Food Pathogen Testing Market Report Scope & Overview:

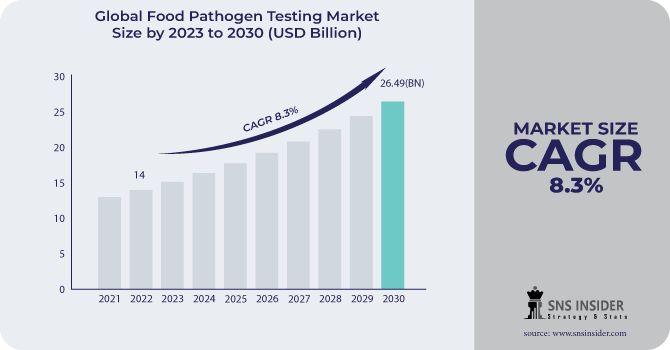

The Food Pathogen Testing Market size was USD 14 billion in 2022 and is expected to Reach USD 26.49 billion by 2030 and grow at a CAGR of 8.3% over the forecast period of 2023-2030.

Foodborne infections have been linked to a wide range of diseases around the world, particularly in developing countries. This has a significant economic impact. It is critical to contain them, and early discovery is critical. Detection and diagnoses were initially based on culture-based procedures, but have recently evolved in tandem with advances in immunological technologies. The goal has always been to find a system that is quick, sensitive, specific, and cost-effective. The methods have all shared a similar purpose, ranging from microbe culture to futuristic biosensor technologies.

Certain foodborne pathogens are directly transmitted from animals to people, while others are conveyed through vectors such as insects, food handlers, contaminated food products or food-processing surfaces, or transmission through sponges, towels, or utensils used in the kitchen.

MARKET DYNAMICS

KEY DRIVERS

-

Cross-contamination of food products

-

Increasing prevalence of food-borne diseases

Foodborne infections are illnesses induced by consuming tainted food. These disorders can range from moderate to severe, and in some cases, they are fatal. Salmonella, E. coli, Listeria, and Campylobacter are some of the most frequent foodborne infections. The presence of dangerous microorganisms in food is detected through food pathogen testing. By identifying and eliminating contaminated food from the supply chain, this testing can be utilized to avoid foodborne illness outbreaks.

When hazardous bacteria are transported from one food to another, this is referred to as cross-contamination. When raw meat, poultry, or seafood comes into contact with other foods, such as fruits, vegetables, or ready-to-eat items, this can occur. Cross-contamination can also happen when food handlers do not properly wash their hands after handling raw foods.

RESTRAIN

-

Lack of knowledge of foodborne illness

-

High investment in the infrastructure of food pathogen

Small companies may find it difficult to obtain the necessary equipment and training to conduct food pathogen testing due to the high cost of investment. This can reduce market competition and make it more difficult for enterprises to provide affordable testing services. Companies may be discouraged from investing in research and development of novel food pathogen testing technology due to the high cost of investment. This can delay market innovation and make it more difficult to create new and better methods of testing for food pathogens. Consumers may face higher rates for food pathogen testing services as a result of the high cost of investing. This can make it more difficult for businesses to afford testing services while also discouraging customers.

OPPORTUNITY

-

Technological advancement in the testing industry

Foodborne disease is a big issue that affects thousands of individuals each year all over the world. Nowadays many new variants of viruses are there in the environment. New variants of viruses need new technologies to be worked on many researchers are trying to find out new methods to combat challenges. The techniques needed to ensure food safety depend heavily on accuracy and efficiency. Since the 1960s, the Typhimurium variety has been responsible for roughly one-quarter of salmonella outbreaks. New testing technologies are being developed that are faster, more accurate, and more affordable. Furthermore, Advancements in automation are making it possible to test for food pathogens more quickly and easily.

CHALLENGES

-

Complexity in the technology of testing

Existing technologies for food hygiene testing provide a number of challenges in generating meaningful test findings. The issues encompass the disadvantages of technologies failing to produce accurate outcomes and technical shortcomings in assessing complex products such as processed food, among others. A faulty food safety testing technique may produce false results, resulting in the release of potentially contaminated ultimate foods. As a result, for the application to be considered effective, food safety tests must be standardized and have a specified set of features.

KEY MARKET SEGMENTS

By Type

-

E. coli

-

Listeria

-

Salmonella

-

Campylobacter

-

Other

By Technology

-

Traditional

-

Rapid

By Application

-

Cereals & Grains

-

Processed Food

-

Meat & Poultry

-

Dairy

-

Fruit & Vegetable

.png)

Based on Type

The market is segmented based on Type which includes E. coli, Listeria, Salmonella, Campylobacter, and others. Salmonella is a bacteria that commonly lives in animal intestines and can contaminate food when it comes into contact with excrement. It is known to cause food poisoning. Salmonella can cause diarrhea, vomiting, and stomach cramps, among other symptoms. It is primarily found in chicken, eggs, meat, and eggs. Raw dairy products, eggs, and undercooked meat have all been linked to large-scale Salmonella outbreaks.

Based on Technology

Based on technology, the largest segment is in the rapid technology group. Food manufacturers are increasingly requiring rapid testing technology to accelerate results and supply chain processes. Furthermore, when compared to traditional technologies, rapid methods offer better accuracy and the ability to test a wide spectrum of pollutants while simultaneously producing accurate data.

REGIONAL ANALYSIS

North America is the leading market for food pathogen testing, with the United States being the largest market. This is due to the high awareness of food safety in the region, stringent regulations, and the presence of a large number of food manufacturers and processors. The increasing export of agricultural products within the region can raise the potential for outbreaks and consequently, health risks posed by microbial pathogens in food. The increased prevalence of foodborne infections in this region is projected to fuel the market.

Asia Pacific is the fastest-growing market for food pathogen testing owing to the increasing investments from various multinational food manufacturers, especially in countries such as China, India, and other countries. This is due to the growing population, increasing disposable incomes, rising demand for processed foods, and the increasing awareness of food safety in the region. Japan is one of the major markets for food pathogen testing in the Asia Pacific region.

Europe is the second largest market for food pathogen testing. This is due to the high standards of food safety in the region, the presence of a large number of food manufacturers and processors, and the increasing demand for rapid and accurate testing methods. Food pathogen testing may become more popular as a result of stricter food safety standards and regulations, as well as an increase in trade volume.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

SGS S.A., Bureau Veritas, ALS Limited, Intertek Group Plc, JBT, TÜV NORD GROUP, Silliker, Inc., IFP Institute Fr Produktqualitt GmbH, Microbac Laboratories, Inc., Eurofins Scientific, Genetic Id Na Inc., and other key players are mentioned in the final report.

Intertek Group Plc-Company Financial Analysis

RECENT DEVELOPMENTS

In August 2023 ALS Limited improved its position as a market leader in food testing and inspection services. With the acquisition of Proanaliz organization of Laboratories, a food testing organization situated in Antalye, Turkey.

In August 2023 Bia Analytical Ltd recently signed an agreement to collaborate with trinamiX GmbH to develop a revolutionary new solution that will provide customers with a rapid portable authenticity result at the time of sampling, bringing testing outside the lab and within the supply chain.

In May 2023 By acquiring Corthorn Quality S.A. Chile, ALS Limited strengthened its food testing, quality control, and certification capabilities. The CQ team brings an abundance of industry experience and commercial knowledge to ALS, complementing our Pacific Region operations while also increasing our Food sector technicality.

| Report Attributes | Details |

| Market Size in 2022 | US$ 14 Billion |

| Market Size by 2030 | US$ 26.49 Billion |

| CAGR | CAGR of 8.3 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (E. coli, Listeria, Salmonella, Campylobacter, Other) • By Technology (Traditional, Rapid) • By Application (Cereals & Grains, Processed Food, Meat & Poultry, Dairy, Fruit & Vegetable) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SGS S.A., Bureau Veritas, ALS Limited, Intertek Group Plc, JBT, TÜV NORD GROUP, Silliker, Inc., IFP Institute Fr Produktqualitt GmbH, Microbac Laboratories, Inc., Eurofins Scientific, Genetic Id Na Inc. |

| Key Drivers | • Cross-contamination of food products • Increasing prevalence of food-borne diseases |

| Market Opportunity | • Technological advancement in the testing industry |