Cloud Supply Chain Management Market Report Scope & Overview:

Get more information on Cloud Supply Chain Management Market - Request Sample Report

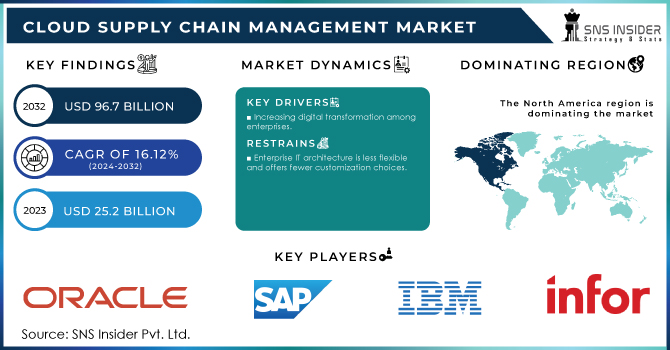

The Cloud Supply Chain Management Market Size was valued at USD 25.2 Billion in 2023 and is expected to reach USD 96.7 Billion by 2032, growing at a CAGR of 16.12% over the forecast period 2024-2032.

This growth is driven by various factors, from increasing requirements for better supply chain visibility and control to the rise of e-commerce and general digital transformation procedures carried out within companies worldwide. More and more companies are beginning to realize the benefits of cloud-based solutions in terms of scalability, cost reduction, and better collaboration between supply chain partners. For Instance, according to the global market survey on supply chain management, more than 92% of enterprises use some kind of cloud supply chain to optimize their operations efficiently. As per AWS, the adoption of cloud-based technology has reduced their security concern by 45% and also optimized their spending on Technology Infrastructure.

The Cloud Supply Chain Management Market has been influenced by several recent product launches and mergers and acquisitions. For example, in May 2022, SAP and Apple teamed up to push the boundaries of digital supply chain applications, further illustrating how key vendors are finding ways to innovate for market demand. Furthermore, the acquisition of Cerner Corporation by Oracle in late 2021 further cemented the company's position in healthcare supply chain management and thus stands out as a strategic move for the integration of cloud solutions into critical industries.

In order to improve demand forecasting, inventory management, and logistics optimization, artificial intelligence and machine learning integration are being heavily prioritized in cloud supply chain management trends. Acceptance of hybrid cloud computing has grown to be a strategic decision for many different types of enterprises looking to combine the flexibility of public cloud infrastructure with on-premise solutions. This enhances data security and control, thereby letting businesses strike a balance between privacy and scalability. On the other hand, ML and Al have changed supply chain management. In other words, task automation, logistics optimization, and predictive demand analysis through ML and Al technologies make the processes more effective and significantly reduce costs. For instance, Maersk, the world's largest shipping company, applies AI in its container shipping process.

Moreover, an increasing emphasis on visibility and collaboration in supply chain operations. Cloud platforms allow tracking of goods in real-time for better communication among its partners and greater transparency across the total supply chain. Improved transparency results in greater decision-making with efficient operations. Moreover, along with the increasing implementation of cloud platforms, businesses are now facing more data security issues and privacy concerns. As a result, companies are now in greater need of strong cybersecurity solutions as they work to protect their critical data. Recent data research indicates that, on average, businesses experienced 4.16 supply chain breaches in 2023 as opposed to 3.29 in 2022.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increasing digital transformation among enterprises

-

Growing adoption of IoT and advanced Analytical solutions.

-

Enterprises are becoming more aware of the benefits of cloud-based supply chain management.

The need for an organizational digital transformation has increased, which would enhance operational efficiency and competitiveness, and has opened many fronts. Cloud supply chain management solutions are in line with such initiatives to offer scalability, flexibility, and accessibility. Cloud-based systems, in streamlining processes, have been greatly sought after by companies to find improved ways of collaboration and data-driven decision-making to maintain preeminence in the market and relevance to customer demands. Cloud SCM solutions help organizations reduce costs by optimizing inventory levels, reducing waste, and streamlining processes. It's only through the use of cloud technologies that businesses can strive towards productivity and efficiency in their supply chains, quite important considering that the market is competitive and cost management is paramount. Besides, a trend to integrate Internet of Things devices and advanced analytics into cloud SCM systems is observed. These technologies improve demand forecasting, predictive maintenance, and overall operational efficiency. Through IoT sensors, data gathering, and analytics, much-needed insights into supply chains may be garnered that can dictate pre-emptive changes at best.

RESTRAINTS:

-

Growing enterprise concerns about security and privacy.

-

Enterprise IT architecture is less flexible and offers fewer customization choices.

-

Cloud-based supply chain management technologies provide enterprises with trouble with data segregation.

KEY MARKET SEGMENTS:

Based on Solution

In the segmentation, The Demand and planning segment held the dominant position with over 32% of the market share in 2023. The market for demand planning and forecasting solutions is expected to grow at the fastest rate over the forecast period. In this day and age, practically every firm is dependent on the internet, which is a driving force in the growing market for cloud SCM demand planning and forecasting solutions. The growing number of internet-dependent enterprises is driving up demand for cloud SCM demand planning and forecasting solutions, which let organizations connect and integrate their activities across networks. This enables closer cooperation among a company's personnel and active response to changing market trends and consumer requirements. Furthermore, demand planning and forecasting is an excellent approach for providing a satisfying experience along the value chain.

Based on Service

In terms of revenue, the service and maintenance segment held the dominant position with more than 40% in 2023. Training and consulting services help organizations to understand how cloud-based solutions can assist them in the optimization of their operations. The use of these resources has increased a great deal over the last few years, what with cloud-based operations catching everyone by surprise due to their scalability and elasticity benefits - not only in terms of flexibility for implementation but also as regards speed coupled with lower operating costs that come courtesy pay-per-use pricing models amongst other advantages.

Based on Vertical

In this segmentation, the Retail segment led the market with more than 30% of the market share in 2023. Since the majority of major companies are switching to cloud-based technology to alter their supply chains with an unparalleled level of visibility and insights that data can bring, the retail industry is expected to rise noticeably. With the rapidly expanding retail sector, the adoption of advanced technologies is increasing tremendously; therefore, the retail industry players need tools that will help organizations handle paper documents, and structured and unstructured data, in a better way to sustain their competitiveness. Thus, most key players are embracing cloud-based technologies in an initiative to transform their supply chains with unparalleled visibility and insights from data. Technology integrations revolve around grasping customer journeys to afford their betterment substantively.

REGIONAL ANALYSIS:

With over 32% of the market, North America held the dominant position in the cloud supply chain management market and is expected to hold its leading position for the foreseeable future due to the region's increasing reliance on cloud environments and growing requirements for modified infrastructure management. Moreover, the expansion of the gross refrigerated storage capacity in the United States is propelling the growth of the market in the area. Additionally, it is anticipated that growing cloud usage in the region will encourage the adoption of data analytics platforms, which will propel market growth. For Instance, The adoption of GS1 standards intended to advance the security, effectiveness, and transparency of supply chains across physical and digital channels across 25 US industries might result in a significant increase in market size in North America.

Moreover, the Government of Canada has a “cloud-first” strategy whereby cloud services are identified and evaluated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud will also allow the Government of Canada to harness the innovation of private-sector providers to make its information technology more agile. Such initiatives are expected to provide ample opportunities for cloud supply chain management.

Need any customization research on Cloud Supply Chain Management Market - Enquiry Now

KEY PLAYERS:

The major key players are SAP SE, Oracle Corporation, Infor Inc, Descartes Systems Group Inc, IBM Corporation, Manhattan Associates, Inc., Logility, Inc., Kewill, Inc., Kinaxis, Inc., TECSYS, Inc & Other Players

Recent Developments:

-

In April 2024, Microsoft Corp. and The Coca-Cola Company announced a five-year strategic partnership Tuesday to connect Coca-Cola's core technology strategy across the company, enable the use of advanced technology, and promote innovation and productivity worldwide.

-

In March 2024, Oracle today announced new generative AI capabilities within the Oracle Fusion Cloud Applications Suite to help customers make better decisions, enhance employee and customer experience, and gain more control across business processes. The latest AI additions consist of new generative AI capabilities that are embedded in existing business workflows across finance, supply chain, HR, sales, marketing, and service and an expansion of the Oracle Guided Journeys' extensibility framework that allows customers and partners to embed more generative AI capabilities in support of their unique industry and competitive needs.

-

In November 2023, Accenture announced it would collaborate with SAP SE to help organizations transform their supply chains with an end-to-end supply chain nerve center that can minimize risk, increase transparency, and add to sustainability objectives.

| Report Attributes | Details |

| Market Size in 2023 | US$ 25.2 Bn |

| Market Size by 2032 | US$ 96.7 Bn |

| CAGR | CAGR of 16.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Transportation management, Procurement and sourcing, Order management, Sales and operation planning, Inventory and warehouse management, Demand planning and forecasting) • By Service (Training and consulting, Support and maintenance, and managed services) • By Deployment Model (Public Cloud, Private Cloud, and Hybrid cloud) • By Vertical (Food and Beverage, Healthcare and life sciences, Manufacturing, Retail and wholesale, Transportation and logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SAP SE, Oracle Corporation, Infor Inc, Descartes Systems Group Inc, IBM Corporation, Manhattan Associates, Inc., Logility, Inc., Kewill, Inc., Kinaxis, Inc., TECSYS, Inc |

| Key Drivers | • Cloud-based supply chain management is becoming more popular in transportation management • Enterprises are increasingly in need of demand management solutions |

| Market Challenges | • Inadequate technical knowledge • Large organizations have challenges in migrating to cloud-based supply chain management |