Motion Sensor Market Report & Overview:

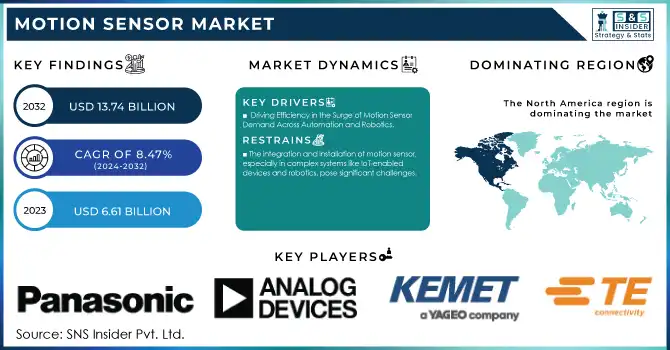

The Motion Sensor Market Size was valued at USD 6.61 Billion in 2023 and is expected to grow to USD 13.74 Billion by 2032 and grow at a CAGR of 8.47 % over the forecast period of 2024-2032.

Get More Information on Motion Sensor Market - Request Sample Report

The motion sensor market is experiencing significant growth, fueled by the increasing demand for safety and security solutions across both residential and commercial sectors. As motion sensor are increasingly integrated into security systems such as surveillance cameras, intrusion alarms, and smart lighting, the market is expanding rapidly. Motion sensor lights, in particular, have become crucial for improving security by automatically activating when motion is detected, ensuring a safer environment. Furthermore, the incorporation of IoT (Internet of Things) with motion sensor is enhancing real-time monitoring and management capabilities, driving adoption in smart homes and commercial security applications. Technological advancements in sensor types, including infrared, ultrasonic, and radar sensor, are also contributing to market expansion. By 2030, the motion sensor market is expected to grow significantly, driven not only by security needs but also by the increasing demand for energy-efficient smart systems. The rise of Industry 4.0, featuring innovations like AI-enabled robots and collaborative technologies, is further accelerating the demand for advanced motion sensor across industries. The growth in global IoT connections, reported to have increased by 12.6 billion according to GSMA, is positively influencing the motion sensor market. Companies like STMicroelectronics have launched innovative products such as the LSM6DSO and LSM6DSOX 6-axis motion sensor, incorporating machine learning and finite state machine technologies to improve performance and extend battery life, particularly in smartphones. The mobile gaming sector is also contributing to the market's growth, with an increased demand for motion sensor for motion-based gaming experiences. Additionally, motion sensor play a vital role in various industrial and scientific fields, including robotics, automotive, and medical research. With continuous innovation from key players, the motion sensor market is set to keep growing, driven by advancements in technology and the rising need for enhanced security.

Market Dynamics

Drivers

-

Driving Efficiency in the Surge of Motion Sensor Demand Across Automation and Robotics

The motion sensor market is experiencing robust growth, driven by the increasing adoption of automation across industries such as robotics, manufacturing, and process control. Automation technologies, powered by Industry 4.0 and AI, are transforming sectors like warehousing, logistics, and manufacturing, with motion sensor playing a pivotal role in enhancing precision, safety, and productivity. As companies focus on boosting efficiency and reducing costs, the integration of motion sensor in automated systems has become indispensable. The home automation market is also contributing to this growth, with a rising demand for smart home solutions that rely on motion sensor for security and energy management. Additionally, proximity sensor are revolutionizing industrial automation by providing contactless precision, which is crucial in robotics, where sensor help robots perform tasks like object detection and navigation with greater efficiency. Ultrasonic sensor are further advancing robotics, offering high accuracy and reliability for a wide range of industrial applications. The investment in Industrial IoT (IIoT) is another key factor driving the motion sensor market, as these sensor enable real-time monitoring and control across different sectors. The increasing reliance on automation, coupled with innovations in sensor technologies, is expected to accelerate the motion sensor market’s expansion. As industries globally adopt more automation technologies to meet competitive pressures and improve operational efficiency, the demand for motion sensor will continue to rise, fostering advancements in sensor technology and driving market growth.

Restraints

-

The integration and installation of motion sensor, especially in complex systems like IoT-enabled devices and robotics, pose significant challenges.

The installation process consumes a considerable amount of time and requires specialized knowledge. In robotics, integrating sensor with actuators and ensuring compatibility with other system components is crucial for seamless performance. This complexity often involves detailed testing, driving up both time and costs. According to statistics, buildings consume over 19% of the total energy usage in the United States, with HVAC systems accounting for 27% of this consumption. Improving energy efficiency could reduce electricity consumption by 14%. In global energy consumption, buildings represent 30% of the total energy used and 60% of electricity production. Lighting, a major energy consumer, accounts for 20% of the total energy and 30% of electricity consumption in buildings. This highlights the importance of energy-efficient technologies such as LEDs, which have a lifespan of over 100,000 hours and convert 40% of electricity into light, making them 40% more efficient than traditional lighting sources. In terms of motion sensor integration, the challenge extends beyond installation. Environmental factors like temperature, humidity, and vibrations can affect sensor performance, which makes proper calibration essential. Specialized expertise is necessary for accurate installation and calibration, which increases operational costs. The complexity of integrating these technologies adds to the overall costs and delays deployment. As industries look to adopt motion sensor for applications such as energy efficiency or automation, these integration challenges must be carefully considered, as they can impact both cost and performance.

Segment Analysis

By Technology

In 2023, the infrared (IR) segment dominated the motion sensor market, accounting for approximately 40% of the market share. Infrared motion sensor are widely used due to their effectiveness in detecting heat signatures and movement, making them suitable for a range of applications, including security systems, automation, and HVAC systems. The primary working principle of infrared sensor involves detecting the infrared radiation emitted by objects, with the most common types being passive infrared (PIR) and active infrared sensor. The growth of this segment is driven by the increasing demand for energy-efficient solutions in residential, commercial, and industrial settings. IR sensor are also vital in smart buildings, contributing to energy savings by controlling lighting and HVAC systems based on occupancy detection. Their cost-effectiveness, reliability, and easy integration into automated systems further boost their widespread adoption, leading to their dominance in the motion sensor market.

By Application

In 2023, the consumer electronics segment led the motion sensor market, accounting for approximately 30% of the market share. This dominance is attributed to the widespread adoption of motion sensor technologies in devices such as smartphones, gaming consoles, wearables, and home automation products. Motion sensor are integral to enhancing user experience in consumer electronics, enabling features like motion detection, gesture recognition, and improved user interfaces. In smartphones, for instance, motion sensor contribute to screen rotation, step tracking, and enhanced camera functionality. The growing trend of smart homes further fuels the demand for motion sensor in devices like smart speakers, security systems, and lighting controls. As the consumer electronics industry continues to innovate, the need for more advanced, compact, and energy-efficient motion sensor is expected to rise, solidifying the consumer electronics segment as a key driver in the motion sensor market.

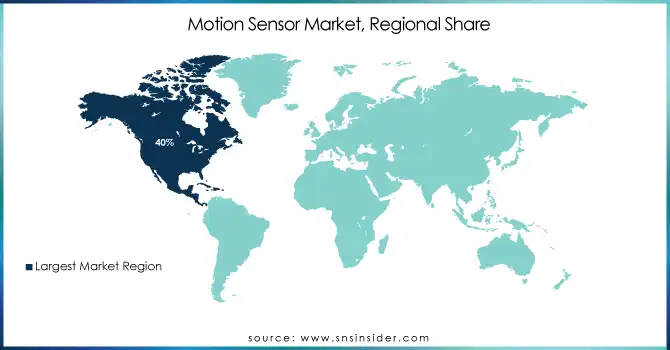

Regional Analysis

North America, accounting for around 40% of the motion sensor market in 2023, is a dominant force due to its robust technological infrastructure and high demand across various industries like automotive, consumer electronics, healthcare, and security. The United States, as a leader in innovation, plays a significant role with its advanced automation and IoT systems, supporting the widespread adoption of motion sensors in smart homes and energy-efficient technologies. Canada's growing focus on smart cities and environmental sustainability further bolsters the demand for motion sensors in building automation and energy systems. Additionally, the region's strength is reinforced by substantial investments from key industry players and continuous advancements in sensor technologies. The integration of artificial intelligence (AI), robotics, and next-generation systems in sectors such as automotive and healthcare also contributes to North America's dominance, maintaining its leadership in the global motion sensor market.

Asia-Pacific is the fastest-growing region in the motion sensor market from 2024 to 2032, driven by rapid industrialization, urbanization, and the adoption of advanced technologies in countries like China, Japan, South Korea, and India. China leads the growth with significant investments in automation and robotics, while Japan and South Korea focus on integrating motion sensors into robotics, consumer electronics, and automotive sectors. India's expanding automotive and electronics industries are also boosting sensor demand, especially in smart devices and vehicles. Additionally, government initiatives promoting smart cities, IoT infrastructure, and energy efficiency are contributing to the growing demand for motion sensors in building automation and security systems. The region's technological advancements, economic growth, and governmental support for innovation position Asia-Pacific as a dominant force in the motion sensor market, ensuring its continued growth and adoption.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Some of the major players in Motion Sensor market with product:

-

Murata Manufacturing Co., Ltd. (Accelerometers, Gyroscopes)

-

NXP Semiconductors (Motion Sensor ICs, Accelerometers)

-

Robert Bosch GmbH (MEMS Sensor, Inertial Sensor)

-

Sensinova India (Ultrasonic and IR Sensor)

-

STMicroelectronics (MEMS Motion Sensor, Accelerometers)

-

TE Connectivity (Motion Detection Sensor, Accelerometers)

-

TDK Corporation (Inertial Sensor, MEMS)

-

KEMET Corporation (Capacitive Sensor, MEMS Sensor)

-

Analog Devices, Inc. (Accelerometers, Inertial Sensor)

-

Honeywell International Inc. (Inertial Sensor, MEMS)

-

Texas Instruments (Accelerometers, Motion Sensor)

-

Panasonic Corporation (MEMS Sensor, Motion Detectors)

-

Infineon Technologies (Inertial Sensor, Motion Detection ICs)

-

Broadcom Inc. (Motion Sensor, Accelerometers)

-

Vishay Intertechnology (MEMS, Accelerometers)

-

Qualcomm Technologies (Motion Sensor ICs)

-

Amphenol Corporation (Accelerometers, Motion Sensor)

-

Microchip Technology Inc. (MEMS Sensor, Accelerometers)

-

On Semiconductor (MEMS Sensor, Motion Detection ICs)

List of suppliers that provide raw materials and components for the motion sensor market, without mentioning their products:

-

3M

-

DuPont

-

Honeywell International Inc.

-

Bosch Sensortec

-

STMicroelectronics

-

NXP Semiconductors

-

TDK Corporation

-

Texas Instruments

-

Infineon Technologies

-

Analog Devices, Inc.

Recent Development

-

October 2024, Murata Manufacturing Ltd. opened a new 200mm silicon capacitor production line at its Caen, France facility on expanding its Integrated Passive Solutions and reinforcing its investment in the European electronics industry.

-

On September 2024, NXP Semiconductors unveiled its Trimension SR250 chip, integrating UWB secure ranging, UWB radar, and 3D AoA for precise and energy-efficient presence and motion detection in IoT and automotive applications.

-

On June2024, TE Connectivity launched its Zhaga-certified LUMAWISE Motion Programmable sensor, enabling energy-efficient outdoor lighting and high-bay warehouse lighting with customizable brightness levels for smart city applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.61 Billion |

| Market Size by 2032 | USD 13.74 Billion |

| CAGR | CAGR of 8.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Infrared, Ultrasonic, Microwave, Dual Technology, Tomographic, Other) • By Application (Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Murata Manufacturing Co., Ltd., NXP Semiconductors, Robert Bosch GmbH, Sensinova India, STMicroelectronics, TE Connectivity, TDK Corporation, KEMET Corporation, Analog Devices, Inc., Honeywell International Inc., Texas Instruments, Panasonic Corporation, Infineon Technologies, Broadcom Inc., Vishay Intertechnology, Qualcomm Technologies, Amphenol Corporation, Microchip Technology Inc., and On Semiconductor are key players in the motion sensor market. |

| Key Drivers | • Driving Efficiency in the Surge of Motion Sensor Demand Across Automation and Robotics |

| Restraints | • The integration and installation of motion sensor, especially in complex systems like IoT-enabled devices and robotics, pose significant challenges. |