DIY Home Automation Market Size & Trends:

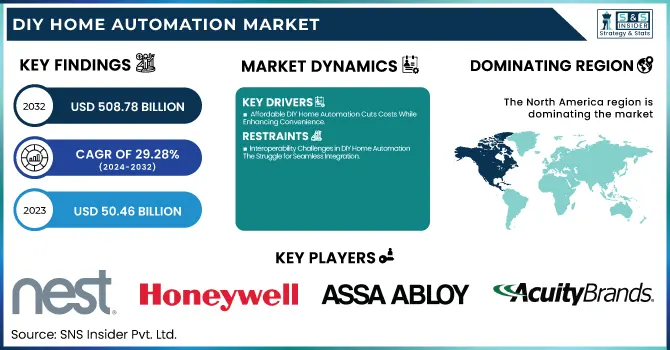

The DIY Home Automation Market was valued at USD 50.46 billion in 2023 and is projected to reach USD 508.78 billion by 2032, growing at a CAGR of 29.28 % from 2024 to 2032. Growth is fueled by increasing consumer demand for smart security, energy-efficient solutions, and AI-driven automation, alongside the affordability and ease of installation of DIY systems. Advancements in wireless connectivity, IoT ecosystems, and AI-based predictive automation are expanding market penetration.

To Get more information on DIY Home Automation Market - Request Free Sample Report

Rising security concerns are driving demand for DIY surveillance systems, while smart lighting and HVAC controls enhance energy efficiency. In the U.S., the market was valued at USD 13.94 billion in 2023 and is expected to reach USD 123.91 billion by 2032 at a CAGR of 24.47%. Compatibility improvements, such as the Matter protocol, are boosting device interoperability. Additionally, government incentives for energy-efficient homes and growing e-commerce availability of DIY kits are accelerating adoption, making smart home technology more accessible worldwide.

DIY Home Automation Market Dynamics:

Drivers:

-

Affordable DIY Home Automation Cuts Costs While Enhancing Convenience

DIY home automation solutions provide a budget-friendly alternative to professionally installed systems, eliminating high labor costs and reducing overall expenses. With plug-and-play devices, wireless connectivity, and app-based controls, homeowners can create a smart home setup at a fraction of the cost compared to traditional installations. The affordability of smart lighting, security cameras, thermostats, and voice-controlled assistants enables broader adoption, even among budget-conscious consumers. Additionally, the modular nature of DIY solutions allows users to expand their setup gradually, avoiding large upfront investments. Beyond installation savings, energy-efficient automation such as smart thermostats and motion-sensing lights helps reduce electricity consumption, leading to long-term cost benefits. The rise of e-commerce and direct-to-consumer sales further lowers prices, making advanced automation accessible to a wider demographic. As technology advances and competition increases, DIY smart home solutions will continue to offer greater affordability, convenience, and long-term financial savings for modern households.

Restraints:

-

Interoperability Challenges in DIY Home Automation The Struggle for Seamless Integration

The lack of universal standards creates compatibility issues among smart home devices from different manufacturers. Due to multiple communication protocols such as Wi-Fi, Zigbee, Z-Wave, Bluetooth, and proprietary ecosystems, many devices could not work together at all. This fragmentation causes consumers to remain within an ecosystem, limiting their options while making integration difficult. Smart home hubs try to fill these gaps but usually come with latency, connectivity failures, and limited functionality. New standards such as Matter are meant to assist with interoperability, yet adoption is still slow. Newer models may also not support older protocols so consumers have difficulty upgrading or replacing devices. In the absence of a common framework, DIY users face convoluted integrations that lead to frustration and thus, budding adoption. Interoperability is one of the major snags we all face in our quest for smart homes DIY solutions, because if everything we add (from any manufacturer) to our smart home can talk to each over the same protocol, things get easier, faster and smarter.

Opportunities:

-

Rising Demand for Energy Efficiency Driving DIY Home Automation Adoption

The growing emphasis on energy efficiency is a major driver for DIY home automation, as consumers seek cost-effective solutions to reduce electricity consumption and lower utility bills. Smart thermostats like Google Nest and Ecobee save tons of energy by optimizing heating and cooling based on occupancy patterns. Likewise, smart lighting systems that feature motion detection and scheduling condense light usage to just the moment when light is needed. Appliances that optimize their energy usage smart refrigerators, washers, and HVAC systems. As energy costs continue to rise and environmental issues become more pressing, the DIY automation movement offers low-cost and easily scalable options for managing energy use in the home. Not to mention, with energy-efficient smart devices, many governments and utility companies will offer rebates and other incentives to get homeowners to adopt energy-efficient smart devices. The burgeoning trend of DIY smart homes will likely continue to gain traction as energy conservation becomes one of the priorities in years to come.

Challenges:

-

Frequent Software & Firmware Updates Creating Compatibility and Security Challenges

Frequent software and firmware updates in DIY home automation systems are essential for enhancing security, fixing bugs, and introducing new features. However, these updates can also lead to compatibility issues, device malfunctions, and security vulnerabilities. Many smart home devices operate on different platforms, and an update on one device may render it incompatible with others in the ecosystem. Additionally, poorly optimized updates can cause devices to lag, disconnect, or even stop functioning entirely. Users who fail to update regularly may face increased cybersecurity risks, as outdated software is more vulnerable to hacking and unauthorized access. Moreover, some manufacturers eventually discontinue support for older devices, forcing consumers to upgrade. This creates frustration among DIY users who expect long-term reliability. Ensuring seamless and secure updates remains a key challenge in maintaining a stable and efficient DIY home automation system.

DIY Home Automation Market Segment Analysis:

By Product

In 2023, the Security & Access Control segment dominated the DIY home automation market, accounting for approximately 32% of total revenue. Growing concerns over home security, burglary, and unauthorized access have driven consumers to invest in smart locks, video doorbells, surveillance cameras, and motion sensors. Popular products from brands like Ring, Arlo, and August offer real-time monitoring and remote access via smartphones, enhancing convenience and peace of mind. The increasing adoption of AI-powered security systems with facial recognition, two-way communication, and cloud storage has further boosted demand. Additionally, the integration of voice assistants like Alexa and Google Assistant enables hands-free security management. With rising urbanization and smart city initiatives, the Security & Access Control segment is expected to continue its dominance in the coming years.

The Home Healthcare segment is projected to be the fastest-growing in the DIY home automation market from 2024 to 2032, driven by increasing demand for remote health monitoring and elderly care solutions. Devices such as smart wearables, AI-powered health assistants, medical alert systems, and connected medication dispensers enable real-time health tracking, emergency alerts, and remote consultations. Innovations like smart blood pressure monitors, glucose trackers, and fall detection sensors enhance patient safety while reducing dependence on hospitals. Integration with IoT, AI, and voice assistants further improves accessibility and ease of use. As global aging accelerates and healthcare costs rise, DIY home healthcare solutions provide a cost-effective, scalable, and accessible alternative, fueling rapid market expansion

By Technology

In 2023, the Network Technologies segment held the largest revenue share of approximately 51% in the DIY home automation market, driven by the increasing need for seamless connectivity between smart home devices. Technologies like Wi-Fi, Ethernet, and cloud-based networking enable real-time communication, remote access, and integration across different platforms. The surge in IoT adoption, coupled with advancements in 5G and edge computing, is further enhancing network reliability and speed. As smart homes become more interconnected, demand for robust, high-speed, and low-latency network solutions is expected to rise. From 2024 to 2032, the Network Technologies segment is projected to be the fastest-growing, fueled by expanding smart city initiatives, rising broadband penetration, and continuous innovations in wireless communication protocols.

By Software

In 2023, the Behavioral segment dominated the DIY home automation market, accounting for approximately 64% of total revenue. This dominance is driven by the widespread adoption of rule-based automation, where smart home devices operate based on user-defined schedules and conditions. Products like programmable thermostats, motion-activated lighting, and scheduled security systems allow homeowners to automate daily tasks, enhancing convenience and energy efficiency. The affordability and ease of installation of behavioral automation solutions make them appealing to a broad consumer base. While AI-driven proactive automation is gaining traction, behavioral automation remains the preferred choice due to its simplicity, user control, and cost-effectiveness. As more households embrace smart home technology, the Behavioral segment is expected to maintain a strong market presence in the coming years.

The Proactive segment is projected to be the fastest-growing in the DIY home automation market from 2024 to 2032, owing to growth in artificial intelligence, machine learning and predictive analytics. Proactive automation differs from conventional behavioral automation as it’s driven by data and AI-powered in the sense that it helps anticipate user needs based on real-time information and adjustments made to smart home parameters accordingly. AI-powered thermostats, adaptive lighting, and intelligent security systems collect data on user habits and environmental factors to create optimal living conditions, guaranteeing comfort, security, and energy efficiency. This trend is being fueled by the increasing need for intuitive, hands-free home automation solutions. Integration with voice assistants, cloud computing, and IoT ecosystems allows for enhanced system intelligence, enabling smart homes to be increasingly responsive and efficient. With the widening availability of AI-enabled automation, we forecast rapid adoption and market growth for the Proactive segment through 2032.

By Application

In 2023, the Safety and Security segment dominated the DIY home automation market, accounting for approximately 40% of total revenue. The rising concerns over home intrusion, theft, and emergencies have driven the widespread adoption of smart security solutions such as video doorbells, motion sensors, smart locks, and AI-powered surveillance cameras. Homeowners prefer DIY security systems due to their cost-effectiveness, easy installation, and remote monitoring capabilities via smartphones. The integration of cloud storage, AI-driven threat detection, and real-time alerts has further enhanced the reliability of these systems. Additionally, insurance incentives and increasing smart city initiatives are fueling demand for security automation. With continuous advancements in biometric authentication, facial recognition, and IoT-enabled security networks, the Safety and Security segment is expected to maintain a strong market position in the coming years.

The Entertainment (Audio and Video) segment is expected to be the fastest-growing in the DIY home automation market from 2024 to 2032. As more and more consumers bring their entertainment into their smart home domains with smart TVs, streaming devices, voice-controlled sound systems, and immersive e home theater setups. Technologies like 4K/8K resolution, voice assistants, and multi-room audio systems are improving user experience, allowing for easy control as well as seamless device connectivity. This growth is moving forward due to increasing latency for streaming services and high-resolution audio and user-friendly experience. In the Entertainment (Audio and Video) segment, which continues to see strong growth as consumer demand for convenience, control, and enriched multimedia experiences grows.

DIY Home Automation Market Regional Outlook:

In 2023, North America dominated the DIY home automation market, capturing around 40% of the total revenue. This dominance was driven by high consumer demand, advanced technological infrastructure, and widespread adoption of smart home devices across the region. With the increasing popularity of smart thermostats, lighting systems, security devices, and other automation solutions, North American consumers are increasingly investing in technology that enhances home convenience, security, and energy efficiency. The availability of affordable smart home products, coupled with easy installation options, has made DIY automation solutions appealing to a broader audience. Additionally, government incentives and initiatives promoting sustainability and smart home technologies have further supported growth. The region's tech-savvy population and strong internet connectivity are expected to continue driving the DIY home automation market in North America throughout the forecast period.

The Asia Pacific region is poised to be the fastest-growing in the DIY home automation market from 2024 to 2032, attributed to heightened urbanization, increasing disposable income, and a tech-savvy population. As smartphones, internet-enabled devices and IoT become more prevalent, consumers are gradually adopting to do-it-yourselves smart home automation and upgrades for more electrical convenience and power savings. The demand for home automation products is bolstered by government policies promoting smart cities and the growing real estate market. This growth is spearheaded by countries like China, India, and Japan that are increasingly embracing affordable, consumer-friendly smart home technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

DIY Home Automation Market Key Players:

Some of the Major Key Players in DIY Home Automation Market along with their Products:

-

Nest Labs, Inc. (USA) – Smart thermostats, security cameras, smoke detectors, and home automation systems.

-

Honeywell International Inc. (USA) – Smart thermostats, security systems, and air quality products.

-

Assa Abloy Group (Sweden) – Smart locks and access control solutions.

-

Acuity Brands, Inc. (USA) – Smart lighting solutions and controls.

-

Johnson Controls Inc. (USA) – Smart HVAC systems, energy management, and security solutions.

-

Schneider Electric (France) – Smart energy management systems, automation controls, and home security solutions.

-

United Technologies Corporation (USA) – Smart building technologies, HVAC, and security systems.

-

Samsung Electronics Co., Ltd. (South Korea) – Smart home appliances, lighting, and security devices.

-

Crestron Electronics, Inc. (USA) – Home automation systems for lighting, entertainment, and security.

-

AMX LLC (Harman) (USA) – Smart control systems for home entertainment, lighting, and climate.

-

Control4 Corporation (USA) – Home automation systems for lighting, entertainment, and security.

-

Siemens AG (Germany) – Smart home solutions, building automation, and energy management.

-

Savant Systems LLC (USA) – Smart home automation systems focusing on entertainment, lighting, and security.

-

ABB Ltd. (Switzerland) – Smart energy systems, building automation, and lighting controls.

-

Smartlabs, Inc. (USA) – Smart home lighting, security, and automation solutions.

-

Nortek, Inc. (USA) – Home automation, security, and HVAC solutions.

List of Suppliers who Provide Raw Material and Component for DIY Home Automation Market:

-

3M

-

Bosch

-

Texas Instruments

-

Qualcomm

-

NXP Semiconductors

-

Broadcom

-

STMicroelectronics

-

Intel

-

Panasonic

-

Honeywell

Recent Development:

-

10 Sept, 2024, ASSA ABLOY has acquired Level Lock, a Redwood City-based technology solutions business, expanding its digital access portfolio in the Americas. Level Lock, founded in 2016, reported 2023 sales of approximately MUSD 16 and enhances ASSA ABLOY’s digital offerings with its innovative platform.

-

Sept 10, 2024, Schneider Electric introduces Schneider Home, a first-of-its-kind energy management solution that integrates solar, battery, EV charging, and utility power, all managed via a single app, helping homeowners boost efficiency and save money.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 50.46 Billion |

| Market Size by 2032 | USD 508.78 Billion |

| CAGR | CAGR of 29.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Lighting Control, Security & Access Control, HVAC Control, Entertainment Control, Home Healthcare, Smart Kitchen, Others) • By Technology (Network Technologies, Protocols & Standards, Wireless Communication Technologies) • By Software (Behavioral, Proactive), • By Application (Safety and Security, Lighting, Entertainment (Audio and Video), Heating, Ventilation and Air conditioning) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nest Labs, Inc. (USA), Honeywell International Inc. (USA), Assa Abloy Group (Sweden), Acuity Brands, Inc. (USA), Johnson Controls Inc. (USA), Schneider Electric SE (France), United Technologies Corporation (USA), Samsung Electronics Co., Ltd. (South Korea), Crestron Electronics, Inc. (USA), AMX LLC (Harman) (USA), Control4 Corporation (USA), Siemens AG (Germany), Savant Systems LLC (USA), ABB Ltd. (Switzerland), Smartlabs, Inc. (USA), Nortek, Inc. (USA). |