting HVAC reconfiguration done leading to downtime. However as many have low ceilings or awkward layouts this limits where a standard containment can be installed. These nuances complicate retrofitting, making this path less desirable, particularly for data centers that have budget-critical SLAs that cannot tolerate outages while further capping general Data Center Containment Market trends.

Data Center Containments Market, By Deployment Type

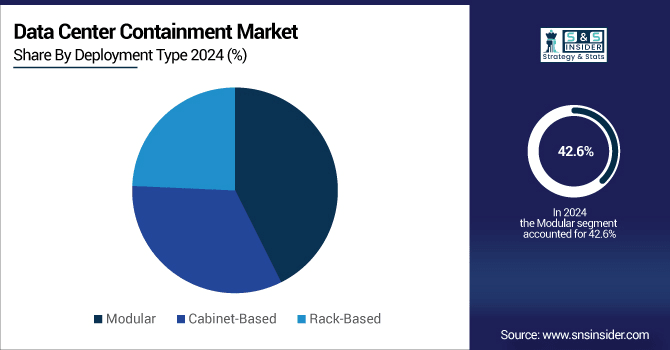

The modular deployment showed an enormous growth in the Data Center Containment Market by registering a 42.6% revenue share in 2024, attributed to its flexibility, portability and simple installation. Vertiv Modular Containment Systems enable thermal control and expansion without re-engineering. These solutions are popular with enterprises as they can be deployed in an agile manner and efficiently occupy space, making them an ideal fit for a range of enterprise and colocation data center infrastructure modernization projects including both greenfield and retrofit deployments.

Rack-Based deployment is expected to register the highest growth rate of 11.43% CAGR during the period, 2025–2032 over the rising edge computing requirements and dense deployments. Subzero Engineering offers optimal rack-based containment for critical environments. Since edge-infrastructure is mostly deployed in urban structures, the space is curtailed and a precise control of airflow is necessary to ensure energy efficiency and thermal integrity. These systems play a key role in ensuring that edge facilities are optimally cooled.

Data Center Containments Market, By Application

In 2024, Data Centers accounted for over 54.2% of the revenue share in the Data Center Containment Market due to booming hyper-scale and colocation growth. Schneider Electric is one of the key provider of aisle containment solution for enhancing the energy efficiency of these facilities. Demand for containment systems that manage airflow and lower cooling expenses around mission critical operations has been fueled by higher frequency of data processing, storing and uptime dependability.

High Performance Computing (HPC) Facilities is anticipated to have the largest growth rate (CAGR) at 11.97% during the period 2025 - 2032, driven by AI and scientific workloads. IBM is embedding high-density thermal containment systems via its HPC solutions. Such systems must support heat loads while remaining stable, and for facilities that are scaling out their operations, containment is key to leveraging that efficiency and performance.

Data Center Containments Market, By Containment

Hot aisle containment (HAC) accounted for a maximum revenue share of 38.7% in the Data Center Containment Market, 2024, owing to their efficiency in handling hot air. Eaton: Reliable hot aisle containment configurations are available from Eaton to lower PUE and improve airflow management. They are designed for hyperscale data centers where energy consumption can be minimized and thermal zones stabilized across large IT environments.

Hybrid Containment is expected to grow at the highest growth rate of 13.10% Cumulative Average Growth Rate (CAGR) in 2025 to 2032, as it can sustain both mixed workloads & mix environments. Legrand has developed hybrid hot and cold aisle solutions that allow for flexible use. Operators who are seeking for flexibility and efficiency that seamlessly blends with what they already have in place, and still offering high energy performance and a high degree of scalability are increasingly choosing these systems.

Data Center Containments Market, By End-User

IT & Telecom segment held the largest Data Center Containment Market share of about 31.8% in 2024 owing to high demand from cloud and 5G deployment in telecommunication sector. Cisco Systems is working with data center operators to incorporate containment solutions to help them run more efficiently. Containment has become table stakes for the type of high-scale IT infrastructure used by the sector as it depends on uptime being as close to 100% as possible, and consistency of cooling.

The healthcare segment is anticipated to register the fastest growing CAGR of 13.64% from 2025 to 2032 owing to rising demand for health data from digital health record and telemedicine segment. Dell Technologies empowers the transformation by offering containment-enabled data center solutions designed for healthcare workloads. Streamlined thermal management systems are increasingly in demand, with the proliferation of new clinical data, imaging, and analytics platforms appearing across modern hospitals and research centers that require secure, compliant, and efficient thermal management system solutions.

Data Center Containments Market Regional Analysis

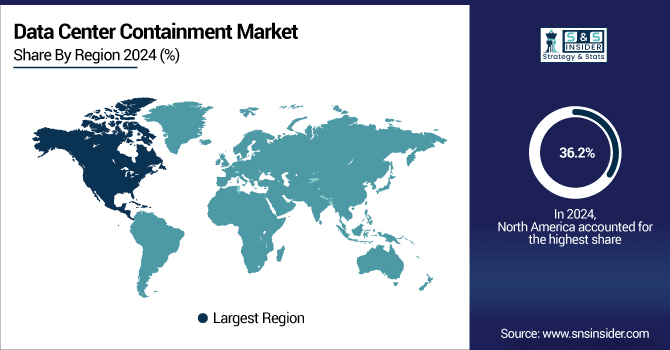

In 2024, North America led the Data Center Containment Market and accounted for a revenue share of 36.2% owing to the concentration of the major players in the regions including tech giants, hyperscale data center networks, and a mature digital ecosystem. The U.S in particular has a huge lead, thanks to its well-established cloud infrastructure, solid regulatory frameworks, and continued investment in AI and edge computing. Operators are looking to develop containment solutions that contribute to energy efficiency and sustainability objectives.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

The U.S. dominates North America’s data center containment market due to its vast hyperscale infrastructure, leading cloud service providers, and strong focus on energy efficiency. Regulatory compliance and heavy investments in AI and edge computing further boost containment system adoption.

Asia Pacific is anticipated to grow at the highest CAGR of 12.53% owing to the concentrated data center development across China, India, and Southeast Asia. Demand is being driven by greater internet access, government digitization initiatives, and increased cloud adoption. With the entry of many regional players into colocation and hyperscale, the demand for scalable and efficient containment solutions to handle thermal loads is driving the rapid growth across the APAC region.

-

China leads the Asia Pacific data center containment market owing to aggressive digitalization, government-backed smart infrastructure projects, and rapid cloud expansion. Major tech giants and rising data localization requirements are driving the deployment of advanced cooling and containment technologies.

Europe Data Center Containment Market growth is driven by stringent energy efficiency regulations, rising demand for green data centers, and adoption of digital transformation across industries. Developed nations such as Germany, the UK, and the Netherlands are at the forefront of the adoption of such advanced thermal management systems. Its emphasis on sustainability, data sovereignty, and renewable-powered infrastructure is accelerating containment solutions into both colocation and enterprise facilities.

-

Germany dominates Europe’s data center containment market due to its robust industrial infrastructure, strict energy regulations, and high demand for green data centers. It serves as a central hub for cloud providers, driving widespread adoption of advanced thermal management solutions.

Middle East & Africa data center containment market is dominated by the UAE, which is driven by smart city projects and sustainability data infrastructure. Brazil leads in Latin America as digital transformation is accelerating and demand for hyperscale facilities is expanding from telecom, cloud, and financial services that require efficient thermal solutions.

Data Center Containments Market Key Players

Major Key Players in Data Center Containments companies are:

-

Schneider Electric

-

Vertiv Group Corp.

-

Eaton Corporation

-

Legrand

-

nVent Electric plc

-

Subzero Engineering

-

Panduit Corporation

-

APC by Schneider Electric

-

Rittal GmbH & Co. KG

-

IBM Corporation

-

Hewlett Packard Enterprise (HPE)

-

Dell Technologies

-

Huawei Technologies Co., Ltd.

-

Cisco Systems, Inc.

-

Stulz GmbH

-

Airedale International Air Conditioning

-

Chatsworth Products, Inc.

-

Canovate Group

-

Great Lakes Case & Cabinet Co., Inc.

-

Minkels.

Data Center Containments Recent Developments:

-

In June 2025, Schneider Electric unveiled its Prefabricated Modular EcoStruxure Pod Data Center and EcoStruxure Rack Solutions, supporting liquid cooling, hot‑aisle containment, and open‑compute standards for AI and HPC workloads.

-

In July 2025, Vertiv announced its acquisition of Great Lakes Data Racks & Cabinets for $200 million, aimed at enhancing its ability to deliver AI‑ready, pre‑engineered rack solutions that integrate containment, cooling, and power systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.97 Billion |

| Market Size by 2032 | USD 4.57 Billion |

| CAGR | CAGR of 11.11% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Modular, Cabinet-Based and Rack-Based) • By Application (Data Centers, IT Server Rooms, Telecom Central Offices and High Performance Computing (HPC) Facilities) • By Containment (Hot Aisle Containment (HAC), Cold Aisle Containment (CAC), Hybrid Containment and Vertical Exhaust Ducts) • By End-User (IT & Telecom, BFSI, Healthcare, Government, Energy & Utilities, Retail & E-commerce, Manufacturing, Media & Entertainment and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric, Vertiv Group Corp., Eaton Corporation, Legrand, nVent Electric plc, Subzero Engineering, Panduit Corporation, APC by Schneider Electric, Rittal GmbH & Co. KG, IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Stulz GmbH, Airedale International Air Conditioning, Chatsworth Products, Inc., Canovate Group, Great Lakes Case & Cabinet Co., Inc. and Minkels. |