Application Gateway Market Report Scope & Overview:

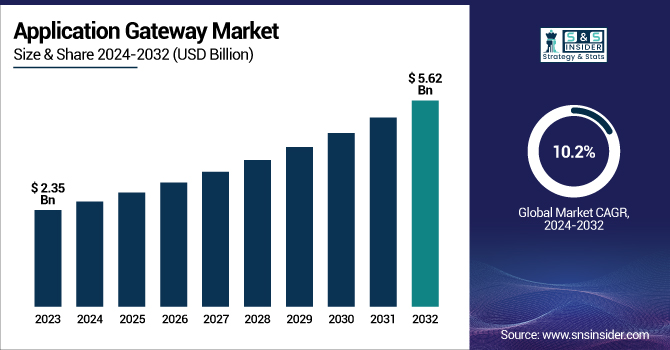

The Application Gateway Market Size was valued at USD 2.35 billion in 2023 and is expected to reach USD 5.62 billion by 2032 and grow at a CAGR of 10.2% over the forecast period 2024-2032.

To Get more information on Application Gateway Market - Request Free Sample Report

The Application Gateway Market is growing rapidly due to increasing cybersecurity threats and the widespread adoption of cloud computing. Acting as intermediaries between users and web applications, application gateways ensure secure communication, traffic management, and protection against threats like SQL injection and cross-site scripting. The rising demand for Web Application Firewalls (WAFs) and AI-driven security solutions is fueling market expansion. Leading players like Microsoft Azure, AWS, F5 Networks, and Citrix Systems are enhancing their offerings with real-time threat detection.

The size of the U.S. Application Gateway Market was USD 0.56 billion in 2023 and is expected to reach USD 1.21 billion by 2032, growing at a CAGR of 8.96% over the forecast period of 2024-2032.

The U.S. Application Gateway Market is experiencing steady growth due to the increasing demand for secure web traffic management and protection against cyber threats. The rising adoption of cloud-based application gateways among enterprises, particularly in BFSI, IT, and healthcare, is driving market expansion. Leading players like Microsoft Azure, AWS, and F5 Networks are investing in AI-driven security solutions to enhance application-layer protection. With stringent data security regulations and growing cloud adoption, the market is expected to witness significant advancements in the coming years.

Application Gateway Market Dynamics

Key Drivers:

-

Growing Adoption of Cloud-Based Solutions Drives the Application Gateway Market Growth

The increasing shift towards cloud computing across industries is a major driver for the Application Gateway Market. As businesses migrate to hybrid and multi-cloud environments, there is a growing need for secure and efficient traffic management solutions. Application gateways play a crucial role in protecting web applications from cyber threats, including DDoS attacks, SQL injection, and cross-site scripting. Leading cloud service providers such as Microsoft Azure, AWS, and Google Cloud are integrating AI-powered security features into their application gateway offerings to enhance real-time threat detection and automated response.

Additionally, the rise in remote work, e-commerce, and digital banking has further fueled the demand for scalable and cost-effective security solutions. As a result, organizations across BFSI, IT & telecom, and healthcare sectors are rapidly adopting cloud-based application gateways to ensure seamless and secure user experiences, ultimately driving market growth.

Restrain:

-

High Implementation Costs Restrain the Growth of the Application Gateway Market

Despite the increasing adoption of application gateways, high initial investment and maintenance costs pose a major challenge for many organizations. Deploying an enterprise-grade application gateway requires significant financial resources, including costs associated with hardware, software licensing, and skilled IT personnel. Additionally, continuous updates and monitoring are essential to ensure optimal performance and security compliance, leading to ongoing operational expenses. SMEs, in particular, find it difficult to allocate budgets for advanced cybersecurity solutions, limiting their adoption of comprehensive application gateway services.

Furthermore, integration complexities with existing IT infrastructures and legacy systems add to the implementation challenges, requiring specialized expertise. While cloud-based gateways offer a cost-effective alternative, concerns regarding data privacy, latency issues, and vendor lock-in further slow down widespread adoption. Unless vendors provide affordable and scalable solutions, the high cost of implementation will continue to hinder market expansion.

Opportunities:

-

Rising Cybersecurity Threats Create Growth Opportunities for the Application Gateway Market

With the rapid rise in cybersecurity threats, including ransomware, phishing, and advanced persistent threats (APTs), businesses are increasingly investing in robust security solutions, presenting a significant opportunity for the Application Gateway Market. The surge in data breaches, cloud security vulnerabilities, and API-based attacks has heightened the demand for intelligent web traffic protection and real-time monitoring capabilities. Application gateways integrated with AI and machine learning algorithms are now being developed to detect anomalies, prevent unauthorized access, and automate security responses.

Furthermore, strict regulatory compliance frameworks such as GDPR, HIPAA, and PCI DSS are compelling organizations to implement advanced security solutions. As cyber threats continue to evolve, the demand for innovative application gateways will surge, fostering market growth.

Challenges:

-

Complex Deployment and Integration Challenges in Multi-Cloud Environments Hinder Market Growth

The growing adoption of multi-cloud and hybrid cloud infrastructures presents significant deployment and integration challenges for application gateways. Enterprises leveraging multiple cloud service providers (AWS, Microsoft Azure, Google Cloud, etc.) often face difficulties in ensuring seamless interoperability and security consistency across different platforms. Managing traffic routing, load balancing, and security policies in multi-cloud environments requires sophisticated orchestration tools and expertise, increasing IT complexity and administrative burdens.

Additionally, compatibility issues with legacy systems, compliance requirements, and network latency concerns further complicate application gateway deployments. Businesses must also address scalability challenges, as traffic spikes can strain existing gateway infrastructures, leading to performance bottlenecks. To overcome these hurdles, companies are investing in containerized gateways, API-driven automation, and software-defined networking (SDN) solutions. However, unless seamless integration mechanisms are developed, these deployment challenges will continue to impede market growth.

Application Gateway Market Analysis

By Component

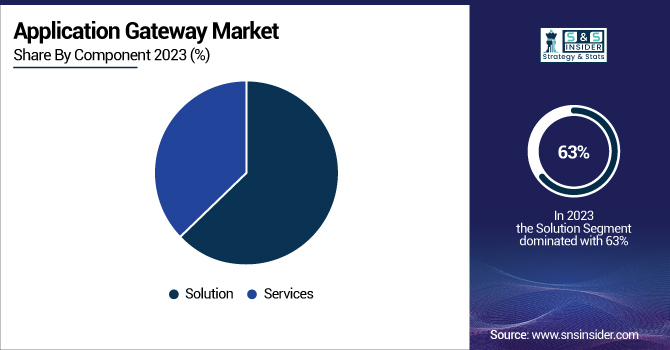

The Solution segment held the largest market share of 63% in 2023 within the Application Gateway Market, driven by the growing demand for advanced web traffic management, security, and load-balancing solutions. Organizations are increasingly adopting application gateway solutions to protect their web applications from cyber threats, including DDoS attacks, SQL injection, and cross-site scripting (XSS). The increasing deployment of cloud-based application gateways by enterprises across industries such as BFSI, healthcare, and IT & telecom is further fueling the segment’s dominance.

The Services segment is projected to grow at the highest CAGR of 11.04% over the forecast period, driven by the increasing need for consulting, deployment, and managed services in the Application Gateway Market. As enterprises transition to cloud and hybrid infrastructures, they require specialized services for seamless integration, configuration, and optimization of application gateways.

For example, Cisco launched its Secure Application Service, providing real-time traffic monitoring and automated risk mitigation for application gateways. Similarly, Akamai introduced managed security services to assist enterprises in continuous threat monitoring and compliance management.

By Enterprise Size

The Large Enterprise segment accounted for the largest market share of 57% in 2023 within the Application Gateway Market, driven by the increasing demand for scalable, secure, and high-performance network security solutions. Large enterprises, particularly in sectors such as BFSI, IT & telecom, and healthcare, are deploying application gateways to safeguard their business-critical applications and sensitive data from cyber threats like DDoS attacks, malware, and API vulnerabilities. Companies such as Microsoft Azure, AWS, and F5 Networks have been at the forefront of developing enterprise-grade application gateway solutions.

Likewise, F5 Networks introduced BIG-IP Advanced WAF, integrating AI-driven security analytics to protect against evolving cyber threats. With the increasing adoption of multi-cloud environments and hybrid architectures, large enterprises are investing heavily in advanced application gateway solutions to enhance network performance, data security, and compliance with global regulations such as GDPR and HIPAA.

The SMEs segment is projected to grow at the highest CAGR of 11.0% during the forecast period, fueled by the increasing adoption of cloud-based security solutions and cost-effective application gateways. Small and medium enterprises (SMEs) are embracing digital transformation and expanding their online presence, making them prime targets for cyber threats. The need for affordable, scalable, and easy-to-deploy application gateway solutions is driving SMEs to adopt cloud-based gateways that offer automated security updates and traffic optimization. Leading vendors such as Cisco, Cloudflare, and Akamai Technologies are focusing on tailored security solutions for SMEs.

The rise of Software-as-a-Service (SaaS) models has further enabled SMEs to adopt subscription-based security solutions, reducing upfront costs while ensuring continuous protection and network optimization. As SMEs continue to prioritize cybersecurity and cloud adoption, the demand for application gateways in this segment is expected to surge significantly.

By End-Use

The IT & Telecommunication segment led the Application Gateway Market in 2023, accounting for 25% of the total revenue share, driven by the increasing need for secure and high-performance network infrastructure. With the rise of cloud computing, 5G networks, and IoT connectivity, telecom companies and IT service providers are deploying application gateways to optimize traffic flow, ensure data security, and protect against cyber threats. The demand for low-latency, scalable, and resilient security solutions has led key players to introduce advanced application gateway solutions.

For example, F5 Networks’ BIG-IP Local Traffic Manager (LTM) is widely used in the telecom sector for intelligent traffic routing, DDoS protection, and load balancing. Similarly, Akamai Technologies’ Edge Application Gateway enhances performance and security for IT firms by integrating AI-driven threat detection and real-time monitoring.

The BFSI segment is projected to grow at the highest CAGR of 11.26%, fueled by the increasing need for secure digital banking solutions and compliance with stringent financial regulations. As cyber threats targeting financial institutions escalate, the demand for secure, scalable, and regulation-compliant application gateways has surged. Banks and financial service providers are integrating AI-driven security solutions to mitigate threats like phishing, ransomware, and DDoS attacks while ensuring seamless digital transactions. Leading companies such as Citrix Systems, AWS, and Fortinet are developing specialized application gateway solutions tailored for BFSI enterprises.

The growing adoption of digital payments, mobile banking, and cloud-based financial services is further accelerating the need for secure and high-performance application gateways. As BFSI firms continue to prioritize data security, regulatory compliance, and digital transformation, the market for application gateways in this segment is set for substantial growth.

Regional Analysis

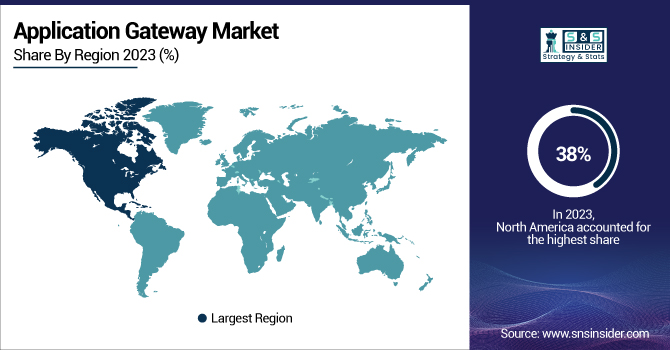

North America held the largest share of the Application Gateway Market in 2023, accounting for approximately 38% of the total revenue. This dominance is driven by increased cybersecurity concerns, cloud adoption, and the rapid digital transformation of enterprises. The region is home to leading cloud service providers and cybersecurity firms, such as Amazon Web Services (AWS), Microsoft Azure, Cisco Systems, and F5 Networks, which are continuously innovating in network security and application gateway solutions.

Additionally, government regulations like the California Consumer Privacy Act (CCPA) and stringent data protection laws have accelerated the adoption of advanced application security solutions in North America. The banking, healthcare, and e-commerce sectors are among the biggest adopters of application gateways to prevent cyber threats and ensure compliance with data security standards like GDPR, PCI-DSS, and HIPAA.

The Asia Pacific region is projected to grow at the highest CAGR of 11.58% during the forecast period, fueled by the rapid digitalization of businesses, increased cloud adoption, and rising cyber threats. Countries such as China, India, Japan, and Australia are witnessing a surge in demand for secure web applications and cloud-native security solutions, driving the adoption of application gateways across various industries. The rise of e-commerce, fintech, and smart cities initiatives has further accelerated market growth, increasing the need for robust security frameworks.

Additionally, government regulations like India’s Data Protection Bill and China’s Cybersecurity Law are pushing enterprises to implement advanced security solutions, including application gateways. As SMEs and large enterprises in the region migrate to multi-cloud and hybrid environments, the demand for scalable, cost-effective, and AI-driven security solutions will continue to boost the Asia Pacific application gateway market in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Akamai Technologies (Akamai Kona Site Defender, Akamai App & API Protector)

-

Avi Networks (Avi Vantage Platform, Avi Web Application Firewall)

-

Barracuda Networks, Inc. (Barracuda Web Application Firewall, Barracuda CloudGen Firewall)

-

Cloud Software Group, Inc. (Citrix Web App Firewall, Citrix ADC)

-

F5, Inc. (F5 BIG-IP Advanced WAF, F5 NGINX Plus)

-

Forcepoint (Forcepoint Web Security Gateway, Forcepoint Next-Gen Firewall)

-

Fortinet, Inc. (FortiWeb Web Application Firewall, FortiADC)

-

Imperva (Imperva Web Application Firewall, Imperva API Security)

-

Juniper Networks, Inc. (Juniper AppSecure, Juniper Secure Edge)

-

Microsoft (Azure Application Gateway, Microsoft Defender for Cloud Apps)

-

Orange Business (Flexible SD-WAN, Business VPN Galerie)

-

Palo Alto Networks Inc. (Prisma Cloud Web Application Firewall, Palo Alto VM-Series Firewalls)

-

Progress Software Corporation (Kemp LoadMaster, Flowmon Anomaly Detection System)

Recent Trends

-

In September 2024, Akamai was recognized as a Leader in the IDC MarketScape: Web Application and API Protection (WAAP) 2024 Vendor Assessment. The report highlighted Akamai's comprehensive solutions addressing security, availability, and compliance requirements for modern digital businesses.

-

In November 2024, Barracuda launched Cloud Application Protection 2.0, enhancing its platform with features like client-side protection, containerized WAF deployment, and an auto-configuration engine. These additions aim to provide robust defense mechanisms for web applications against evolving threats.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.35 Billion |

| Market Size by 2032 | US$ 5.63 Billion |

| CAGR | CAGR of 10.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Solution, Services) •By Enterprise Size (SMEs, Large Enterprise) •By End-Use (BFSI, Manufacturing, Government & Public Sector, IT & Telecommunication, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Akamai Technologies, Avi Networks, Barracuda Networks, Inc., Cloud Software Group, Inc., F5, Inc., Forcepoint, Fortinet, Inc., Imperva, Juniper Networks, Inc., Microsoft, Orange Business, Palo Alto Networks Inc., Progress Software Corporation. |