Dimer Acid Market Key Insights:

Get More Information on Dimer Acid Market - Request Sample Report

The Dimer Acid Market Size was valued at USD 3.0 billion in 2023, and is expected to reach USD 5.2 billion by 2032, and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The dimer acid market is expanding significantly with growing demands from end-use industries such as coatings, adhesives, lubricants, and personal care products. Dimer acid is a fatty acid that is derived from natural oils. It is preferable for its special properties, mainly its excellent adhesion, flexibility, and durability. Such properties make it an ideal component in formulations where performance and environmental sustainability are the critical factors. The increasing concern regarding eco-friendly material has provided a spur to manufacturers to innovate and bring out bio-based dimer acids that correspond to the ever-growing consumer trend for eco-friendly products. For example, improvements in bioprocessing technologies made it possible to manufacture dimer acids from renewable feedstocks; hence, it meets the efforts in reducing carbon footprints and enhancing sustainability in chemical manufacturing.

The supply dynamics include the availability of raw materials, regulatory inputs, and technological up-gradation. Further, the volatility in supply to the natural oils, which form the major feedstock input to produce dimer acid, can create further challenges for pricing and availability. Apart from this, the growing regulatory check on the usage of petrochemical-derived products is making manufacturers revisit alternative sources of dimer acid production. It was catalytic towards innovation, as pressure to have greener chemicals has led to the development of sustainable dimer acids. For instance, certain players have just begun using advanced enzymatic processes to convert renewable feedstocks into dimer acids as the industry leans towards sustainability.

Recent developments within the market indicate how competitive the market is and what some of the major players have been doing to hold their positions within the market. A key milestone for Arkema is the launch of bio-based dimer acid derivatives responding to the fast-growing demand for sustainable chemical solutions. The benefits will be not only an improvement in product portfolios but also a response to even newer environmental regulations and rising consumer expectations. Similar to BASF, the company has also driven focus through its product portfolio by investing in R&D of high-performance dimer acids to cater to higher performance standards in coatings and adhesives, thereby strengthening its grip further in the market.

Collaborations and partnerships in the Dimer Acid Market are key aspects, as they enable knowledge sharing and technological advancement. A new dimer acid-based additive line for improving paint and coating performance was recently produced by a collaboration of two industry leaders. This would mean product development and catering to diverse customer needs can be very well promoted by innovative ideas and strategic alliances. Companies are, on the other hand, involving themselves more and more in industry events and trade shows to showcase their capabilities with dimer acid technologies, thereby showing networking and trends within emerging markets.

Dimer acid penetration in diversified applications also gains pace with growth in high-performance lubricant demand as well as surface active agents. This can happen mainly through automotive and industrial sectors where superior properties of dimer acid can bring about enhanced lubricant performance and efficiency. The innovations in dimer acid formulations that have just been introduced can be used for producing lubricants that offer high resistance to extreme temperatures and pressures. Therefore, they confer significant benefits to machinery and equipment preservation. Such tendencies would naturally continue, especially if industries become more aware of the benefits of using dimer acid to increase efficiency and reduce maintenance costs. With this factor, the Dimer Acid Market would see further proliferation growth, driven by innovation, sustainability, and the changed needs of end-users in varied industry sectors.

Market Dynamics:

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Dimer Acid Market Growth

Increasing consumer awareness of environmental sustainability is driving demand toward more ecological products in areas such as coatings, adhesives, and personal care. The increasing pressure to achieve sustainability and meet growing demands for tough, environmental-friendly regulations are also driving the trend toward bio-based dimer acids that are derived from renewable resources. This aspect also goes in tandem with the focus of the world on greener alternatives while also enabling enhancement in the performance properties of the end product. Companies are now diligently working toward dimer acid formulations that could have the least possible environmental impact and yet still be of high efficiency and effectiveness. This has led to the emergence of new bio-based dimer acid products, which would provide equivalent or higher performance value in comparison with the traditional petrochemical-based versions. For example, some companies are focusing on enzymatic processes to convert sustainable feedstocks into quality dimer acids; this will help them to answer the ever-growing demand for sustainable materials. Market growth with an increase in the focus on ecological products is likely to open several opportunities for more shares of dimer acid in the market for key players.

-

Technological Advancements in Dimer Acid Production Enhance Market Competitiveness

Advances in technology appeared on the competency-enhancing areas of the dimer acid market. Not only were better production techniques associated with the development of efficient catalytic processes and enzymatic methods, but so was know-how improvement for yield and quality at lower production costs. These advances make it possible to produce dimer acids from various feedstocks, such as plant-based oils, and thus increase the variety of products available. Additional benefits include advanced technologies for extraction and purification, allowing the production of highly pure dimer acids that satisfy and often exceed the very high-purity requirements for most applications, such as high-performance coatings and adhesives. The implementation of digital technologies and automation in the manufacturing process contributes to better utilization of time and resources and also to less waste and more sustainable production. The more companies invest in R and D and innovate their processes, the better placed they are to respond to the changing demands of the market and the opportunities being built. Such technological advancements enhance product offerings and help in establishing a competitive edge in the growing dimer acid market.

Restraint:

-

Volatility in Raw Material Prices Poses a Significant Restraint on Market Growth

Raw material price volatilities, mainly because of fluctuations in the availability and cost of natural oils, present one of the biggest challenges to this dimer acid market. Due to the role natural oils play as the primary feedstock for the production of dimer acids, these prices are highly sensitive to climatic changes, geopolitical tensions, or changes in agricultural practices. Manufacturers would thus struggle hard to manage both the production levels and the respective price structure as supply uncertainties prevail over these raw materials. The implications on profitability and, by extension, market position may then deteriorate further. Increasing costs of raw material entries may, in addition, result in higher prices for final products, which in turn cause a likely reduction in demand from cost-sensitive customers. This requires the need for efficient supply chain management techniques and alternative feedstocks to minimize the effects of price volatility. However, the raw material price has inherent volatility that acts as a considerable growth barrier in the dimer acid market and makes it necessary for the players to continue to develop new techniques for long-term sustainability.

Opportunity:

-

Emerging Markets Present Significant Opportunities for Dimer Acid Manufacturers

Industrialization and urbanization remain on an upward trajectory in Asia-Pacific, Latin America, and parts of Africa. Emerging markets therefore represent a huge growth potential for dimer acid producers. A growing middle class in the region offers growth potential as it increases the demand for consumer goods, which then calls for the demand for coatings, adhesives, and personal care products to be ramped up. As local industries grow, the demand for high-performance materials that offer superior quality and durability requirements for finished products is increasing and making dimer acids more attractive. Additionally, governments of these countries are promulgating policies that promote sustainable materials as part of the worldwide efforts to be a greener world. This regulatory back will be facilitative in garnering an environment favorable to bio-based dimer acids, thus giving manufacturers that extra force to exploit these markets. With the careful positioning of the businesses in emerging regions and partnering with local players, manufacturers are going to take advantage of the fast-growing demand and have a stronghold in those markets that in the long run boost the dimer acid market growth.

Challenge:

-

Intense Competition Among Key Players Creates Challenges for Market Entry

The business competition in the dimer acid market is rather intense among key players, which makes entry for new firms challenging. Those already in business have economies of scale distribution networks and powerful brands, which continue to preclude smaller or new entrants from effectively competing. With significant players in this industry who have strong R&D capabilities, they can innovate continuously and introduce advanced products/technologies, thereby sustaining a competitive edge. Such a competitive scenario can lead to price wars, where everyone tries to cut down on prices to get market shares. It mainly hurts the pricing patterns of all involved in this sector. This could also be other regulatory compliance issues that would prove to be a challenge for new entrants, as the landscape of environmental and safety regulations that one would have to navigate can be so complex and resource-hungry. For niche-market focus by new entrants, investment in innovative technology, and strategic partnerships would create an enhanced presence in the market. However, high competition in the dimer acid market will act as a significant barrier to entry as potential new entrants will need to be considered carefully before making any strategic planning.

Market Segmentation Analysis

By Source

In 2023, the Natural dimer acid segment dominated and accounted for a more than 70% revenue share. The main reason for this dominance is the growing demand for bio-based products throughout various industries, as natural dimer acids are obtained from renewable sources - vegetable oils-like that contribute to the sustainability goals of the world. Natural dimer acids are gradually gaining entry into adhesives, coatings, and personal care industries due to their low environmental footprint with excellent performance characteristics. The top dimer acid market players consist of bio-based dimer acid products by Croda International Plc and Arkema. This trend has reflected the overall market shift towards greener alternatives. It only seems to add regulatory pressure and customer demand for sustainable solutions, further driving the uptake of natural dimer acids.

By Product Type

In 2023, the Distilled Dimer Acid segment dominated and accounted for the highest market share of more than 50% in the Dimer Acid Market. This is because of the significant preferences for pure and performance-oriented products in high-end applications such as adhesives, coatings, and lubricants where factors like consistency and stability are of prime importance. The distilled version offers better color stability, lower volatility, and greater adhesion properties than the other types, making it suitable for industrial applications that demand high-performance materials. For example, with the expansion of product lines in the distilled dimer acid product, leaders such as BASF and Evonik were keen on the rise in demand in areas such as the automotive and construction sectors requiring high-performance adhesives and coatings. Its focus on distilled dimer acid comports with the increasing demand for specialty chemicals that deliver results under more stringent demands.

By Application

The Coatings and Adhesives segment dominated the Dimer Acid Market in 2023, with an estimated market share of more than 40%. This segment accounts for dominance due to extensive usage in high-performance coatings and adhesives, where it finds application in the construction, automotive, and packaging industries. Such applications rely on the excellent adhesion, flexibility, and resistance to extremely tough environmental conditions that dimer acids provide. For example, Henkel and Arkema have utilized the superior bonding properties of dimer acids to develop advanced adhesive solutions, mainly for the automotive and industrial sectors, where both strength and durability are considered the key concerns. The demand for environmentally friendly coatings and adhesives adds to this end also; dimer acids synthesized from renewable sources meet the performance as well as sustainability requirements.

By End-use Industry

In 2023, the Automotive segment dominated the Dimer Acid Market in 2023, with an estimated market share of over 35%. The auto industry widely applies dimer acids for the preparation of high-performance adhesives, coatings, and lubricants paramount to the structural and maintenance assembly of automobiles. Superior heat and corrosion resistance along with excellent wear properties make dimer acids ideal for under-the-hood applications, body panels, and protective coatings in vehicles. Top corporations like BASF and Croda have taken advantage of this strong demand with new lines of dimer acid-based products that improve vehicle strength and fuel efficiency. Pressure in the auto industry to build lighter, more fuel-efficient vehicles has further contributed to the demand for advanced adhesives and coatings derived from dimer acids; these compounds can reduce vehicle weight without impacting structural integrity.

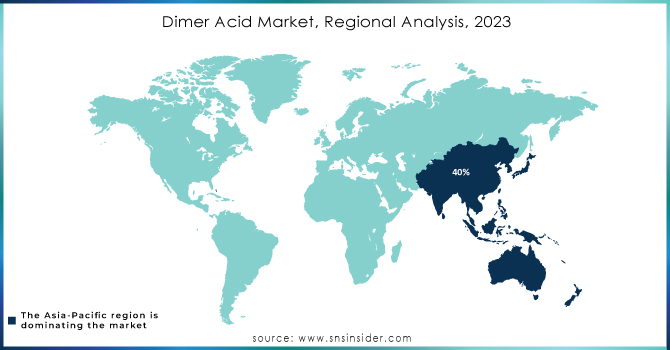

Regional Analysis

The Asia-Pacific region dominated the dimer acid market in 2023, occupying more than 40% of the total revenue share. The main cause of this great leading role of the region is the high requirements in the automotive, construction, and electronics sectors in countries like China, India, and Japan, in which dimer acids are widely used for the preparation of highly efficient adhesives, coatings, and lubricants. For instance, the booming construction and automotive industries in China have fueled demand for dimer acid-based products, which provide improved durability and environmental sustainability. Finally, top players like Mitsubishi Chemical and Henkel have also been increasing their presence in the Asia-Pacific region due to the increasing industrial base and welcoming regulatory climate, thus enhancing market position in this region.

Moreover, North America emerged as the fastest-growing region in the Dimer Acid Market for the year 2023, with an estimated CAGR of more than 6%. Increasing demand for bio-based materials and growing sustainability initiatives across various industries are major drivers behind this rapid growth. The coatings and adhesives sectors in the U.S. and Canada are shifting gears because companies prefer more ecological alternatives. Dimer acid production based on bio-based dimer acid and government policies supporting green chemicals are additional factors that have accounted for the further growth of this market. BASF, one of the key manufacturers, has been investing uninterruptedly in the region to come up with innovative, sustainable dimer acid solutions catering to the rising demand in the automotive, construction, and personal care sectors.

Need Any Customization Research On Dimer Acid Market - Inquiry Now

Key Players

-

Arkema S.A. (Rilsan, Epikote)

-

BASF SE (Kraton G, Joncryl)

-

Cargill, Inc. (Cargill Dimer Acid, Cargill Dimer Acid Esters)

-

Croda International Plc (Crodafos, Crodarom)

-

Drew Marine (Drew Marine Dimer Acid, Drew Marine Dimer Esters)

-

Evonik Industries AG (Dimer Acid Derivatives, Dynasylan)

-

Henkel AG & Co. KGaA (Loctite Dimer Acid, Technomelt)

-

Kraton Corporation (Kraton Dimer Acid, Kraton G Polymer)

-

Mitsubishi Chemical Corporation (Dimer Acid Products, MCPP)

-

New Japan Chemical Company (NJC Dimer Acid, NJC Dimer Acid Esters)

-

Nexeo Solutions, LLC (Nexeo Dimer Acid, Nexeo Dimer Acid Esters)

-

Oleon N.V. (Oleon Dimer Acid, Dimer Acid Esters)

-

P&G Chemicals (P&G Dimer Acid, P&G Dimer Acid Derivatives)

-

Qingdao JHF Chemical Co., Ltd. (Qingdao JHF Dimer Acid, JHF Dimer Acid Derivatives)

-

Rohm and Haas Company (Rohm Dimer Acid, Dimer Acid Ester Products)

-

SABIC (SABIC Dimer Acid, SABIC Dimer Acid Esters)

-

Solenis LLC (Solenis Dimer Acid, Solenis Dimer Esters)

-

The Chemical Company (TCC Dimer Acid, TCC Dimer Acid Esters)

-

Univar Solutions Inc. (Univar Dimer Acid, Univar Dimer Acid Derivatives)

-

Wuxi City Changxin Chemical Co., Ltd. (Wuxi Dimer Acid, Changxin Dimer Acid Products)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.0 Billion |

| Market Size by 2032 | US$ 5.2 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Natural Dimer Acid, Synthetic Dimer Acid) •By Product Type (Standard, Distilled, Distilled & Hydrogenated) •By Application (Coatings and Adhesives, Lubricants, Personal Care Products, Plastics, Others) •By End-use Industry (Automotive, Construction, Electronics, Food and Beverage, Personal Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cargill, Inc., Henkel AG & Co. KGaA, Arkema S.A., BASF SE, Evonik Industries AG, Drew Marine, Kraton Corporation, Croda International Plc, Mitsubishi Chemical Corporation, Univar Solutions Inc. and other key players |

| Key Drivers | • Growing Demand for Eco-Friendly Products in Various Industries Boosts Dimer Acid Market Growth •Technological Advancements in Dimer Acid Production Enhance Market Competitiveness |

| RESTRAINTS | • Volatility in Raw Material Prices Poses a Significant Restraint on Market Growth |