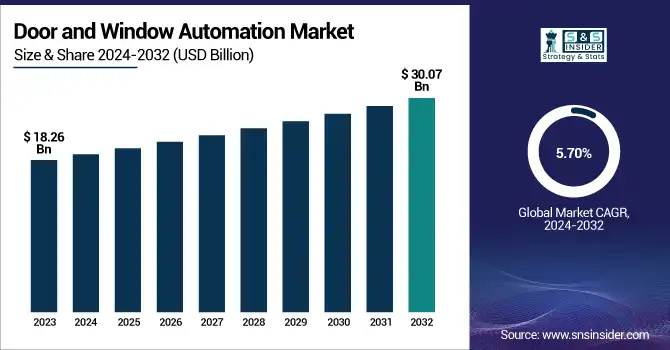

Door and Window Automation Market Size & Growth:

The Door and Window Automation Market was valued at USD 18.26 billion in 2023 and is projected to reach USD 30.07 billion by 2032, growing at a CAGR of 5.70% from 2024 to 2032. This growth is driven by increasing demand for smart home automation, rising adoption of energy-efficient solutions, and the expansion of commercial and industrial infrastructure.

The U.S. door and window automation market, valued at USD 3.25 billion in 2023, is projected to reach USD 5.81 billion by 2032, growing at a CAGR of 6.63%. Technological advancements in IoT, AI-driven security systems, and touchless access control are further accelerating market expansion. Additionally, strict building safety regulations, aging infrastructure requiring automation upgrades, and the rise of sustainable construction contribute to strong demand. The U.S. market aligns with global trends, with high disposable income, urbanization, and rapid smart city development fueling automation adoption across residential, commercial, and industrial sectors.

To Get more information on Door and Window Automation Market - Request Free Sample Report

Door and Window Automation Market Dynamics:

Drivers:

-

Revolutionizing Doors and Windows Smart Automation Meets Sustainability

The door and window automation industry is evolving rapidly driven by energy efficiency regulations sustainability goals and advanced automation technologies. Government initiatives like ENERGY STAR certifications and LEED updates are encouraging the integration of AI-powered automated doors and windows that optimize energy consumption and reduce HVAC dependency. Events such as FGIA’s Igniting Innovation panel and the record-breaking International Builders’ Show IBS 2025 have showcased cutting-edge solutions including automated sliding systems urban aluminum-framed designs and eco-friendly smart home integrations. Companies like Quaker Windows Weather shield and ThermaTru are leading innovation focusing on enhanced insulation and minimal environmental impact. As the AEC industry accounts for 35% of global energy consumption and 38% of CO2 emissions automation is becoming essential for sustainable construction. With industry momentum growing the future of doors and windows is smarter greener and more efficient than ever.

Restraints:

-

High Initial Costs and Retrofitting Challenges Hindering Adoption of Automated Doors and Windows

Advanced automated systems incorporate smart sensors, AI-driven controls, and IoT integration, significantly increasing costs compared to traditional manual systems. The expenses extend beyond just purchasing automated doors and windows; additional costs include wiring, connectivity infrastructure, and maintenance. Retrofitting existing structures with automation technology presents further challenges, as older buildings may require extensive modifications to accommodate smart systems. Many commercial and residential property owners hesitate to invest in automation due to unclear long-term cost benefits, despite potential energy savings and enhanced security. The lack of standardized protocols across different automation brands also complicates retrofitting, leading to compatibility issues. Overcoming these challenges will require innovations in cost-effective solutions, increased government incentives for energy-efficient automation, and advancements in wireless and modular automation technologies.

Opportunities:

-

The increasing adoption of automated doors and windows in commercial and industrial sectors is transforming security, efficiency, and convenience.

Airports, hospitals, hotels, and manufacturing facilities are integrating automated solutions to enhance accessibility, minimize energy loss, and streamline operations. With smart infrastructure projects on the rise, businesses are leveraging AI-powered access control, motion sensors, and remote monitoring systems to improve security and user experience. Automated entrances reduce wait times in high-traffic areas, while smart ventilation systems optimize indoor air quality in healthcare and industrial environments. The hospitality sector is also embracing automation to provide seamless guest experiences with keyless entry and self-operating systems. As urbanization accelerates and industries prioritize efficiency, the demand for intelligent door and window solutions continues to rise. The convergence of IoT, AI, and energy management technologies further strengthens market expansion, making automation a crucial component in modernizing commercial and industrial buildings.

Challenges:

-

Retrofitting automation into existing buildings presents significant challenges due to complex installation requirements.

Unlike new constructions designed with automation in mind, older buildings often lack the necessary wiring, structural support, and compatibility for seamless integration. Installing automated doors and windows requires skilled labor, specialized tools, and modifications to existing frameworks, which increases costs and project timelines. Additionally, integrating automation with current security, HVAC, and lighting systems demands precise calibration and software synchronization, adding further complexity. Many building owners hesitate due to potential disruptions and high labor expenses, slowing adoption rates. As the market grows, advancements in wireless technologies and modular automation systems are helping simplify installations, reducing costs and making retrofitting more accessible. However, widespread adoption still depends on greater industry standardization and increased availability of skilled professionals to handle complex integration processes efficiently.

Door and Window Automation Industry Segmentation Overview:

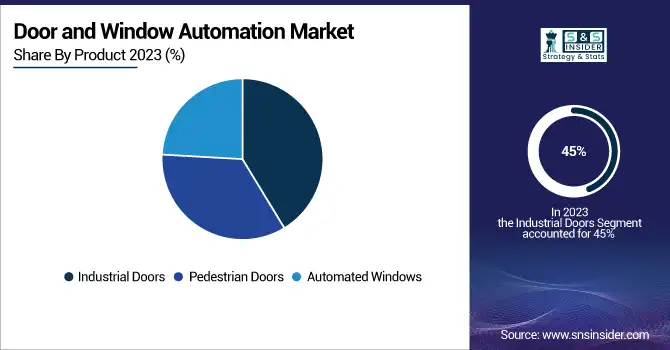

By Product

The Industrial Doors segment dominated the Door and Window Automation Market, accounting for approximately 45% of total revenue in 2023. This dominance is driven by the increasing demand for automated security solutions in warehouses, factories, and logistics centers. Industrial doors provide enhanced safety, energy efficiency, and operational convenience, making them essential for facilities handling high traffic and large equipment. Advancements in high-speed roll-up doors, sectional overhead doors, and fire-rated doors have further boosted adoption. Additionally, the rise of smart factories and Industry 4.0 initiatives has accelerated the integration of IoT-enabled doors with remote access controls and predictive maintenance capabilities. With stringent workplace safety regulations and a growing emphasis on automation in industrial infrastructure, the demand for industrial automated doors is expected to continue its upward trajectory in the coming years.

The Automated Windows segment is the fastest-growing in the Door and Window Automation Market from 2024 to 2032, driven by rising demand for energy-efficient and smart building solutions. Advanced IoT-enabled windows with sensor-based ventilation, self-tinting glass, and AI-driven climate control are gaining traction in residential and commercial spaces. Governments worldwide are enforcing stringent energy efficiency regulations, such as ENERGY STAR and LEED certifications, accelerating adoption. The push for sustainable construction and smart cities is further fueling growth, with automated windows helping reduce HVAC dependency and carbon footprints. Increased integration with smart home ecosystems and voice-controlled assistants is enhancing convenience, making these solutions highly attractive for modern homeowners and businesses. With continuous advancements in glass technology, AI automation, and connectivity, the automated windows segment is set to experience rapid market expansion over the forecast period.

By Component

The Operators segment held the largest revenue share of approximately 35% in the Door and Window Automation Market in 2023, driven by increasing adoption in commercial, industrial, and residential applications. Operators play a crucial role in automating sliding, swinging, and revolving doors and windows, enhancing convenience, security, and energy efficiency. The demand is fueled by smart infrastructure projects, the expansion of automated access control systems, and stringent safety regulations in public buildings. Technological advancements, including IoT-enabled remote operation, AI-driven motion sensing, and improved durability, are further boosting growth. The rising need for touchless entry solutions in high-traffic areas like airports, hospitals, malls, and office buildings is also accelerating market penetration. With the continuous development of smart and energy-efficient buildings, the Operators segment is expected to maintain its dominance in the coming years.

The Sensors & Detectors segment is the fastest-growing in the Door and Window Automation Market over the forecast period 2024-2032, driven by advancements in smart home technology, security systems, and energy efficiency solutions. These components play a critical role in motion detection, obstacle sensing, temperature regulation, and remote monitoring, enhancing safety, convenience, and energy optimization. Growing adoption of IoT, AI-powered analytics, and wireless connectivity is further accelerating demand. The rise of touchless access control, automated climate control, and stringent building safety regulations is pushing widespread implementation across residential, commercial, and industrial sectors. As urbanization and smart infrastructure projects expand, the need for high-precision sensors integrated with automated doors and windows is expected to surge, making this segment a key driver of market growth.

By Application

The Sensors & Detectors segment is the fastest-growing in the Door and Window Automation Market over the forecast period 2024-2032, driven by advancements in smart home technology, security systems, and energy efficiency solutions. These components play a critical role in motion detection, obstacle sensing, temperature regulation, and remote monitoring, enhancing safety, convenience, and energy optimization. Growing adoption of IoT, AI-powered analytics, and wireless connectivity is further accelerating demand. The rise of touchless access control, automated climate control, and stringent building safety regulations is pushing widespread implementation across residential, commercial, and industrial sectors. As urbanization and smart infrastructure projects expand, the need for high-precision sensors integrated with automated doors and windows is expected to surge, making this segment a key driver of market growth.

The Commercial Buildings segment is the fastest-growing sector in the Door and Window Automation Market over the forecast period 2024-2032, driven by increasing investments in smart infrastructure, energy efficiency, and security solutions. Businesses, hotels, hospitals, shopping malls, and office complexes are rapidly adopting automated doors and windows to enhance safety, accessibility, and operational efficiency. The growing focus on touchless entry systems, driven by hygiene concerns post-pandemic, and the integration of IoT-based security solutions are accelerating demand. Regulatory mandates promoting energy-efficient buildings and smart climate control systems are further boosting market expansion. Additionally, the rise of co-working spaces, smart offices, and commercial real estate modernization is increasing the adoption of automated sliding doors, sensor-activated windows, and AI-driven building management systems. With continuous technological advancements and urbanization trends, the Commercial Buildings segment is expected to witness robust growth throughout the forecast period.

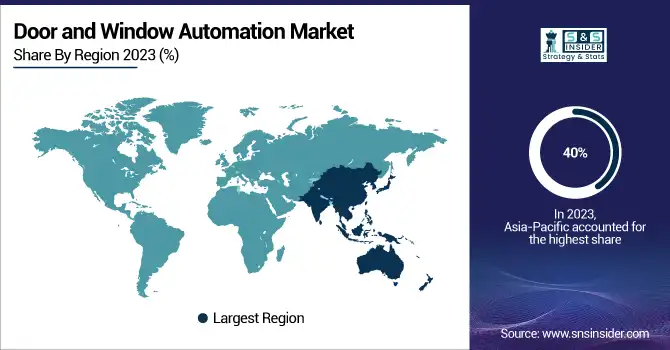

Door and Window Automation Market Regional Insights:

The Asia-Pacific region dominated the Door and Window Automation Market in 2023, capturing around 40% of total revenue, driven by rapid urbanization, smart city projects, and expanding infrastructure. Countries like China, India, Japan, and South Korea are experiencing high demand due to the growing adoption of energy-efficient and automated building solutions. Government initiatives promoting smart buildings and sustainability further accelerate market growth. The hospitality, healthcare, and retail sectors are increasingly integrating automated doors and windows for security, efficiency, and convenience. Rising disposable incomes and evolving consumer preferences for tech-integrated living spaces are fueling demand. With advancements in IoT, AI, and touchless automation technologies, the Asia-Pacific market is expected to lead the industry’s growth in the forecast period.

The North America segment is the fastest-growing region in the Door and Window Automation Market over the forecast period 2024-2032, driven by rising demand for smart homes, energy-efficient buildings, and touchless access solutions. The United States and Canada are witnessing rapid adoption due to strong investments in commercial infrastructure, high consumer awareness, and stringent energy regulations. Growth in automated security systems and the expansion of AI and IoT-powered solutions further fuel market expansion. The hospitality, healthcare, and retail sectors are key adopters, prioritizing automation for convenience and safety. Additionally, government incentives for green building technologies and increasing renovation activities in residential and commercial spaces boost demand, making North America a key driver of market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Door and Window Automation Market are:

-

Assa Abloy (Sweden) – Automated doors, access control systems, smart locks

-

BEA (Belgium) – Motion sensors, presence detectors for automatic doors

-

Bosch Security Systems (Germany) – Smart surveillance, access control, motion sensors

-

CAME Group (Italy) – Automatic gates, barriers, industrial door automation

-

dormakaba (Switzerland) – Automatic doors, access solutions, smart locks

-

GEZE GmbH (Germany) – Sliding doors, swing door drives, access control

-

Honeywell International Inc. (USA) – Smart home security, access control, motion sensors

-

Insteon (USA) – Smart home automation, remote-controlled door locks

-

Legrand (France) – Smart building solutions, access control, home automation

-

NABCO Entrances Inc. (USA) – Automatic sliding doors, swinging doors, revolving doors

-

Panasonic Corporation (Japan) – Automatic doors, smart security solutions

-

Record USA (USA) – Revolving doors, sliding doors, swing doors

-

Schneider Electric (France) – Smart building management, access control

-

Siemens AG (Germany) – Smart infrastructure, building automation, security systems

-

Stanley Black & Decker (USA) – Electronic locks, smart security systems, access control’

Some key suppliers of raw materials and components for the Door and Window Automation Market:

-

Shandong Oyade Sealant Industry Co., Ltd.

-

Taiyuan Simis Precision Casting Co., Ltd.

-

Foshan Huajingda Metal Product Factory

-

Guangzhou A.C.T Products Co., Ltd.

-

Ningbo Haidi Metal Technology Co., Ltd.

-

Jinan Lumei Construction Material Co., Ltd.

-

Ningbo Suijin Machinery Technology Co., Ltd.

-

Shandong Nisen Trade Co., Ltd.

-

OBEN Hardware

Recent Development:

-

On 4 September 2024, Bosch Smart Home unveiled the [+M] product line at IFA 2024, featuring Matter-compatible devices like the Radiator Thermostat II [+M], Door/Window Contact II [+M], and Plug Compact [+M], enabling seamless integration across smart home ecosystems.

-

On 17 October 2024, Schneider Electric announced the £654 million acquisition of Motivair, securing a 75% controlling interest to enhance its liquid cooling solutions for high-performance data centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.26 Billion |

| Market Size by 2032 | USD 30.07 Billion |

| CAGR | CAGR of 5.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Industrial Doors, Pedestrian Doors, Automated Windows) • By Component (Operators, Motors & Actuators, Sensors & Detectors, Access Control Systems, Switches, Alarms, Control Panels) • By Application (Residential Buildings, Education Buildings, Hotels & Restaurants, Industrial Buildings, Industrial Production Units, Airports, Healthcare Facilities Facilities, Public Transit Systems, Commercial Buildings, Entertainment Buildings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Assa Abloy, BEA, Bosch Security Systems, CAME Group, dormakaba, GEZE GmbH, Honeywell International Inc., Insteon, Legrand, NABCO Entrances Inc., Panasonic Corporation, Record USA, Schneider Electric, Siemens AG, and Stanley Black & Decker. |