Digital Twins in Healthcare Market Report Scope & Overview:

To Get More Information on Digital Twins in Healthcare Market - Request Sample Report

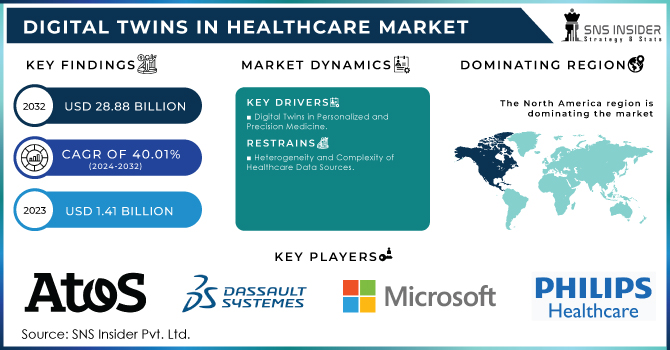

The Digital Twins in Healthcare Market size was valued at USD 1.41 billion in 2023, and is expected to reach USD 28.88 billion by 2032, and grow at a CAGR of 40.01% over the forecast period 2024-2032.

Demand for digital twins in healthcare is escalating rapidly, driven by the need for personalized medicine, improved patient outcomes, and operational efficiency.

The aging population, coupled with rising chronic diseases, necessitate predictive and preventive care models. Digital twins offer a virtual replica of patients, allowing for precise disease modeling, drug simulations, and optimized treatment plans. Furthermore, healthcare institutions are under pressure to reduce costs while enhancing quality. Digital twins can optimize resource allocation, streamline workflows, and minimize errors.

The demand for personalized medicines has surged which is evidenced by the substantial growth in the number of these treatments available on the market, which doubled from 132 to 286 between 2016 and 2020. Furthermore, a notable shift in drug development is highlighted by the FDA's approval data: personalized medicines accounted for a significant 25% of new drug approvals in 2019, a dramatic increase from just 5% in 2005.

The demand for digital twins in healthcare is driven by the need for increasingly sophisticated and granulated patient models. There is a strong desire for digital twins that can represent various levels of biological complexity, from entire body systems to individual cells. This granularity is essential for precision medicine, disease modeling, and drug development. Furthermore, the ability to create composite digital twins, integrating multiple biological systems and disease states, is seen as crucial for addressing complex health conditions.

Real-time data integration and dynamic modeling capabilities are key requirements for digital twins. The demand for high-fidelity digital twins, capable of accurately simulating physiological responses and disease progression, is growing. This necessitates robust data infrastructure and advanced computational power.

Additionally, there is a burgeoning demand for digital twin repositories (DT banks) to facilitate data sharing, clinical trial matching, and drug discovery. The concept of digital twin threads, tracking patient data over time, is gaining traction as it offers potential for longitudinal studies and personalized care pathways.

The supply of digital twin solutions is growing, with a diverse range of players including IT giants, healthcare providers, and specialized startups. The market is characterized by rapid technological advancements in areas like AI, IoT and data analytics, fueling innovation. However, challenges persist in data interoperability, cybersecurity, and the need for skilled professionals to develop and implement these complex systems.

Government initiatives are pivotal in driving the adoption of digital twins in healthcare. Many countries are investing in digital health infrastructure, promoting data sharing and standardization, and supporting research and development in this area. Regulatory frameworks are being established to ensure patient privacy and data security while encouraging innovation. Additionally, government-funded pilot projects and public-private partnerships are accelerating the deployment of digital twin solutions in healthcare delivery. Overall, a supportive regulatory environment and public-private collaboration are essential for the successful growth of the digital twins in healthcare market. Governments are developing regulatory frameworks to support the adoption of digital twins while ensuring patient data privacy and security. The European Union's General Data Protection Regulation (GDPR) is a prominent example of such a framework.

Many governments recognize the potential of digital twins and participating heavily in research and development. For instance, the U.S. has initiatives under the Precision Medicine Initiative and the National Institutes of Health (NIH) focusing on developing digital twins for various diseases.

The healthcare landscape is undergoing a transformative shift with the integration of digital twin technology. Innovations are emerging from that are redefining surgical precision, enhancing patient care, and optimizing treatment outcomes.

One notable advancement is the development of patient-specific 3D maps, which leverage advanced imaging and AI to create highly accurate virtual representations of patients. These digital twins are proving invaluable in surgical planning, execution, and post-operative assessment. By providing detailed anatomical insights and minimizing radiation exposure, this technology is significantly improving surgical outcomes.

In the realm of cardiology, AI-driven platforms are transforming cardiac imaging into actionable insights. By creating digital twins of the heart and combining them with predictive analytics, healthcare providers can gain unprecedented understanding of patient-specific anatomy and device interactions. This knowledge is instrumental in selecting optimal treatment plans and improving the success of procedures like transcatheter aortic valve implantation.

Market Dynamics

Drivers

-

By creating dynamic, virtual representations of patients, organs or even entire healthcare systems, digital twins offer unprecedented opportunities for improvement.

Enhanced patient care is a primary driver, with digital twins enabling personalized treatment plans, early disease detection and proactive health management. These virtual models facilitate predictive analytics, allowing for the identification of at-risk populations and the optimization of preventive interventions. Moreover, digital twins streamline clinical operations by providing insights into resource allocation, patient flow, and quality improvement initiatives. Lastly, their application in training and simulation enhances healthcare professionals' skills, ultimately improving patient safety and outcomes.

-

Digital Twins in Personalized and Precision Medicine

The application of digital twin technology in healthcare is a burgeoning field with immense potential. While still in its nascent stages, research has demonstrated promising applications across various medical domains. From creating "virtual twins" that simulate patient responses to treatment options to modeling complex diseases like multiple sclerosis, digital twins are transforming healthcare. Their utility extends to optimizing treatment plans, accelerating drug development, and enhancing overall patient care.

Digital twins are revolutionizing healthcare by offering a comprehensive view of patients. By integrating data from various sources, these virtual representations enable personalized treatment plans, early disease detection, and improved patient outcomes. Digital twins also enhance diagnostic accuracy, facilitate real-time monitoring, and empower patients to actively participate in their care. Predictive analytics and seamless care coordination further strengthen the value of digital twins in modern healthcare.

Restraints

-

Heterogeneity and Complexity of Healthcare Data Sources

The widespread adoption of digital twins in healthcare is hindered by several challenges. Data integration remains a significant obstacle due to the heterogeneity and complexity of healthcare data sources. Ensuring the privacy and security of sensitive patient information is paramount but poses substantial technical and regulatory hurdles. The demanding computational resources required for complex simulations and model maintenance present another barrier. Furthermore, the accuracy and reliability of digital twin models depend on constant data updates and algorithmic refinement, which can be resource-intensive. Lastly, substantial investments in technology infrastructure and healthcare professional training are necessary for successful digital twin implementation, creating financial and human capital constraints.

Key Segmentation

By Type

Process and system digital twins dominated the market with 56% share in 2023. These digital representations of healthcare processes and systems leverage advanced technologies like AI, VR, and mixed reality to optimize workflows and improve efficiency. For instance, doctors can interact with holographic representations of patients, accessing real-time data to inform treatment decisions.

On the other hand, product digital twins are gaining traction due to the increasing adoption of IoT sensors and electronic manufacturing devices in healthcare. These digital replicas of medical products enable manufacturers to simulate product performance, identify potential issues, and accelerate development cycles, ultimately leading to higher-quality products.

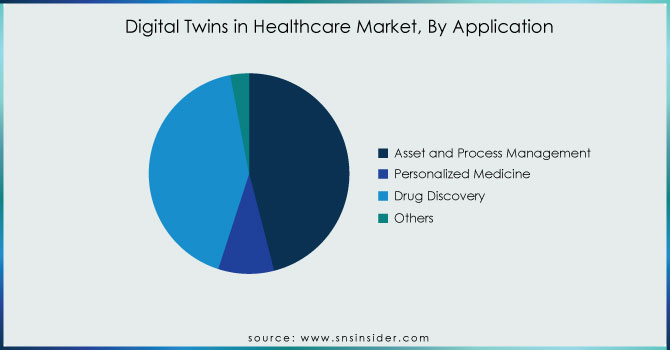

By Application

Asset and process management were the leading segment with 46% in 2023, driven by the need for optimized resource utilization and maintenance planning within healthcare facilities. Digital twins in this area create virtual representations of physical assets, enabling efficient management and predictive maintenance.

The drug discovery segment is experiencing rapid growth due to the potential of digital twins to accelerate drug development processes. By simulating drug interactions and manufacturing processes, pharmaceutical companies can reduce development time, improve efficiency, and enhance product quality.

Do You Need any Customization Research on Digital Twins in Healthcare Market - Enquire Now

By End-use

Hospitals and clinics represented the largest segment with 58% in 2023, driven by the need for operational efficiency, resource optimization, and improved patient care. Digital twins enable healthcare facilities to simulate various scenarios, optimize staffing, and enhance overall performance.

Clinical Research Organizations (CROs) is another key segment experiencing rapid growth. Digital twins are being adopted by CROs to accelerate drug development, reduce costs, and improve trial efficiency. By simulating patient responses and treatment outcomes, CROs can make more informed decisions and accelerate the drug development process.

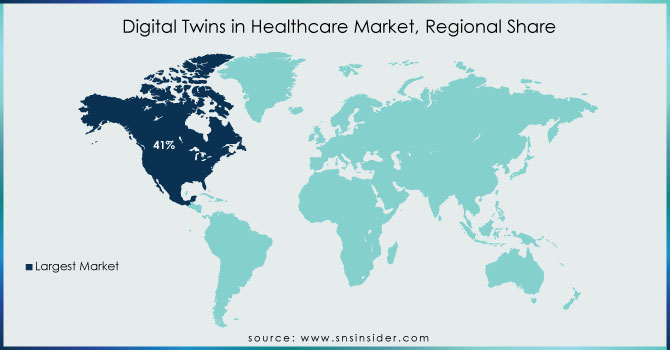

Regional Analysis

North America dominated the digital twins in healthcare market with 41% in 2023, driven by factors such as advanced healthcare infrastructure, early adoption of digital technologies and the presence of key industry players.

The region's robust technological ecosystem and supportive regulatory environment have accelerated the integration of digital twins into healthcare practices.

The Asia Pacific region is emerging as a rapidly growing market for digital twins in healthcare. Fueled by increasing investments in healthcare technology, a burgeoning middle class, and the growing prevalence of chronic diseases, the demand for innovative solutions like digital twins is on the rise. The region's large population and untapped potential present significant opportunities for market expansion.

Key Players

The Major players are Atos, Dassault Systems (3DS System), Microsoft, Philips Healthcare, Unlearn.AI, Inc., PrediSurge, QiO Technologies, Verto Healthcare, ThoughWire, Fasttream Technologies, Twin Health and others.

RECENT DEVELOPMENTS

Unlearn and QurAlis Corporation joined forces in June 2023 to expedite and enhance ALS clinical trials. Unlearn's cutting-edge artificial intelligence technology, specifically digital twins, will be integrated into QurAlis' research to develop more effective treatments for amyotrophic lateral sclerosis (ALS).

In January 2023, a strategic partnership between Microsoft, Schneider Electric, and Emirates Health Services led to the development of EcoStruxure for Healthcare. This innovative digital twin platform is designed to significantly enhance the efficiency and sustainability of UAE hospitals. By optimizing energy consumption and overall operational performance, the solution aims to achieve a 30% improvement in hospital efficiency.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.41 Bn |

| Market Size by 2032 | US$ 28.88 Bn |

| CAGR | CAGR of 40.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Process & System Digital Twin, Product Digital Twin) • By Application (Asset and Process Management, Personalized Medicine, Drug Discovery, Others) • By End-use (Clinical Research Organizations (CROs), Hospitals and Clinics, Research & Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Atos, Dassault Systems (3DS System), Microsoft, Philips Healthcare, Unlearn.AI, Inc., PrediSurge, QiO Technologies, Verto Healthcare, ThoughWire, Fasttream Technologies, Twin Health |

| Key Drivers |

• By creating dynamic, virtual representations of patients, organs or even entire healthcare systems, digital twins offer unprecedented opportunities for improvement

• Digital Twins in Personalized and Precision Medicine |

| Market Restraints | • Heterogeneity and Complexity of Healthcare Data Sources |