Digital Workplace Market Report Scope & Overview:

Get more information on Digital Workplace Market - Request Free Sample Report

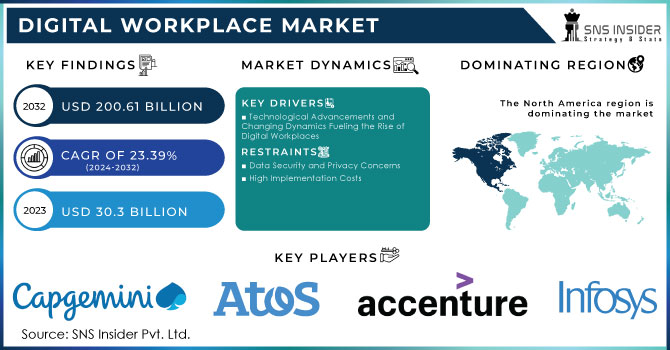

The Digital Workplace Market size was valued at USD 30.3 Billion in 2023 and is expected to grow to USD 200.61 Billion By 2032 and grow at a CAGR of 23.39% over the forecast period of 2024-2032.

The digital workplace market has grown significantly as a result of the rise in remote work technologies, an increased desire for collaboration among employees, and migration to cloud-based solutions. This market includes a variety of tools and services to support remote work, such as communication software, collaboration platforms, and virtual desktop infrastructure (VDI). As businesses increasingly prioritize agility and digital transformation, the demand for comprehensive digital workplace solutions has surged.

The demand for digital workplace solutions has been fueled by the global shift to remote and hybrid work models, accelerated by the COVID-19 pandemic, which has created an unprecedented need for tools that enable seamless communication, collaboration, and productivity regardless of physical location. Companies are increasingly investing in these solutions to enhance employee engagement, streamline operations, and maintain business continuity. For example, Microsoft Teams, a leading collaboration platform, saw its daily active users surge from 75 million in April 2020 to over 300 million by 2023, reflecting the strong demand for digital workplace tools.

The rise of BYOD and enterprise mobility is fueling market growth. These technologies offer greater flexibility and mobility, while also reducing costs associated with traditional IT infrastructure. Businesses are embracing these trends to streamline operations and improve efficiency. Moreover, the integration of AI, IoT, and VR is expected to accelerate the adoption of cloud-based and flexible workplace solutions. These advancements will fuel industry growth in the coming years.

Government regulations play a significant role in shaping the digital workplace market. In regions like the European Union, stringent data protection laws such as the General Data Protection Regulation (GDPR) impose strict requirements on the handling of employee data within digital workplace platforms. This has led vendors to incorporate advanced security features and compliance tools to meet regulatory standards. Additionally, government initiatives promoting digitalization and remote work, such as the EU’s Digital Decade targets, have further bolstered the market, encouraging companies to adopt digital workplace technologies to remain competitive.

The surge in digital workplaces and remote work has accelerated the adoption of AI and automation technologies. These innovations are automating manual processes and creating new avenues for businesses to boost productivity and streamline operations. For example, in May 2022, Wipro partnered with Scania to enhance employee experience through Wipro's Live Workspace, offering increased automation and support. This collaboration aimed to help Scania achieve sustainable transport solutions and a digital workplace while leveraging Wipro's unique capabilities.

The convergence of mobile technologies, evolving workforce demographics, and the rise of connected workplaces are fueling the transformation of digital workplace services. Many organizations are increasingly adopting cloud services like IaaS, BaaS, PaaS, and SaaS to meet their business needs and ensure seamless operations.

Cloud services empower organizations to provide instant access to critical data and enterprise applications across various devices while maintaining robust security measures. These factors are poised to create growth opportunities for key players in the global digital workplace market throughout the forecast period.

Market Dynamics

Drivers

-

Technological Advancements and Changing Dynamics Fueling the Rise of Digital Workplaces

The rapid adoption of digital workplace solutions is driven by a confluence of technological advancements, evolving workforce dynamics, and pressing business needs. Technological innovations, such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), have transformed the way work is done. These technologies offer flexibility, scalability, automation, and data-driven insights, making them indispensable components of modern workplaces. Moreover, the shift towards remote work and the increasing preference for BYOD have necessitated digital tools and platforms that support effective communication, collaboration, and productivity. Younger generations, who are digitally native, expect technology-enabled workplaces that align with their preferences for flexibility and collaboration.

Businesses are also turning to digital workplaces to address critical challenges. By streamlining processes, automating tasks, and optimizing resource utilization, organizations can enhance productivity, reduce costs, and improve collaboration among team members. Additionally, digital workplaces enable organizations to deliver better customer experiences through faster response times, personalized interactions, and efficient processes. Finally, regulatory factors, such as data privacy and security compliance, have underscored the importance of implementing robust digital workplace solutions to protect sensitive information and mitigate risks. These factors collectively drive the growing demand for digital workplace solutions across various industries.

Restraints

-

Data Security and Privacy Concerns

The increasing reliance on digital tools and cloud-based solutions raises significant concerns about data security and privacy. Organizations must ensure that sensitive information is protected, which can be challenging given the complexity of modern cyber threats. Compliance with stringent regulations like GDPR also adds to the burden, potentially slowing down the adoption of digital workplace solutions.

-

High Implementation Costs:

The initial investment required to implement comprehensive digital workplace solutions can be substantial, particularly for small and medium-sized enterprises (SMEs). Costs associated with software, infrastructure upgrades, employee training, and ongoing maintenance can be prohibitive, discouraging some organizations from fully embracing these technologies.

Key Market Segmentation

By Component

The solutions segment, comprising workplace solutions like social and collaborative tools, cloud storage tools, and content management systems, accounted for 67.6% of the market share in 2023. This growth is attributed to the increasing adoption of these tools by end-users to enhance resource utilization and productivity. For instance, Trianz PULSE, a cutting-edge digital workplace solution, offers a centralized platform for clients, vendors, and partners to collaborate and communicate, simplifying remote workforce management.

Trianz PULSE facilitates a workplace social network, fosters collaboration and team building, and provides a platform for posting corporate messages on social media. Additionally, it enhances productivity and efficiency by offering self-service capabilities for IT departments. These advantages of digital workplace solutions will contribute significantly to the growth of the segment during the forecast period.

The services segment, which includes consulting services, training support and maintenance, and integration and implementation services, is projected to grow at a CAGR of 23.5% during the forecast period. These services assist organizations in effectively aligning their digital workplaces. They also provide cost-effective support for technical inquiries, preventing downtime associated with implementing digital workplace solutions.

By Organization

The large enterprise segment dominated the market in 2023, capturing a significant revenue share of 61.5%. Many large enterprises are adopting cloud technology and innovative AI-powered solutions to streamline operations. For example, Tata Consultancy Services' Cognix, a digital workspace solution tailored for large organizations, offers real-time dashboards, intelligent reporting, and cutting-edge technologies like AR, VR, and cognitive automation. The implementation of such solutions is driving the adoption of digital workplace solutions within large enterprises.

The Small & Medium Enterprises (SMEs) segment is poised for rapid growth, with a projected CAGR of 24.3% during the forecast period. Despite their limited organizational infrastructure, SMEs are rapidly adopting digital workplace services. These services offer numerous benefits, including increased workforce productivity, business efficiency, mobilized desk-based operations, faster time to market, lower costs, and improved customer experience. SMEs are increasingly turning to cloud-based solutions to reduce costs, eliminate the need for hardware maintenance, and achieve scalability, resulting in lower operating and capital expenditures. These factors are fueling the growth of the digital workplace industry within SMEs.

By End-use

The IT & telecom sector accounted for 22.8% of the market revenue in 2023. The surge in remote work, the growing popularity of SaaS services, and the increasing adoption of BYOD in countries like the U.S., Canada, India, China, and Australia have fueled the demand for digital workplace solutions within the IT & telecom industry. As economies worldwide become increasingly digital, the pandemic has emphasized the need for workforce flexibility and resilience. Organizations are actively investing in digital solutions to ensure business continuity and withstand future disruptions.

The healthcare & pharmaceuticals segment is projected to grow at a CAGR of 24.3% during the forecast period. Many healthcare organizations are embracing modern digital workplace solutions, which offer benefits such as centralized information access, reduced paperwork, and significant cost savings. By adopting a digital workplace, healthcare enterprises can enhance communication, collaboration, and information flow throughout the organization, regardless of location or time.

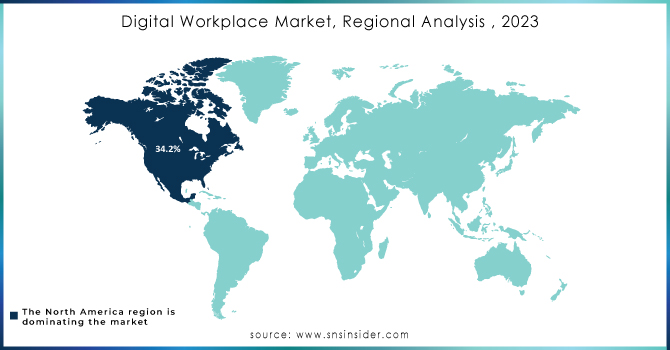

Regional Analysis

North America dominated the digital workplace market in 2023, capturing a revenue share of 34.2%. The region's growth is driven by the increasing adoption of emerging technologies like AI, BYOD, and enterprise mobility management solutions. Numerous regional workplace transformation service providers are rapidly integrating cloud technologies and AI into their offerings. For example, in May 2020, IBM launched IBM Talent & Transformation, a business solution utilizing AI to assist human resources departments in bridging their skills gap. This solution empowers professionals in various fields, including HR, legal, finance, and marketing, to embrace digital technology. Additionally, the region's robust manufacturing, retail, and automotive sectors fuel a strong demand for software and robotics solutions, further driving market development.

The Asia Pacific region is poised for significant growth, with a projected CAGR of 23.6% during the forecast period. This growth is fueled by the rapid digitization of various industries and the increasing adoption of cloud platforms by enterprises. Market players in the region are actively pursuing strategies such as product development, collaborations, and strategic partnerships to maintain a strong market position.

Need any customization research on Digital Workplace Market - Enquiry Now

Key Players:

The major players are Infosys Limited, Accenture plc, Atos SE, Capgemini, Cognizant, Tata Consultancy Services Limited, HCL Technologies Limited, IBM, Mphasis, DXC Technology, Tech Mahindra Limited, Trianz, and others.

Recent Developments

In 2024, Microsoft introduced Microsoft 365 Copilot, an AI-powered assistant designed to enhance productivity and streamline workflows across various Microsoft 365 applications.

Google Workspace has seen significant updates throughout 2024, including improved collaboration features, AI-powered tools, and enhanced security measures.

| Report Attributes | Details |

| Market Size in 2023 | US$ 30.3 Bn |

| Market Size by 2032 | US$ 200.61 Bn |

| CAGR | CAGR of 23.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Organization Size (Small and Medium Enterprises, Large Enterprises) • By End-use (BFSI, IT & Telecommunication, Retail & Consumer Goods, Healthcare & Pharmaceuticals, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Infosys Limited, Accenture plc, Atos SE, Capgemini, Cognizant, Tata Consultancy Services Limited, HCL Technologies Limited, IBM, Mphasis, DXC Technology, Tech Mahindra Limited, Trianz |

| Key Drivers | • Technological Advancements and Changing Dynamics Fueling the Rise of Digital Workplaces |

| Market Restraints | • Data Security and Privacy Concerns

• High Implementation Costs |