Online Grocery Market Size & Overview:

The online Grocery Market was valued at USD 369.2 billion in 2023 and is expected to reach USD 2789.1 billion by 2032, growing at a CAGR of 25.22% from 2024-2032. The online grocery market has seen rapid growth in recent years, driven by changing consumer habits, technological advancements, and the increasing adoption of digital platforms and the convenience and time-saving benefits of online shopping, which have reshaped the way consumers purchase groceries. Technological advancements, such as user-friendly mobile apps, AI-driven personalized recommendations, and efficient last-mile delivery solutions, have further enhanced the customer experience and fueled market growth.

Get More Information on Online Grocery Market - Request Sample Report

Major players like Amazon Fresh, Walmart, and Instacart have continued to expand their services, leveraging data analytics and robotics to optimize supply chains and delivery processes. Urbanization and the growing use of smartphones and the internet are also key drivers, particularly in developing regions where online grocery platforms are increasingly becoming accessible to a wider audience. According to the survey, over 50% of U.S. consumers now use online grocery services, up from just 23% in 2019. Additionally, rising disposable incomes, busy lifestyles, and an increasing focus on healthier, organic, and specialty food options are driving more consumers to explore online grocery shopping.

Market Dynamics

Drivers

-

Consumers prefer the ease of shopping from home with quick delivery options.

-

Rising demand for healthier, organic, and specialty food options drives online purchases.

-

Online grocery platforms often offer competitive prices and promotions that attract budget-conscious consumers.

Online grocery platforms often attract budget-conscious consumers by offering competitive prices, promotions, and discounts that are hard to find in traditional brick-and-mortar stores. These platforms leverage data analytics to personalize promotions, making them more relevant to individual shoppers. For instance, Amazon Fresh and Walmart+ frequently offer exclusive deals, free delivery, and subscription discounts, which help retain cost-sensitive customers. A survey by McKinsey in 2023 found that nearly 61% of online grocery shoppers cite lower prices and special promotions as a key reason for choosing online platforms over traditional stores.

Additionally, these platforms frequently run loyalty programs and cashback offers, which incentivize repeated purchases and build long-term customer loyalty. For example, Instacart’s Express membership offers reduced service fees and free delivery on orders over a certain amount, making it a popular choice among regular users. Flash sales, bulk buying discounts, and personalized coupons further enhance the appeal. According to research, 45% of U.S. consumers used online grocery services specifically to take advantage of such deals in 2023. The convenience of comparing prices across multiple platforms also empowers consumers to make cost-effective decisions, further driving the popularity of online grocery shopping among budget-focused individuals. These strategies not only boost sales volumes but also help platforms differentiate themselves in an increasingly competitive market.

The rising demand for healthier, organic, and specialty food options is a significant driver of online grocery purchases, as consumers increasingly prioritize health and wellness in their food choices. Online grocery platforms offer a wider selection of organic, gluten-free, vegan, and other specialty products that are often difficult to find in local stores. Platforms like Whole Foods (via Amazon) and Thrive Market specialize in catering to health-conscious consumers by offering curated selections of organic and non-GMO products. The convenience of detailed product information, customer reviews, and easy access to niche brands further boosts online sales. 41% of U.S. online grocery shoppers in 2023 chose e-commerce platforms for their ability to meet specific dietary needs, underscoring the growing influence of health trends on purchasing behavior.

Restraints

-

Poor delivery infrastructure and limited service areas restrict market reach.

-

Slow or unreliable internet connections can hinder the shopping experience.

-

Concerns over product quality and accuracy of orders can affect customer satisfaction.

-

Maintaining the freshness of perishable items during delivery remains a significant challenge.

Maintaining the freshness of perishable items during delivery is a major challenge for the online grocery market, as it directly impacts customer satisfaction and repeat business. Products like fruits, vegetables, dairy, and meat require specialized storage and quick, temperature-controlled delivery to ensure they arrive in good condition. According to a 2023 survey, 37% of online grocery shoppers reported concerns about the quality and freshness of perishable goods upon delivery. The logistics involved, including cold chain management and timely delivery, add significant operational costs and complexity for providers. Failure to maintain proper conditions can lead to spoiled items, increased returns, and customer dissatisfaction. Companies like Amazon Fresh and Instacart are investing in refrigerated vehicles and advanced packaging solutions, but these measures are costly and difficult to scale, especially in less urban areas. The challenge of preserving freshness remains a key barrier to the broader adoption of online grocery shopping, particularly for fresh and highly perishable items.

Concerns over product quality and order accuracy significantly impact customer satisfaction in the online grocery market. Shoppers often worry about receiving damaged goods, expired items, or incorrect products, which can erode trust in online services. These concerns are particularly prominent for fresh produce, where customers prefer to select items themselves to ensure quality. The inability to physically inspect products before purchase leads to uncertainty, and when items don’t meet expectations, it often results in complaints, refunds, or negative reviews. Retailers like Walmart and Instacart are striving to address these issues through improved quality checks, better packaging, and more accurate order-picking processes, but challenges remain. High standards for product quality and order accuracy are essential for maintaining customer loyalty and market growth.

Segment Analysis

By Product

In 2023, The staples & cooking essentials segment dominated the market and accounted for the largest revenue share of around 31.0% driven by the repetitive purchase of staples like flour, food grains, and cooking essentials, such as oil, which are household necessities, particularly in the Asia Pacific region.

The breakfast and dairy segment is expected to see significant growth during the forecast period, fueled by increased demand for both milk and non-dairy products, along with the convenience of doorstep delivery provided by vendors. Additionally, busy lifestyles and higher disposable incomes are encouraging consumers to purchase these items online rather than visiting physical stores.

By Delivery

In 2023, the Scheduled Delivery segment led the market, accounting for over 59% of the market share. It is projected to maintain its leading position throughout the forecast period, as consumers increasingly choose scheduled deliveries that fit their preferred time slots, catering to busy lifestyles and minimizing waiting times.

However, the instant delivery segment is anticipated to manifest the highest CAGR during the forecast period. Market trends in instant delivery for the online grocery sector show an increasing preference for fast, on-demand grocery services.

By Platform

In 2023, the App segment dominated the market and accounted for more than 60.0% of the market share. This segment has grown significantly due to the convenience and speed it provides, especially for repeat buyers and frequent users. Grocery shopping apps enhance the user experience with personalized features such as push notifications for deals, tailored recommendations, and quick reordering of favorite items. These app-based platforms are especially attractive to tech-savvy, younger consumers who appreciate the ease of shopping on the go. Additionally, apps leverage smartphone capabilities like location services to streamline delivery efficiency.

Web-based platforms are expected to experience the highest CAGR during the forecast period. This platform is especially favored by users who prefer a larger screen for browsing and comparing products, or who may not want to download and install extra apps on their devices. Web-based grocery platforms offer a broad view of products, detailed descriptions, and straightforward navigation. They are also advantageous for users who want to research or compare prices across various sites.

By Purchase

The Subscription model segment held the largest market share of around 58% in 2023. This segment is becoming increasingly popular in the online grocery market, especially for staple items and frequently used products. In this model, customers subscribe to receive specific products at set intervals, such as weekly or monthly. This approach is convenient for those who want to automate the replenishment of essentials, saving time and effort on repeated orders. It is particularly suited for items with predictable usage, like dairy products, baby care items, or specialty coffee. Subscription models often provide advantages such as discounted prices, free delivery, or exclusive access to certain products.

The one-time purchase segment is projected to grow during the forecast period. This segment represents a more traditional approach in the online grocery market. It involves customers making individual purchases as needed, without any commitment to future orders. This segment caters to consumers who prefer shopping based on immediate needs or specific occasions, offering flexibility and a range of choices.

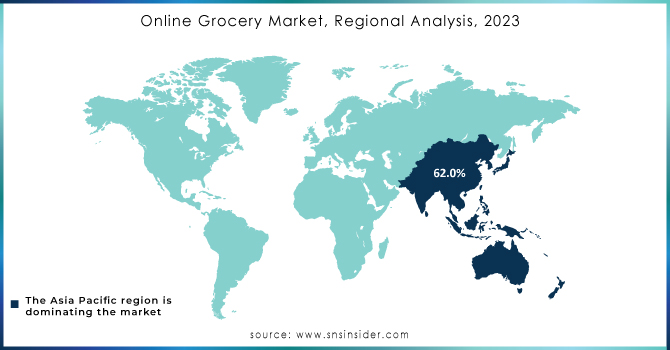

Regional Analysis

Asia Pacific led the online grocery market in 2023 and held the largest revenue share at 62.0%. This regional growth is largely driven by government initiatives in countries like India and China that support e-commerce and digitalization. The growing demand for the industry is fueled by factors such as a rising population, higher disposable incomes, and a sophisticated, food-conscious consumer base across the region. Additionally, greater mobile accessibility and broadband adoption are disrupting traditional grocery shopping models, enabling customers to purchase food anytime and from anywhere. Social trends, including road congestion and longer working hours, have also contributed to the increasing popularity of online grocery shopping in Asia Pacific.

North America is projected to see significant growth during the forecast period. The region is home to key players like Walmart, Instacart, Amazon.com, Inc., Target, and Kroger Co., with the U.S. specifically experiencing steady growth in e-commerce sales.

Need any customization research on Online Grocery Market - Enquiry Now

Key Players

The major key players include Target Brands, Inc., Tesco.com, The Kroger Co., Walmart, Alibaba.com, Amazon.com, Inc., Instacart, JD.com, Supermarket Grocery Supplies Pvt. Ltd., AEON CO., LTD., Inc., and several others.

Recent Developments

-

In July 2023, Woolworths Group Limited launched the MILKRUN app in New Zealand. This app enables consumers to place orders within minutes and provides an ultra-convenient shopping experience.

-

In February 2023, Kroger Co. opened a new facility in South Florida, U.S., to enhance its delivery services.

-

In March 2022, Instacart launched "The Instacart Platform," a suite of enterprise-grade technologies designed to revolutionize the grocery industry. With this innovative offering, Instacart aims to empower retailers and enhance the consumer experience, catering to various shopping preferences.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 369.2 Billion |

|

Market Size by 2032 |

USD 2789.1 Billion |

|

CAGR |

CAGR 25.22 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Platform (Web-Based, App-Based) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

The major key players include Target Brands, Inc., Tesco.com, The Kroger Co., Walmart, Alibaba.com, Amazon.com, Inc., Instacart, JD.com, Supermarket Grocery Supplies Pvt. Ltd., AEON CO., LTD., Inc., and several others. |

|

Key Drivers |

• Consumers prefer the ease of shopping from home with quick delivery options. |

|

Market Restraints |

• Poor delivery infrastructure and limited service areas restrict market reach. |