Edible Insect for Animal Feed Market Report Scope And Overview:

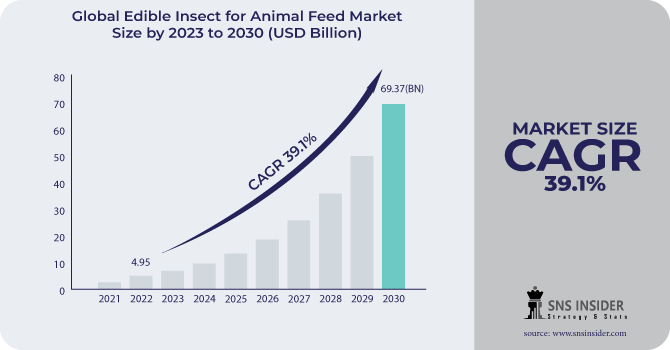

The Edible Insect for Animal Feed Market size was USD 4.95 billion in 2022 and is expected to Reach USD 69.37 billion by 2030 and grow at a CAGR of 39.1% over the forecast period of 2023-2030.

Edible insect for animal feed is a term used to describe the use of insects as a protein source in animal diets. Insects are a highly healthy food source since they are high in protein, fat, vitamins, and minerals. They're also extremely simple to grow and harvest, making them a more sustainable and environmentally friendly alternative to traditional protein sources like fishmeal and soybean meal.

Based on insect type, the mealworm insect type segment accounted for 52.6% of the edible insects for the animal feed market in 2022. Mealworms are in high demand due to factors such as their high nutritional value and little danger of zoonotic infections. Mealworms are a sustainable alternative, and the feces produced by animals that consume mealworms is an excellent organic fertilizer.

MARKET DYNAMICS

KEY DRIVERS

-

Growing demand for sustainable protein sources

Traditional protein sources such as fishmeal and soybean meal are becoming more expensive and less sustainable. Edible insects offer a sustainable solution to the growing demand for protein. Also, they are a good source of protein, fat, vitamins, and minerals. They can be used to feed a wide range of animals, including poultry, swine, fish, and pets. The growing demand for sustainable protein sources is driving investment in insect farming and the development of new insect-based feed products. This is expected to fuel the growth of edible insects for the animal feed market in the coming years.

RESTRAIN

-

Animal welfare concerns

Insect farming is still a relatively new industry, and there is a lack of research on the environmental impact of insect farming at scale. The main animal welfare concern associated with insect farming is the conditions in which insects are raised and slaughtered. Insects are often raised in crowded and unsanitary conditions. They are also often slaughtered using methods that are considered inhumane. The edible insect for animal feed industry is still in its early stages of development, and there is a need for more research on the environmental and animal welfare impacts of insect farming.

-

Consumer acceptance

OPPORTUNITY

-

Increase in production capacity and investment in animal feed

Edible insects are a protein source that is both sustainable and environmentally friendly. Traditional protein sources require more land, water, and energy to manufacture. Population growth and rising affluence are driving up global demand for animal protein. This puts a strain on traditional protein sources like fishmeal and soybean meal. Insect farming is seeing increased investment, which is assisting in increasing production capacity and lowering costs. With the increased production capacity and investment in animal feed, edible insect-based feed is becoming more economical and available to producers. This is fueling demand for edible insect-based feed products from a wide range of industries, including chicken, swine, fish, and pet food.

CHALLENGES

-

The cost of producing insect-based feed

Insect-based feed is now more expensive than standard protein sources like fishmeal and soybean meal. The expense of building and operating insect farming facilities is relatively high. Insects are often fed on food waste, which can be costly to collect and transport. The expense of harvesting insects and preparing them, such as drying and grinding them into powder before they can be utilized as feed. This can be an expensive process.

IMPACT OF RUSSIA UKRAINE WAR

Russia and Ukraine are major suppliers of wheat and other grains used as bug feed. The disruption in the supply of these grains brought about by the war has increased the expense of making insect-based feed. The supply of Wheat and other grains used to feed insects has been reduced demand by 25%. Furthermore, the war has created prices and economic uncertainty. This has made it more difficult for edible insect-based enterprises to obtain financial support and engage in new expansion efforts. Since the start of the war, the price of insect-based feed has risen by 20%.

IMPACT OF ONGOING RECESSION

Insect-based feed is a more sustainable and cost-effective protein source than fishmeal and soybean meal. But in recession, this is likely to stimulate demand for insect-based feed. Traditional protein sources such as fishmeal and soybean meal may pose significant competition for businesses in the edible insect industry. The cost of insect-based feed has increased by 15% since the start of the war. This makes edible insects used in animal feed are expensive, customers may spend less on beef, pig, chicken, and other animal products resulting in high pricing, thus they may prefer less expensive feed. Also, investment in the edible insect industry has decreased by 10%.

MARKET SEGMENTATION

by insect Type

-

Black Soldier Fly

-

Mealworm

-

Housefly

-

Silkworm

-

Orthoptera

-

Others

by Product Type

-

Meal Powder

-

Oil

-

Whole Dried

by End-use

-

Livestock

-

Poultry

-

Swine

-

-

Pet Food

-

Aquaculture

.png)

REGIONAL ANALYSIS

Europe is expected to hold the leading 34.5% share of the edible insect market for animal feed in 2022. This region has a rising demand for edible insects in the animal feed sector, as well as the stringent regulation regarding the use of insect protein in feed products for pigs, poultry, and fish, creates significant potential in the region's edible insects for the animal feed market.

North America is expected to account for nearly 33% of the edible insects for the animal feed market in 2022. The market is being driven by the increasing demand for sustainable protein sources and the growing awareness of the benefits of edible insects.

The Asia Pacific region is the largest and fastest-growing market for edible insects for animal feed. The growing population, the increasing demand for meat and other animal products, and the rising awareness of the benefits of edible insects are some of the key factors driving the growth of the market.

Latin America and Middle East & Africa are expected to witness moderate growth during the forecast period. The lack of awareness about the benefits of edible insects and the limited number of established players in these regions are some of the key factors restraining the growth of the market in these regions.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Edible Insect for Animal Feed Market are Enviroflight, Agri Protein, Enterra Feed, Ynsect, Protix, Proti-Farm, Bioflytech, Entomotech, Nordic Insect Economy, Co-Prot, Entomo Farms, Deli Bugs, InnovaFeed, Kreca, and other key players.

Enviroflight-Company Financial Analysis

RECENT DEVELOPMENTS

In April 2023, Sumitomo Corp. of Japan will become the country's first significant trading house to sell insect-based feed for farmed fish later this year. Amid decarbonization initiatives, insects are gaining global attention as a valuable source of protein. By 2030, the company hopes to import and sell 30,000 tonnes of bug feed.

In March 2022, Ynsect, a French distributor of edible insects for human and animal feed, announced the acquisition of US mealworm manufacturer Jord Producers, strengthening its reach in the thriving US pet food sector. Jord Producers, based in Nebraska, will enable it to access the rapidly increasing backyard chicken feed business.

In October 2021, Aspire Food Group announced the development of a new automated cricket processing factory in Ontario and London, Canada. With this investment, the company would be able to create 10,000 tonnes of cricket-based products every year.

| Report Attributes | Details |

| Market Size in 2022 | US$ 4.95 Billion |

| Market Size by 2030 | US$ 69.37 Billion |

| CAGR | CAGR of 39.1 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By insect Type (Black Soldier Fly, Housefly, Orthoptera, Mealworm, Silkworm, Others) • By Product Insect Type (Meal Powder, Oil, Whole Dried) • By End-use (Livestock, Pet Food, Aquaculture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Enviroflight, Agri Protein, Enterra Feed, Ynsect, Protix, Proti-Farm, Bioflytech, Entomotech, Nordic Insect Economy, Co-Prot, Entomo Farms, Deli Bugs, InnovaFeed, Kreca |

| Key Drivers | • Growing demand for sustainable protein sources |

| Market Opportunity | • Increase in production capacity and investment in animal feed |