Veterinary Reference Laboratory Market Report Scope & Overview:

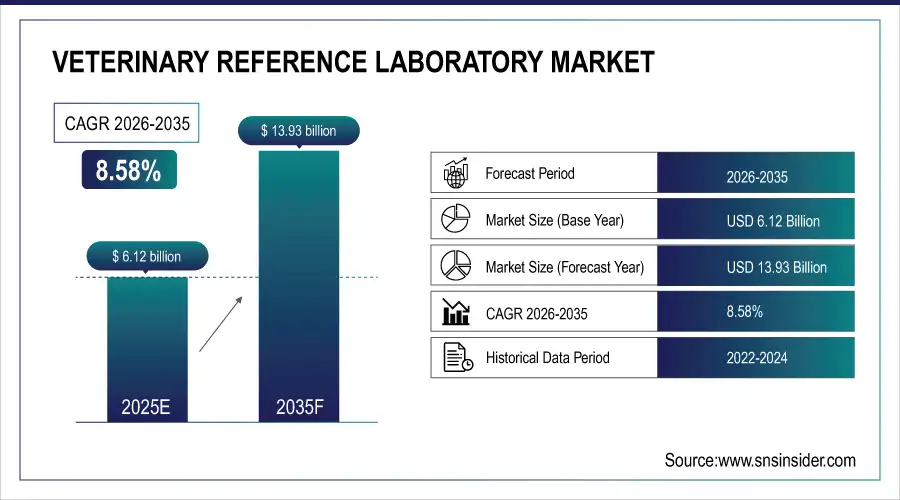

Veterinary reference Laboratory market was valued at USD 6.12 billion in 2025 and is expected to reach USD 13.93 billion by 2035, growing at a CAGR 8.58% over the forecast period of 2026-2035.

The veterinary reference laboratory market provides advanced diagnostic testing services for animal health, supporting veterinarians with accurate disease detection, monitoring, and preventive care. Growth is driven by rising pet ownership, increasing demand for specialized diagnostics, and advancements in molecular testing, digital pathology, and automation, enabling faster, more precise, and scalable veterinary diagnostic solutions worldwide.

The market grows at nearly 9% annually, with companion animals contributing over 60% of diagnostic demand.

Veterinary Reference Laboratory Market Size and Forecast

-

Market Size in 2025: USD 6.12 Billion

-

Market Size by 2035: USD 13.93 Billion

-

CAGR: 8.58%

-

Base year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information On Veterinary Reference Laboratory Market - Request Free Sample Report

Trends in the Veterinary Reference Laboratory Market

-

Molecular and PCR-based diagnostics: Enable early, highly accurate detection of infectious, genetic, and zoonotic animal diseases.

-

Digital pathology and AI-assisted analysis: Improve diagnostic precision, remote collaboration, and faster interpretation of pathology samples.

-

Preventive and wellness testing: Growing pet humanization increases routine screening, early diagnosis, and long-term health monitoring.

-

Laboratory automation: Streamlines workflows, reduces errors, and supports faster turnaround with rising diagnostic test volumes.

-

Specialized and esoteric diagnostics: Increasing specialty veterinary care drives demand for complex endocrine, oncology, and genetic tests.

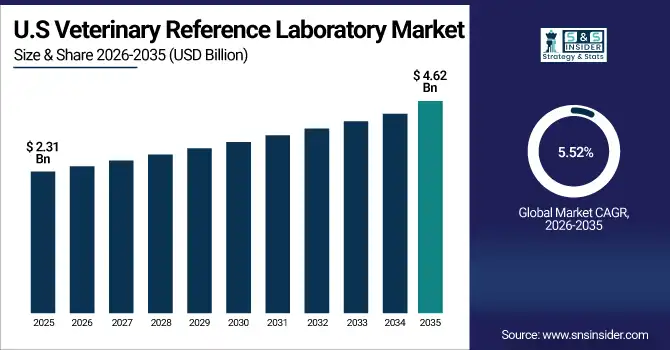

U.S. Veterinary Reference Laboratory Market Insights:

The U.S. Veterinary Reference Laboratory Market is projected to grow from USD 2.31 Billion in 2025 to USD 4.62 Billion by 2035, at a CAGR of 5.52%. Growth is driven by rising pet ownership and pet humanization, increasing demand for advanced and preventive diagnostic testing, growing prevalence of chronic and age-related animal diseases, expansion of pet insurance coverage, and continued adoption of molecular diagnostics, digital pathology, and laboratory automation that improve diagnostic accuracy and efficiency.

Veterinary Reference Laboratory Market Growth Drivers:

-

Rising Pet Ownership and Pet Humanization Driving Advanced Veterinary Diagnostics

The increasing perception of pets as family members is significantly boosting demand for high-quality veterinary care and advanced diagnostic services. Pet owners are increasingly willing to invest in preventive screening, early disease detection, and specialized testing offered by veterinary reference laboratories. Globally, companion animals account for over 60% of total veterinary diagnostic testing demand, reflecting higher per-pet healthcare spending. This shift toward preventive and precision care continues to drive consistent growth in reference laboratory test volumes.

Veterinary Reference Laboratory Market Restraints:

-

High Cost of Advanced Diagnostic Infrastructure and Skilled Expertise

The high cost of advanced diagnostic equipment and specialized personnel remains a major restraint for the veterinary reference laboratory market. Investments in molecular testing platforms, digital pathology systems, and laboratory automation require significant upfront capital and ongoing operational expenses. In addition, limited availability of trained veterinary pathologists increases labour costs and constrains scalability. Advanced diagnostic procedures typically cost about 40% more than routine tests, limiting affordability and adoption, particularly among smaller veterinary practices.

Veterinary Reference Laboratory Market Opportunities:

-

Expanding Preventive Wellness Testing and Precision Veterinary Care

The growing emphasis on preventive wellness and precision veterinary medicine is creating strong opportunities for veterinary reference laboratories. Routine health screening, genetic testing, and early disease risk assessment are increasingly adopted to improve long-term animal health outcomes. Reference laboratories play a critical role by offering comprehensive wellness panels and advanced molecular diagnostics. Preventive and wellness testing now accounts for over 45% of companion animal diagnostic volumes, driving recurring testing demand and supporting sustained market expansion.

Veterinary Reference Laboratory Market Segment:

-

By Animal Type: In 2025, Companion animals (Pets & Equines) dominated with 63% share; Livestock animals (Food-Producing) is fastest growing segment during 2026-2035.

-

By Service Type: In 2025, Clinical biochemistry dominated with 35% share; Molecular diagnostics is fastest growing segment during 2026-2035.

-

By Technology: In 2025, Clinical Chemistry Analyzers and immunoassays dominated with 42% share; PCR & Molecular Diagnostics is fastest growing segment during 2026-2035.

-

By End User: In 2025, Veterinary clinics & hospitals dominated with 70% share and this segment projects rapid growth during 2026-2035.

Veterinary Reference Laboratory Market Segment Analysis:

By Animal Type: Companion Animals Lead as Livestock Diagnostics Show Steady Growth

Companion animals dominate the animal type segment due to rising pet ownership, increasing pet humanization, and higher spending on advanced and preventive diagnostics. Reference laboratories receive a large share of testing volumes from routine wellness panels, chronic disease monitoring, and specialized diagnostics for pets.

Livestock animals show steady growth, driven by disease surveillance, herd health management, and food safety requirements. Demand is supported by government animal health programs and the need to control infectious and zoonotic diseases, particularly in large-scale farming operations.

By Service Type: Clinical Biochemistry Leads in 2025 as Molecular Diagnostics Emerges as the Fastest-Growing Segment

Clinical biochemistry dominated the service type segment in 2025, driven by its widespread use in routine health assessment, disease screening, and treatment monitoring. These tests form the foundation of veterinary diagnostics and generate high, recurring testing volumes for reference laboratories.

Molecular diagnostics is the fastest-growing service segment during 2026–2035, supported by increasing adoption of PCR-based testing, genetic screening, and early detection of infectious and hereditary diseases, aligning with the shift toward precision and preventive veterinary medicine.

By Technology: Clinical Chemistry & Immunoassays Lead as PCR & Molecular Technologies Accelerate

Clinical chemistry analyzers and immunoassays lead the technology segment due to their widespread adoption, cost efficiency, and suitability for high-throughput routine testing. These technologies are extensively used for wellness screening and standard diagnostic panels.

PCR and molecular diagnostic technologies are the fastest-growing, supported by rising demand for highly sensitive, rapid, and accurate disease detection, particularly for infectious, zoonotic, and genetic conditions.

By End User: Veterinary Clinics & Hospitals Lead as Outsourced Diagnostics Expand

Veterinary clinics and hospitals dominate the end-user segment as they rely heavily on reference laboratories for complex and high-volume diagnostic testing beyond in-house capabilities. Outsourcing enables access to advanced technologies without significant capital investment.

This segment is also the fastest-growing, driven by increasing patient loads, growth in specialty veterinary practices, and rising demand for advanced and preventive diagnostic services.

Veterinary Reference Laboratory Market - Regional Analysis:

North America Veterinary Reference Laboratory Market Insights:

In 2025, North America accounted for the largest share of the veterinary reference laboratory market, holding approximately 43.20% of global revenue. Growth is driven by high pet ownership, strong pet humanization trends, and widespread adoption of advanced diagnostic technologies such as molecular testing and digital pathology. Well-established veterinary healthcare infrastructure, high diagnostic spending per animal, and the strong presence of leading reference laboratory providers further support sustained market leadership across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Veterinary Reference Laboratory Market Insights:

Europe holds a significant share of the veterinary reference laboratory market, supported by strict animal welfare regulations, strong disease surveillance programs, and increasing demand for preventive veterinary care. Reference laboratories play a key role in food safety testing, zoonotic disease monitoring, and companion animal diagnostics. Continued investments in laboratory automation, molecular diagnostics, and digital pathology are driving steady market growth across major European countries.

Asia-Pacific Veterinary Reference Laboratory Market Insights:

Asia-Pacific is the fastest-growing region in the veterinary reference laboratory market, expected to grow at a CAGR of around 13.91% during the forecast period. Growth is fuelled by rising pet adoption, expanding livestock populations, increasing awareness of animal health, and improving veterinary infrastructure. Growing demand for disease surveillance, food safety testing, and advanced diagnostics is accelerating reference laboratory expansion across emerging and developed economies.

Latin America Veterinary Reference Laboratory Market Insights:

Latin America is experiencing moderate growth in the veterinary reference laboratory market, driven by expanding livestock production, rising focus on food safety, and gradual improvement in veterinary healthcare services. Increasing awareness of companion animal health and growing adoption of outsourced diagnostic testing are supporting steady market development across the region.

Middle East & Africa Veterinary Reference Laboratory Market Insights:

The Middle East & Africa veterinary reference laboratory market is growing steadily, supported by government-led animal health initiatives, rising investments in livestock disease control, and increasing demand for diagnostic services. Improving veterinary infrastructure and growing awareness of zoonotic disease prevention are gradually strengthening the role of reference laboratories across the region.

Veterinary Reference Laboratory Market Competitive Landscape:

IDEXX Laboratories, Inc., headquartered in Westbrook, Maine, USA, is the global leader in veterinary diagnostics and reference laboratory services, operating one of the largest veterinary reference lab networks worldwide. The company provides advanced testing solutions for companion and livestock animals, supported by strong R&D capabilities and digital diagnostic platforms.

-

In March 2025: IDEXX expanded its global reference laboratory capacity and enhanced AI-assisted diagnostic workflows to improve turnaround times and support rising demand for advanced molecular and pathology testing.

Mars Petcare (Antech Diagnostics), headquartered in Los Angeles, California, USA, is a major player in veterinary reference diagnostics, offering comprehensive laboratory testing services integrated with Mars’ extensive veterinary hospital and clinic network. The company focuses on high-volume diagnostics, preventive care, and seamless data integration across veterinary practices.

-

In February 2025: Antech Diagnostics invested in automation and digital pathology upgrades across its North American and European laboratories to improve efficiency and diagnostic accuracy.

Veterinary Reference Laboratory Market Key Players

-

IDEXX Laboratories, Inc.

-

Mars Petcare (Antech Diagnostics)

-

Zoetis Inc. (Reference Diagnostics / Vetnostics)

-

Eurofins Scientific SE

-

SYNLAB Group

-

Boehringer Ingelheim Animal Health (Diagnostic Services)

-

Neogen Corporation

-

Heska Corporation

-

Randox Laboratories

-

Cerba HealthCare (Laboratoire Cerba)

-

VCA Inc. (Mars Veterinary Health)

-

IDEXX BioAnalytics

-

BioBest Laboratories

-

Pathway Diagnostics

-

University of Minnesota Veterinary Diagnostic Laboratory

-

Texas A&M Veterinary Medical Diagnostic Laboratory

-

University of California Davis Veterinary Diagnostic Lab

-

Kansas State Veterinary Diagnostic Laboratory

-

Iowa State University Veterinary Diagnostic Laboratory

-

State / Regional Government Veterinary Reference Labs

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.12 Billion |

| Market Size by 2035 | USD 13.93 Billion |

| CAGR | CAGR of 8.58% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal Type: (Companion animals (Pets & Equines), Livestock animals (Food-Producing)) • By Service Type: (Clinical biochemistry,Hematology,Immunodiagnostics,Molecular diagnostics,Microbiology & parasitology,Histopathology,Toxicology) • By Technology: (PCR & real-time PCR,Immunoassays,Next-generation sequencing (NGS),Clinical chemistry analyzers,Digital pathology) • By End User: (Veterinary clinics & hospitals,Research institutes & universities,Pharmaceutical & biotechnology companies,Government & diagnostic agencies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IDEXX Laboratories, Mars Petcare (Antech Diagnostics), Zoetis Inc., Eurofins Scientific, SYNLAB Group, Boehringer Ingelheim Animal Health, Neogen Corporation, Heska Corporation, Randox Laboratories, Cerba HealthCare, VCA Inc., IDEXX BioAnalytics, BioBest Laboratories, Pathway Diagnostics, University of Minnesota Veterinary Diagnostic Laboratory, Texas A&M Veterinary Medical Diagnostic Laboratory, University of California Davis Veterinary Diagnostic Lab, Kansas State Veterinary Diagnostic Laboratory, Iowa State University Veterinary Diagnostic Laboratory, State & Regional Government Veterinary Reference Labs |