Digital X-Ray Systems Market Report Scope & Overview:

Get More Information on Digital X-Ray Systems Market - Request Sample Report

The Digital X-Ray Systems Market Size was valued at USD 7.9 billion in 2023 and is expected to reach USD 15.4 billion by 2032 and grow at a CAGR of 7.8% over the forecast period 2024-2032.

The Digital X-ray systems market has been on an upward graph, owing to advancements in imaging technology and the increasing demand for better diagnostic aids. Drivers affecting this market dynamic include technological innovations, growing healthcare expenditure, and a rising preference toward digital solutions over traditional film-based systems. These systems are valued for their superior image quality, faster processing time, and lower radiation exposure important in making an accurate and efficient diagnosis.

Recent developments are again underlining the active role that leading companies play in pushing the boundaries of digital X-ray technology. For example, Siemens Healthineers has just now enhanced local manufacturing capability with the introduction of a new digital X-ray system, developed for improved diagnostic precision and operational efficiency. This represents a great and devoted undertaking by Siemens for the explanation and availing of better access to advanced diagnostic tools to satisfy local healthcare needs. Similarly, Carestream came up with an X-ray system that integrated various new features to enhance productivity and diagnostics accuracy. The new system is expected to support numerous clinical applications and further extend the lead of Carestream in the market.

Another important platform is that Shimadzu has also presented a new digital X-ray system, emphasizing user-friendly interfaces and high-resolution images. This will be designed to ensure that the images obtained are clear and full of detail to meet the basis of any diagnosis and subsequent planning of treatment. By the look of things, Shimadzu is tireless in refining digital X-ray technologies to respond to the ever-changing needs of healthcare professionals.

Konica Minolta has also been very active in the digital X-ray segment, introducing new systems into the market that allow dynamic imaging. These systems are designed to enable great flexibility and adaptability in all clinical situations, from the casualty department to the outpatient clinic. Konica Minolta's step reflects a greater trend that tends to pervade the integration into everyday medical practice of more versatile technologies that can easily adapt to changing clinical environments.

In this Digital X-ray systems market, Samsung comes with its new GM85 Fit mobile digital radiography. It is compact and portable, designed to provide quality high imaging in a mobile format, enabling those facilities that need flexible and efficient diagnostic solutions. The GM85 Fit embodies the attention that Samsung has paid to combining portability with top-of-the-range imaging technology to provide healthcare professionals with a tool that can ably handle the variability of clinical situations.

The digital X-ray systems market is characterized by rapid technological evolution and an increasing focus on enhancing diagnostic accuracy and operational efficiencies. The active involvement of key industry participants in the launch of innovative systems underlines the dynamic nature of this market and the constant drive to make healthcare delivery better through improved imaging solutions.

Digital X-Ray Systems Market Dynamics:

Drivers

-

Innovations in digital X-ray technology enhance image quality, reduce radiation exposure, and improve diagnostic accuracy.

Digital X-ray technology has revolutionized the platform of medical imaging with better image quality, low radiation dosage, and greater diagnostic accuracy. Two new state-of-the-art flat-panel detectors that have recently been introduced have greatly changed how images are captured by their capabilities in capturing images of a much higher resolution with great detail and contrast compared to the previously used film-based systems. This technological leap makes the identification of abnormalities, such as tumors or fractures, much more precise and a lot earlier; thus, it may allow for more effective treatment and better patient outcomes. Besides, dose optimization techniques have been introduced, such as AEC systems that allow radiologists and technologists to reduce radiation doses without compromising image quality. Such systems automatically adapt the exposure parameters to both patient size and clinical requirements in a bid to avoid superfluous radiation doses while at the same time keeping the diagnostic image sharp and useful. Besides, innovations in software algorithms in advanced image processing and AI-based enhancement tools have increased diagnostic accuracy that also assisted radiologists in detecting subtle pathologies, and reduced the possibility of missing any diagnosis. These AI-powered tools can process imagery in real-time, bring forth areas of concern, and provide quantification data to support clinical decisions. Together, these advances serve to enhance the overall quality of digital X-ray images and contribute to safer, more precise diagnostic practices that benefit both healthcare providers and patients.

-

Rising investments in healthcare infrastructure drive the adoption of advanced diagnostic tools.

Increasing investments in healthcare infrastructure act as a significant catalyst for advanced diagnostic tool adoption, including digital X-ray systems. This adoption is a result of increasing interest on the part of both the government and private bodies to invest in infrastructure modernization initiatives in health facilities. In turn, this also leads to an increasing focus on the integration of advanced infrastructures that allow better diagnosis and better care for the patient. For example, newly built or renovated hospitals have increasingly been retrofitting their facilities with sophisticated imaging devices in an attempt to offer higher standards of care and attract more patients seeking sophisticated diagnostic services. The massive investments being made in healthcare infrastructure, particularly in developing regions, are encouraging the transition toward digital X-ray systems due to key advantages such as higher acquisition speed and reduced film processing compared to analog techniques. This proves to be very rewarding, especially when the healthcare resources are at a premium and the need for diagnostic solutions is very efficient. The establishment of more specialized centers, such as dedicated oncology or orthopedic centers, demonstrates another developing interest in higher-order imaging modalities that can provide accurate and detailed studies necessary for diagnosis and treatment planning. These infrastructural investments also facilitate the acquisition of better digital X-ray systems and provide for training health professionals to harness the applications of technology, thus allowing wider applications in current clinical use. It improves the quality of healthcare services given to the patients, thus resulting in a better healthcare system.

Restraints

-

The significant upfront investment required for digital X-ray systems can be a barrier for smaller healthcare facilities.

The high initial investment in the case of digital X-ray systems may be a very serious barrier for smaller healthcare facilities that already work with tight budgets and very scarce financial resources. The cost of acquiring and installing for the staff at such facilities, advanced digital X-ray machine systems along with software and training, may be prohibitive for most. This financial challenge could impair their operational ability, so to speak, in integrating modern technology; thus, they might get bound to using older, inefficient systems. Hence, the smaller facilities may be hard-pressed to keep up with equal, or at least competitive, levels of diagnostic accuracy and efficiency relative to larger, more well-funded counterparts for an overall quality service.

Opportunities

-

The increasing need for mobile and portable X-ray systems in emergency and remote settings presents substantial market opportunities.

The strong growth of mobile and portable X-ray systems in emergency and remote settings presents huge opportunities by bridging the large gaps in the availability of diagnostic imaging. Such as, in emergencies related to natural disasters, it provides an ability for the quick deployment of mobile X-ray units, which greatly enhances patient care by extending the timely diagnostic imaging available at a site within or outside the campus of the hospital. These systems are designed to be compact and lightweight for easy transportation so that healthcare providers can conduct essential imaging in diverse and challenging environments where traditional stationary units are not viable. This trend has created an opportunity for manufacturers and providers alike to develop, innovate, and market such solutions to meet the specific needs of increased flexibility and mobility in diagnostic machinery, hence reaching deeper into the healthcare industry.

Challenges

-

Navigating complex regulatory requirements and ensuring compliance with varying standards across regions can impede market growth.

In the digital X-ray systems market, overcoming tight regulatory requirements and compliance matters with diverse standards among regions could be a potential opportunity for firms to provide specialized regulatory expertise and tailored solutions by presenting a niche. For instance, since several countries have laws of their own regarding safety, performance, and quality as far as medical imaging devices go, the ability of companies to make adjustments of their products to these diverse standards is going to be a competitive advantage. That would include the creation of region-specific certifications, along with proactive communication with regulatory bodies to get easier approval. In the end, compliant solutions with multiple regulatory frameworks can help the manufacturer serve global markets, expand their base of customers, and attain leading positions in the industry. This approach will contribute to overcoming not only market entry barriers but also establishing the necessary level of confidence in healthcare providers who search for reliable and compliant imaging systems to equip their practices.

Digital X-Ray Systems Market Segment Analysis

By Type

In 2023, Direct Radiography (DR) systems dominated the market, holding a market share of approximately 65% in the Digital X-ray systems market. This is very advantageous since DR has had a significant edge over CR systems because of superior image quality, speedier processing of images, and reduced needs for film processing. DR systems use digital detectors to acquire the images of X-rays directly, therefore increasing efficiency by immediate results and minimizing the cost in time and resources compared to the traditional film-based systems. For example, it includes the fact that hospitals and diagnostic centers prefer the use of DR systems since they can give high-resolution images at lower radiation doses, thus making them a preferred choice in high-volume settings and emergency care. This is due to this technological advancement and operational efficiency, through which DR systems captured the dominant share in the market.

By Technology

In 2023, Flat Panel Detectors dominated the Digital X-Ray Systems market, at an estimated share of about 70%. Flat Panel Detectors are preferred because of their exceptionally high-quality image output and quicker processing compared to Charge-Coupled Device systems. These detectors make use of advanced digital technologies to provide high-resolution images with great clarity and contrast, which becomes vital for diagnoses. For example, Flat Panel Detectors installed in hospitals and imaging centers can give immediate results with less exposure to radiation to the patient and easily integrate them into the digital workflow. It is due to the efficiency and diagnostic capabilities of Flat Panel Detectors that they have widely been adopted and taken the leading market position.

By Portability

In 2023, Fixed Digital X-Ray Systems dominated the Digital X-Ray Systems market, with an estimated market share of about 75%. This group includes ceiling-mounted and floor-mounted systems that are favored for high image quality and robustness in a range of clinical applications. Fixed systems tend to be preferred in hospitals and large diagnostic centers because they can handle high volumes of patients and provide consistent high-resolution imaging. For example, ceiling-mounted systems have greater flexibility and more efficiency in space within a busy radiology department, while floor-mounted systems work well in settings that require stability and fine-tuned precision. With the development of advanced features and ensuring reliability, fixed digital X-ray systems have always been the dominant choice among users in the market reflection of their prime importance in diagnostic imaging.

By Application

General Radiography dominated the market for Digital X-ray systems, contributing around 50% in 2023. Because general radiography is in nature the most wide-ranging application, ranging from chest X-rays to abdominal scans and skeletal imaging, it is used in routine diagnostic procedures at hospitals and clinics. The general trend of wide usage of General Radiography results due to the versatility and core functions it plays in diagnostics within various conditions and populations. These systems are fitted in emergency departments to deliver rapid trauma examinations and are used in the outpatient setting for routine examination purposes, thereby gaining them the largest share of the market. The wide applicability of general X-ray systems and their critical function in day-to-day medical practice have positioned general radiography as the leading segment.

By End-user

The Hospitals segment dominated the Digital X-Ray Systems market and accounted for approximately 60% share in 2023. This is because hospitals conduct a large amount of diagnostic imaging, and are often equipped with multi-modality imaging suites that can accommodate multiple digital X-ray systems. Thus, the systems also need to be more fully featured to allow for a greater variety of image acquisition and to meet the imaging requirements of different departments, such as emergency care, radiology, and internal medicine. For example, digital X-ray systems are installed in every hospital to serve broad diagnosis needs, from routine examination to complicated cases; hence, they enjoy the leading market position. Their wide and varied application in treatment at every hospital straightforwardly justifies their leading market share in digital X-ray technologies.

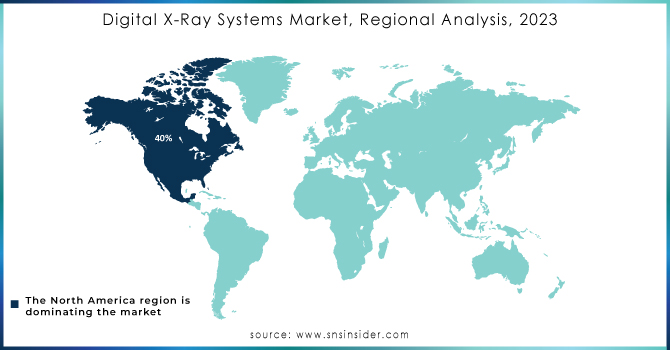

Digital X-Ray Systems Market Regional Outlook

North America dominated the Digital X-Ray Systems market in 2023, estimated to be about 40% owing to its fully developed infrastructure of healthcare, advanced technological adoption, and huge investment in the portfolio of medical imaging technology. This dominance can be attributed to the early diagnosis capabilities, large network of hospitals and diagnostic centers across the region with the installation of various types of advanced digital X-ray systems. Major hospitals in U.S. and Canada, for instance, are some of the early adopters of the latest imaging technologies so as to enhance the quality of diagnosis, patients' services, and operational efficiency. This region is further favored by high healthcare expenditure coupled with innovative medical research and thus holds a dominant market position.

Need any customization research on Digital X-Ray Systems Market - Enquiry Now

Key Players

Some of the major players in the Digital X-Ray Systems Market are GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Carestream Health, Hologic, Inc., Agfa-Gevaert Group, Samsung Medison Co., Ltd., Konica Minolta Healthcare, and other players

Recent Developments

-

May 2024: AI enhances processing steps regarding image acquisition in digital X-ray systems, which could save a significant amount of time on behalf of the radiographer.

-

January 2024: Carestream Health introduced its newest offering, a digital X-ray system designed to set new standards for imaging quality and clinical productivity.

-

November 2023: Carestream Horizon digital X-ray system, a high-quality, economic solution for diverse healthcare settings.

Digital X-Ray Systems Market Report Scope:

Report Attributes Details Market Size in 2023 USD 7.9 Billion Market Size by 2032 USD 15.4 Billion CAGR CAGR of 7.8% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments •By Type (Computed Radiography (CR), Direct Radiography (DR))

•By Technology (Flat Panel Detectors, Charge-Coupled Device (CCD))

•By Portability (Portable Digital X-Ray Systems, Fixed Digital X-Ray Systems [Ceiling Mounted, Floor Mounted])

•By Application (General Radiography, Dental Radiography, Mammography, Orthopedic Imaging, Emergency Care, Others)

•By End-user (Hospitals, Diagnostic Imaging Centers, Orthopedic Clinics, Dental Clinics, Veterinary Clinics)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Carestream Health, Hologic, Inc., Agfa-Gevaert Group, Samsung Medison Co., Ltd., Konica Minolta Healthcare and other key players Key Drivers • Innovations in digital X-ray technology enhance image quality, reduce radiation exposure, and improve diagnostic accuracy

• Rising investments in healthcare infrastructure drive the adoption of advanced diagnostic toolsRESTRAINTS •The significant upfront investment required for digital X-ray systems can be a barrier for smaller healthcare facilities