IT Asset Disposition (ITAD) Market Size & Overview:

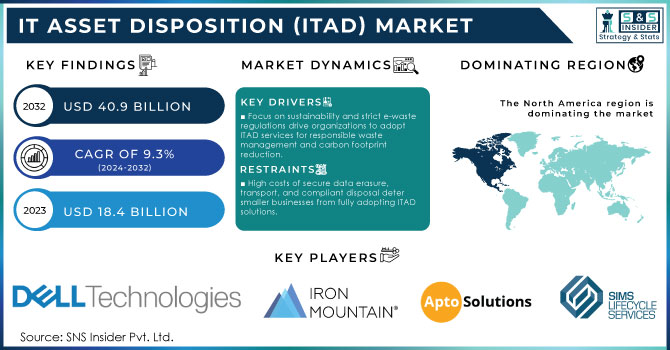

The IT Asset Disposition (ITAD) Market size was valued at USD 21.98 billion in 2025 and is expected to grow to USD 53.49 billion by 2035, and grow at a CAGR of 9.3% over the forecast period of 2026-2035.

The IT Asset Disposition (ITAD) market has grown exponentially due to the presence of ever-increasing regulatory mandates by governments around the world and rising e-waste requiring safe disposal. The regulatory push is projected to increase demand for IT asset disposition services from companies that want to comply with strict e-waste legislation, while simultaneously ensuring the secure disposal of sensitive data.

IT Asset Disposition (ITAD) Market Size and Forecast:

-

Market Size in 2025: USD 21.98 billion

-

Market Size by 2035: USD 53.49 billion

-

CAGR (2026–2035): 9.3%

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get more information on IT Asset Disposition (ITAD) Market - Request Sample Report

Key Trends Shaping the IT Asset Disposition (ITAD) Market:

-

Data Security & Compliance Focus: Rising concerns over data breaches and strict regulations drive secure IT asset disposal and certified data destruction practices.

-

Sustainability & Circular Economy: Growing emphasis on recycling, refurbishing, and reusing IT equipment supports eco-friendly disposal practices and reduces electronic waste.

-

Cloud Migration Impact: Increasing enterprise shift to cloud services leads to higher disposal of legacy hardware and data center equipment.

-

Service-Based ITAD Models: Expansion of managed and outsourced ITAD services offers organizations cost efficiency, scalability, and specialized expertise in handling IT assets.

-

Technological Integration: Use of blockchain, AI, and advanced tracking systems enhances transparency, asset traceability, and accountability throughout the disposition process.

-

Enterprise & Government Demand: Large organizations and public sectors drive ITAD adoption to ensure compliance, sustainability, and secure data management.

The growing need for IT Asset Disposition (ITAD) services is fuelled by the transition of businesses towards cloud-based solutions and data center consolidation. Cloud migration and data center consolidation lead to decommissioned IT assets like servers, storage devices, and networking equipment that require proper disposal. ITAD services supervise this process alongside data erasure, logistics, and eco-sustainable disposal techniques which include recycling and refurbishment. By utilizing ITAD services, companies ensure compliance with data protection and environmental standards, making ITAD providers essential in managing the IT lifecycle from deployment to decommissioning in cloud-centric infrastructures

ITAD Market Insights: Device Lifecycle, Data Security, and Sustainability

|

Category |

Details |

|---|---|

|

Device Refurbishment Rate |

55% of disposed assets are refurbished and resold |

|

Data Security Compliance |

85% of organizations prioritize data sanitization compliance (GDPR, HIPAA) |

|

E-waste Recycling Efficiency |

72% of IT assets are recycled after disposal |

|

Average Asset Lifespan |

Laptops: 3-5 years, Desktops: 5-7 years, Servers: 4-6 years |

|

Data Sanitization Methods |

Data Wiping: 60%, Degaussing: 25%, Physical Destruction: 15% |

|

End-of-Life Management |

40% of assets sent for certified recycling, 20% sent to secondary markets |

|

Environmental Impact (CO2e) |

ITAD reduces an average of 1.2 metric tons of CO2e per 100 disposed devices |

|

Resale Value Recovery Rate |

Average recovery rate: 45-50% of original device value |

|

ITAD Service Provider Trends |

35% of companies outsource ITAD services, 65% manage in-house |

|

Compliance Audits Frequency |

70% of organizations conduct annual compliance audits on ITAD practices |

The U.S. IT Asset Disposition (ITAD) Market was valued at USD 7.03 Billion in 2025 and is projected to reach USD 18.45 Billion by 2035, growing at a CAGR of 10.1% during 2026-2035. Market growth is driven by increasing regulatory compliance demands for secure data destruction, growing concerns for e-waste management, increasing enterprise interest in data security and sustainability, fast-paced IT infrastructure upgrades in enterprises, and the growing adoption of circular economy principles to unlock maximum value from asset recovery

IT Asset Disposition (ITAD) Market Drivers:

- Growing focus on environmental sustainability and strict government regulations around e-waste disposal encourage organizations to adopt ITAD services. Compliance with these regulations helps reduce carbon footprints and manage electronic waste responsibly.

- Increasing cases of data breaches and stringent data privacy regulations (such as GDPR and CCPA) are pushing organizations to properly dispose of IT assets to avoid data leaks, ensuring sensitive information is destroyed securely.

- Many companies are incorporating CSR into their business models, opting for eco-friendly ITAD solutions. These initiatives help them enhance their brand image by responsibly recycling and reselling old IT equipment.

The concern for data security and data privacy arising due to an increase in data breach cases and the implementation of stringent data protection regulations is one of the key factors contributing to the growth of the IT Asset Disposition market. The data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the USA, have forced organizations to ensure the security and privacy of personal and confidential data across the entire data lifecycle, which includes data disposal. According to the Identity Theft Resource Center, the data breach cases in the USA alone have reached 1,802 cases in 2023, compromising the data of more than 422 million individuals. This proves the significance of data protection during the disposal of outdated IT assets so that data breach cases are not incurred. The data stored in the disposed IT assets can cause severe financial loss and damage the reputation of the organization if the data is found to be non-compliant with the data regulations.

For example, in 2023, Morgan Stanley was fined USD 60 million by the U.S. Office of the Comptroller of the Currency (OCC) for failing to adequately dispose of outdated data center equipment, which led to potential data exposure. This incident is a reminder that certified ITAD providers offering secure data wiping, destruction, and certification disposal services should be used. As organizations seek ITAD solutions promising guaranteed data erasure and compliance with privacy laws, this aspect is expected to drive the growth of the global IT asset disposition market over the forecast period.

IT Asset Disposition (ITAD) Market Restraints:

- The cost of secure data erasure, transportation, and environmentally compliant disposal of IT assets can be high, deterring smaller businesses from fully embracing ITAD solutions.

- Many organizations, especially small and medium enterprises (SMEs), are still unaware of the benefits of ITAD services or the risks associated with improper disposal of IT assets, limiting market adoption.

The service cost associated with secure data erase and environmentally compliant disposal process is a major key restrain in the growth of the ITAD market. Organizations are bound by strict data security and environmental regulations that require proper e-waste management and secure data destruction. This requires a lot of investment in technology, infrastructure, and qualified processes that are expensive. Such costs can be burdensome and form a reason for not availing ITAD services in small organizations, especially when the budget is a concern. As a result, organizations resort to poor and harmful or improper methods of disposal that result in data breaches in the organization and environmental issues. This cost factor is a major impediment in the adoption of full ITAD services, especially in small organizations.

IT Asset Disposition (ITAD) Market Segmentation Analysis:

By Asset Type, Computers Drive ITAD Market with Rising End-of-Life Hardware and E-Waste Regulations

The computers segment dominated the ITAD market share on account of large quantity of computer hardware deployed world over. By 2025 there were an estimated 2.2 billion personal computers in use around the world, and a significant proportion of those assets were near to end-of-life stage. ITAD growth Drivers One of the key reasons behind ITAD being growht Driver for ADISA certification is technology has been accelerating at great speed, and that within 3-5 years new computers might be out to date. It has been recognized by Governments across the world the need for recycling and safe disposal of such assets where it is also made obligatory to ensure responsible end-of-life management through regulations. As one example, recycling computer equipment is promoted by the U.S. EPA as an aspect of its Electronics Recycling Challenge where more than 25% of all electronics were recycled in 2022. Secondly, corporate and government clients often refresh in bulk and cycle their hardware which also creates the need for effective ITAD services due to the demand for environmentally sensitive asset disposal options. Due to increasing issues of e-waste and the importance of safely disposing of confidential information stored on the computers, computers are now a large share of ITAD revenue.

By Service, Data Sanitization & Destruction Lead Market Amid Growing Privacy Regulations and Compliance Needs

Data sanitization and destruction services dominated the ITAD market in 2025 due to stringent regulations surrounding data privacy and protection. Governments are tightening up on regulations such as the EU General Data Protection Regulation – GDPR, U.S. Federal Information Security Management Act (FISMA) so organizations must now prove that sensitive information is completely destroyed when IT assets are decommissioned. According to the 2024 U.S. Federal Trade Commission (FTC) report, 56% of data breaches were associated with poor disposal practices which need proper sanitization services. For organizations that manage sensitive customer and corporate data, methods of data destruction degaussing, overwriting, and physical destruction are essential. There are ITAD service providers that, due to the increased need coming from companies in highly regulated industries including healthcare, banking, and government, have been offering organizations more help with adhering to laws such as the U.S. Health Insurance Portability and Accountability Act (HIPAA), requires organizations dealing with patient data to dispose of that information securely. Additionally, companies have adopted these services to mitigate the risks of data breaches and avoid hefty fines, thus driving the market for data sanitization and destruction services.

By End-use, IT & Telecom Sector Dominates ITAD Demand Through Infrastructure Upgrades and Secure Decommissioning

Due to the rising rate of growth of digital infrastructure and the constant upgrade of hardware because of advancements in communication technology, the IT & telecom sector led the market for ITAD in 2025. According to the U.S. Federal Communications Commission (FCC), by 2024, more than 85% of U.S. households had access to at least one type of broadband service, and telecommunication companies have been constantly upgrading their infrastructure to keep up with the demands of their customers. This has led to an increase in the rate of IT asset turnover, especially with regard to things such as servers, routers, and switches that are usually expected to be decommissioned and salvaged. Telecommunication companies, in particular, are in dire need of ITAD services that can ensure the destruction of data during the decommissioning of old infrastructure, especially in line with the standards set by the U.S. National Security Agency (NSA) for the destruction of data. Moreover, the rising use of 5G technology around the world has led to tons of old 4G infrastructure that needs to be digested, and the ITAD market is an essential foundation for the IT and telecom industry.

IT Asset Disposition (ITAD) Market Regional Analysis:

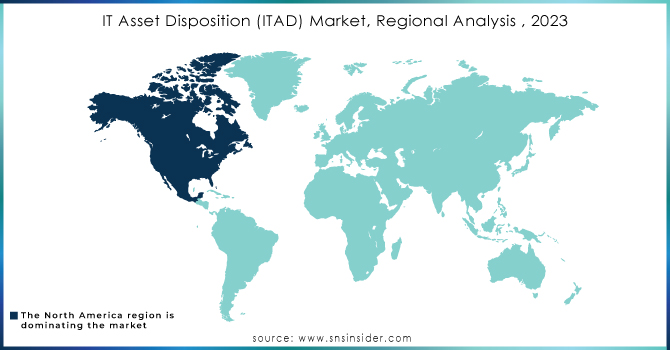

North America IT Asset Disposition (ITAD) Market Insights

In 2025, the IT Asset Disposition (ITAD) Market in North America is projected to lead with an estimated 35% share due to the presence of stringent e-waste regulations, fast hardware refresh cycles, and increasing enterprise requirements for verified data destruction. North America has a strong IT infrastructure, widespread cloud adoption, and a robust regulatory environment for environmental compliance, making it conducive for large-scale adoption of ITAD solutions. Secure recycling, data sanitizing, and environmentally responsible asset recovery processes improve the efficiency and sustainability of ITAD in North America.

United States Leads IT Asset Disposition (ITAD) Market in North America

The North America ITAD Market is highly mature and driven by regulations related to environment conservation and government directives on workplace safety such as Health insurance portability and accountability act (HIPAA) in the U.S. coupled with increasing number of data centers within the region. Strong federal programs (e.g.EPA’s Electronics Recycling) and regulations such as HIPAA and FISMA, support the proper disposal of electronics. A robust ITAD provider ecosystem, as well as extensive enterprise and government contracts put the U.S. in a strong position leading regional ITAD markets.

Asia Pacific IT Asset Disposition (ITAD) Market Insights

The Asia Pacific region is projected to be the largest market for ITAD during the forecast period, at a CAGR of 13.2% due to increasing digitalization in this region and following it increasing IT infrastructure development and also promotes e-waste management. ITAD adoption is moving at a faster pace than ever before due to growing manufacturing hubs, increasing device proliferation and favorable government recycling policies. Companies in the market are demanding secure disposal and destruction solutions to adhere to international standards, with little attention being given to SMEs that demand due to frequent hardware refresh cycle.

Japan Leads IT Asset Disposition (ITAD) Market Growth in Asia Pacific

Japan has the highest market share in the Asia Pacific Market for the ITAD Market, which can be attributed to the high level of technology adoption, the highest tradition for corporate compliance, and the initiation of e-waste recycling by the Japanese Government. With the presence of major electronic device manufacturing centers and high data security standards, Japanese organizations are particular about obtaining ITAD certification. High priority for sustainability, sophisticated recycling, and the adoption of ITAD by organizations for secure hardware retirement also add to the dominance of Japan in the ITAD market.

Europe IT Asset Disposition (ITAD) Market Insights

As of 2025, the IT Asset Disposition (ITAD) Market in Europe has a substantial market share due to the strict environmental regulations, data security regulations, and sustainability initiatives of businesses. The Waste Electrical and Electronic Equipment (WEEE) Directive and GDPR compliance in the EU ensure that businesses follow secure and sustainable ITAD processes. Innovation in the recycling of e-waste, the growth of certified ITAD companies, and the increasing interest of businesses in green initiatives are factors that contribute to the steady growth of the market.

Germany Dominates Europe’s IT Asset Disposition (ITAD) Market

Germany is at the forefront of the European IT Asset Disposition Market because of its robust regulatory environment, sophisticated recycling infrastructure, and high adoption of enterprise IT. The focus on environmental regulations, in addition to the need for secure data destruction by enterprises, drives the adoption of ITAD. Germany’s leadership in the adoption of circular economy principles, in addition to investments in environmentally responsible disposal solutions, cements its position in the European ITAD market.

Latin America and Middle East & Africa IT Asset Disposition (ITAD) Market Insights

The IT Asset Disposition (ITAD) Market in Latin America and the Middle East & Africa is growing steadily in 2025 due to the increasing adoption of digitalization, the rise in corporate IT infrastructure, and government initiatives for e-waste recycling. The rising demand for secure data sanitizing and responsible asset disposal in enterprises is driving the adoption of the ITAD market. The growth of the telecom and banking industries, along with government efforts for sustainability, is supporting the ITAD market.

Regional Leaders in Latin America and Middle East & Africa IT Asset Disposition (ITAD) Market

Brazil is the leading country in the Latin American IT Asset Disposition (ITAD) Market, thanks to the growing IT infrastructure, digital transformation in the corporate sector, and an increasing number of e-waste recycling programs. In the Middle East & Africa region, the UAE is the major player in the market, thanks to the smart city initiatives, sustainability regulations, and corporate sector requirements for secure IT asset disposal. The focus on green technology by both countries sustains their dominance in the growth of the ITAD market in their respective regions.

Do you need any custom research on IT Asset Disposition (ITAD) Market - Enquiry Now

IT Asset Disposition (ITAD) Market Competitive Landscape:

CompuCom Systems, Inc.

CompuCom Systems, Inc. is a leading IT managed services and solutions provider headquartered in the United States, specializing in end-to-end digital workplace services, cloud computing, and IT asset lifecycle management. The company delivers technology-driven solutions that optimize operations, improve productivity, and ensure secure IT asset handling. With strong expertise in IT asset disposition (ITAD), CompuCom supports businesses in responsibly managing end-of-life assets through secure data destruction, sustainable recycling, and remarketing programs. By combining technology innovation with sustainability initiatives, CompuCom enables enterprises to achieve digital transformation while reducing environmental impact and ensuring compliance with global security and regulatory requirements.

- In February 2025, CompuCom Systems, Inc. announced a strategic partnership with Verkada to strengthen business security solutions using advanced cloud-based technologies. The collaboration integrates CompuCom’s IT service expertise with Verkada’s physical security innovations, enabling organizations to adopt a more streamlined, data-driven approach for protecting people, assets, and operations.

Sims Lifecycle Services, Inc.

Sims Lifecycle Services, Inc. (SLS), part of Sims Limited, is a global leader in IT asset disposition, data center decommissioning, and electronics recycling solutions. Headquartered in the United States, SLS helps organizations securely and sustainably manage end-of-life IT equipment while maximizing asset recovery value. The company’s services include secure data destruction, redeployment, and resale of refurbished equipment, alongside environmentally responsible recycling practices. With operations across multiple regions, SLS plays a pivotal role in supporting circular economy principles, enabling clients to reduce e-waste, ensure regulatory compliance, and meet sustainability targets through innovative IT lifecycle management strategies.

- In January 2024, Sims Lifecycle Services, Inc. partnered with MOLG, a U.S.-based provider of digital and automation tools, to advance the repurposing of Open Compute Project (OCP) data center materials. The collaboration focuses on automating processes within the reverse data center supply chain, addressing increasing demand for scalable and efficient operations.

Iron Mountain

Iron Mountain Incorporated is a global leader in storage, information management, and secure IT asset disposition services. Founded in 1951 and headquartered in Boston, Massachusetts, Iron Mountain provides comprehensive solutions for data protection, secure storage, and end-of-life IT asset management. Its ITAD services cover secure data sanitization, hardware recycling, and remarketing of retired equipment, ensuring compliance with stringent regulatory standards such as HIPAA, GDPR, and FISMA. Leveraging its global network, Iron Mountain helps enterprises minimize security risks, recover asset value, and support sustainability initiatives, making it a trusted partner for organizations managing sensitive information and technology lifecycle needs.

- In September 2024, Iron Mountain acquired Wisetek, a leading IT asset disposition (ITAD) firm, to expand its IT lifecycle management capabilities. This strategic acquisition strengthens Iron Mountain’s ability to deliver advanced, secure, and sustainable solutions for managing end-of-life IT assets.

IT Asset Disposition (ITAD) Market Companies:

-

IBM Global Asset Recovery Services

-

Hewlett-Packard Enterprise (HPE)

-

Iron Mountain Incorporated

-

Sims Lifecycle Service (Sims Lifecycle Services)

-

TES-AMM (a subsidiary of SK ecoplant)

-

Arrow Electronics, Inc.

-

CloudBlue (an Ingram Micro Company)

-

LifeSpan International, Inc.

-

ITRenew, Inc. (now part of Iron Mountain)

-

EPC, Inc. (a CSI Leasing Company)

-

Blancco Technology Group

-

Quantum Lifecycle Partners

-

CompuCycle, Inc.

-

GreenTek Reman Pvt. Ltd.

-

Exit Technologies

-

RenewIT

-

Wisetek Solutions

-

Veolia Environnement S.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 21.98 Billion |

| Market Size by 2035 | USD 53.49 Billion |

| CAGR | CAGR of 9.3% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Asset Type (Computers/Laptops, Smartphones and Tablets, Peripherals, Storages, Servers, Others) •By Organization Size (Small and Medium-sized Enterprises, Large Enterprises) •By Service (De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction/Data Sanitation, Logistics Management and Reverse Logistics, Others) •By End-use (BFSI, IT & Telecom, Government, Energy and Utilities, Healthcare, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM (Global Asset Recovery Services), Dell Technologies, Hewlett Packard Enterprise, Iron Mountain Incorporated, Sims Lifecycle Services, TES-AMM, Arrow Electronics, Inc., Apto Solutions, Inc., CloudBlue, LifeSpan International, Inc., ITRenew, EPC, Inc., Blancco Technology Group, Quantum Lifecycle Partners, CompuCycle, Inc., GreenTek Reman Pvt. Ltd., Exit Technologies, RenewIT, Wisetek Solutions, Veolia Environnement S.A.. |