Education ERP Market Report Scope & Overview:

To Get More Information on Education ERP Market - Request Sample Report

Education ERP Market was valued at USD 16.56 billion in 2023 and is expected to reach USD 75.84 billion by 2032, growing at a CAGR of 18.46% from 2024-2032.

The growing demand for automated business processes in academic institutions and the need to protect the sensitive data of academic organizations are driving the education ERP market. Additionally, improved performance as well as improved communication and teamwork amongst various organizational areas fuels the growth of the education ERP market. Automated management systems can be used to support distance learning by providing students with access to course materials, assignments, and assessments online. They can also be used to track student progress and provide support to students who are struggling. Automated management systems can be used to personalize learning for each student. This can be done by tracking student progress, identifying areas of need, and recommending appropriate resources.

The increasing demand for ERP systems in colleges and universities to improve efficiency, reduce costs, and improve student outcomes further drives the growth of the education ERP market. The global enrolment in higher education is expected to grow from 257 million in 2020 to 372 million in 2030. This growth is creating a need for more efficient and effective management of academic and administrative processes in colleges and universities. The student demographics in higher education are changing, with more students from diverse backgrounds and with different learning needs. ERP systems can help colleges and universities to meet the needs of these students by providing personalized learning experiences and by tracking student progress.

The growing demand for integrated solutions that combine student information management, financial operations, and human resources into a single platform is a significant driver. Additionally, the rise in online and remote learning has accelerated the need for robust ERP solutions that support diverse learning environments and administrative functions. Increased funding for educational technology and the need for real-time data analytics to improve decision-making further contribute to the market's growth. As educational institutions continue to seek comprehensive, scalable solutions to manage their operations more effectively, the Education ERP market is set to expand rapidly.

MARKET DYNAMICS

Drivers

-

Increasing demand for automated management systems in educational institutions.

-

The increase in the use of digital tools and platforms in education drives the need for integrated ERP systems.

-

The rise of e-learning and hybrid education models requires robust ERP systems to support diverse educational needs and administrative functions.

The growth of e-learning and hybrid education models has significantly increased the demand for robust ERP systems to manage diverse educational needs and administrative functions. This expansion underscores the shift towards digital and hybrid learning environments, which require sophisticated ERP solutions to handle a range of functions.

These ERP systems are crucial for integrating various aspects of online and hybrid education, including course management, student enrolment, remote collaboration tools, and digital content delivery. They provide seamless management of both traditional and virtual classrooms, facilitating efficient scheduling, attendance tracking, and performance assessment. Additionally, ERP systems support the administrative side by automating processes like grading, financial transactions, and communication between students and faculty. The need for these integrated solutions is driven by the increasing complexity of managing diverse learning environments and ensuring a cohesive educational experience. As educational institutions continue to adopt and expand e-learning and hybrid models, the demand for comprehensive ERP systems to support these new paradigms will continue to grow.

The growing adoption of digital tools and platforms in education has significantly boosted the demand for integrated ERP systems. As of 2023, approximately 73% of higher education institutions have implemented or are planning to implement digital learning tools, reflecting a substantial shift towards technology-driven education. The use of digital platforms for teaching, learning management, and administrative tasks has increased, requiring seamless integration to manage these diverse tools effectively.

ERP systems address this need by consolidating various educational processes into a unified platform, thereby simplifying administration, improving data accuracy, and enhancing operational efficiency. These systems integrate functions such as student information management, financial operations, and academic scheduling, which are crucial as institutions increasingly rely on digital tools for their day-to-day activities. The surge in digital adoption, coupled with the need for cohesive management, drives the demand for sophisticated ERP solutions that can integrate and streamline these digital assets, ensuring a more efficient and connected educational environment.

Restraints

-

High implementation and maintenance costs of ERP systems

-

Customizing ERP solutions to meet the specific needs of diverse educational institutions can be challenging and costly, requiring significant time and resources.

-

Some ERP systems may not scale effectively with the growth of educational institutions or adapt to changing needs, limiting their long-term utility.

Some ERP systems face scalability issues, struggling to keep up with the growth of educational institutions and evolving needs, which can limit their long-term effectiveness. A survey conducted in 2022 found that 40% of educational institutions experienced difficulties in scaling their existing ERP systems as they expanded. As student enrolment increases and administrative requirements grow, ERP systems must be adaptable and capable of handling larger volumes of data, users, and complex processes.

However, not all ERP solutions are designed with scalability in mind, leading to performance bottlenecks, slower processing times, and difficulties in accommodating new functionalities. Institutions may find their systems outdated or unable to support modern needs such as online learning integration, advanced analytics, and mobile accessibility. This inability to scale effectively can result in additional costs for system upgrades or replacements, undermining the initial investment and posing challenges for institutions aiming to sustain efficient operations as they grow and evolve.

KEY MARKET SEGMENTATION

By Component

With the largest revenue share of more than 65% in 2023, the software segment dominated the market. The fast-paced advancements in technology, especially in cloud computing, AI, and machine learning, have greatly improved the functionality of Education ERP software. These innovations bring advanced features like predictive analytics, personalized learning, and real-time data processing, making ERP solutions more appealing and efficient for educational institutions.

The services segment is projected to grow at the highest CAGR of 22.76% during the forecast period, driven by the increasing need for expert guidance, customization, ongoing support, and training to effectively implement and use ERP systems. As educational institutions adopt ERP solutions to enhance their operational efficiency, the demand for comprehensive support services to manage these systems is steadily increasing.

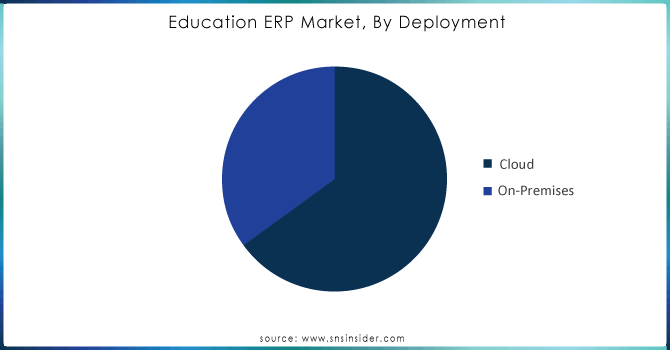

By Deployment

In 2023, the cloud segment led the market with the largest revenue share of more than 61.24%. The growth of the cloud segment is fueled by the demand for scalable, cost-effective, and secure solutions that accommodate remote and hybrid learning models. Cloud-based ERP solutions offer educational institutions unmatched scalability, enabling them to rapidly adjust resources in response to evolving needs. This scalability is especially beneficial for institutions experiencing growth or fluctuating enrolment, as it allows them to easily expand or reduce their IT infrastructure and software capabilities without significant upfront investments in hardware or software licenses.

The on-premise segment is anticipated to grow at a substantial CAGR over the forecast period. On-premises ERP systems offer educational institutions a high degree of Adaptation and governance over their software, catering directly to their specific needs and operational workflows. Educational institutions can tailor features, user interfaces, reporting formats, and integrations with existing systems to ensure that the ERP system aligns perfectly with their organizational objectives and operational needs.

Do You Need any Customization Research on Education ERP Market - Enquire Now

By Application

In 2023, the learning management system segment held the largest market share, accounting for 28.89% of the revenue and it anticipated to dominate the market in the given forecast period. Integrating Learning Management Systems (LMS) with broader ERP systems boosts operational efficiency by unifying administrative tasks like student enrolment, scheduling, attendance tracking, and grading. This smooth integration allows for real-time synchronization of data across different modules, removing data silos and guaranteeing accuracy. The student information system segment is projected to experience the highest CAGR during the forecast period. The advanced analytics integrated into SIS platforms allow educational institutions to extract actionable insights from student data. These analytics tools monitor student performance, behavior patterns, and demographic trends, supporting data-driven decision-making and strategic planning.

By End-User

With a maximum revenue share of more than 62% in 2023, the higher education segment dominated the market. The surge in global enrolment in higher education institutions is driven by factors such as demographic changes, enhanced access to education, and a growing global demand for higher education credentials. This expansion calls for robust enterprise resource planning (ERP) systems to manage the increasing number of students across administrative and academic processes efficiently. ERP systems optimize admissions by automating application processing, ensuring prompt communication with prospective students, and streamlining enrolment management.

The K-12 segment is anticipated to experience a substantial CAGR throughout the forecast period. K-12 schools encounter various administrative challenges, including managing student admissions, tracking attendance, scheduling, grading, and handling financial operations.

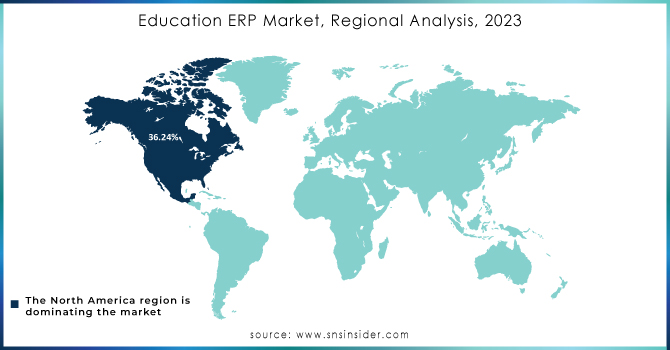

REGIONAL ANALYSIS

In 2023, North America dominated the education ERP market with the largest revenue share of more than 36.24%. In North American education, there is an increasing demand for data-driven decision-making to enhance educational outcomes and institutional effectiveness. Enterprise resource planning (ERP) systems provide powerful analytics and reporting features that allow institutions to examine student performance data, monitor trends, and pinpoint areas needing improvement.

The education ERP market in Asia Pacific is expected to grow at the highest CAGR of 24.54% from 2024-2032. Economic growth, urbanization, and higher disposable incomes lead to greater investments in education and technological infrastructure.

The education ERP market in Europe is anticipated to grow at a significant CAGR during the forecast period. In Europe, there is an increasing shift towards cloud-based ERP solutions, driven by the scalability, flexibility, and cost-efficiency provided by cloud computing.

KEY PLAYERS

The major players in the Education ERP Market are The major key players are Jenzabar, Kira Talent, Microsoft 365 Education, Moodle, PowerSchool, Sage Intacct, SchoolMint Workday, ADP Workforce Now, Blackbaud, Campus Management, and Canvas LMS (Instructure) and others.

RECENT DEVELOPMENTS

In July 2024, Ellucian collaborated with MDS Computer Systems Co. in Saudi Arabia to advance higher education with cutting-edge technology solutions.

In June 2024, Microsoft revealed updates to Copilot for Microsoft 365 and Microsoft Education, designed to equip educators with advanced tools to enhance collaboration and productivity in educational environments.

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.56 Bn |

| Market Size by 2032 | US$ 75.84 Bn |

| CAGR | CAGR of 18.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Software, Services) • By Deployment (On-Premise, Cloud) • By Application (Student Information System, Learning Management System, Human Resource Management, Finance & Accounting Management, Others) • By End-use (K-12, Higher Education) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Jenzabar, Kira Talent, Microsoft 365 Education, Moodle, PowerSchool, Sage Intacct, SchoolMint Workday, ADP Workforce Now, Blackbaud, Campus Management, and Canvas LMS (Instructure) |

| Key Drivers |

• Increasing demand for automated management systems in educational institutions. • The increase in the use of digital tools and platforms in education drives the need for integrated ERP systems. |

| Market Restraints |

• High implementation and maintenance costs of ERP systems • Customizing ERP solutions to meet the specific needs of diverse educational institutions can be challenging and costly, requiring significant time and resources. |