Electronic Access Control Systems Market Size & Trends:

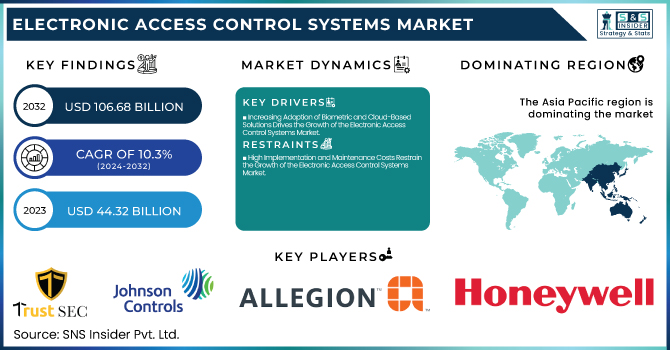

The Electronic Access Control Systems Market Size was valued at USD 53.92 Billion in 2025 and is expected to reach USD 143.71 Billion by 2035 and grow at a CAGR of 10.3% over the forecast period 2026-2035.

The Market is expanding at a fast pace owing to the increasing security concerns in the commercial, residential, and government segments. These solutions improve security by combining biometrics, cloud computing, and IoT technology. The major factors propelling the market are urbanization, smart buildings, and government regulations. The mobile-based access and multi-factor authentication approach is revolutionizing the security environment. Cloud-based solutions are gaining popularity owing to their scalability and remote access capabilities. Vendors are focusing on AI-powered facial recognition, touchless authentication, and blockchain technology for secure identity management. Wireless technology and smart lock solutions are already revolutionizing the market and hence defining the future of access control solutions.

To Get more information on Electronic Access Control Systems Market - Request Free Sample Report

Market Size and Forecast: 2025

-

Market Size in 2025 USD 53.92 Billion

-

Market Size by 2035 USD 143.71 Billion

-

CAGR of 10.3% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Electronic Access Control Systems Market Trends:

• Rapid shift toward biometric authentication technologies such as facial recognition, fingerprint scanning, and iris recognition to enhance security accuracy and eliminate risks associated with lost or stolen credentials.

• Growing adoption of cloud-based access control platforms enabling remote access management, real-time monitoring, scalability, and easier system updates across multiple locations.

• Increasing integration of AI-driven analytics to support behavioral monitoring, anomaly detection, and predictive threat identification within access control environments.

• Rising deployment of IoT-enabled access control systems that seamlessly connect with surveillance, alarm, and building management systems for automated and coordinated security responses.

• Expanding demand for contactless and touch-free access solutions, driven by hygiene concerns, user convenience, and advancements in voice recognition and gesture-based authentication technologies.

The U.S. Electronic Access Control Systems Market was estimated to be around USD 16.8 billion, mainly because of the extensive adoption of such solutions in commercial office environments, government institutions, healthcare facilities, and critical infrastructure.

Electronic Access Control Systems Market Growth Drivers:

-

Increasing Adoption of Biometric and Cloud-Based Solutions Drives the Growth of the Electronic Access Control Systems Market

The growing need for sophisticated security solutions has resulted in an increased adoption of biometric authentication and cloud-based access control solutions. Organizations and businesses are adopting biometric readers, facial recognition, and fingerprint recognition due to their enhanced security and reliability compared to the traditional keycard or PIN-based systems. In addition, the cloud-based access control system is gaining momentum due to its scalability, remote control, and seamless integration with the Internet of Things-enabled security infrastructure. The increasing requirement for real-time monitoring and data-driven decision-making is compelling organizations to invest in cloud-enabled security solutions. In addition, the increasing regulations and requirements for access control in the healthcare, banking, and military industries have fueled the demand for the market. The development of AI and machine learning technologies is making cloud and biometric solutions more accurate, secure, and user-friendly. These factors are contributing significantly to the overall growth of the Electronic Access Control Systems Market

Electronic Access Control Systems Market Restraints:

-

High Implementation and Maintenance Costs Restrain the Growth of the Electronic Access Control Systems Market

Although electronic access control systems provide greater security and convenience, the initial cost of investment and maintenance is a major hindrance to the growth of the market. The implementation of biometric readers, Smart locks, and cloud-based access solutions involves a high initial investment, making it difficult for small and medium-scale enterprises (SMEs) to implement these solutions. In addition, the expenses involved in system integration, software development, and improvement of cybersecurity further add to the overall cost.

Electronic Access Control Systems Market Opportunities:

-

Integration of Artificial Intelligence and IoT Presents Lucrative Growth Opportunities for the Electronic Access Control Systems Market

The increasing integration of Artificial Intelligence (AI) and Internet of Things (IoT) in access control solutions is opening up new opportunities for development. AI-powered facial recognition, behavior analysis, and predictive security solutions are improving the accuracy and efficiency of electronic access control. IoT-based smart access solutions provide seamless connectivity with CCTV cameras, alarm systems, and other security infrastructure for real-time monitoring and automatic response to potential threats. Moreover, AI-powered analytics have the ability to identify suspicious behavior and unauthorized access attempts, which significantly improves security management. Businesses are now adopting cloud-based IoT solutions that provide centralized control of multiple access points, improving efficiency.

Electronic Access Control Systems Market Segment Analysis:

By Verticals

The Government, Residential & Education sector dominated the Electronic Access Control Systems Market in 2025, accounting for the largest market share because of growing investments in security infrastructure in government buildings, residential complexes, and educational institutions. Governments globally are adopting biometric authentication, smart card readers, and cloud-based access control systems to improve security and restrict unauthorized access. NEC Corporation and IDEMIA are upgrading biometric identity verification systems to support large-scale government security initiatives. The Commercial Spaces sector is growing at the fastest pace in the Electronic Access Control Systems Market because of the growing adoption of cloud-based access management, mobile credentials, and AI-driven security systems. With the growing adoption of hybrid work environments and digitalized security infrastructure, there has been a significant demand for touchless authentication, mobile-based access control, and security platforms.

By Components

The Biometrics & Card-Based Reader market accounted for the largest revenue share of 42% in 2025, dominating the Electronic Access Control Systems market. The increasing need for secure and convenient authentication solutions in government buildings, financial institutions, healthcare, and corporate settings has driven the use of biometric scanners and card-based access solutions. IDEMIA’s MorphoWave Contactless Fingerprint Reader provides high-speed, touchless authentication, which is suitable for high-traffic environments, while Suprema’s FaceStation F2 features facial recognition and liveness detection technology. The Multi-Technology Readers market is expected to register the highest CAGR of 11.15% during the forecast period. This is due to the growing need for flexible access control solutions. Organizations and businesses require systems that are interoperable and can read multiple credential types, such as RFID, NFC, biometric, and mobile credentials. Major industry players such as Honeywell, Allegion, and LenelS2 have introduced sophisticated multi-technology readers to cater to these requirements.

Electronic Access Control Systems Market Regional Analysis:

In 2025, the Asia Pacific market dominated the Electronic Access Control Systems Market, accounting for the largest market share of about 33%. The Asia Pacific market was fueled by rapid urbanization, smart city projects, infrastructure development, and growing security concerns in the commercial, government, and residential sectors. China, India, and Japan are some of the major adopters of advanced access control systems, such as biometric authentication, smart card readers, and AI-based surveillance systems. For example, China’s aggressive adoption of facial recognition systems for public security, airport entry, and financial institutions has contributed greatly to the growth of the market. Hikvision and Dahua Technology have developed AI-based biometric access control systems, improving security in high-density cities.

North America Electronic Access Control Systems Market Insights

North America is a mature and technology-driven market for electronic access control systems, with high awareness levels and strict enforcement of security regulations in the commercial, government, and critical infrastructure sectors. The use of biometric authentication, cloud-based access control, and AI-based security solutions is also driven by the increasing number of cybersecurity threats and the need for real-time monitoring. The region is also a beneficiary of the early adoption of IoT-enabled smart buildings, the presence of major security technology vendors, and investments in infrastructure development in the healthcare, BFSI, defense, and data center sectors.

Europe Electronic Access Control Systems Market Insights

The European market for electronic access control systems is fueled by the need to comply with data protection and occupational health and safety regulations such as GDPR. There is a high demand for electronic access control systems in commercial buildings, transportation hubs, government institutions, and industrial facilities, and there is a growing trend towards biometric and touchless access control solutions. The rise of smart city developments and green buildings is also fueling the adoption of comprehensive access control solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Electronic Access Control Systems Market Insights

The European market for electronic access control systems is driven by the need to comply with data protection and occupational health and safety regulations such as GDPR. The demand for electronic access control systems is high in commercial buildings, transportation hubs, government institutions, and industrial facilities, and there is a trend towards biometric and touchless access control systems. The development of smart cities and green buildings is also driving the adoption of comprehensive access control solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Electronic Access Control Systems Market Key Players:

-

TRUSTSEC (TrustSEC Bio Access, TrustSEC Smart Card Solutions)

-

Johnson Controls International plc (C•CURE Access Control, P2000 Security Management System)

-

Allegion plc (Schlage Electronic Locks, Von Duprin Access Control Solutions)

-

Honeywell Security Group (Pro-Watch Integrated Security Suite, NetAXS Access Control)

-

Identiv, Inc. (Hirsch Velocity Software, uTrust TS Readers)

-

Nedap N.V. (AEOS Access Control, Nedap Long-Range Identification Systems)

-

Suprema HQ Inc. (BioStar 2 Access Control, FaceStation F2)

-

Bosch Security Systems Inc. (Bosch Access Management System, Matrix Access Control)

-

Gemalto N.V. (SafeNet Authentication Solutions, Gemalto Digital Identity Solutions)

-

NEC Corporation (NeoFace Facial Recognition, NEC Bio-IDiom)

-

IDEMIA (MorphoWave Contactless Biometric Reader, IDEMIA Smart Identity Solutions)

-

FINGERPRINTS (FPC Touch Sensors, FPC Biometric Access Solutions)

-

Axis Communications (Axis A1001 Network Door Controller, Axis A8105-E Network Video Door Station)

-

Lenel Systems International (LenelS2 OnGuard, BlueDiamond Mobile Credentialing)

-

Time and Data Systems International (TDSI GARDiS Access Control, TDSI DIGIgarde Plus)

-

AMAG Technology (Symmetry Access Control, Symmetry Blue Mobile Credentials)

-

Gunnebo (Gunnebo Entrance Control, Gunnebo Access Management Solutions)

Competitive Landscape for Electronic Access Control Systems Market:

Allegion plc is a leading global provider of electronic access control systems, offering advanced solutions including smart locks, biometric readers, and integrated security platforms. The company serves commercial, institutional, and residential markets, focusing on secure, scalable, and digitally enabled access management solutions.

-

In February 2025, Allegion plc reported revenue growth in its fourth-quarter and full-year financial results for 2024. The company experienced increased earnings and strong performance in its Americas segment, driven by pricing and volume growth.

Johnson Controls is a major global player in the electronic access control systems market, providing integrated security solutions including access control, video surveillance, and building management systems. The company serves commercial, industrial, and institutional facilities, emphasizing smart, connected, and energy-efficient security technologies.

-

In November 2024, Johnson Controls expanded the AI capabilities of its OpenBlue digital ecosystem. The enhancements included customer-facing generative AI applications, more autonomous building controls, and an improved user interface. These updates aimed to provide smarter, more insightful solutions, allowing building operators to manage facilities with reduced manual intervention.

|

Report Attributes |

Details |

|---|---|

| Market Size in 2025 | USD 53.92 Billion |

| Market Size by 2035 | USD 143.71 Billion |

| CAGR | CAGR of 10.3% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Components (Biometrics & Card-Based Reader, Multi-Technology Readers, Electronic Locks and Controllers) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

TRUSTSEC, Johnson Controls International plc, Allegion plc, Honeywell Security Group, Identiv, Inc., Nedap N.V., Suprema HQ Inc., Bosch Security Systems Inc., Gemalto N.V., NEC Corporation, IDEMIA, FINGERPRINTS, Axis Communications, Lenel Systems International, Time and Data Systems International, AMAG Technology, Gunnebo. |