Driving Simulator Market Report Scope & Overview:

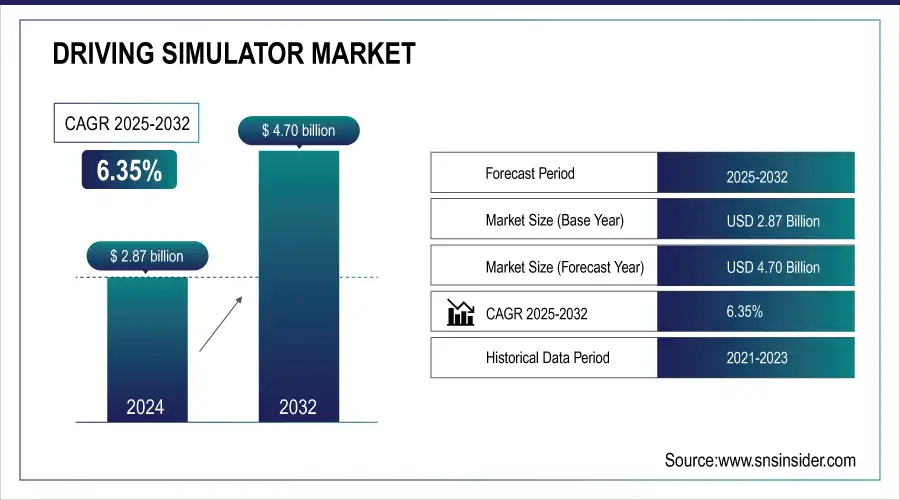

The Driving Simulator Market was valued at USD 2.87 Billion in 2024 and is expected to reach USD 4.70 Billion by 2032, growing at a CAGR of 6.35% from 2024-2032. The adoption of advanced driving simulation technologies is rising, especially in North America and Europe, where automakers and training centers invest in immersive driving environments. Global installations of driving simulators are increasing, with Asia-Pacific experiencing rapid growth due to expanding driver training initiatives and vehicle testing needs. From 2020 to 2023, simulator-based road safety training has helped reduce accidents as governments and institutions embrace digital learning. Cloud-based driving simulators are gaining momentum, offering remote accessibility, real-time analytics, and scalable training solutions, with North America and Europe at the forefront of adoption.

To get more information on Driving Simulator Market - Request Free Sample Report

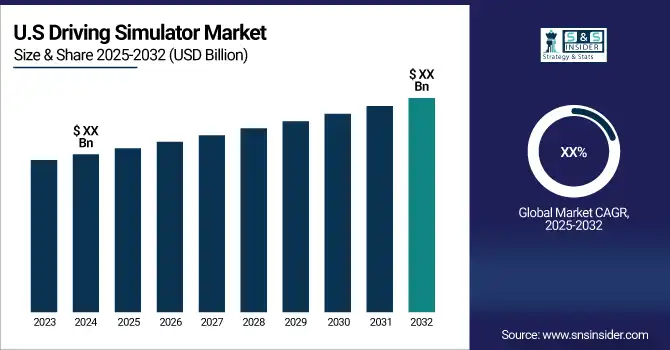

Market Size and Forecast:

-

Market Size in 2024: USD 2.87 Billion

-

Market Size by 2032: USD 4.70 Billion

-

CAGR: 6.35% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Driving Simulator Market Trends

-

Increasing adoption of driving simulators for driver training and road safety programs, particularly in developing countries.

-

Rising use of advanced simulators in automotive R&D to test autonomous vehicles, ADAS, and electric vehicle technologies.

-

Growth in virtual reality (VR) and augmented reality (AR)-based driving simulators for immersive training experiences.

-

Expanding applications in aviation, marine, and defense sectors, beyond conventional automotive training.

-

Rising demand for compact and affordable simulators for commercial driving schools and fleet operators.

-

Integration of AI and machine learning to enhance simulation accuracy and driver behavior analysis.

-

Growth of cloud-based and remote simulation platforms enabling flexible training and testing environments.

Driving Simulator Market Growth Drivers

-

Increasing demand for safe and efficient driver training is boosting the adoption of advanced driving simulators.

Robust adoption of advanced driving simulators by vehicle manufacturers fuels market growth, owing to the rising importance of road safety as well as skilled drivers. Simulators are being used to improve training effectiveness globally as per the data comparison and statistics without any risk in the real world by governments and driving schools. They provide an immersive experience that simulates tough driving situations and emergencies so that learning is a lot more effective. Automotive makers also use simulators to test vehicles, saving money, time, and safety from the development of prototypes. The increasing number of road accidents as well as strict driving rules and regulations are projected to spur the demand for driving simulators, especially, the countries having invested in the construction of driver education infrastructure, which will continue to open up the market for driving simulators.

Driving Simulator Market Restraints

-

High initial investment and maintenance costs hinder the widespread adoption of driving simulators.

Although they have their advantages, driving simulators have a huge initial cost and their implementation is quite difficult for smaller driving schools and institutions. Profile Advanced simulators which boast realistic graphical presentation, haptic feedback, and AI-driven analytics demand complex hardware and software making their procurement all the more expensive. In addition to this, operational expenses include regular updates for the software, maintenance, and technical support. Such financial restrictions are impediments for mass adoption, especially for poor areas with low budgets. Though economical options have emerged, the lofty upfront cost is still a significant hurdle preventing full-scale adoption across commercial driving schools and research facilities.

Driving Simulator Market Opportunities

-

Integration of VR and cloud-based training solutions is enhancing accessibility and realism in driving simulators.

Evolving technologies like VR and cloud-based solutions are transforming the conventional driving simulator landscape with unprecedented realism and access. Improved driver engagement and skill development While traditional simulators rely on a traditional screen-based environment, VR-based simulators provide a fully immersive training experience. In addition to that, cloud-based driving simulators facilitate organizations with remote training and data analytics, allowing them to scale their training programs without any hassle. Cloud-driven simulation tools also give automotive manufacturers a way to test vehicle performance. The rapid growth of technology and investments that are being made in digital learning drive the adoption of VR and cloud-based simulators, which will further widen the scope for market participants.

Driving Simulator Market Challenges

-

Limited awareness and adoption in emerging markets slow down market penetration and growth.

While technological improvements are boosting the integration and adoption of driving simulator systems, awareness and adaptability are still minimal in developing economies in light of the absence of infrastructure and training staff. Most of the driving schools and institutions are still not aware of the perks that simulators provide when it comes to enhancing learning efficiency and road safety and they still use the traditional way of training. Furthermore, the lack of governmental incentives as well as regulations for simulator-based training does further delay market penetration. To overcome this challenge, we need investment from those in the industry and significantly more awareness campaigns, additional training programs, and cost-effective lodging solutions that can help drive adoption in developing regions.

Driving Simulator Market Segment Analysis

By Simulator Type

In 2024, the full-scale simulator segment dominated the market and accounted for a significant revenue share. The functional growth of this segment is ascribed to the integrated training format of full-scale simulators as it mimics a real driving environment with high fidelity. Immersive and ultra-realistic training scenarios are critical for professional developer training, research, and vehicle development, which is part of the reason these simulators are highly priced.

The advanced driving simulation market is expected to register the fastest CAGR during the forecast period, The demand for high-fidelity training solutions that utilize technology to replicate complex driving scenarios continues to increase. Now, these advanced driving simulators have immersive experiences and interactivity, so they have become key driving training, research, and vehicle-testing tools.

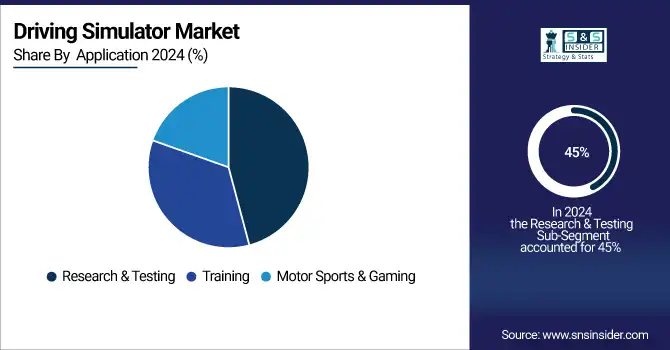

By Application

In 2024, the research & testing segment dominated the market and accounted for the highest share of more than 45% of revenue. The growing use of driving simulators for advanced vehicle testing and research. These simulations allow automakers and research institutions to assess new vehicle designs, safety features, and autonomous driving technologies without any risk and in a controlled environment.

The training segment is expected to register the fastest CAGR during the forecast period. The growing awareness about the significance of efficient driver training programs in improving road safety and accident reduction. Driving simulators are the highlights of the moment to provision the training market for both new and experienced drivers to practice different driving scenarios in a team-beneficial risk-free ambiance, using different automotive simulators.

By End-Use

The automotive segment dominated the market and represented a significant revenue share in 2024. Such a monarchy is primarily a function of the automotive sector's insatiable drive to discover new and better ways to ensure automobile security and eliminate leading to the area of energy course. The driving simulator is an invaluable asset for the realistic simulation and exploration of new vehicle designs, advanced driver-assistance systems, and autonomous driving technologies under controlled conditions in a safe environment. By simulating a range of driving conditions and scenarios, automakers can perfect their products and test them against strict safety standards.

The aviation segment is expected to register the fastest CAGR due to the growing need for pilot training courses with the expansion of the aviation industry. As the plethora of airlines increases, with newer and better planes, the demand for high-quality simulation training to provide proficient and safe pilots remains a necessity.

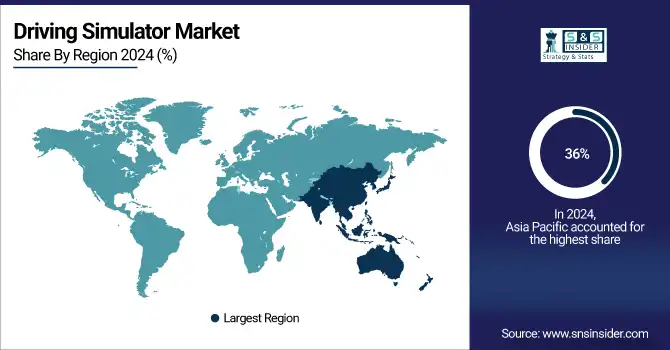

Driving Simulator Market Regional Analysis

Asia Pacific Driving Simulator Market Insights

In 2024, The Asia Pacific segment dominated the market and accounted for a revenue share of more than 36%. Demand for the increase in skilled drivers, and advanced driver training solutions has continued to grow with the rapid urbanization of the region and expansion of the road infrastructure. Second, the increased investment in advanced driving simulation technology is driven by the steady development of the automotive industry in regions such as China, India, and Japan.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Driving Simulator Market Insights

North America is anticipated to register the fastest CAGR throughout the forecast period. Rising awareness towards road safety & driver training in the region is anticipated to propel the growth of advanced driving simulators. Moreover, the presence of leading automotive manufacturers and technology companies in North America is encouraging investment in the latest simulation technologies.

Europe Driving Simulator Market Insights

Europe holds a significant share in the Driving Simulator Market in 2024, supported by strong demand from the automotive, motorsport, and aviation training sectors. Countries such as Germany, the U.K., and France are leading adopters, with universities, OEMs, and research institutes integrating simulators for driver safety studies, autonomous vehicle development, and racing applications. The region’s emphasis on road safety regulations and advanced driver assistance systems (ADAS) testing further accelerates market growth.

Latin America (LATAM) Driving Simulator Market Insights

The LATAM Driving Simulator Market is steadily expanding, driven by rising investments in automotive testing facilities, road safety awareness, and the growing popularity of motorsport culture. Brazil, Mexico, and Argentina are key contributors, with increasing adoption in professional driving schools, transport training centers, and universities. Collaborations between simulator manufacturers and local institutions are improving accessibility, while government-backed initiatives for driver skill development support market penetration.

Middle East & Africa (MEA) Driving Simulator Market Insights

The MEA region is witnessing growing adoption of Driving Simulators, fueled by rapid urbanization, infrastructure development, and an increasing focus on traffic safety training. Countries such as the UAE, Saudi Arabia, and South Africa are investing in advanced simulation technologies for defense, aviation, and automotive applications. The rise of smart mobility projects and partnerships with international simulator providers is expected to boost market opportunities, particularly in driver training and autonomous vehicle research.

Driving Simulator Market Competitive Landscape

GarchingSim

GarchingSim is an autonomous driving simulator developed to provide photorealistic environments and streamlined workflows, aimed at enhancing research and development in the mobility sector.

-

In January 2024, researchers introduced GarchingSim, an autonomous driving simulator featuring photorealistic scenes and a user-friendly workflow, enhancing accessibility for startups and research institutions.

Mercedes-AMG

Mercedes-AMG is a high-performance automotive brand known for its innovations in motorsport and advanced driving technologies.

-

In August 2024, Mercedes-AMG recognized simulators such as Assetto Corsa Competizione, iRacing, and Gran Turismo 7 for their Mercedes-AMG GT3 race car, launching a competition that offered sim racers the opportunity to test drive the actual GT3 vehicle.

Driving Simulator Market Key Players

The major key players along with their products are

-

John Deere – Virtual Reality Driving Simulator,

-

AVSimulation – SCANeR Studio,

-

Ansible Motion – Delta Series DIL Simulator,

-

Moog Inc. – Automotive Driver-in-the-Loop (DIL) Simulator,

-

ECA Group – SFERA Advanced Driving Simulator,

-

Cruden B.V. – Cruden Simulator Platform,

-

Tecknotrove Systems – TecknoSIM Car Simulator,

-

MTS Systems Corporation – MTS Flat-Trac Driving Simulator,

-

OKTAL (A Sogeclair Company) – OKTAL Driving Simulation Suite,

-

VI-grade – VI-grade Compact Simulator,

-

IPG Automotive – CarMaker Driving Simulation,

-

ST Engineering Antycip – Virtual Reality Driving Training System,

-

AB Dynamics – Advanced Vehicle Driving Simulator (aVDS),

-

SHRail – Train & Metro Driving Simulators,

-

Anthony Best Dynamics (ABD) – Guided Soft Target (GST) Simulator

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.87 Billion |

|

Market Size by 2032 |

USD 4.70 Billion |

|

CAGR |

CAGR of 6.35% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Simulator Type (Compact, Full-scale, Advanced) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

|

Company Profiles |

John Deere, AVSimulation, Ansible Motion, Moog Inc., ECA Group, Cruden B.V., Tecknotrove Systems, MTS Systems Corporation, OKTAL (A Sogeclair Company), VI-grade, IPG Automotive, ST Engineering Antycip, AB Dynamics, SHRail, Anthony Best Dynamics (ABD) |