Digital Textile Printing Inks Market Report Scope & Overview:

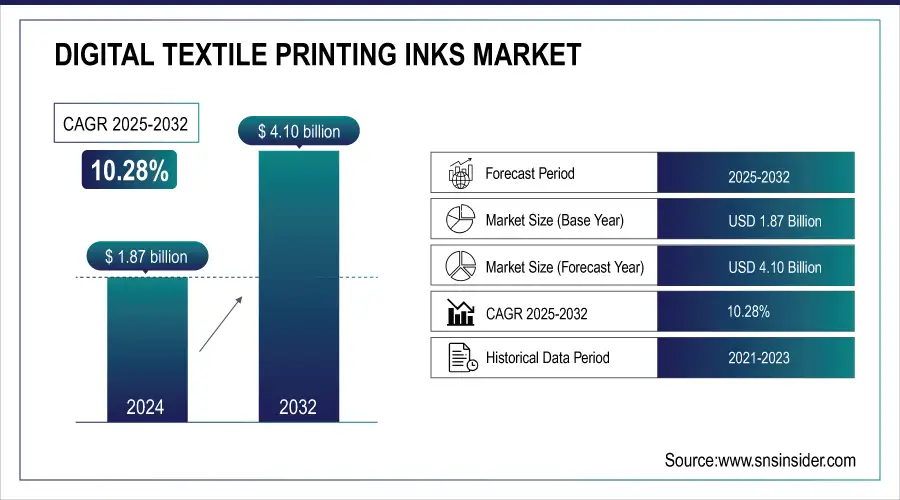

The Digital Textile Printing Inks Market size was USD 1.87 billion in 2024 and is expected to reach USD 4.10 billion by 2032 and grow at a CAGR of 10.28% over the forecast period of 2025-2032.

The rising demand for customized textiles is a significant growth driver in the digital textile printing inks. It was fueled by customization-oriented textiles demand for custom designs in clothing/fashion, home décor, and promotional items that portray individual preferences or brand identity is on the rise with consumers. Also, digital textile printing not only allows for high-quality, customization in the denim itself but, due to shorter lead times, is better suited for small-batch or on-demand production than traditional methods. For instance, in 2023, Epson Corporation partnered with Japanese fashion designer Yuima Nakazato to create a new couture collection using Epson's sustainable digital textile printing technology, emphasizing the use of eco-friendly pigment inks.

Get More Information on Digital Textile Printing Inks Market - Request Sample Report

Key Digital Textile Printing Inks Market Trends

-

Shift toward pigment-based inks for versatility and water savings

-

Rising demand for sustainable and eco-friendly inks

-

Growth of sublimation printing in sportswear and home textiles

-

Integration with advanced printhead technologies

-

Customization and on-demand textile production

-

R&D in high-performance and specialty inks

Digital Textile Printing Inks Market Growth Drivers

-

Increase in demand for promotional apparel, flags, and banners drive the market growth.

One of the significant factors for the digital textile printing ink market growth is to rising demand for decorative apparel, and advertisements through promotional apparel, flags, and banners. In the wider future of businesses and organizations that are looking for novel approaches in promoting their brands, the necessity of tailor-made textiles that can communicate more than just brand representatives and images has started to become pressing. Promotional apparel, such as branded t-shirts, jackets, and caps, is a superb advertising tool when it comes to events and events due to its high visibility and low cost. Likewise, flags and banners are massively used for promotions in trade shows, sports events, public festivals, etc. Through digital textile printing, which can accommodate high-resolution, full-color designs on a variety of different fabrics, promotional output is easier and cheaper to produce fast, even for short-run orders. This is driven even more by e-commerce platforms that allow companies to order tailor-made textiles in small batches. The growing demand for digital textile printing inks utilized to produce well-colored, long-lasting, and custom promotional products has broadened the market for manufacturers.

For instance, in India the government's initiatives, such as the production-linked incentive (PLI) scheme, aim to boost garment exports to USD 50 billion by 2030, further supporting the industry's expansion

Digital Textile Printing Inks Market Restraints

-

Difficulties in innovation the designs in clothing and garment may hamper the market growth.

The hinderance in innovation of design for apparels and textiles will act as a restraining factor for the growth of digital textile printing inks market. Digital printing advances offer you high-quality, customizable designs; however, without advanced creativity matched by an experienced design innovator, digital printing won’t be able to reach its full potential. Clothing and garment manufacturers are often left a step behind as the demand curve changes with the changing consumer trends paving the way for stagnant product lines. New technologies, such as digital textile printing, could therefore be adopted at a slower pace, as companies may be less likely to use them if they do not see a design differentiation benefit over conventional methods. Even further, the arduous nature of making quality, moving designs that match consumer tastes often needs expert designers and considerable investments in tech, perceived as obstacles for the smaller or poorer firms. This may lead to a lack of demand for digital textile printing inks as continuous innovation in designs can become less challenging over time, thus restraining the growth of the market over the long term.

Digital Textile Printing Inks Market Segment Analysis

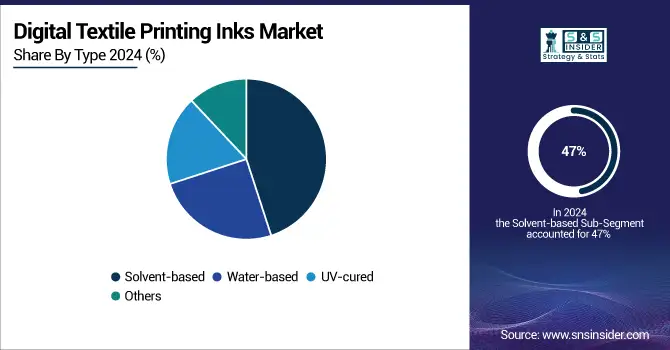

By Type

Solvent-based held the largest market share around 47% in 2024. It is due to their overall durability, color output, and compatibility. These inks are especially suited for large-format prints, including banners, flags, and promotional wearables, where durable prints are required. Due to their high durability, solvent-based inks show higher resistance against fading, smudging, and weather-related wear and are best suited for outdoor applications where they are commonly exposed to extreme temperatures and other climate conditions. They also adhere very well to different types of fabrics (both synthetic and natural fibers), which expands their use in various areas. Although there is a trend towards the use of environmentally friendly substitutes, such as water-based and pigment inks, solvent-based inks continue to be a market favorite, thanks to superior print quality and durability. These systems are the most common among printers and command the largest market share, as they provide bright, high-quality prints with minimal maintenance.

By Ink Type

Reactive held the largest market share around 39% in 2024.As compared to other types of inks that can be used on textiles, reactive inks are preferred as they form a strong bond with cellulose fibers, such as that found in cotton, ensuring bright, radiant prints with fine details, high quality and durability. This ink type is very common in the apparel industry, where high-quality, durable prints are needed. It provides good color fastness, washability, and hand feel of fabric, making them the most preferred for fashion brands and home textiles. They can be used on all kinds of fabric, but work best on natural fibers. This hypoallergenic nature of reactive inks is the most critical property for the applications such as fashion and home decor, as reactive inks are known to obtain vibrant, sharp prints. Though there are other ink types like sublimation and pigment that cater to their own niche markets, none come close in print quality and performance (color match and durability) as well as true leadership role in the digital textile printing vertical as this type has.

By Application

Clothing & Household Textiles held the largest market share around 28% in 2024. This segment is benefitted from the growing demand for customized, fashionable designs in clothing (i.e., fashion apparel, sportswear, and branded merchandise). The benefits of rapid response, design flexibility, and complex print repeat capability offered by digital textile printing are highly attractive to the fashion and home textiles sectors. Digital textile printing has become especially appealing to apparel manufacturers and designers because of its capability to create short production runs of customized products, as well as colorful firm prints that last longer than traditional inks. Another important trend that has greatly helped digital printing technologies to thrive is the growing demand for sustainable and on-demand production in the fashion industry.

Digital Textile Printing Inks Market Regional Outlook

Asia Pacific Digital Textile Printing Inks Market Insights

Asia Pacific held the largest market share around 48% in 2024. It is due to the presence of a strong manufacturing base fast-developing textile industries, and growing demand for customized and on-demand printing. Few major countries/regions such as China, India, Bangladesh, and Vietnam which are home to several of the world's largest textile and garment manufacturing centers and where the textile industry is one of the major industries in the economy. The garment, industry in these countries has rapidly embraced digital printing technologies, as they achieve short lead times, high-quality printing and smaller lot orders, all requirements for an increasingly fast-moving fashion sector. Moreover, growing demand for customized fabrics and e-commerce it's further driving the digital printing technologies in the region. In addition, government initiatives in various countries are promoting the textile sector and encouraging the transition towards more sustainable and efficient production processes, such as digital printing. All these factors together have resulted into Asia pacific becoming world leader in digital textile printing inks market hence commanding Cost highest share in the global market Cost.

Europe Market for Digital Textile Printing Inks Insights

Europe also plays a significant role in the digital textile printing inks market in 2024, due to high demand from fashion, home textiles, and technical textiles. Presence of eco-friendly and water based inks to comply with strict environmental conditions are also driving adoption in the region. Countries such as Germany, Italy, and Spain are now the innovators, bringing to market, high-quality textile printing with ecosolvent inks. Europe The activities of the leading manufacturers in combination with a constant development of pigment and reactive inks contribute to making Europe competitive on the world market.

North America Digital Textile Printing Inks Market Insights

The North American market is growing at a steady pace on demand for customisation, on demand printing and fast fashion solutions and the trend is expected to continue in the foreseeable future. The region is (since) dominated by the US with state-of-the-art digital printing installations and innovations in UV and pigment inks which help to drive the move away from screen printing to digital for textiles. Growing utilization in clothing, sportswear, and home furnishing and emphasis on sustainable inks is expanding it further.

Latin America (LATAM) digital textile printing inks market by Material Insights

The trade scope in LATAM is Increasing gradually on the account of Textile Manufacturing, Increasing Automation and Increasing Adoption- of Eco-Friendly Inks. Brazil and Mexico are the major players, with textile printers who are using more and more digital inks to serve both domestic and abroad market requirements. Adoption of new printing technologies and government initiatives toward sustainable textiles are driving the growth of the market in the region.

Middle East & Africa (MEA) Digital Textile Printing Inks -Additive Masterbatches Market Insights

Growth in 2024 will be modest for MEA as fashion, home textile and industrial textile demand increase. Digital textile inks market is growing in countries including Saudi Arabia, UAE and South Africa in response to increasing consumer demand for customized and high-quality fabrics. Rapid urbanization, infrastructure development, and efforts toward sustainable printing solutions are contributing to the steady market growth in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Competitive Landscape for Digital Textile Printing Inks Market

INX International Ink Co.

INX International Ink is a global manufacturer of printing inks and coatings, specializing in packaging, commercial, and digital printing solutions. The company focuses on advancing sustainable ink technologies to reduce environmental impact while ensuring print performance.

-

In 2024, INX International Ink launched its Expedition Eco-friendly Inks, designed to lower the environmental footprint of printing operations while maintaining high-quality output.

JK Group

JK Group is a leading supplier of digital inks for textile printing, recognized for its innovation in eco-friendly and high-performance ink formulations. The company emphasizes reducing volatile organic compounds (VOCs) and improving print quality in textile applications.

-

In 2023, JK Group introduced the J-Teck 3 ECO-Solvent Inks, offering an environmentally friendly alternative to conventional solvent-based inks with reduced VOC emissions and enhanced color vibrancy on textiles.

Nazdar Ink Technologies

Nazdar is a prominent ink manufacturer, providing UV, water-based, and solvent-based inks for screen, digital, and textile printing markets. The company is committed to developing high-performance inks that deliver durability, adhesion, and consistent print quality.

-

In 2023, Nazdar released the Nazdar 700 Series UV Inks for textile and garment printing, offering improved adhesion and durability across a wide range of fabrics while enhancing overall print quality.

Digital Textile Printing Inks Market Companies are

-

INX International Ink (Expedition Inks, NSC Inks)

-

JK Group (Aqua Inks, J-Teck)

-

Nazdar Company (Nazdar 700 Series, Nazdar 120 Series)

-

BASF SE (Texaprint Reactive Inks, Desmodur Ink Systems)

-

Dover Corporation (Markem-Imaje Inks, DigiDot Inks)

-

DyStar Group (Remazol Inks, Dystar Pigment Inks)

-

Zhengzhou Hongsam Digital Science & Technology Co., Ltd. (Hongsam Sublimation Inks, Hongsam Pigment Inks)

-

Huntsman Corporation (Huntsman Reactive Inks, Huntsman Disperse Inks)

-

Kornit Digital Ltd. (Kornit Allegro Inks, Kornit Storm Inks)

-

Sensient Technologies Corporation (Sensient Digital Inks, Sensient Sublimation Inks)

-

Sawgrass Technologies (SubliJet-HD Inks, Virtuoso Inks)

-

SPGPrints B.V. (Revolution Inks, RotaMesh Inks)

-

Zhejiang Lanyu Digital Technology Co. Ltd (Lanyu Sublimation Inks, Lanyu Pigment Inks)

-

Sun Chemical (SunTex Inks, SunInks)

-

Toyo Ink SC Holdings Co. (Sublisafe Inks, Toyo Water-based Inks)

-

Epson Corporation (Ultrachrome Inks, SureColor Inks)

-

HP Inc. (HP Thermal Inkjet Inks, HP Latex Inks)

-

Ricoh Company (Ricoh DS Inks, Ricoh Gen5 Inks)

-

Mimaki Engineering Co., Ltd. (Mimaki Sb54 Inks, Mimaki LUS-200 Inks)

-

Roland DG Corporation (Roland Eco-Sol Max Inks, Roland Texart Inks)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.87 Billion |

| Market Size by 2032 | USD 4.10 Billion |

| CAGR | CAGR of 10.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solvent-based, Water-based, UV-cured, Others) • By Ink Type (Reactive, Acid, Direct Disperse, Sublimation, Pigment) • By Application (Advertising & Promotion, Ceramic Tiles Printing, Clothing & Household Textiles, Packaging, Publication, Glass Printing, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | INX International Ink, JK Group, and Nazdar Company, BASF SE, Dover Corporation, DyStar Group, Zhengzhou Hongsam Digital Science & Technology Co., Ltd., Huntsman Corporation, Kornit Digital Ltd., Sensient Technologies Corporation, Sawgrass Technologies, SPGPrints B.V., Zhejiang Lanyu Digital, Technology Co. Ltd, Sun Chemical, Toyo Ink SC Holdings Co., and Others. |