Medical Imaging Devices Market Size & Trends:

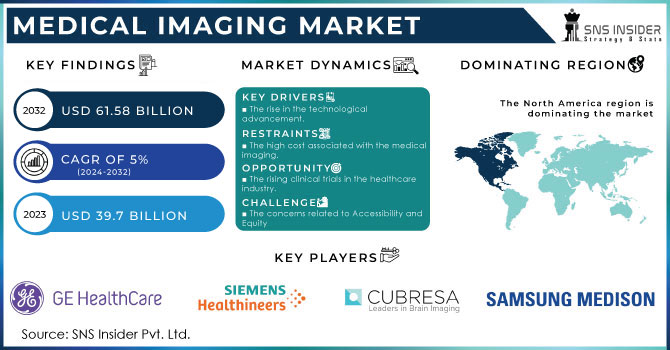

The Medical Imaging Devices Market size was valued at USD 39.7 billion in 2023 and is expected to reach USD 61.58 billion by 2032 and grow CAGR of 5% over the forecast period of 2024-2032.

Get More Information on Medical Imaging Devices Market - Request Sample Report

The Medical Imaging Devices Market is experiencing rapid growth due to advancements in technology, the increasing prevalence of chronic diseases, and a rising demand for early and accurate diagnosis. Key drivers include the aging population, technological innovations like AI-assisted analysis and 3D imaging, and the benefits of early detection. For instance, the demand for MRI scans is expected to increase due to their non-invasive nature and ability to provide detailed images of soft tissues.

The rising incidence of chronic diseases, such as cardiovascular disease, cancer, and neurological disorders, necessitates regular diagnosis and monitoring, which often rely on imaging techniques. Moreover, the aging population, with its increased susceptibility to chronic conditions, is driving demand. The United Nations Population Division projects that the number of people aged 65 and older will double within the next 30 years, reaching 1.6 billion by 2050. The increasing global life expectancy is a major factor driving growth in the medical imaging industry. Medical imaging is essential for diagnosing, managing, and treating these conditions, providing non-invasive insights into the body. With the global population aging, the demand for diagnostic imaging services is expected to rise significantly, fueling market growth. This trend highlights the importance of advanced imaging technologies in addressing the healthcare needs of an aging population. The United Nations predicts that a baby born in 2021 will live about 25 years longer than someone born in 1950, reaching an average age of 71. Women are generally expected to live five years longer than men.

Medical imaging plays a crucial role in early and accurate disease diagnosis, leading to effective treatment. In the United States, the National Center for Health Statistics estimates that there were 1,958,310 new cancer cases and 609,820 cancer-related deaths in 2023. The increasing prevalence of chronic diseases has significantly driven up the demand for medical imaging, resulting in a global rise in diagnostic imaging tests. According to the World Health Organization (WHO), approximately 3.6 billion diagnostic tests are performed worldwide each year, with around 350 million of these tests involving pediatric patients.

The supply side of the market is dominated by major multinational companies offering a wide range of imaging equipment and solutions. Ongoing research and development efforts are leading to continuous innovations, with a focus on improving image quality, reducing radiation exposure, and enhancing workflow efficiency. More sensitive detectors and AI-powered image reconstruction techniques are resulting in sharper, clearer images with lower noise levels and reduced artifacts. Additionally, manufacturers are developing technologies to reduce radiation exposure while maintaining diagnostic image quality, through techniques like iterative reconstruction, automatic exposure control, and personalized dose management. To improve workflow efficiency, automation, cloud-based solutions, and AI-assisted image interpretation are being implemented to streamline processes, facilitate collaboration, and improve accuracy. Another notable innovation is the development of portable imaging devices. These devices, such as handheld ultrasound scanners and wearable electrocardiogram monitors, allow for more convenient and accessible healthcare, particularly in remote or underserved areas. Government regulations play a crucial role in ensuring the safety and efficacy of medical imaging devices and establishing standards for equipment performance, radiation safety, and data privacy.

The FDA publication reported in January 2024 that as of July 2023, a total of 692 AI-enabled medical devices had been approved for market. Of these, over 75% were specifically designed for radiology applications.

Factors like increased investments, product innovation, and technological advancements, including AI and point-of-care imaging, are expected to drive further growth in the medical imaging industry.

Market Dynamics

Drivers

-

Fueled by Technological Innovations and Rising Chronic Disease Prevalence

One of the primary drivers is the increasing prevalence of chronic diseases, such as cardiovascular disease, cancer, and neurological disorders. These conditions often require regular monitoring and diagnosis, which rely heavily on medical imaging techniques. Additionally, the aging population is contributing to the rising demand for diagnostic imaging services, as older individuals are more likely to suffer from chronic health conditions. Technological advancements are also fueling the growth of the medical imaging market. The development of newer, more accurate, and less invasive imaging techniques, such as 3D imaging and AI-assisted analysis, enables earlier detection and more effective treatment of diseases. Furthermore, integrating AI into medical imaging improves image analysis, enhances diagnostic accuracy, and streamlines workflows.

Another important factor driving market growth is the increasing awareness of the benefits of early disease detection through medical imaging. As people become more informed about the importance of preventive healthcare, they are more likely to seek out diagnostic imaging services. This increased awareness is contributing to higher utilization rates and driving market expansion.

Restraints

-

High Costs and Regulatory Hurdles Impact Growth

One of the primary restraints is the high cost associated with medical imaging procedures. The cost of equipment, maintenance, and operation can be prohibitive for many healthcare facilities, limiting their ability to invest in advanced imaging technologies. Additionally, regulatory hurdles and reimbursement challenges can pose significant obstacles for market players. Government regulations regarding the use of medical imaging equipment, as well as reimbursement policies for diagnostic procedures, can impact market growth.

Moreover, a large and competitive refurbished equipment market, particularly in emerging economies, can limit the adoption of new and innovative imaging systems. Refurbished equipment often offers a more cost-effective alternative for smaller healthcare facilities, reducing the demand for new devices.

Medical Imaging Devices Market Segmentation Analysis

By Type

Computed tomography (CT) dominated the medical imaging device market in 2023, capturing a substantial 29.04% share. Its ability to provide detailed images of various body parts has made it indispensable for diagnosing a wide range of diseases. However, magnetic resonance imaging (MRI) is emerging as the fastest-growing segment, driven by its non-invasive nature and superior soft tissue visualization capabilities. This trend suggests a shift towards more advanced imaging techniques that offer greater diagnostic accuracy and patient comfort.

By Application

Cardiology emerged as the dominant segment in the medical imaging device market in 2023, capturing a substantial 25.66% share. This dominance is attributed to the rising prevalence of cardiovascular diseases and the critical role of medical imaging in diagnosis and monitoring. However, oncology is anticipated to experience the most rapid growth, driven by the increasing incidence of cancer and the indispensable nature of medical imaging in cancer detection and treatment. This shift reflects the evolving healthcare landscape and the growing demand for advanced imaging technologies to address complex medical conditions.

By End User

Hospitals dominated the medical imaging device market in 2023, capturing a substantial 45.99% share. Their comprehensive range of medical services and access to advanced imaging technologies contributed to this dominance. However, diagnostic imaging centers are poised for rapid growth, driven by the increasing demand for specialized diagnostic services and the growing trend of outsourcing imaging services. This shift reflects the evolving healthcare landscape and the need for more specialized and efficient imaging facilities.

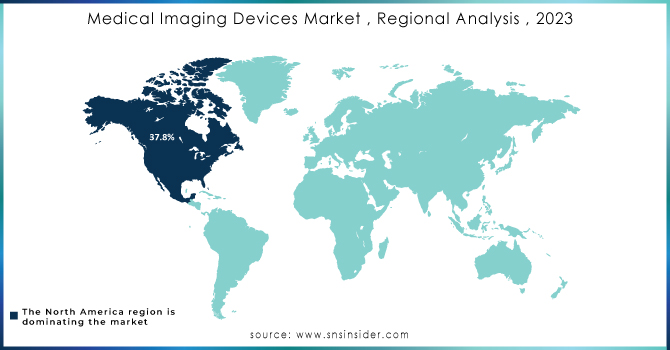

Regional Overview

The Medical Imaging Devices Market is experiencing significant growth globally, driven by various factors. North America, particularly the United States, held the largest market share 37.8% in 2023 due to increased technology adoption, improved accessibility, and high healthcare spending. Europe is also witnessing growth, fueled by investments in R&D and the rising prevalence of chronic diseases. The Asia Pacific region is poised for the fastest growth, driven by population growth, increased R&D activity, and the need for advanced imaging devices. Key factors contributing to market growth include technological innovations, changing patient care strategies, and evolving epidemiological patterns. The demand for medical imaging professionals is also on the rise, with projected job growth in the coming years.

Need any customization research on Medical Imaging Devices Market - Enquiry Now

Key Players:

Samsung Medison Co., Ltd., Siemens Healthineers, GE Healthcare, Canon Medical Systems Corporation, Koninklijke Philips N.V., FUJIFILM VisualSonics Inc., Mindray Medical International, Konica Minolta, Carestream Health, Hitachi, Koning Corporation, Varex Imaging, Hologic, Inc., Esaote, PerkinElmer Inc. and others.

Recent Developments

-

GE Healthcare introduced a new AI-powered ultrasound system in January 2024, designed to improve image quality and workflow efficiency. The system utilizes deep learning algorithms to enhance image clarity and reduce operator workload.

-

Siemens Healthineers launched a new CT scanner with advanced dose reduction technology in February 2024, aiming to minimize radiation exposure for patients. The scanner incorporates AI-based algorithms to optimize image quality while reducing scan times.

-

Philips unveiled a new MRI system with a wider bore size and improved patient comfort in March 2024. The system is designed to enhance patient experience and improve diagnostic accuracy for a variety of applications.

-

Canon Medical Systems announced the development of a new PET/CT scanner with advanced image reconstruction capabilities in April 2024. The scanner offers improved sensitivity and specificity for cancer detection and staging.

-

Agfa Healthcare released a new X-ray imaging system with enhanced image quality and workflow efficiency in May 2024. The system incorporates cloud-based software solutions to streamline image management and sharing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 39.7 Bn |

| Market Size by 2032 | US$ 61.58 Bn |

| CAGR | CAGR of 5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Type (Magnetic Resonance Imaging, Computed Tomography, X-ray, Ultrasound, Nuclear Imaging) • By Application (Cardiology, Neurology, Orthopedics, Gynecology, Oncology, Others) • By End User (Hospitals, Specialty Clinics, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Medison Co., Ltd., Siemens Healthineers, GE Healthcare, Canon Medical Systems Corporation, Koninklijke Philips N.V., FUJIFILM VisualSonics Inc., Mindray Medical International, Konica Minolta, Carestream Health, Hitachi, Koning Corporation, Varex Imaging, Hologic, Inc., Esaote, PerkinElmer Inc. and others |

| Key Drivers | • Fueled by Technological Innovations and Rising Chronic Disease Prevalence |

| Market Opportunities | • The rising clinical trials in the healthcare industry. |